|

市场调查报告书

商品编码

1750316

宠物过敏治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Pet Allergy Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

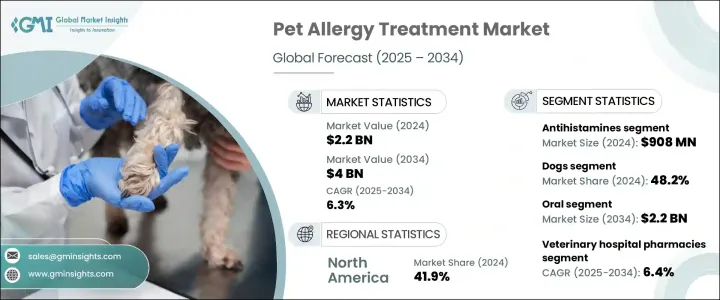

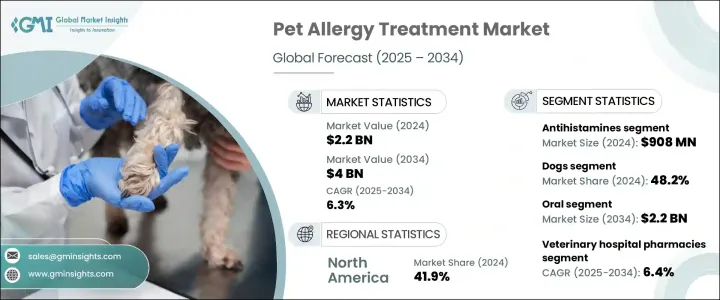

2024年,全球宠物过敏治疗市场规模达22亿美元,预估年复合成长率为6.3%,2034年将达40亿美元。这一增长主要源于全球伴侣动物数量的增长以及宠物各种过敏症状的诊断增加。随着越来越多的家庭饲养宠物,跳蚤过敏、食物敏感和环境反应等过敏症状在动物中也变得越来越常见,对有效治疗的需求也日益迫切。随着宠物主人和兽医对现有解决方案的认识不断提高,需求持续激增。幼宠和成年宠物过敏症状的持续上升,正推动治疗产品的创新和普及。这些治疗方法不仅能改善动物的生活质量,还能透过更有效地控制症状,降低宠物主人的长期兽医费用。宠物过敏疗法通常结合多种药物,针对不同类型的过敏反应,包括皮肤过敏、跳蚤过敏、食物过敏和环境过敏。宠物护理支出的增加和兽医服务的普及进一步加速了市场需求。随着宠物主人越来越关注搔痒、发红和打喷嚏等症状,重视早期和持续的治疗在促进全球市场产品需求方面发挥着至关重要的作用。

宠物过敏市场的治疗旨在透过各种剂型(例如抗组织胺、皮质类固醇、外用产品和过敏原特异性免疫疗法)来管理和控制动物的过敏症状。 2024 年,该市场价值达 22.3 亿美元。在各类药物中,抗组织胺占据主导地位,创造了 9.08 亿美元的收入。这些药物因其快速起效和安全性而被广泛用作一线治疗药物。抗组织胺以快速缓解瘙痒、发炎和打喷嚏等过敏症状而闻名。它们有多种剂型——片剂、液体和注射剂——为宠物主人和兽医提供了便捷的选择。此外,一些抗组织胺药物无需处方即可获得,提高了药物的可及性,从而提高了药物的采用率。它们广泛可用,并且易于在不同大小和物种的动物身上使用,进一步巩固了该领域的主导地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 22亿美元 |

| 预测值 | 40亿美元 |

| 复合年增长率 | 6.3% |

按宠物类型分析,狗占据了大部分市场份额,2024 年占 48.2%。这个细分市场受益于越来越多的家庭养狗,以及随之而来的宠物相关支出的成长。狗被诊断出患有过敏性疾病(尤其是慢性皮肤病)的频率更高,这促使对针对性过敏治疗的需求增加。狗过敏性疾病发生率的上升,加上人们越来越愿意为高品质的医疗保健解决方案花钱,推动了这个类别的扩张。先进的犬类专用药物的开发进一步提高了治疗效果和客户满意度。

