|

市场调查报告书

商品编码

1750303

机器人战斗车辆市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Robotic Combat Vehicles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

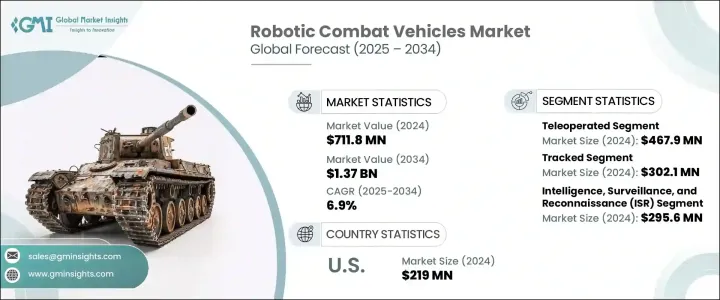

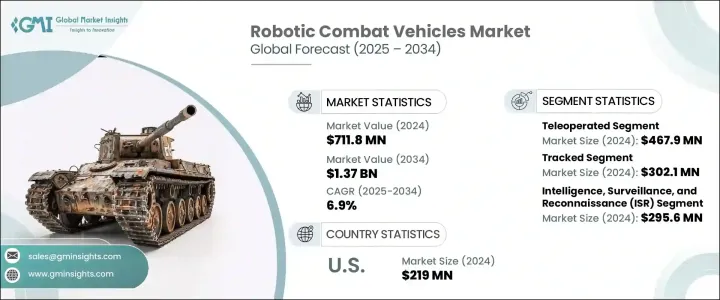

2024年,全球机器人作战车辆市场价值为7.118亿美元,预计到2034年将以6.9%的复合年增长率增长,达到13.7亿美元,这得益于全球国防预算的不断增长以及人工智慧(AI)和自主技术的进步。随着各国不断增加国防开支,各国更加重视军事能力的现代化建设和部队效能的提升。机器人作战车辆(RCV)因其能够显着降低人员风险并提升作战能力,正日益成为全球军事战略中不可或缺的一部分。

机器人作战车辆能够在高风险环境中以最少的人工干预执行任务,从而重塑战场格局。它们的使用使军队能够更有效率地进行从侦察到直接作战等复杂行动,而无需将士兵置于不必要的危险之中。这些车辆配备了先进的感测器、人工智慧系统和武器,使其能够执行传统上由人类士兵执行的任务,例如监视、搜救,甚至进攻行动。现代战争日益复杂,推动了对这些先进无人系统的需求不断增长。当今的军事行动需要更灵活和动态的解决方案,尤其是在地形复杂或敌人适应性强的情况下。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.118亿美元 |

| 预测值 | 13.7亿美元 |

| 复合年增长率 | 6.9% |

市场依作战模式细分为自主系统和遥控系统。遥控遥控车辆市场在2024年创造了4.679亿美元的收入,这得益于对需要在复杂环境(例如城市作战或动态战区)中即时控制的系统的需求。这些系统为军事人员提供了更大的灵活性,同时仍保留了人为控制,这对于任务的可靠性和伦理考量至关重要。随着军队向完全自主系统过渡,遥控遥控车辆是适应这些技术的重要过渡阶段。

就机动性而言,市场分为轮式、履带式和混合动力车辆。履带式遥控装甲车市场在2024年创造了3.021亿美元的市场规模。这些履带式车辆在崎岖地形上拥有卓越的机动性,使其成为前线作战和恶劣环境下作战的理想选择。它们能够携带更重的有效载荷,包括先进的武器和感测器设备,这进一步增加了其在直接作战和火力支援方面的需求。此外,履带式车辆具有更高的稳定性和后座力吸收能力,使其非常适合快速机动和实弹射击。

2024年,美国机器人作战车辆市场价值达2.19亿美元,这得益于政府在国防项目和计画上的大量投入,例如军方对地面和空中作战无人系统的重视。此外,陆军的机器人作战车辆计画和海军的无人系统路线图等项目也促进了人们对这些技术的兴趣日益浓厚。降低军事人员风险的需求日益增长,加上不断演变的威胁,进一步刺激了美国对机器人战斗车辆的需求。

机器人作战车辆市场的几个关键参与者正积极增强其产品,整合人工智慧驱动功能并提升机器人系统的稳健性。通用动力陆地系统公司、BAE系统公司和Teledyne FLIR等公司在提升这些车辆的功能性和自主性方面处于领先地位。他们也致力于扩展产品组合,以满足侦察、监视和后勤等多样化的军事需求。与政府机构和国防承包商的合作是这些参与者获得长期合约并巩固其市场地位的另一种策略。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 关键零件价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 全球国防预算不断增加

- 人工智慧和自主导航的进步

- 模组化作战平台的开发

- 高风险区域对无人解决方案的需求

- 增加军事现代化计划

- 产业陷阱与挑战

- 开发和营运成本高

- 网路安全漏洞

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按营运模式,2021 年至 2034 年

- 主要趋势

- 自主

- 遥控

第六章:市场估计与预测:依移动性,2021 年至 2034 年

- 主要趋势

- 轮式

- 履带式

- 杂交种

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 情报、监视和侦察(ISR)

