|

市场调查报告书

商品编码

1750309

防污染鼻喷剂市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Anti-pollution Nasal Spray Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

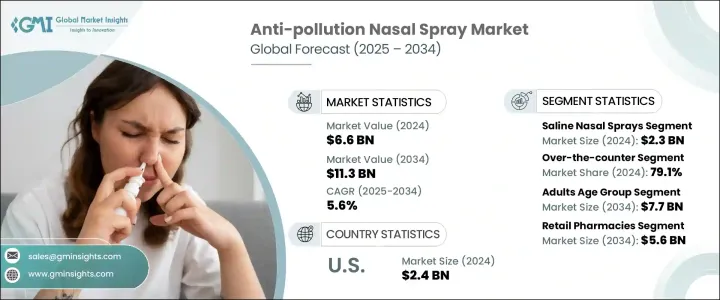

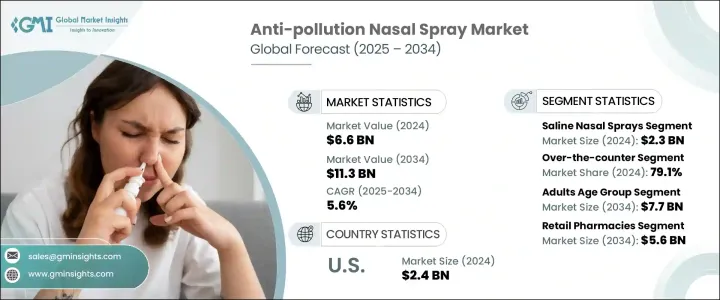

2024年,全球抗污染鼻喷剂市场规模达66亿美元,预计到2034年将以5.6%的复合年增长率成长,达到113亿美元。这一稳步增长主要源于人们对空气污染及其对人体健康的有害影响日益增长的担忧。接触污染空气会导致多种危及生命的疾病,包括心血管疾病、呼吸系统併发症和其他慢性疾病。随着城市环境污染水平的上升以及越来越多的人居住在人口稠密的地区,对鼻喷剂等预防性健康解决方案的需求大幅增长。这些产品越来越被视为一种简单有效的防御机制,可以抵御可能加重呼吸系统疾病的空气污染物。

越来越多的证据显示细悬浮微粒和环境过敏原对鼻腔和呼吸系统的影响。随着污染持续加剧,尤其是在工业区和大都市地区,消费者开始寻求能够快速缓解并长期保护的日常产品。鼻喷剂,尤其是那些专门用于清除鼻腔刺激物和污染物的喷雾剂,正逐渐成为日常呼吸护理中被广泛接受的一部分。气喘、过敏性鼻炎和慢性阻塞性肺病等空气污染相关呼吸系统疾病发生率的上升,对市场扩张起到了关键作用。消费者对定期使用鼻喷剂的预防益处的认识不断提高,以及对早期干预的重视,正在鼓励他们采用鼻喷剂。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 66亿美元 |

| 预测值 | 113亿美元 |

| 复合年增长率 | 5.6% |

就产品类型而言,市场细分为生理食盐水鼻喷剂、顺势疗法鼻喷剂、屏障保护型鼻喷剂和类固醇鼻喷剂。生理食盐水鼻喷剂以2024年23亿美元的估值领先市场。其主导地位主要源于其已被证实能够有效清除空气中的颗粒物并保持鼻腔湿润。这类喷雾剂因其操作简便、风险低而广受欢迎,适合日常使用,且适用于各个年龄层。它们能够缓解灰尘、烟雾和其他污染物对鼻腔的刺激,成为消费者的首选。

根据产品分类,市场分为处方药和非处方药 (OTC) 鼻喷剂。 OTC 市场在 2024 年成为主导类别,占整体市占率的 79.1%。随着人们更加积极主动地管理自身健康,OTC 产品因其可近性和便利性而广受欢迎。消费者越来越倾向于选择无需医生咨询的鼻喷剂,尤其是在治疗鼻塞和鼻刺激等轻微但常见的症状时。自我照顾和预防性保健习惯的普及也进一步支持了这一趋势。

