|

市场调查报告书

商品编码

1750307

共乘即服务市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Carpool-as-a-Service Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

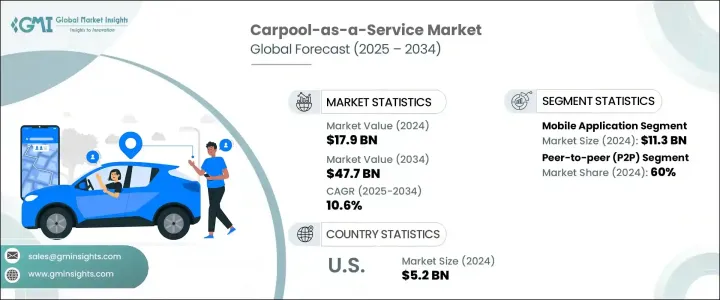

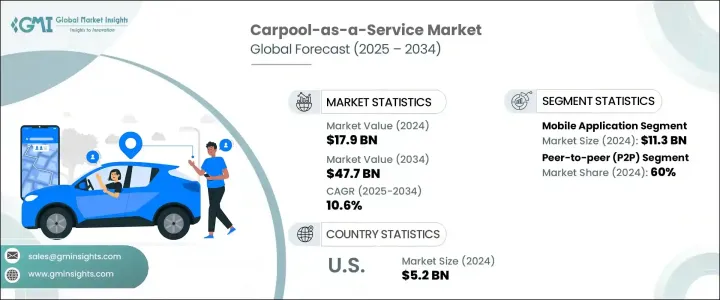

2024年,全球共乘即服务 (CaaS) 市场规模达179亿美元,预计到2034年将以10.6%的复合年增长率成长,达到477亿美元。受城市交通拥堵加剧、环境永续意识增强以及消费者对经济实惠的共享交通解决方案日益增长的青睐等因素推动,该市场正呈现强劲增长势头。随着城市数位化程度不断提高,永续发展成为首要目标,私人营运商、市政交通机构和企业出行计画正将共乘融入多模式交通系统。这种整合正在应对交通拥堵、油耗和通勤成本等关键挑战,同时满足当今出行用户不断变化的需求。

共乘即服务 (CaaS) 的需求正在各种用例中不断增长,包括日常通勤、员工接驳车、长途旅行以及活动交通。基于应用程式的预订、即时匹配和优化路线的便利性,使共乘成为替代单人用车的可行且具有吸引力的替代方案。企业正在采用这些平台来改善员工交通,减轻车队管理负担,并履行其环境、社会和治理 (ESG) 承诺。共乘在上班族、学生和城市居民中的广泛吸引力,持续支撑着它在城市中心和不断扩张的郊区的日常应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 179亿美元 |

| 预测值 | 477亿美元 |

| 复合年增长率 | 10.6% |

先进技术是CaaS发展的关键推动力。人工智慧、GPS追踪、即时路线规划、应用程式内支付以及基于演算法的出行匹配等领域的创新,正在提升服务效率和客户满意度。这些解决方案正被整合到更广泛的出行即服务 (MaaS) 平台中,将共乘与数位钱包、即时公共交通资料和智慧城市基础设施连接起来。这种程度的互通性对于建立完全互联的城市交通生态系统至关重要。

就平台而言,市场细分为行动应用程式、混合系统和基于 Web 的解决方案。行动应用程式引领市场,2024 年营收约 113 亿美元。智慧型手机使用率的提高、行动互联网的普及以及对即时共享出行解决方案日益增长的需求,推动了这一细分市场的主导地位。这些应用程式提供用户友好的介面,并可方便地存取行程安排、即时追踪和数位支付等功能。服务提供者专注于以行动为中心的策略,透过个人化通知、特定位置服务和流畅的导航来提高用户参与度,从而提升忠诚度和用户留存率。行动应用程式还可与车联网系统和语音助理集成,实现免提交互、即时交通洞察和客製化通勤建议。此外,行动优先模式能够以最小的基础设施需求快速扩展,使服务供应商能够有效率地启动和扩展业务。

市场也按类型细分为点对点 (P2P)、企业对消费者 (B2C) 和其他模式。 P2P 细分市场在 2024 年占据最大份额,为 60%。人们对去中心化共乘网路的兴趣日益浓厚,这种网路透过数位平台将私人车主与乘客直接联繫起来,这支撑了这个细分市场的成长。这种安排降低了开销,提供了灵活性,并允许个人将车辆的閒置容量货币化。它吸引了寻求节省成本的日常通勤者和寻求额外收入的司机。 P2P 平台配备了智慧乘车匹配、安全支付和直接应用内部通讯等功能,可增强用户信心并简化乘车协调。随着城市中心的发展和通勤需求的增加,P2P 服务持续受到欢迎,尤其是在学生、自由工作者和城市专业人士中。

