|

市场调查报告书

商品编码

1750298

薄壁包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Thin Wall Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

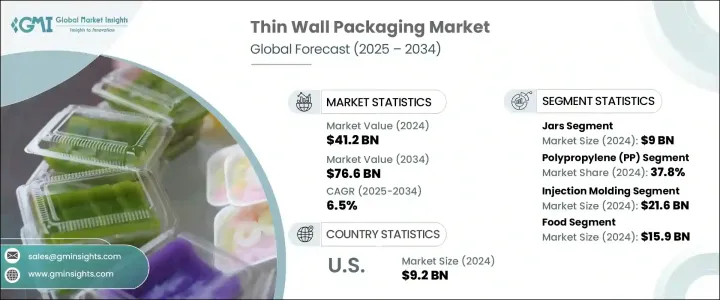

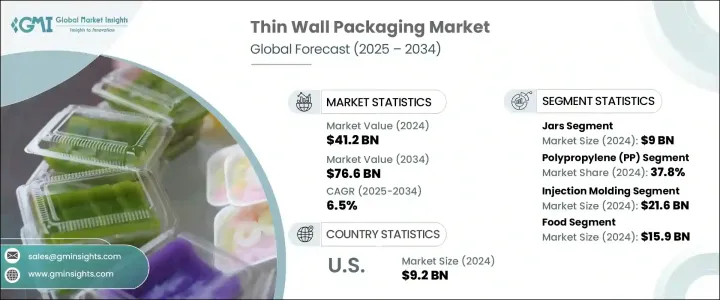

2024年,全球薄壁包装市场规模达412亿美元,预计到2034年将以6.5%的复合年增长率增长,达到766亿美元,这主要得益于生活方式的转变、对方便食品的需求不断增长以及餐饮服务渠道的不断拓展。随着城市中心的扩张和消费者日常生活的日益繁忙,轻盈、耐用且经济高效的包装形式越来越受到青睐。薄壁包装能够缩短生产週期,减少材料使用,同时确保产品完整性。它还能透过适应当今快节奏零售和食品配送生态系统的形式,满足现代供应链的需求。

随着便携式、可微波加热和可重复密封容器的需求不断增长,薄壁包装已成为城市食品消费中不可或缺的一部分。这些包装迎合了消费者对便利餐点和速食零食的偏好,尤其是在人口密集地区。薄壁容器凭藉其优异的阻隔性和结构完整性,有助于延长保质期,同时支持永续发展目标。如今,它们被广泛用于包装乳製品、冷冻食品和零食。消费者倾向于选择这些包装,因为它们实用,尤其是在包装趋势更倾向于极简主义和环保意识的当下。罐装包装因其可重复使用的特性而广受欢迎,适用于个人护理、家居用品和食品领域。它们密封性好,易于取用,同时保持新鲜。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 412亿美元 |

| 预测值 | 766亿美元 |

| 复合年增长率 | 6.5% |

2024年,罐装包装市场规模达90亿美元,标誌着其在薄壁包装领域占据主导地位。这类容器结构轻巧、材料用量低且生产成本低廉,广泛应用于食品、个人护理和家居用品等类别。罐装包装为各种应用提供了理想的包装解决方案,为製造商和消费者提供了多功能性和实用性。罐装包装日益普及,不仅源自于其价格实惠,也源自于消费者对便利性、易用性和永续性的偏好。罐装包装可重复使用且易于储存,尤其适合需要重复取用或控制份量的产品。

2024年,聚丙烯 (PP) 市场占有 37.8% 的份额。这种聚合物兼具强度高、重量轻和价格实惠等特点,使其成为薄壁包装的理想选择,尤其是在快速循环注塑成型中。其防潮性和化学稳定性使其成为食品级应用的首选。增强型 PP 配方可在不影响耐用性的情况下实现更薄的壁厚,使企业能够在满足监管压力的同时减少碳足迹。