- 直接战斗与火力支援

- 战斗工程

- 医疗后送

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- BAE Systems

- Elbit Systems

- General Dynamics Land Systems

- HDT Global

- Israel Aerospace Industries

- Kratos Defense and Security Solutions

- Milrem Robotics

- Nexter Systems

- Oshkosh Defense

- Qinetiq

- Rheinmetall

- Teledyne FLIR

- Textron Systems

The Global Robotic Combat Vehicles Market was valued at USD 711.8 million in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 1.37 billion by 2034, driven by rising global defense budgets and advancements in artificial intelligence (AI) and autonomous technologies. As countries continue to increase their defense spending, there is a heightened focus on modernizing military capabilities and enhancing force effectiveness. RCVs are becoming increasingly integral to military strategies globally due to their ability to significantly reduce the risk to human personnel while enhancing operational capabilities.

By enabling missions in high-risk environments with minimal human intervention, robotic combat vehicles are reshaping the battlefield. Their use allows military forces to conduct complex operations more efficiently, from reconnaissance to direct combat, without exposing soldiers to unnecessary danger. These vehicles are equipped with advanced sensors, AI systems, and weaponry that enable them to perform tasks traditionally carried out by human soldiers, such as surveillance, search-and-rescue, and even offensive operations. The growing demand for these advanced unmanned systems is driven by the increasing complexity of modern warfare. Military operations today require more versatile and dynamic solutions, especially in situations where the terrain is challenging or the enemy is highly adaptive.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $711.8 Million |

| Forecast Value | $1.37 Billion |

| CAGR | 6.9% |

The market is segmented by the mode of operation into autonomous and teleoperated systems. The teleoperated RCVs segment generated USD 467.9 million in 2024, due to the demand for systems that require real-time control in complex environments, such as urban combat or dynamic combat zones. These systems offer military personnel greater flexibility while still retaining human control, which is vital for mission reliability and ethical considerations. As militaries transition toward fully autonomous systems, teleoperated RCVs serve as an important intermediary step in adapting to these technologies.

In terms of mobility, the market is divided into wheeled, tracked, and hybrid vehicles. The tracked RCV segment generated USD 302.1 million in 2024. These tracked vehicles offer superior mobility on rugged terrain, making them ideal for frontline operations and combat situations in difficult environments. Their ability to carry heavier payloads, including advanced weaponry and sensor equipment, further increases their demand in direct combat and fire support roles. Additionally, tracked vehicles provide greater stability and recoil absorption, making them well-suited for rapid maneuvers and live-fire scenarios.

U.S. Robotic Combat Vehicles Market was valued at USD 219 million in 2024 due to substantial government spending on defense programs and initiatives, such as the military's focus on unmanned systems for ground and aerial operations. Furthermore, programs like the Army's Robotic Combat Vehicle initiative and the Navy's unmanned systems roadmap contribute to the growing interest in these technologies. The increasing need to reduce risks to military personnel, coupled with evolving threats, further fuels demand for RCVs in the U.S.

Several key players in the Robotic Combat Vehicles Market are actively enhancing their offerings by integrating AI-driven capabilities and improving the robustness of their robotic systems. Companies like General Dynamics Land Systems, BAE Systems, and Teledyne FLIR are leading the way in advancing the functionality and autonomy of these vehicles. They are also focusing on expanding their product portfolios to cater to diverse military needs, such as reconnaissance, surveillance, and logistics. Collaborations with government agencies and defense contractors are another strategy used by these players to secure long-term contracts and reinforce their market presence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising global defense budgets

- 3.3.1.2 Advancements in ai and autonomous navigation

- 3.3.1.3 Development of modular combat platforms

- 3.3.1.4 Demand for unmanned solutions in high-risk zones

- 3.3.1.5 Increasing military modernization programs

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High development and operational costs

- 3.3.2.2 Cybersecurity vulnerabilities

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Mode of Operation, 2021 – 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Autonomous

- 5.3 Teleoperated

Chapter 6 Market Estimates and Forecast, By Mobility, 2021 – 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Wheeled

- 6.3 Tracked

- 6.4 Hybrid

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Intelligence, surveillance, and reconnaissance (ISR)

- 7.3 Direct Combat & Fire Support

- 7.4 Combat Engineering

- 7.5 Medical Evacuation

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BAE Systems

- 9.2 Elbit Systems

- 9.3 General Dynamics Land Systems

- 9.4 HDT Global

- 9.5 Israel Aerospace Industries

- 9.6 Kratos Defense and Security Solutions

- 9.7 Milrem Robotics

- 9.8 Nexter Systems

- 9.9 Oshkosh Defense

- 9.10 Qinetiq

- 9.11 Rheinmetall

- 9.12 Teledyne FLIR

- 9.13 Textron Systems