|

市场调查报告书

商品编码

1750282

中风治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Stroke Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

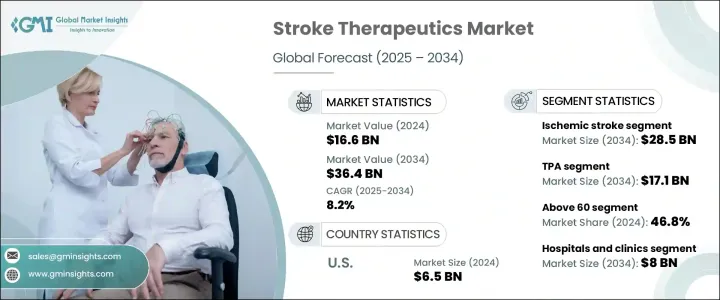

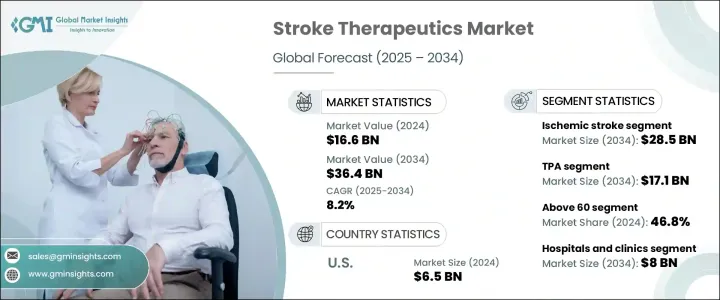

2024年,全球卒中治疗市场规模达1,66亿美元,预计2034年将以8.2%的复合年增长率成长,达到364亿美元。这主要得益于老龄人口的成长,以及肥胖、高血压、久坐不动的生活方式以及糖尿病等慢性疾病等风险因素的增加。老龄化人口尤其容易患卒中,这导致对先进药物治疗的需求增加。同时,公众健康意识的增强以及政府在早期诊断和预防方面的倡议加强,正在加速卒中治疗的普及。

製药公司投资研发,专注于新型生物製剂、基因疗法和标靶药物,旨在改善临床疗效。个人化医疗正成为一个备受关注的关键领域,有助于实现更精准、更有效的治疗方法。中风治疗药物涵盖从抗血小板药物和抗凝血剂到溶栓剂和神经保护药物等各种药物。大量的研发资金支持正在帮助拓展研发管道,新的疗法旨在改善缺血性和出血性中风的疗效。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 166亿美元 |

| 预测值 | 364亿美元 |

| 复合年增长率 | 8.2% |

缺血性中风是指脑血管阻塞引起的中风,在治疗市场中占主导地位。该领域在2024年创造了131亿美元的市场规模,预计到2034年将达到285亿美元,复合年增长率为8.1%。鑑于缺血性中风占全球总病例的大多数,其需求趋势仍然强劲。高胆固醇、心房颤动和糖尿病等诱发疾病的盛行率不断上升,持续推动更有效治疗的需求。药物创新,尤其是在溶栓治疗和抗血小板药物研发方面的创新,正在帮助提高存活率和復原效果。

依年龄层细分,60岁以上族群占比最高,到2024年将达46.8%。由于血管健康状况下降和常见的合併症,中风风险会随着年龄增长而显着增加。老化也会影响神经血管反应性,因此老年人是治疗介入的关键族群。医疗基础设施的持续改善和以年龄为中心的健康计划预计将使该细分市场持续增长至2034年。

2024年,美国中风治疗市场规模达65亿美元,这得益于先进的医疗体系、高强度的研发投入以及强大的製药实力。包括干细胞疗法和基于人工智慧的诊断整合在内的快速创新巩固了美国的领先地位。精准医疗和数位健康平台的日益关注,进一步增强了早期发现能力,并提高了治疗效果。公共部门和私营部门的密切合作正在推动临床试验和产品线开发的扩展。

鲁宾、辉瑞、勃林格殷格翰、赛诺菲、基因泰克、诺华、拜耳、阿斯特捷利康、第一三共、强生服务、Cadrenal Therapeutics、Prestige Consumer Healthcare、默克、卫材和百时美施贵宝等主要公司正在采取积极的成长策略。这些策略包括扩大临床产品线、建立研发合作关係、争取突破性药物的监管批准,以及探索个人化医疗以提供标靶治疗。许多公司投资于人工智慧平台和生物製剂创新,以优化治疗方案和患者疗效。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 中风发生率上升

- 药物研发进展

- 提高认识和早期诊断

- 中风研究投资和政府资助不断增加

- 产业陷阱与挑战

- 严格的监管审批

- 副作用和安全问题

- 成长动力

- 成长潜力分析

- 监管格局

- 管道分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依中风类型,2021 年至 2034 年

- 主要趋势

- 缺血性中风

- 出血性中风

- 其他中风类型

第六章:市场估计与预测:依药物类别,2021 年至 2034 年

- 主要趋势

- 组织纤溶酶原激活剂(TPA)