2024年,美国薄壁包装市场规模达92亿美元。预製食品和零食消费的增加,刺激了对轻量化、保护性包装解决方案的需求。此外,电子商务和送货上门服务的兴起,也推动了包装创新,这些创新优先考虑材料节约和环保合规性。消费者意识的增强以及政府主导的永续发展措施进一步加速了这一趋势。

全球薄壁包装产业的领先公司包括 ILIP Srl、Paccor GmbH、Amcor plc、Greiner Packaging International GmbH 和 Berry Global Inc.。全球薄壁包装市场的主要参与者正在大力投资永续创新、策略併购和区域扩张,以提升市场占有率。各公司正专注于轻量化设计技术,并采用生物基聚丙烯等可回收材料,以符合绿色包装法规。一些公司已与食品和饮料品牌合作,提供客製化解决方案,以提升货架吸引力并延长保鲜期。扩大北美和亚太等高成长地区的产能是当务之急,同时采用先进的注塑机来提高速度和效率。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 方便食品和即食食品需求激增

- 永续性和轻量化措施的成长

- 食品配送和 QSR 通路的兴起

- 新兴经济体的快速都市化

- 射出成型和模内贴标 (IML) 技术不断进步

- 产业陷阱与挑战

- 对塑胶使用的严格环境法规

- 易腐货物的阻隔性能有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 杯子

- 浴缸

- 托盘

- 罐子

- 盖子

- 其他容器

第六章:市场估计与预测:依材料类型,2021-2034 年

- 主要趋势

- 聚丙烯(PP)

- 聚乙烯(PE)

- 高密度聚乙烯(HDPE)

- 低密度聚乙烯(LDPE)

- 聚苯乙烯(PS)

- 聚对苯二甲酸乙二醇酯(PET)

- 聚氯乙烯(PVC)

- 其他的

第七章:市场估计与预测:按生产工艺,2021-2034 年

- 主要趋势

- 热成型

- 射出成型

- 其他的

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 食物

- 乳製品

- 即食食品

- 烘焙和糖果

- 肉类、家禽和海鲜

- 饮料

- 个人护理和化妆品

- 家居用品

- 电气和电子产品

- 药品和营养保健品

- 工业的

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- ALPLA Group

- Akshar Plastic

- Amcor Plc

- Berry Global Inc.

- Borouge

- Chemco Plast

- Cosmo Films

- Double H Plastics

- EVCO Plastics

- Greiner Packaging International GmbH

- ILIP Srl

- IPL Plastics Inc.

- Mold-Masters

- Paccor

- Prabhoti Plastic Industries

- SABIC

- SP International Industries Pvt. Ltd.

The Global Thin Wall Packaging Market was valued at USD 41.2 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 76.6 billion by 2034, driven by shifting lifestyle patterns, increasing demand for convenience food options, and expanding foodservice channels. As urban centers grow and consumer routines become more hectic, the appeal of lightweight, durable, and cost-efficient packaging formats has intensified. Thin-wall packaging enables quicker production turnaround and reduced material use while delivering product integrity. It also supports modern supply chain needs with formats that fit today's fast-paced retail and food delivery ecosystems.

With rising demand for portable, microwaveable, and resealable containers, thin wall formats have become indispensable across urban food consumption. These packages align with consumers' preference for on-the-go meals and instant snacks, especially in high-density regions. Thanks to their barrier properties and structural integrity, thin wall containers help extend shelf life while supporting sustainability goals. They're now widely chosen for packaging dairy, frozen entrees, and snack foods. Consumers gravitate toward these options for practicality, especially as packaging trends lean more toward minimalism and eco-consciousness. Jars are popular for their reusable nature and suitability across personal care, household goods, and food applications. They offer an effective seal that maintains freshness while being easy to handle.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $41.2 Billion |

| Forecast Value | $76.6 Billion |

| CAGR | 6.5% |

The jars segment generated USD 9 billion in 2024, marking its dominance within the thin wall packaging landscape. These containers are extensively used across food, personal care, and household product categories due to their lightweight structure, reduced material usage, and cost-effective production. Jars offer an ideal packaging solution for a wide range of applications, providing both manufacturers and consumers with versatility and functionality. Their growing popularity stems not only from their affordability but also from consumer-driven preferences for convenience, ease of use, and sustainability. Reusability and easy storage make jars a preferred option, especially for products that require repeated access or portion control.

