|

市场调查报告书

商品编码

1750297

电子飞行仪表系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electronic Flight Instrument System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

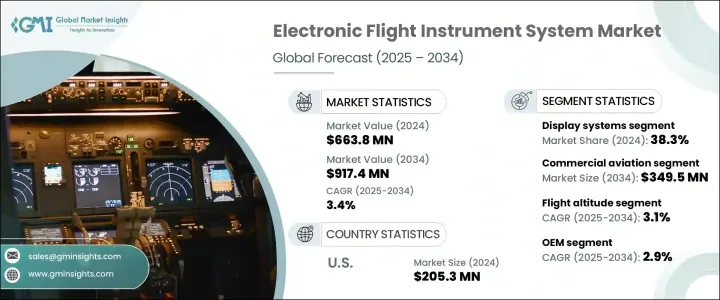

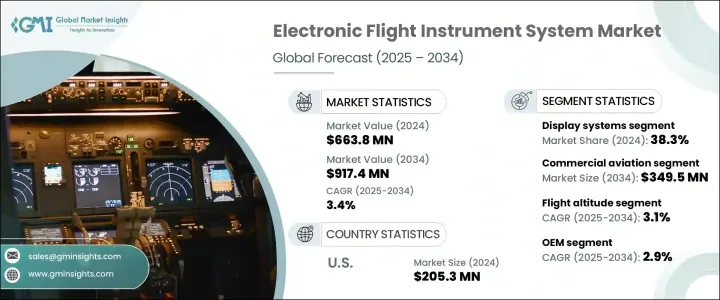

2024年,全球电子飞行仪表系统 (EFIS) 市场规模达6.638亿美元,预计到2034年将以3.4%的复合年增长率增长,达到9.174亿美元,这主要得益于商用飞机交付量的激增、全球航空旅行的增加以及航空公司机队升级的稳步增长。随着空中交通流量的成长以及营运商对安全性和运作精度的重视,对即时整合飞行资料的需求正推动EFIS在新飞机和改装飞机中的应用。这些系统简化了飞行计画、燃油使用和导航流程,符合航空业对更有效率、更安全的飞行营运的追求。

然而,由于美国对航太和航空电子零件征收关税,市场面临暂时的阻力。这些措施大幅提高了国内製造商的成本,扰乱了供应链,并延缓了尖端飞行系统的整合。一些供应商透过本地化生产来抵消关税的影响,但价格和零件供应的不确定性导致商用和国防领域的市场短期放缓。儘管面临这些挑战,航空利益相关者仍继续优先考虑航空电子设备的升级,尤其是那些符合不断变化的监管要求和安全规定的升级。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.638亿美元 |

| 预测值 | 9.174亿美元 |

| 复合年增长率 | 3.4% |

在零件领域,控制面板市场在2025年至2034年期间的复合年增长率为4.6%。高解析度触控萤幕显示器、可重构布局和模组化硬体设计等技术进步正在提升驾驶舱的人体工学,并简化飞行员的工作流程。这些系统支援即时资料整合和无缝介面定制,以满足不同的任务需求和飞机类型。与智慧航电套件和下一代飞行管理系统的增强相容性,推动了其应用,尤其是在需要灵活性和效率的多用途飞机上。

预计到2034年,商用航空市场将创造3.495亿美元的收入。航空公司正在用支援即时天气资料、高级地形测绘和交通视觉化的下一代EFIS系统取代传统系统。此外,成本效益计画和燃油优化也促使老旧飞机机队进行改造。许多航空公司正在转向支援预测分析的系统,以提高安全裕度并在飞行过程中提供即时洞察。

受电子飞行仪表系统 (EFIS) 创新的推动,美国电子飞行仪表系统市场在 2024 年实现了 2.053 亿美元的产值。大规模商用飞机改装项目和战略防御升级共同推动了该行业的成长。政府推动的措施增强了态势感知能力、网路弹性和自主能力,并促进了对数位驾驶舱解决方案的投资增加。

全球电子飞行仪表系统 (EFIS) 市场的主要参与者包括 BAE Systems、Aspen Avionics、Avidyne Corporation、Garmin、Genesys Aerosystems 和 Dynon Avionics。在电子飞行仪表系统市场营运的公司(例如 Dynon Avionics、Genesys Aerosystems、Avidyne Corporation、Garmin、Aspen Avionics 和 BAE Systems)正在采取多项关键策略来增强其全球影响力。许多公司正在投资研发,以创建支援有人驾驶和无人机的 AI 整合和模组化 EFIS 平台。与原始设备製造商 (OEM) 和监管机构的合作有助于简化对不断发展的航空标准的遵守。製造商专注于以用户为中心的创新,例如可自订介面和触控萤幕面板,以满足商用、军用和通用航空领域的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 下一代飞机对先进航空电子设备的需求不断增加

- 商用飞机交付量和机队扩张的增加

- 航空客运量和航空公司营运效率的成长

- 整合航空电子架构的采用率不断提高

- 扩大军事和国防航空领域

- 产业陷阱与挑战

- 初期投资改造成本高

- 与现有航空电子系统的复杂集成

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- Pestel 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依组成部分,2021-2034

- 主要趋势

- 显示系统

- 控制面板

- 处理系统

- 其他的

第六章:市场估计与预测:依平台类型,2021-2034

- 主要趋势

- 商业航空

- 窄体飞机

- 宽体飞机

- 支线喷射机

- 军事航空

- 战斗机

- 运输和侦察机

- 军用直升机

- 商务及通用航空

- 无人驾驶飞行器(UAV)

