|

市场调查报告书

商品编码

1750301

高压直流 (HVDC) 电容器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测High Voltage Direct Current (HVDC) Capacitor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

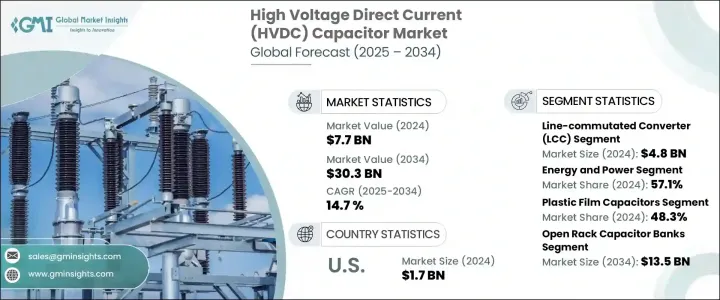

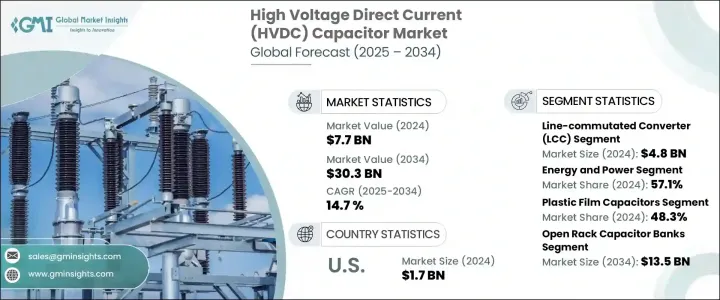

2024年,全球高压直流 (HVDC) 电容器市场规模达77亿美元,预计到2034年将以14.7%的复合年增长率成长,达到303亿美元。这主要得益于工业和城市领域(尤其是发展中经济体)电力需求的加速成长。随着城市扩张和工业园区能源消耗的增加,对更可靠、更有效率的输电系统的需求也日益增长。在强大的电容器解决方案的支持下,高压直流技术在实现长距离电力传输和最大限度减少能源损失方面发挥着至关重要的作用。在亚洲和非洲等基础设施快速发展的地区,高压直流系统正成为国家电网和跨境输电网路现代化不可或缺的一部分。

清洁能源基础设施投资的增加、工业营运电气化的转型以及电网升级,都推动了对高压直流电容器的需求。这些系统的使用有助于公用事业公司管理尖峰负载、稳定电网运行并优化能源分配。然而,全球贸易紧张局势和进口关税先前扰乱了供应链,尤其是来自海外市场的材料。为了减轻这些影响,该行业一直致力于加强本地供应链,投资国内製造能力,并加强研发力度,以提高组件效率并减少对外国来源的依赖。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 77亿美元 |

| 预测值 | 303亿美元 |

| 复合年增长率 | 14.7% |

从技术角度来看,2024年线路换流器 (LCC) 市值为 48 亿美元。 LCC 系统因其成本效益高且能够处理长距离大容量电力传输,广泛应用于大型输电专案。其在大容量应用中的卓越性能使其成为众多电网开发人员的可靠选择。 LCC 技术的需求依然旺盛,尤其是在能源基础设施快速扩张的地区。

2024年,能源和电力应用领域的高压直流 (HVDC) 电容器市场占据了57.1%的市场份额,凸显了其在产业发展中的主导地位。这一强劲的市场地位源自于重大的电网增强计画、再生能源资产的大规模部署以及传统输电系统的持续更新换代。各大洲的国家都在加大对高压直流 (HVDC) 技术的投资,以克服传统交流 (AC) 系统的限制。这些电容器有助于稳定电压水平、平衡电力潮流并减少长距离传输损耗,这对于将偏远的太阳能和风电场连接到城市需求中心至关重要。

受全国范围内推动能源转型和智慧电网营运的推动,美国高压直流 (HVDC) 电容器市场在 2024 年创造 17 亿美元。联邦和州级计画推动清洁能源发展,包括离岸风电和公用事业规模的太阳能,推动了高压输电投资。在先进电容器解决方案的支援下,高压直流系统能够将再生能源与现有电网框架无缝互连,有助于平衡负载并缓解间歇性问题。

全球高压直流 (HVDC) 电容器市场的领导企业,例如伊顿公司、西门子股份公司、TDK 株式会社和日立能源有限公司,正在采取策略性倡议以巩固其市场地位。这些措施包括建立在地化生产中心以减少对全球供应链的依赖,开发高性能介电材料以提高产品效率,以及与政府和公用事业公司合作进行大型输电项目。各公司投资于先进的电容器设计,以打造模组化、可扩展的 HVDC 系统,从而满足不断变化的能源需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 价格波动

- 供应链重组

- 生产成本影响

- 需求面影响

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 衝击力

- 成长动力

- 都市化与电力需求激增

- 工业电气化的成长

- 长距离电力传输需求不断成长

- 电网现代化和基础设施升级

- 再生能源整合度不断提高

- 自动化和控制系统的技术进步

- 产业陷阱与挑战

- 初始资本投入高

- 复杂的安装和技术专长

- 成长动力

- 成长潜力分析

- 科技与创新格局

- 重要新闻和倡议

- 未来市场趋势

- 波特的分析

- PESTEL分析

- 监管格局

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 塑胶薄膜电容器

- 铝电解电容器

- 陶瓷电容器

- 钽电容器

- 其他的

第六章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 线换向转换器(LCC)

- 电压源变换器(VSC)

第七章:市场估计与预测:按安装类型,2021 - 2034 年

- 主要趋势

- 开放式机架电容器组

- 封闭式机架电容器组

- 桿上电容器组

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 商业的

- 工业的

- 能源和电力

- 航太和国防

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- API Capacitors

- Condis

- Eaton Corporation

- ELECTRONICON Kondensatoren GmbH

- General Atomics

- GE Vernova

- Hitachi Energy Ltd

- Isofarad Kft.