按年龄细分,市场包括儿童和成人使用者。成人细分市场在2024年占据最大市场份额,价值46亿美元,预计到2034年将成长至77亿美元,预测期内复合年增长率为5.5%。成人更频繁地暴露在污染水平往往更高的户外环境中,这促使人们使用鼻喷剂来对抗污染引起的呼吸道症状。医疗保健资讯的获取管道更加便捷,可支配收入的提高,以及人们对自我管理健康习惯日益增长的兴趣,进一步刺激了这一细分市场的需求。

根据应用,市场分为过敏、鼻窦充血和气喘。过敏领域在2024年占据突出地位,价值31亿美元。由空气中的过敏原和污染物引起的过敏症状日益增多,促使消费者寻求快速有效的缓解方法。用于缓解过敏的鼻喷剂因其便捷的管理症状和改善日常舒适度而越来越受欢迎。倡导更好过敏管理的公共卫生运动也在推动产品普及方面发挥辅助作用。

抗污染鼻喷剂的分销管道包括医院药房、零售药局和线上药局。零售药局在2024年成为领先细分市场,预计到2034年将达到56亿美元。零售店的受欢迎程度源于其广泛的覆盖范围以及能够立即获得各种鼻喷剂产品的能力。寻求快速非处方解决方案的消费者通常依赖零售药局的便利性和可近性。随着自我照护日益成为主流,零售药局将继续成为寻求有效管理日常健康问题的消费者的关键接触点。

从区域格局来看,美国在2024年占据了北美市场的主要份额,估值达24亿美元。与污染相关的呼吸系统疾病发生率的上升,以及消费者群体的知情度不断提升,增强了美国对鼻喷剂的需求。城市中心的高污染水平和日益增强的健康意识,导致人们对防护性健康产品的依赖性不断增强。

市场领导企业合计占据约65%-75%的市场份额,这些企业持续专注于产品创新、策略合作和业务扩张,以满足日益增长的消费者需求。市场集中度依然较高,主要参与者采取积极策略,以保持竞争优势,并应对全球日益增长的对污染引起的呼吸系统健康问题的关注。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 呼吸健康意识不断增强

- 过敏和呼吸系统疾病的盛行率不断上升

- 鼻腔给药系统的进展

- 产业陷阱与挑战

- 监管挑战和安全问题

- 替代剂型的可用性

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 管道分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 顺势疗法鼻喷剂

- 盐水鼻喷剂

- 屏障保护鼻喷剂

- 类固醇鼻喷剂

第六章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 处方

- 在柜檯

第七章:市场估计与预测:按年龄组,2021 - 2034 年

- 主要趋势

- 儿科

- 成年人

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 过敏

- 鼻窦充血

- 气喘

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Altamira Therapeutics

- Arm & Harmer (Church & Dwight)

- AstraZeneca

- Beekeepers' Naturals

- BF Ascher

- GlaxoSmithKline

- Himalaya Wellness

- Merck

- Nasaleze

- NeilMed Pharmaceuticals

- Sterimar

- Trutek

- Xlear

The Global Anti-Pollution Nasal Spray Market was valued at USD 6.6 billion in 2024 and is estimated to expand at a CAGR of 5.6% to reach USD 11.3 billion by 2034. This steady growth is largely attributed to the rising concern surrounding air pollution and its harmful impact on human health. Exposure to polluted air is linked to several life-threatening conditions, including cardiovascular diseases, respiratory complications, and other chronic illnesses. With pollution levels rising in urban environments and more people living in densely populated areas, the demand for preventive health solutions like nasal sprays has increased considerably. These products are increasingly viewed as a simple and effective defense mechanism against airborne contaminants that can aggravate respiratory health.

A growing body of evidence highlights the impact of fine particulate matter and environmental allergens on the nasal passages and respiratory system. As pollution continues to intensify, especially in industrial and metropolitan areas, consumers are turning toward daily-use products that can offer quick relief and long-term protection. Nasal sprays, especially those formulated to remove irritants and pollutants from the nasal passages, are becoming a widely accepted part of respiratory care routines. The rising incidence of air pollution-related respiratory disorders, including asthma, allergic rhinitis, and chronic obstructive pulmonary disease, is playing a key role in supporting market expansion. Increasing awareness about the preventive benefits of using nasal sprays regularly and the emphasis on early intervention are encouraging consumer adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.6 Billion |

| Forecast Value | $11.3 Billion |

| CAGR | 5.6% |

In terms of product type, the market is segmented into saline nasal sprays, homeopathic nasal sprays, barrier protection nasal sprays, and steroid nasal sprays. Saline nasal sprays led the market with a valuation of USD 2.3 billion in 2024. Their dominance is largely due to their proven effectiveness in flushing out airborne particles and maintaining moisture in nasal passages. These sprays are favored for their simplicity and minimal risk, making them suitable for everyday use and for a wide range of age groups. Their ability to relieve nasal irritation from dust, smoke, and other pollutants makes them a preferred choice among consumers.