从商业模式的角度来看,CaaS 市场包括佣金制、订阅制、免费增值和其他收入策略。佣金制模式在 2024 年占据了市场主导地位,因为它具有可扩展的结构,允许平台从每笔完成的行程中赚取一定比例的收入。该模式以极低的前期投资支援成长,对用户和服务提供者都具有吸引力。它鼓励临时用户和兼职司机广泛参与,无需昂贵的入职培训或车队投资。由于其简单易用、营运成本低且适应不同市场,该模式被广泛应用,尤其适用于采用轻资产框架营运的平台。

根据应用,市场分为日常通勤、长途旅行、机场接送、活动旅行和其他。 2024年,日常通勤成为主要细分市场,占据了最高的收入份额。随着城市拥堵加剧、油价上涨以及消费者对环保通勤替代方案的意识增强,这一细分市场正在不断扩大。共乘有助于缓解交通压力、减少排放并降低通勤费用。专业人士、学生和零工等使用者经常依赖这些服务,尤其是在车辆密度高、停车位有限的城市。 GPS辅助路线规划和行动支付等功能提高了可靠性,尤其是在尖峰时段。企业和机构越来越多地透过提供奖励并将共享乘车服务整合到内部移动系统中来推广日常共乘。

从地区来看,美国引领北美市场,2024 年市场规模达 52 亿美元,预估预测期内复合年增长率为 10.9%。美国的成长动力源自于智慧型手机的高普及率、完善的数位基础设施以及庞大的通勤人口。全美各大城市都面临日常交通挑战,对替代交通解决方案的需求强劲。多家提供先进数位解决方案的服务供应商的存在也支持了其广泛应用。政府鼓励永续交通的政策,加上共乘车道的开放和共享汽车通行费的降低,进一步激励了 CaaS 的使用。随着企业持续投资于基于云端的系统、预测分析和人工智慧驱动的工具,以提升乘客体验、营运效率和环境绩效,市场正在快速发展。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 组件提供者

- 製造商

- 技术提供者

- 配销通路分析

- 最终用途

- 利润率分析

- 供应商格局

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 对贸易的影响

- 技术与创新格局

- 专利分析

- 监管格局

- 成本細項分析

- 重要新闻和倡议

- 衝击力

- 成长动力

- 城市拥挤与污染减少

- 政府支持与政策推动

- 为用户节省成本

- 技术和平台成熟度

- 产业陷阱与挑战

- 入住率低和可靠性问题

- 使用者信任与安全问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依商业模式,2021 - 2034 年

- 主要趋势

- 佣金制模式

- 基于订阅的模式

- 免费增值模式

- 其他的

第六章:市场估计与预测:依平台,2021 - 2034 年

- 主要趋势

- 行动应用程式

- 杂交种

- 网路为基础的平台

第七章:市场估计与预测:按类型,2021 - 2034

- 主要趋势

- 点对点(P2P)

- 企业对消费者(B2C)

- 其他的

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 日常通勤

- 长途旅行

- 机场接送

- 基于活动的旅行

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Berymo

- BlaBlaCar

- Carma

- DiDi

- Getaround

- Gojek Tech

- Grab.

- Liftshare

- Lyft

- Motar

- Ola Cabs

- Poparide

- Quick Ride

- Scoop

- Splt

- Trempy

- Uber

- Via.

- Waze Carpool

- Zimride

The Global Carpool-As-A-Service (CaaS) Market was valued at USD 17.9 billion in 2024 and is estimated to grow at a CAGR of 10.6% to reach USD 47.7 billion by 2034. The market is experiencing robust momentum, propelled by increasing urban congestion, heightened awareness of environmental sustainability, and a growing preference for affordable, shared transportation solutions. As cities become more digitally connected and sustainability becomes a primary objective, carpooling is being integrated into multimodal transport systems by private operators, municipal transit agencies, and corporate mobility programs. This integration is addressing key challenges such as traffic congestion, fuel consumption, and commuting costs while meeting the evolving needs of today's mobility users.

Demand for CaaS is expanding across various use cases, including routine commuting, employee shuttles, long-haul rides, and transportation for events. The convenience of app-based bookings, instant ride-matching, and optimized routing has positioned carpooling as a viable and attractive alternative to single-occupancy vehicle use. Businesses are adopting these platforms to improve employee transportation, reduce fleet management burdens, and align with environmental, social, and governance (ESG) commitments. The widespread appeal of shared rides among workers, students, and city dwellers continues to support daily adoption in both urban centers and expanding suburban regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.9 Billion |

| Forecast Value | $47.7 Billion |

| CAGR | 10.6% |

Advanced technology is a key enabler in the development of CaaS. Innovations in artificial intelligence, GPS tracking, real-time route mapping, in-app payments, and algorithm-based ride matching are driving service efficiency and customer satisfaction. These solutions are being integrated into broader mobility-as-a-service (MaaS) platforms, linking carpooling to digital wallets, real-time public transit data, and smart city infrastructure. This level of interoperability is critical for building a fully connected urban transport ecosystem.

