|

市场调查报告书

商品编码

1750317

手术剪市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Surgical Scissors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

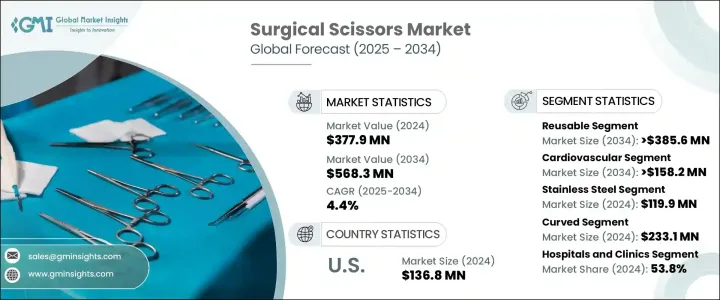

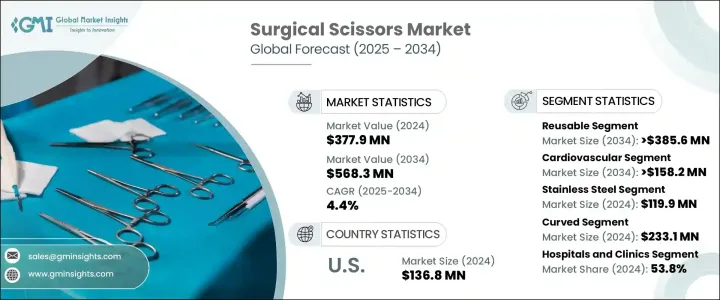

2024年,全球手术剪市场规模达3.779亿美元,预计到2034年将以4.4%的复合年增长率成长,达到5.683亿美元。这主要得益于全球人口老化和慢性病病例增加所带来的手术数量成长。随着医疗保健系统对日益增长的需求做出回应,医院和外科中心纷纷投资于先进的高精度手术器械。微创手术的创新进一步推动了对耐用且旨在改善患者预后的手术器械的需求。随着精准度和安全性成为重中之重,高品质的手术剪已成为高效手术的关键。

随着心血管疾病、癌症和糖尿病等慢性疾病的发生率上升,外科手术的数量持续增加。这一趋势,尤其是在老年人群中,刺激了对高可靠性和高效手术剪的需求。许多医疗机构投资于技术升级的电动工具,以提高手术准确性并缩短手术时间。由于外科基础设施的不断发展,新兴市场的需求也出现了类似的成长,这推动了精密工具的采购。在众多类型中,可重复使用的剪刀正日益受到青睐,因为它们能够降低长期营运成本,并符合医疗保健的可持续发展目标。这些剪刀采用碳化钨或优质不銹钢等材料製成,具有更长的使用寿命、更锋利的切口和更高的性能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.779亿美元 |

| 预测值 | 5.683亿美元 |

| 复合年增长率 | 4.4% |

手术剪刀市场主要分为两类:可重复使用剪刀和一次性剪刀。预计可重复使用剪刀市场将以4.7%的复合年增长率成长,到2034年达到3.856亿美元。随着医疗机构专注于降低长期成本,他们正在转向可重复使用的器材。越来越多的外科中心和医院开始采用可多次消毒和重复使用的剪刀,从而最大限度地减少一次性剪刀带来的浪费。此外,可重复使用剪刀采用不銹钢或碳化钨等优质材料製成,从而提高了其精度和耐用性。这些材料提高了手术过程中缝合的可靠性。

心血管手术剪刀市场预计将以4.8%的复合年增长率成长,到2034年达到1.582亿美元,这主要得益于心臟手术的精准需求,因为精准的切口对于患者的生存至关重要。心血管手术剪刀采用特殊设计的锋利刀片,可最大限度地减少对脆弱心臟组织的损伤,从而确保更好的手术效果。这些剪刀的先进工程设计使其具有极高的精准度,这对于此类复杂且高风险的手术至关重要。

2024年,美国手术剪市场规模达1.368亿美元,得益于其强大的医疗体系、大量的手术以及手术器械技术的持续创新。美国始终保持市场领先地位,不断推出新产品并取得进展,提升了各领域手术器械的可用性和专业化程度。因此,美国市场持续吸引大量投资,推动更精密、更专业的手术器械的开发,以实现精准高效的手术。

为了确保竞争优势,Elixir Surgical、Surgicalholdings、INTEGRA、Storz、WPI、Teleflex、Aspen、HuFriedy、Stryker、KLS Martin、Medline、B. Braun、Millennium Surgical、BD 和 Scanlan 等公司正在大力投资研发和精密製造。这些公司专注于设计符合人体工学的专用手术剪刀,拓展产品组合,并加强全球分销合作伙伴关係,以满足全球日益增长的外科手术需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 手术剪技术的进步

- 慢性病盛行率上升

- 对微创手术的需求

- 门诊手术激增

- 产业陷阱与挑战

- 产品生命週期短

- 可重复使用器械的感染风险担忧

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 各国应对措施

- 对产业的影响

- 供应方影响(製造成本)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(消费者成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(製造成本)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 定价分析