根据给药途径,市场分为口服、肠外和外用製剂。口服药物市场占据主导地位,预计2034年将达到22亿美元。口服药物因其易于使用而备受青睐,是长期过敏管理的理想选择。这些药物通常以咀嚼片和液体等可口剂型提供,更容易融入宠物的日常生活,不会造成压力或不适。宠物主人喜欢口服药物,因为它们是非侵入性的,可以谨慎地添加到饮食中,从而提高治疗依从性和疗效。此外,製药公司也不断开发更多口味、更亲民的产品,使其更容易被动物接受,从而增强了它们在宠物照护者中的受欢迎程度。

宠物过敏治疗药物的通路包括兽医院药局、零售店和线上平台。兽医院药局在2024年占最大份额,预计到2034年将以超过6.4%的复合年增长率成长。这些药房受益于直接获得专业护理的优势,因为治疗通常经过兽医专业人员的全面评估后才进行。提供个人化用药计画和专家指导的能力显着提升了客户的信任度和忠诚度。宠物主人也倾向于依赖这些管道获得更高品质且经兽医认可的药物,从而巩固了其市场主导地位。

从地区来看,2024年北美占据全球宠物过敏治疗市场41.9%的份额,光是美国市场就达到8.512亿美元。宠物饲养普及、可支配收入高以及获得先进兽医护理等因素促成了该地区的领先地位。宠物人性化趋势的日益增强也导致宠物健康和保健产品支出增加,从而支持了市场扩张。竞争态势激烈,全球领导企业和地区参与者都在推出创新解决方案并扩展产品组合。

包括礼来动保、硕腾、默克动保、Vetoquinol、维克和勃林格殷格翰在内的顶级公司占据了整个市场的约55-60%。这些公司采取收购、合作和新产品发布等策略性倡议,以在这个不断发展的行业中站稳脚跟,并推动进一步成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 宠物过敏盛行率上升

- 非处方药(OTC)的供应情况

- 宠物拥有量增加,兽医费用增加

- 产业陷阱与挑战

- 药物的副作用

- 越来越多人采用自然疗法或家庭疗法

- 成长动力

- 成长潜力分析

- 监管格局

- 管道分析

- 未来市场趋势

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按药物类别,2021 - 2034 年

- 主要趋势

- 抗组织胺药

- 皮质类固醇

- 免疫疗法

- 其他药物类别

第六章:市场估计与预测:按宠物类型,2021 - 2034 年

- 主要趋势

- 狗

- 猫

- 兔子

- 其他宠物类型

第七章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 口服

- 肠外

- 外用

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 兽医院药房

- 零售药局

- 网路药局

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Boehringer Ingelheim International

- Ceva Sante Animale

- Dechra

- Elanco

- Idexx

- Merck Animal Health

- Neogen Corporation

- PetIQ

- Provetica

- Vetoquinol

- Virbac

- Zoetis

The Global Pet Allergy Treatment Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 4 billion by 2034. This growth is primarily driven by the rising number of companion animals globally and the increasing diagnosis of various allergic conditions in pets. With more households owning pets, conditions such as flea allergies, food sensitivities, and environmental reactions are becoming more common in animals, creating a strong need for effective treatments. As awareness increases among pet owners and veterinarians about available solutions, demand continues to surge. The consistent rise in allergic conditions among both young and adult pets is encouraging innovation and greater adoption of therapeutic products. These treatments not only improve the quality of life for animals but also reduce long-term veterinary costs for pet owners by managing symptoms more effectively. Pet allergy therapies typically involve a combination of drugs aimed at different types of reactions, including skin, flea, food, and environmental allergies. Increasing pet care expenditures and improved access to veterinary services are further accelerating market demand. As pet parents become more attentive to symptoms such as itching, redness, and sneezing, the emphasis on early and consistent treatment is playing a crucial role in boosting product uptake across global markets.

Treatments in the pet allergy market aim to manage and control allergic symptoms in animals through various formulations such as antihistamines, corticosteroids, topical products, and allergen-specific immunotherapy. In 2024, the market was valued at USD 2.23 billion. Among drug classes, antihistamines emerged as the leading segment, generating revenue worth USD 908 million. These drugs are widely used as a first-line therapy due to their quick onset of action and safety profile. Antihistamines are known for delivering fast relief from allergic signs such as itching, inflammation, and sneezing. Their availability in multiple formats-tablets, liquids, and injectables-makes them a convenient option for both pet owners and veterinarians. Additionally, the option to obtain some antihistamines without a prescription increases accessibility, promoting higher adoption rates. Their widespread availability and ease of administration across different animal sizes and species further support this segment's dominance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $4 Billion |

| CAGR | 6.3% |

When analyzed by pet type, dogs held the majority share, accounting for 48.2% of the market in 2024. This segment benefits from the rising number of households adopting dogs and the subsequent increase in pet-related spending. Dogs are more frequently diagnosed with allergic conditions, particularly chronic skin issues, prompting higher demand for targeted allergy treatments. This growing incidence of allergic disorders in dogs, combined with an increasing willingness to spend on high-quality healthcare solutions, fuels the expansion of this category. The development of advanced dog-specific medications further enhances treatment effectiveness and customer satisfaction.