In terms of platforms, the market is segmented into mobile applications, hybrid systems, and web-based solutions. Mobile applications led the market, with revenue reaching approximately USD 11.3 billion in 2024. The dominance of this segment is fueled by increasing smartphone usage, widespread mobile internet access, and growing demand for real-time ride-sharing solutions. These applications offer a user-friendly interface and convenient access to features like ride scheduling, live tracking, and digital payments. Service providers are focusing on mobile-centric strategies that improve user engagement through personalized notifications, location-specific services, and smooth navigation, all of which enhance loyalty and user retention. Mobile apps also integrate with connected vehicle systems and voice assistants, allowing for hands-free interaction, real-time traffic insights, and tailored commuting suggestions. Additionally, the mobile-first model enables rapid expansion with minimal infrastructure requirements, allowing providers to launch and scale efficiently.

The market is also segmented by type into peer-to-peer (P2P), business-to-consumer (B2C), and other models. The P2P segment accounted for the largest share at 60% in 2024. The growth of this segment is underpinned by rising interest in decentralized ride-sharing networks that connect private vehicle owners with passengers directly through digital platforms. This arrangement reduces overhead, offers flexibility, and allows individuals to monetize their vehicle's idle capacity. It appeals to daily commuters seeking cost savings and drivers looking for extra income. P2P platforms come equipped with features such as intelligent ride matching, secure payments, and direct in-app communication, which strengthen user confidence and simplify ride coordination. As urban centers grow and commuting demand increases, P2P services continue to gain popularity, especially among students, freelancers, and urban professionals.

From a business model standpoint, the CaaS market includes commission-based, subscription-based, freemium, and other revenue strategies. The commission-based model dominated the market in 2024 due to its scalable structure that allows platforms to earn a percentage of each completed ride. This model supports growth with minimal upfront investment, making it attractive for both users and providers. It encourages broad participation from casual users and part-time drivers without the need for expensive onboarding or fleet investments. The structure is widely used due to its simplicity, low operational costs, and adaptability across different markets, especially for platforms that operate with asset-light frameworks.

By application, the market is divided into daily commuting, long-distance travel, airport transfers, event-based travel, and others. Daily commuting emerged as the leading segment in 2024, accounting for the highest revenue share. This segment is expanding as urban congestion worsens, fuel prices rise, and consumers become more conscious of eco-friendly commuting alternatives. Carpooling helps reduce traffic pressure, cut emissions, and lower commuting expenses. Users such as professionals, students, and gig workers regularly rely on these services, especially in cities with high vehicle density and limited parking. Features like GPS-assisted route planning and mobile payments improve reliability, particularly during peak hours. Businesses and institutions are increasingly promoting daily carpooling by offering incentives and integrating shared rides into internal mobility systems.

Regionally, the United States led the North American market, generating USD 5.2 billion in 2024 and projected to grow at a CAGR of 10.9% during the forecast period. Growth in the U.S. is driven by high smartphone adoption, established digital infrastructure, and a large commuting population. Major cities across the country face daily traffic challenges, creating strong demand for alternative transit solutions. The presence of multiple service providers offering advanced digital solutions also supports widespread adoption. Government policies encouraging sustainable transportation, combined with access to carpool lanes and reduced tolls for shared vehicles, further incentivize CaaS usage. The market is evolving rapidly as companies continue to invest in cloud-based systems, predictive analytics, and AI-driven tools that enhance rider experience, operational efficiency, and environmental performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Impact on trade

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Cost breakdown analysis

- 3.7 Key news & initiatives

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Urban congestion and pollution reduction

- 3.8.1.2 Government support and policy push

- 3.8.1.3 Cost savings for users

- 3.8.1.4 Technology and platform maturity

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Low occupancy and reliability issues

- 3.8.2.2 User trust and safety concerns

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Business Model, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Commission-Based model

- 5.3 Subscription-Based model

- 5.4 Freemium model

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Platform, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Mobile application

- 6.3 Hybrid

- 6.4 Web-based platform

Chapter 7 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Peer-to-Peer (P2P)

- 7.3 Business-to-Consumer (B2C)

- 7.4 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Daily commuting

- 8.3 Long-Distance travel

- 8.4 Airport transfers

- 8.5 Event-Based travel

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Berymo

- 10.2 BlaBlaCar

- 10.3 Carma

- 10.4 DiDi

- 10.5 Getaround

- 10.6 Gojek Tech

- 10.7 Grab.

- 10.8 Liftshare

- 10.9 Lyft

- 10.10 Motar

- 10.11 Ola Cabs

- 10.12 Poparide

- 10.13 Quick Ride

- 10.14 Scoop

- 10.15 Splt

- 10.16 Trempy

- 10.17 Uber

- 10.18 Via.

- 10.19 Waze Carpool

- 10.20 Zimride