- 抗血小板药物

- 抗凝血剂

- 其他药物类别

第七章:市场估计与预测:依年龄组,2021 年至 2034 年

- 主要趋势

- 40岁以下

- 41-59

- 60岁以上

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院和诊所

- 门诊手术中心(ASC)

- 復健中心

- 研究和学术机构

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AstraZeneca

- Bayer

- Boehringer Ingelheim

- Bristol-Myers Squibb (BMS)

- Cadrenal Therapeutics

- Daiichi Sankyo

- Eisai

- Genentech

- Johnson & Johnson Services

- Lupin

- Merck

- Novartis

- Pfizer

- Prestige Consumer Healthcare

- Sanofi

The Global Stroke Therapeutics Market was valued at USD 16.6 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 36.4 billion by 2034, fueled by the rising elderly population, coupled with increased prevalence of risk factors like obesity, hypertension, sedentary lifestyles, and chronic illnesses such as diabetes. An aging demographic is especially susceptible to stroke, leading to greater demand for advanced pharmaceutical treatments. At the same time, increased public health awareness and stronger government initiatives around early diagnosis and prevention are accelerating the adoption of therapeutics.

Pharmaceutical firms invest in research and development, focusing on novel biologics, gene therapies, and targeted drugs designed to improve clinical outcomes. Personalized medicine is becoming a key area of interest, allowing for more precise and effective treatment approaches. Stroke therapeutics includes medications, from antiplatelet agents and anticoagulants to thrombolytics and neuroprotective drugs. Substantial financial backing for R&D is helping expand the development pipeline, with new therapies aimed at improving outcomes for both ischemic and hemorrhagic stroke types.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.6 Billion |

| Forecast Value | $36.4 Billion |

| CAGR | 8.2% |

Ischemic stroke, which occurs when a blood vessel to the brain is blocked, dominates the therapeutic market. This segment generated USD 13.1 billion in 2024 and is forecasted to hit USD 28.5 billion by 2034, growing at a CAGR of 8.1%. Given that ischemic strokes account for the majority of total cases globally, this demand trajectory remains strong. The rising prevalence of contributing conditions like high cholesterol, atrial fibrillation, and diabetes continues to push the need for more effective treatments. Drug innovations, especially in thrombolytic therapy and antiplatelet development, are helping improve survival rates and recovery outcomes.

When segmented by age group, individuals aged 60 and above have the largest share at 46.8% in 2024. The risk of stroke significantly increases with age due to declining vascular health and common comorbidities. Aging also affects neurovascular responsiveness, making seniors a key demographic for therapeutic intervention. The ongoing improvement of healthcare infrastructure and age-focused health initiatives are expected to sustain segment growth through 2034.

United States Stroke Therapeutics Market was valued at USD 6.5 billion in 2024, supported by advanced healthcare systems, high R&D intensity, and strong pharmaceutical presence. Rapid innovations, including stem cell therapies and AI-based diagnostic integration, reinforce the country's leadership. The growing focus on precision medicine and digital health platforms is further enhancing early detection and improving treatment efficacy. Robust public and private sector collaboration is fueling the expansion of clinical trials and pipeline development.

Key players such as Lupin, Pfizer, Boehringer Ingelheim, Sanofi, Genentech, Novartis, Bayer, AstraZeneca, Daiichi Sankyo, Johnson & Johnson Services, Cadrenal Therapeutics, Prestige Consumer Healthcare, Merck, Eisai, and Bristol-Myers Squibb are adopting aggressive growth strategies. These include expanding clinical pipelines, forming R&D partnerships, pursuing regulatory approvals for breakthrough drugs, and exploring personalized medicine to deliver targeted therapies. Many invest in AI platforms and biologics innovation to optimize treatment delivery and patient outcomes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising stroke incidence cases

- 3.2.1.2 Advancement in drug development

- 3.2.1.3 Growing awareness and early diagnosis

- 3.2.1.4 Rising investment in stroke research and government funding

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Strict regulatory approvals

- 3.2.2.2 Side effects and safety concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Stroke Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Ischemic stroke

- 5.3 Hemorrhagic stroke

- 5.4 Other stroke types

Chapter 6 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Tissue plasminogen activators (TPA)

- 6.3 Antiplatelet agents

- 6.4 Anticoagulants

- 6.5 Other drug classes

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Below 40

- 7.3 41-59

- 7.4 above 60

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Ambulatory surgical centers (ASCs)

- 8.4 Rehabilitation centers

- 8.5 Research and academic institutions

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AstraZeneca

- 10.2 Bayer

- 10.3 Boehringer Ingelheim

- 10.4 Bristol-Myers Squibb (BMS)

- 10.5 Cadrenal Therapeutics

- 10.6 Daiichi Sankyo

- 10.7 Eisai

- 10.8 Genentech

- 10.9 Johnson & Johnson Services

- 10.10 Lupin

- 10.11 Merck

- 10.12 Novartis

- 10.13 Pfizer

- 10.14 Prestige Consumer Healthcare

- 10.15 Sanofi