The polypropylene (PP) segment held a 37.8% share in 2024. This polymer's blend of strength, light weight, and affordability makes it ideal for thin wall packaging, especially in fast-cycle injection molding. Its moisture resistance and chemical stability make it a preferred choice for food-grade applications. Enhanced PP formulations allow thinner walls without compromising durability, enabling companies to reduce carbon footprints while meeting regulatory pressures.

United States Thin Wall Packaging Market generated USD 9.2 billion in 2024. Increased consumption of prepared meals and snacks has fueled demand for lightweight, protective packaging solutions. Additionally, the rise of e-commerce and home delivery services has prompted packaging innovations that prioritize material reduction and environmental compliance. This trend is further accelerated by growing consumer awareness and government-led sustainability initiatives.

Leading companies in the Global Thin Wall Packaging Industry comprise ILIP S.r.l., Paccor GmbH, Amcor plc, Greiner Packaging International GmbH, and Berry Global Inc. Key players in the Global Thin Wall Packaging Market are investing heavily in sustainable innovation, strategic mergers, and regional expansion to enhance market presence. Companies are focusing on lightweight design technologies and adopting recyclable materials like bio-based polypropylene to align with green packaging mandates. Several have partnered with food and beverage brands to offer customized solutions that improve shelf appeal and extend freshness. Expanding production capacity in high-growth regions such as North America and Asia Pacific is a top priority, alongside adopting advanced injection molding machinery to improve speed and efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Surge in demand for convenience and ready-to-eat foods

- 3.7.1.2 Growth in sustainability and lightweighting initiatives

- 3.7.1.3 Rise of food delivery and QSR channels

- 3.7.1.4 Rapid urbanization in emerging economies

- 3.7.1.5 Increasing advancements in injection molding and in-mold labeling (IML)

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Stringent environmental regulations on plastic use

- 3.7.2.2 Limited barrier properties for perishable goods

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Cups

- 5.3 Tubs

- 5.4 Trays

- 5.5 Jars

- 5.6 Lids

- 5.7 Other containers

Chapter 6 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Polypropylene (PP)

- 6.3 Polyethylene (PE)

- 6.3.1 High-density polyethylene (HDPE)

- 6.3.2 Low-density polyethylene (LDPE)

- 6.4 Polystyrene (PS)

- 6.5 Polyethylene terephthalate (PET)

- 6.6 Polyvinyl chloride (PVC)

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Production Process, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Thermoforming

- 7.3 Injection molding

- 7.4 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Food

- 8.2.1 Dairy products

- 8.2.2 Ready-to-eat meals

- 8.2.3 Bakery & confectionery

- 8.2.4 Meat, poultry & seafood

- 8.3 Beverages

- 8.4 Personal care & cosmetics

- 8.5 Household products

- 8.6 Electrical & electronics

- 8.7 Pharmaceuticals & nutraceuticals

- 8.8 Industrial

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ALPLA Group

- 10.2 Akshar Plastic

- 10.3 Amcor Plc

- 10.4 Berry Global Inc.

- 10.5 Borouge

- 10.6 Chemco Plast

- 10.7 Cosmo Films

- 10.8 Double H Plastics

- 10.9 EVCO Plastics

- 10.10 Greiner Packaging International GmbH

- 10.11 ILIP S.r.l.

- 10.12 IPL Plastics Inc.

- 10.13 Mold-Masters

- 10.14 Paccor

- 10.15 Prabhoti Plastic Industries

- 10.16 SABIC

- 10.17 SP International Industries Pvt. Ltd.