|

市场调查报告书

商品编码

1750299

飞机窗户与挡风玻璃市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Aircraft Windows and Windshields Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

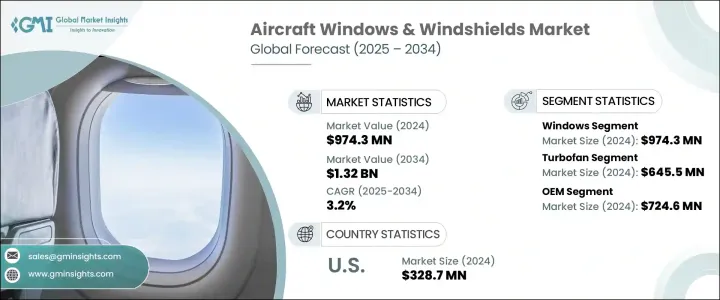

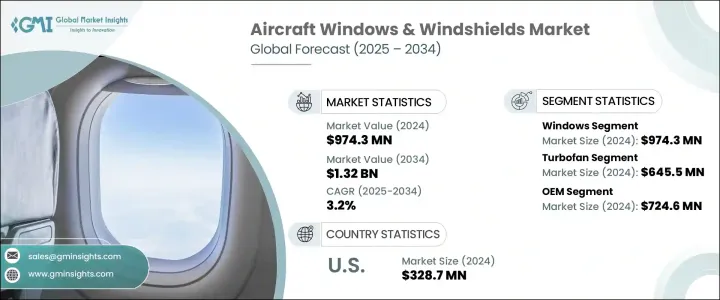

2024年,全球飞机窗和挡风玻璃市场价值达9.743亿美元,预计到2034年将以3.2%的复合年增长率成长,达到13.2亿美元。这得益于商用和公务飞机产量和部署量的不断增长,以及对先进窗系统持续增长的需求。新型飞机平台和改装正在推动向轻量化、抗衝击材料的转变,而乘客舒适度和能源效率仍然是新产品开发的重要考量。随着产业适应更严格的监管准则,材料创新和不断发展的空气动力学正在塑造下一代设计。

近年来,贸易政策影响了製造业的策略。对铝和特殊玻璃等关键原料征收关税导致生产成本上涨高达15%,尤其是在北美。这些转变促使全球供应链重新调整,并为一些国际製造商创造了成本优势。此外,售后市场供应商因依赖进口零件而面临成本压力。这种地缘政治紧张局势加剧了整个供应和分销网络的成本敏感性。材料科学的进步正在推动优质飞机窗户和挡风玻璃的研发。聚碳酸酯层压板、电致变色调光系统和石墨烯涂层等技术因能够提高极端条件下的性能而日益受到重视。自修復薄膜、嵌入式感测器和智慧着色功能在优化能源利用的同时,也改变了客舱体验。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.743亿美元 |

| 预测值 | 13.2亿美元 |

| 复合年增长率 | 3.2% |

按产品类别细分,飞机窗户细分市场在2024年创造了9.743亿美元的市场规模。这些部件不仅注重可视性,还能应付极端压力差、温度变化和衝击等情况。该行业正在稳步转向先进的聚碳酸酯基替代品,以减轻飞机重量并提高燃油效率,同时又不损害结构弹性。儘管由于航空管理局的严格标准,这项转型需要高昂的研发和认证成本,但这些投资因其性能、生命週期可靠性和法规合规性的提升而物有所值。

2024年,飞机窗户和挡风玻璃市场中的涡轮扇发动机市场价值为6.455亿美元,因为高性能多层窗户能够承受剧烈的温度梯度、高海拔压力以及潜在的鸟类撞击。许多新一代飞机都使用内建除冰和温度调节功能的先进挡风玻璃,以确保飞行员的视野和驾驶舱的安全。随着机队规模的扩大,原始设备製造商(OEM)的出货量正在增长,而由于旧机型挡风玻璃更换和升级的需求不断增长,售后市场仍然活跃。

由于关键製造中心、庞大的机队以及完善的维护、维修和大修 (MRO) 生态系统,美国飞机窗和挡风玻璃市场规模在 2024 年达到 3.287 亿美元。军事采购计划以及严格的联邦航空管理局 (FAA) 合规标准,持续推动国防和商业领域对耐用、轻质、技术先进的材料的需求。

全球飞机窗与挡风玻璃市场的领导者包括圣戈班航太、NORDAM 集团、GENTEX 公司、GKN航太和 PPG 工业公司。飞机窗与挡风玻璃市场的主要参与者正在透过技术合作、设施扩建和材料创新来巩固其地位。各公司大力投资可提高舒适度和性能的智慧窗系统,尤其是在高端和防御领域。与 OEM 的策略合作有助于确保产品儘早整合到新平台中,而开发抗衝击、轻量化解决方案的努力有助于满足严格的 FAA 和 EASA 要求。主要製造商本地化供应链以减轻关税影响并缩短交货时间。研发仍然是一项核心策略,公司专注于电光升级、防冰增强和新型复合结构,以降低生命週期成本和重量。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 价格波动

- 供应链重组

- 生产成本影响

- 需求面影响

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 增加飞机交付量和扩大机队规模

- 材料和涂层的技术进步

- 国防和军用飞机现代化程度不断提高

- 售后市场需求受车队老化和维护、修理和大修 (MRO) 成长推动

- 产业陷阱与挑战

- 认证成本高

- 供应链中断

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 视窗

- 挡风玻璃

第六章:市场估计与预测:依飞机类型,2021-2034

- 主要趋势

- 涡轮螺旋桨

- 涡轮风扇

- 涡轮喷射

- 涡轮轴

第七章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- OEM

- 售后市场

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Control Logistics Inc

- GENTEX CORPORATION

- GKN Aerospace

- Lee Aerospace

- Llamas Plastics Inc.