- KYOCERA AVX Components Corporation

- LIFASA

- Samwha Capacitor Group

- Siemens AG

- Sieyuan Electric Co., Ltd.

- TDK Corporation

- Vishay Intertechnology, Inc.

- ZEZ SILKO

The Global High Voltage Direct Current (HVDC) Capacitor Market was valued at USD 7.7 billion in 2024 and is estimated to grow at a CAGR of 14.7% to reach USD 30.3 billion by 2034, fueled by accelerating power demand across industrial and urban sectors, particularly in developing economies. As cities expand and industrial zones increase their energy consumption, the need for more reliable and efficient power transmission systems continues to rise. HVDC technology, supported by robust capacitor solutions, plays a crucial role in enabling long-distance electricity transfer while minimizing energy losses. In regions undergoing rapid infrastructure development, such as Asia and Africa, HVDC systems are becoming integral to modernize national power grids and cross-border transmission networks.

Rising infrastructure investments in clean energy, the shift toward electrification of industrial operations, and grid upgrades have all pushed demand for HVDC capacitors. The use of these systems helps utilities manage peak loads, stabilize grid operations, and optimize energy distribution. However, global trade tensions and import tariffs previously disrupted the supply chain, especially for materials sourced from overseas markets. To mitigate these impacts, the industry has focused on strengthening local supply chains, investing in domestic manufacturing capacity, and increasing R&D to enhance component efficiency and reduce reliance on foreign sources.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.7 Billion |

| Forecast Value | $30.3 Billion |

| CAGR | 14.7% |

Based on technology, the line-commutated converter (LCC) segment was valued at USD 4.8 billion in 2024. LCC systems are widely used in large-scale transmission projects because of their cost efficiency and ability to handle bulk power transmission over extended distances. Their proven performance in high-capacity applications makes them a trusted choice for many power grid developers. Demand for LCC technology remains high, especially in regions undergoing rapid energy infrastructure expansion.

The energy and power application segment in the high voltage direct current (HVDC) capacitor market captured 57.1% in 2024, underscoring its dominant role in shaping the industry. This strong market position stems from significant grid reinforcement initiatives, large-scale deployment of renewable energy assets, and continued replacement of legacy transmission systems. Countries across all continents are increasingly investing in HVDC technologies to overcome the limitations of conventional alternating current (AC) systems. These capacitors help stabilize voltage levels, balance power flow, and reduce transmission losses across long distances, crucial for connecting remote solar and wind farms to urban demand centers.

United States High Voltage Direct Current (HVDC) Capacitor Market generated USD 1.7 billion in 2024, driven by a nationwide push for energy transition and smarter grid operations. Federal and state-level programs promoting clean energy development, including offshore wind and utility-scale solar, fuel high-voltage transmission investments. HVDC systems, supported by advanced capacitor solutions, enable seamless interconnection of renewable generation with existing grid frameworks, helping to balance load and mitigate intermittency.

Leading players in the Global High Voltage Direct Current (HVDC) Capacitor Market-such as Eaton Corporation, Siemens AG, TDK Corporation, and Hitachi Energy Ltd-are pursuing strategic initiatives to strengthen their position. These include establishing localized production hubs to reduce dependency on global supply chains, developing high-performance dielectric materials to enhance product efficiency, and collaborating with governments and utilities on large-scale transmission projects. Companies invest in advanced capacitor design for modular and scalable HVDC systems tailored to evolving energy demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 key companies impacted

- 3.2.4 strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Urbanization and power demand surge

- 3.3.1.2 Growth in industrial electrification

- 3.3.1.3 Increasing demand for long-distance power transmission

- 3.3.1.4 Grid modernization and infrastructure upgrades

- 3.3.1.5 Rising integration of renewable energy sources

- 3.3.1.6 Technological advancements in automation and control systems

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 High initial capital investment

- 3.3.2.2 Complex installation and technical expertise

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Technological & innovation landscape

- 3.6 Key news and initiatives

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Regulatory landscape

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Plastic film capacitors

- 5.3 Aluminium electrolytic capacitor

- 5.4 Ceramic capacitor

- 5.5 Tantalum capacitors

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Line-commutated converter (LCC)

- 6.3 Voltage-source converter (VSC)

Chapter 7 Market Estimates & Forecast, By Installation Type, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Open rack capacitor banks

- 7.3 Enclosed rack capacitor banks

- 7.4 Pole-mounted capacitor banks

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Industrial

- 8.4 Energy and power

- 8.5 Aerospace and defense

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 API Capacitors

- 10.2 Condis

- 10.3 Eaton Corporation

- 10.4 ELECTRONICON Kondensatoren GmbH

- 10.5 General Atomics

- 10.6 GE Vernova

- 10.7 Hitachi Energy Ltd

- 10.8 Isofarad Kft.

- 10.9 KYOCERA AVX Components Corporation

- 10.10 LIFASA

- 10.11 Samwha Capacitor Group

- 10.12 Siemens AG

- 10.13 Sieyuan Electric Co., Ltd.

- 10.14 TDK Corporation

- 10.15 Vishay Intertechnology, Inc.

- 10.16 ZEZ SILKO