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 飞行高度

- 导航

- 资讯管理

- 引擎监控

- 其他的

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- OEM (原始设备製造商)

- 售后市场(MRO 和航空电子设备升级)

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Aspen Avionics

- Avidyne Corporation

- BAE Systems

- Dynon Avionics

- Garmin

- Genesys Aerosystems

- Honeywell International

- Kanardia

- L3Harris Technologies

- LPP SRO

- Meggitt

- MGL Avionics

- Taskem Corporation

- Thales

- Universal Avionics

The Global Electronic Flight Instrument System Market was valued at USD 663.8 million in 2024 and is estimated to grow at a CAGR of 3.4% to reach USD 917.4 million by 2034, driven by a surge in commercial aircraft deliveries, rising global air travel, and a steady increase in airline fleet upgrades. As air traffic grows and operators prioritize safety and operational precision, demand for real-time, integrated flight data is fueling the adoption of EFIS in both new aircraft and retrofits. These systems streamline flight planning, fuel usage, and navigation, aligning with the aviation industry's push for more efficient and secure flight operations.

However, the market faced temporary headwinds due to US-imposed tariffs on aerospace and avionics components. These measures significantly raised costs for domestic manufacturers, disrupting supply chains and delaying the integration of cutting-edge flight systems. Some suppliers responded by localizing production to counteract the tariff impact, but uncertainty in pricing and part availability led to short-term market slowdowns in both commercial and defense sectors. Despite these challenges, aviation stakeholders continue to prioritize avionics upgrades, especially those complying with evolving regulatory requirements and safety mandates.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $663.8 Million |

| Forecast Value | $917.4 Million |

| CAGR | 3.4% |

Within components, the control panels segment held a 4.6% CAGR during 2025-2034. Advancements such as high-resolution touch-screen displays, reconfigurable layouts, and modular hardware designs are enhancing cockpit ergonomics and streamlining pilot workflows. These systems allow real-time data integration and seamless interface customization, catering to mission profiles and aircraft categories. Enhanced compatibility with smart avionics suites and next-gen flight management systems fuels adoption, particularly in multi-role aircraft that demand flexibility and efficiency.

The commercial aviation segment is expected to generate USD 349.5 million by 2034. Airlines are replacing legacy systems with next-generation EFIS that support real-time weather data, advanced terrain mapping, and traffic visualization. In addition, cost-efficiency initiatives and fuel optimization prompt retrofitting across aging aircraft fleets. Many carriers are moving toward predictive analytics-enabled systems that improve safety margins and offer real-time insights during flight.

U.S. Electronic Flight Instrument System Market generated USD 205.3 million in 2024, driven by the innovation in electronic flight instrument systems (EFIS). A combination of large-scale commercial aircraft retrofitting programs and strategic defense upgrades contributes to the sector's growth. Government-driven initiatives enhance situational awareness, cyber-resilience, and autonomous capabilities, and foster increased investment in digital cockpit solutions.

Key players in Global Electronic Flight Instrument System Market include BAE Systems, Aspen Avionics, Avidyne Corporation, Garmin, Genesys Aerosystems, and Dynon Avionics. Companies operating in the electronic flight instrument system market-such as Dynon Avionics, Genesys Aerosystems, Avidyne Corporation, Garmin, Aspen Avionics, and BAE Systems-are adopting several key strategies to enhance their global footprint. Many are investing in R&D to create AI-integrated and modular EFIS platforms that support manned and unmanned aircraft. Collaborations with OEMs and regulatory bodies are helping streamline compliance with evolving aviation standards. Manufacturers focus on user-centric innovations such as customizable interfaces and touchscreen panels to meet demand across commercial, military, and general aviation sectors.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing demand for advanced avionics in next-generation aircraft

- 3.3.1.2 Rise in commercial aircraft deliveries and fleet expansion

- 3.3.1.3 Growth in air passenger traffic and airline operational efficiency

- 3.3.1.4 Increased adoption of integrated avionics architectures

- 3.3.1.5 Expanding military and defense aviation sector

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial investment and retrofit costs

- 3.3.2.2 Complex integration with existing avionics systems

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 Pestel analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 (USD Million & units)

- 5.1 Key trends

- 5.2 Display systems

- 5.3 Control panels

- 5.4 Processing systems

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Platform Type, 2021-2034 (USD Million & units)

- 6.1 Key trends

- 6.2 Commercial aviation

- 6.2.1 Narrow-body aircraft

- 6.2.2 Wide-body aircraft

- 6.2.3 Regional jets

- 6.3 Military aviation

- 6.3.1 Fighter jets

- 6.3.2 Transport & reconnaissance aircraft

- 6.3.3 Military helicopters

- 6.4 Business & general aviation

- 6.5 Unmanned aerial vehicles (UAVs)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & units)

- 7.1 Key trends

- 7.2 Flight altitude

- 7.3 Navigation

- 7.4 Information management

- 7.5 Engine monitoring

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million & units)

- 8.1 Key trends

- 8.2 OEM (original equipment manufacturer)

- 8.3 Aftermarket (MROs and avionics upgrades)

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Aspen Avionics

- 10.2 Avidyne Corporation

- 10.3 BAE Systems

- 10.4 Dynon Avionics

- 10.5 Garmin

- 10.6 Genesys Aerosystems

- 10.7 Honeywell International

- 10.8 Kanardia

- 10.9 L3Harris Technologies

- 10.10 LPP SRO

- 10.11 Meggitt

- 10.12 MGL Avionics

- 10.13 Taskem Corporation

- 10.14 Thales

- 10.15 Universal Avionics