- LP Aero Plastics Inc.

- Perkins Aircraft Windows

- PPG Industries, Inc.

- Saint-Gobain Aerospace

- The NORDAM Group LLC

The Global Aircraft Windows and Windshields Market was valued at USD 974.3 million in 2024 and is estimated to grow at a CAGR of 3.2% to reach USD 1.32 billion by 2034, driven by the rising production and deployment of both commercial and business aircraft with sustained demand for advanced window systems. New aircraft platforms and retrofits are driving the shift toward lightweight, impact-resistant materials, while passenger comfort and energy efficiency remain essential considerations in new product development. As the industry adapts to stricter regulatory guidelines, material innovations and evolving aerodynamics are shaping next-generation designs.

Trade policies have influenced manufacturing strategies in recent years. The introduction of tariffs on critical raw materials like aluminium and specialty glass led to production cost hikes of up to 15%, particularly in North America. These shifts prompted a realignment of global supply chains and created cost advantages for some international manufacturers. Additionally, aftermarket vendors saw cost pressures due to their reliance on imported components. Such geopolitical tensions have intensified cost sensitivities across the supply and distribution network. Advancements in material science are propelling the development of superior aircraft windows and windshields. Technologies such as polycarbonate laminates, electrochromic dimming systems, and graphene-infused coatings are gaining prominence for enhancing performance in extreme conditions. Self-healing films, embedded sensors, and smart-tinting functions transform cabin experiences while optimizing energy use.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $974.3 Million |

| Forecast Value | $1.32 Billion |

| CAGR | 3.2% |

In the product category breakdown, the aircraft windows segment generated USD 974.3 million in 2024. These components are engineered not only for visibility but also to handle extreme pressure differentials, temperature shifts, and impact scenarios. The industry is steadily shifting toward advanced polycarbonate-based alternatives to lighten aircraft weight and enhance fuel efficiency, without compromising structural resilience. While the transition demands high R&D and certification costs due to strict aviation authority standards, these investments are justified by improvements in performance, lifecycle reliability, and regulatory compliance.

The turbofan segment in the aircraft windows & windshields market was valued at USD 645.5 million in 2024 as high-performance, multi-layered windows withstand severe thermal gradients, high-altitude pressures, and potential bird impacts. Many new-generation aircraft use advanced windshields with built-in de-icing and thermal regulation features to ensure pilot visibility and cockpit safety. As fleets expand, OEM shipments are gaining momentum, while the aftermarket remains active due to increasing demand for windshield replacements and upgrades in older airframes.

United States Aircraft Windows & Windshields Market reached USD 328.7 million in 2024, owing to key manufacturing hubs, large aircraft fleets, and a solid maintenance, repair, and overhaul (MRO) ecosystem. Military procurement programs, along with rigorous FAA compliance standards, continue to drive the demand for durable, lightweight, and technically advanced materials across both defense and commercial sectors.

Leading players in the Global Aircraft Windows & Windshields Market include Saint-Gobain Aerospace, The NORDAM Group LLC, GENTEX Corporation, GKN Aerospace, and PPG Industries, Inc. Key players in the aircraft windows & windshields market are strengthening their positions through technology partnerships, facility expansions, and material innovation. Companies invest heavily in smart window systems that enhance comfort and performance, especially in the premium and defense segments. Strategic collaborations with OEMs help ensure early integration of products into new platforms, while efforts to develop impact-resistant, lightweight solutions help meet strict FAA and EASA requirements. Major manufacturers localize supply chains to mitigate tariff impacts and improve lead times. R&D remains a core strategy, with firms focusing on electro-optic upgrades, anti-icing enhancements, and new composite structures that reduce lifecycle costs and weight.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-side impact

- 3.2.1.3.1.1 Price volatility

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-side impact

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 Market share dynamics

- 3.2.1.3.2.3 Consumer response patterns

- 3.2.1.3.1 Supply-side impact

- 3.2.1.4 Key companies impacted

- 3.2.1.5 Strategic industry responses

- 3.2.1.5.1 Supply chain reconfiguration

- 3.2.1.5.2 Pricing and product strategies

- 3.2.1.5.3 Policy engagement

- 3.2.1.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing aircraft deliveries and fleet expansion

- 3.3.1.2 Technological advancements in materials and coatings

- 3.3.1.3 Rising defense and military aircraft modernization

- 3.3.1.4 Aftermarket demand driven by aging fleets and MRO growth

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High certification costs

- 3.3.2.2 Supply chain disruptions

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Windows

- 5.3 Windshields

Chapter 6 Market Estimates & Forecast, By Aircraft Type, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Turboprop

- 6.3 Turbofan

- 6.4 Turbojet

- 6.5 Turboshaft

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Control Logistics Inc

- 9.2 GENTEX CORPORATION

- 9.3 GKN Aerospace

- 9.4 Lee Aerospace

- 9.5 Llamas Plastics Inc.

- 9.6 LP Aero Plastics Inc.

- 9.7 Perkins Aircraft Windows

- 9.8 PPG Industries, Inc.

- 9.9 Saint-Gobain Aerospace

- 9.10 The NORDAM Group LLC