Based on the route of administration, the market is divided into oral, parenteral, and topical formulations. The oral segment led the market and is expected to reach USD 2.2 billion by 2034. Oral treatments are highly favored due to their ease of use, making them ideal for long-term allergy management. These medications are often available in palatable forms like chews and liquids, making them easier to incorporate into a pet's routine without causing stress or discomfort. Pet owners prefer oral options because they are non-invasive and can be discreetly added to meals, improving treatment compliance and outcomes. Additionally, pharmaceutical companies are consistently developing more flavor-friendly products, making them more acceptable to animals, which strengthens their popularity among pet caregivers.

Distribution channels for pet allergy treatments include veterinary hospital pharmacies, retail outlets, and online platforms. Veterinary hospital pharmacies held the largest share in 2024 and are forecasted to grow at over 6.4% CAGR through 2034. These pharmacies benefit from direct access to specialized care, as treatments are usually dispensed following thorough assessments by veterinary professionals. The ability to offer personalized medication plans and expert guidance significantly boosts customer trust and loyalty. Pet owners also tend to rely on these channels for higher-quality and veterinarian-approved medications, reinforcing their dominant market position.

Regionally, North America accounted for 41.9% of the global pet allergy treatment market share in 2024, with the U.S. market alone reaching USD 851.2 million. Factors such as widespread pet ownership, high disposable income, and access to advanced veterinary care contribute to the region's leading position. The increasing trend of pet humanization also results in more spending on health and wellness products for pets, supporting market expansion. Competitive dynamics are intense, with both global leaders and regional players introducing innovative solutions and expanding product portfolios.

Top companies including Elanco Animal Health, Zoetis, Merck Animal Health, Vetoquinol, Virbac, and Boehringer Ingelheim collectively account for around 55-60% of the total market. These players engage in strategic moves such as acquisitions, partnerships, and new product launches to maintain their foothold and drive further growth in this evolving industry.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of pet allergies

- 3.2.1.2 Availability of over the counter (OTC) medications

- 3.2.1.3 Increasing pet ownership and rising veterinary expenditure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects of medications

- 3.2.2.2 Increasing adoption of natural or home-based remedies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Future market trends

- 3.7 Trump administration tariffs

- 3.7.1 Impact on trade

- 3.7.1.1 Trade volume disruptions

- 3.7.1.2 Retaliatory measures

- 3.7.2 Impact on the Industry

- 3.7.2.1 Supply-side impact

- 3.7.2.1.1 Price volatility in key materials

- 3.7.2.1.2 Supply chain restructuring

- 3.7.2.1.3 Production cost implications

- 3.7.2.2 Demand-side impact (selling price)

- 3.7.2.2.1 Price transmission to end markets

- 3.7.2.2.2 Market share dynamics

- 3.7.2.2.3 Consumer response patterns

- 3.7.2.1 Supply-side impact

- 3.7.3 Key companies impacted

- 3.7.4 Strategic industry responses

- 3.7.4.1 Supply chain reconfiguration

- 3.7.4.2 Pricing and product strategies

- 3.7.4.3 Policy engagement

- 3.7.5 Outlook and future considerations

- 3.7.1 Impact on trade

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Antihistamines

- 5.3 Corticosteroids

- 5.4 Immunotherapy

- 5.5 Other drug classes

Chapter 6 Market Estimates and Forecast, By Pet Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Rabbits

- 6.5 Other pet types

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Parenteral

- 7.4 Topical

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Boehringer Ingelheim International

- 10.2 Ceva Sante Animale

- 10.3 Dechra

- 10.4 Elanco

- 10.5 Idexx

- 10.6 Merck Animal Health

- 10.7 Neogen Corporation

- 10.8 PetIQ

- 10.9 Provetica

- 10.10 Vetoquinol

- 10.11 Virbac

- 10.12 Zoetis