Based on product classification, the market is categorized into prescription-based and over-the-counter (OTC) nasal sprays. The OTC segment emerged as the dominant category in 2024, accounting for 79.1% of the overall market share. As people become more proactive in managing their health, OTC products have gained immense popularity due to their accessibility and convenience. Consumers are increasingly inclined to choose nasal sprays that do not require a doctor's consultation, especially for addressing minor yet frequent symptoms like nasal congestion and irritation. The popularity of self-care and preventive health practices continues to support this trend.

Age-wise segmentation of the market includes pediatric and adult users. The adult segment held the largest market share in 2024, with a value of USD 4.6 billion, and is expected to grow to USD 7.7 billion by 2034, registering a CAGR of 5.5% during the forecast period. Adults are more frequently exposed to outdoor environments where pollution levels tend to be higher, driving the use of nasal sprays to combat pollution-induced respiratory symptoms. Better access to healthcare information, higher disposable incomes, and a growing interest in self-managed health routines have further fueled demand in this segment.

By application, the market is divided into allergy, sinus congestion, and asthma. The allergy segment held a prominent position in 2024, valued at USD 3.1 billion. The increasing occurrence of allergy symptoms caused by airborne allergens and pollutants is prompting consumers to seek fast-acting and effective relief options. Nasal sprays designed for allergy relief are being used more frequently as they offer a convenient way to manage symptoms and improve daily comfort. Public health campaigns promoting better allergy management also play a supporting role in driving product adoption.

Distribution channels for anti-pollution nasal sprays include hospital pharmacies, retail pharmacies, and online pharmacies. Retail pharmacies emerged as the leading segment in 2024 and are projected to reach USD 5.6 billion by 2034. The popularity of retail outlets stems from their widespread availability and ability to provide immediate access to a broad range of nasal spray options. Consumers looking for quick, non-prescription solutions often rely on retail pharmacies for convenience and accessibility. As self-care becomes more mainstream, retail pharmacies continue to serve as a critical touchpoint for consumers looking to manage everyday health concerns efficiently.

In the regional landscape, the U.S. accounted for a major share of the North American market in 2024, with a valuation of USD 2.4 billion. The rising occurrence of respiratory ailments linked to pollution, along with a well-informed consumer base, has strengthened the demand for nasal sprays in the country. High pollution levels in urban centers and growing health consciousness have led to an increased reliance on protective health products.

Leading companies in the market, which together control approximately 65%-75% of the total market share, continue to focus on product innovation, strategic collaborations, and business expansion to meet the growing consumer demand. The market remains concentrated, with key players adopting aggressive strategies to retain their competitive edge and respond to increasing global awareness about pollution-induced respiratory health issues.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing awareness for respiratory health

- 3.2.1.2 Increasing prevalence of allergies and respiratory disorders

- 3.2.1.3 Advancement in nasal drug delivery systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory challenges and safety concerns

- 3.2.2.2 Availability of alternative dosage form

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Pipeline analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Homeopathic nasal sprays

- 5.3 Saline nasal sprays

- 5.4 Barrier protection nasal spray

- 5.5 Steroid nasal sprays

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Prescription

- 6.3 Over the counter

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pediatric

- 7.3 Adults

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Allergy

- 8.3 Sinus congestion

- 8.4 Asthma

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospital pharmacies

- 9.3 Retail pharmacies

- 9.4 Online pharmacies

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Altamira Therapeutics

- 11.2 Arm & Harmer (Church & Dwight)

- 11.3 AstraZeneca

- 11.4 Beekeepers’ Naturals

- 11.5 B.F Ascher

- 11.6 GlaxoSmithKline

- 11.7 Himalaya Wellness

- 11.8 Merck

- 11.9 Nasaleze

- 11.10 NeilMed Pharmaceuticals

- 11.11 Sterimar

- 11.12 Trutek

- 11.13 Xlear