- 技术格局

- 差距分析

- 波特的分析

- PESTEL分析

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按剪刀类型,2021 年至 2034 年

- 主要趋势

- 可重复使用的

- 一次性的

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 心血管

- 骨科手术

- 胃肠病学

- 神经病学

- 其他应用

第七章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 不銹钢

- 钛

- 钨

- 陶瓷製品

- 其他材料

第八章:市场估计与预测:按笔尖形状,2021 年至 2034 年

- 主要趋势

- 弯曲

- 直的

- 其他尖端形状

第九章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院和诊所

- 门诊手术中心

- 其他最终用户

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Aspen

- B. Braun

- Becton, Dickinson and Company

- ELIXIR SURGICAL

- HuFriedy

- INTEGRA

- STORZ

- KLS Martin

- MEDLINE

- MILLENNIUM SURGICAL

- SCANLAN

- stryker

- Surgicalholdings

- Teleflex

- WPI

The Global Surgical Scissors Market was valued at USD 377.9 million in 2024 and is estimated to grow at a CAGR of 4.4% to reach USD 568.3 million by 2034, fueled by the growing number of surgeries driven by an aging global population and an uptick in chronic disease cases. As healthcare systems respond to rising demand, hospitals and surgical centers invest in advanced, high-precision surgical instruments. Innovations in minimally invasive procedures further push the need for surgical tools that are both durable and designed to support better patient outcomes. As precision and safety become top priorities, high-quality scissors have become essential in supporting efficient surgical performance.

With the rise in chronic diseases such as cardiovascular disorders, cancer, and diabetes, the number of surgical interventions continues to grow. This trend, especially among elderly populations, fuels demand for highly reliable and efficient surgical scissors. Many healthcare facilities invest in technologically enhanced power tools to improve procedural accuracy and reduce operation time. Emerging markets are seeing a similar rise in demand due to developing surgical infrastructure, which is pushing procurement of sophisticated tools. Among various types, reusable scissors are gaining strong traction because they reduce long-term operational costs and align with healthcare sustainability goals. These scissors are crafted from materials like tungsten carbide or premium stainless steel and offer enhanced longevity, sharper cuts, and higher performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $ 377.9 Million |

| Forecast Value | $568.3 Million |

| CAGR | 4.4% |

The market for surgical scissors is divided into two main types: reusable and disposable. The reusable scissors segment is expected to grow with a projected CAGR of 4.7%, reaching USD 385.6 million by 2034. As healthcare facilities focus on reducing long-term costs, they are shifting toward reusable instruments. Surgical centers and hospitals are increasingly adopting scissors that can be sterilized and reused multiple times, thus minimizing waste from disposable alternatives. Additionally, reusable scissors are made from high-quality materials like stainless steel or tungsten carbide, which enhances their precision and durability. These materials improve the reliability of sutures during surgeries.

The cardiovascular procedures segment of the surgical scissors market is projected to grow at a CAGR of 4.8% and reach USD 158.2 million by 2034, driven by the precise demands of heart surgeries, where small, accurate incisions are critical for patient survival. Cardiovascular surgical scissors are specially designed with exceptionally sharp blades to minimize damage to delicate heart tissues, ensuring better surgical outcomes. The advanced engineering of these scissors allows for a high level of precision, essential for such complex and high-stakes procedures.

U.S. Surgical Scissors Market generated USD 136.8 million in 2024, benefiting from a strong healthcare system, a high volume of surgeries, and continuous innovations in surgical tool technology. The U.S. remains a leader in the market, with frequent new product introductions and advancements that improve the availability and specialization of surgical instruments across various fields. As a result, the U.S. market continues to attract significant investment, driving the development of more sophisticated and specialized tools for precise and efficient surgeries.

To secure a competitive edge, companies like Elixir Surgical, Surgicalholdings, INTEGRA, Storz, WPI, Teleflex, Aspen, HuFriedy, Stryker, KLS Martin, Medline, B. Braun, Millennium Surgical, BD, and Scanlan are heavily investing in R&D and precision manufacturing. These firms focus on designing ergonomic, specialty scissors, expanding their product portfolios, and strengthening global distribution partnerships to meet increasing surgical demands worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in surgical scissors technology

- 3.2.1.2 Rising prevalence of chronic diseases

- 3.2.1.3 Demand for minimally invasive procedures

- 3.2.1.4 Surge in outpatient surgeries

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Short product lifecycle

- 3.2.2.2 Concerns over infection risks with reusable instruments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Pricing analysis

- 3.7 Technology landscape

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Scissors Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Reusable

- 5.3 Disposable

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cardiovascular

- 6.3 Orthopedic surgery

- 6.4 Gastroenterology

- 6.5 Neurology

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Materials, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Stainless steel

- 7.3 Titanium

- 7.4 Tungsten

- 7.5 Ceramic

- 7.6 Other materials

Chapter 8 Market Estimates and Forecast, By Tip Shapes, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Curved

- 8.3 Straight

- 8.4 Other tip shapes

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals & clinics

- 9.3 Ambulatory surgery centers

- 9.4 Other end users

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aspen

- 11.2 B. Braun

- 11.3 Becton, Dickinson and Company

- 11.4 ELIXIR SURGICAL

- 11.5 HuFriedy

- 11.6 INTEGRA

- 11.7 STORZ

- 11.8 KLS Martin

- 11.9 MEDLINE

- 11.10 MILLENNIUM SURGICAL

- 11.11 SCANLAN

- 11.12 stryker

- 11.13 Surgicalholdings

- 11.14 Teleflex

- 11.15 WPI