|

市场调查报告书

商品编码

1750320

铝箔市场机会、成长动力、产业趋势分析及2025-2034年预测Aluminum Foil Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

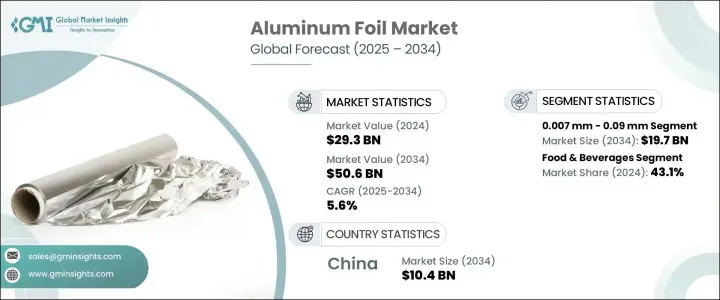

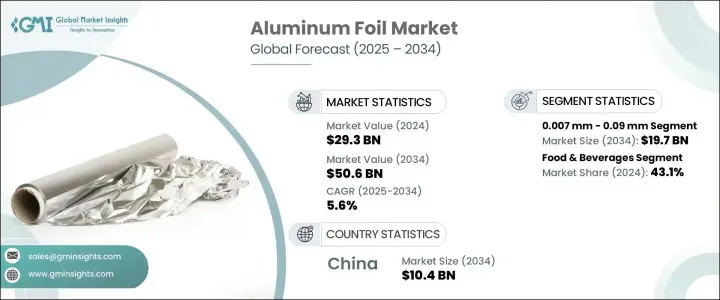

2024年,全球铝箔市场规模达293亿美元,预计到2034年将以5.6%的复合年增长率成长,达到506亿美元。这一增长主要得益于食品和医药包装行业日益增长的需求,以及工业绝缘和汽车隔热领域日益增长的应用。铝箔以其轻质、高阻隔性和可回收性而闻名,已成为现代包装解决方案的关键材料,尤其是在全球对永续材料的关注日益增强的背景下。在发展中国家,包装食品消费量的激增进一步促进了市场扩张,促使製造商和供应商不断满足不断变化的包装标准。

多种因素加速了这一成长,包括遵守环境和包装法规、消费者对便捷易用产品的偏好,以及对包装材料可回收性的日益关注。尤其是在医药领域,由于对产品保质期和污染预防的严格要求,铝箔发挥着至关重要的作用。在此背景下,铝箔复合膜的需求预计将持续成长。此外,技术进步也带来了新的市场机会,例如活性和可生物降解的铝箔解决方案、奈米复合膜产品以及铝箔复合材料,所有这些产品都具有更优异的性能和永续性优势。同时,建筑和汽车等行业正在转向更轻、更节能的材料,进一步拓宽了铝箔在包装以外的应用领域。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 293亿美元 |

| 预测值 | 506亿美元 |

| 复合年增长率 | 5.6% |

专注于清洁生产流程的投资,例如绿色能源冶炼和回收能力,也有助于减少对环境的影响。这些努力可能会重塑价值链,增强铝箔製造业的整体永续性。随着各国对生产设施进行现代化改造并转向环保运营,长期效益将继续支持该产业的成长。

按厚度细分,铝箔市场包括 0.007 毫米 - 0.09 毫米、0.09 毫米 - 0.2 毫米、0.2 毫米 - 0.4 毫米等类别。其中,0.007 毫米 - 0.09 毫米部分占据最大收益份额,2024 年创造 113 亿美元的收益。预计到 2034 年,该部分收益将达到 197 亿美元,复合年增长率为 5.8%。其主导地位归因于其在各种应用领域的适应性,包括食品包装、药品、家用包装和工业绝缘。成本效益、阻隔强度和灵活性的平衡使其成为满足消费者和商业需求的首选。它尤其因其能够保护内容物免受湿气、氧气和光线的影响而受到重视,这使其成为一次性物品和可回收形式的理想选择。

就终端应用产业而言,市场可分为食品饮料、药品、个人护理和化妆品、家居、工业及其他。 2024年,食品饮料领域占最大份额,占全球市场收入的43.1%。铝箔在该领域的广泛应用得益于其对水分、光照和空气等外部因素的有效防护。它有助于延长保质期、保持产品新鲜度并确保安全——这些都是包装食品行业的关键要求。铝箔广泛应用于软包装袋、盖子、容器和复合包装,适用于各种消费品。

从区域来看,中国市场在2024年的营收为59亿美元,预计到2034年将达到104亿美元,复合年增长率为5.8%。中国将继续主导全球铝箔生产,到2025年将占全球铝箔产量的约60%。国内铝箔产量也出现了显着成长,反映出消费成长的普遍趋势。为了因应产能过剩和环境问题等挑战,中国正在放弃扩大初级冶炼业务,转而采用更环保的替代方法。这些措施包括利用再生能源和提高回收能力,目标是到2027年每年回收超过1500万吨铝。

全球铝箔产业仍维持适度整合,截至2024年,五家领先公司合计占据超过40%的市场。许多企业正专注于新兴市场,以满足医疗保健、绝缘材料和电子等行业对先进铝箔日益增长的需求。这项策略转变不仅强调产量扩张,也强调产品创新,包括具有压花、多层和高硬度等特性的优质铝箔。随着市场的发展,竞争态势可能会受到永续性、技术创新和全球贸易协调的影响。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税的影响—结构化概述

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 原物料价格波动

- 来自替代包装材料的竞争

- 环境问题

- 与铝浸出有关的健康问题

- 产业陷阱与挑战

- 原物料价格波动

- 来自替代包装材料的竞争

- 环境问题

- 与铝浸出有关的健康问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 价值链分析

- 原物料供应商

- 铝箔製造商

- 转换器和处理器

- 经销商

- 最终用途

- 定价分析

- 成本结构分析

- 价格趋势分析

- 价格预测

- 技术格局

- 製造流程概述

- 铸件

- 热轧

- 冷轧

- 退火

- 整理和分切

- 技术进步

- 铝箔生产自动化

- 品质控制技术

- 製造流程概述

- 监理框架

- 食品接触材料法规

- 美国FDA法规

- 欧盟法规

- 其他地区法规

- 环境法规

- 贸易政策和关税

- 法规对市场成长的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按厚度,2021 - 2034 年

- 主要趋势

- 0.007 毫米 - 0.09 毫米

- 0.09 毫米 - 0.2 毫米

- 0.2 毫米 - 0.4 毫米

- 其他的

第六章:市场估计与预测:按箔类型,2021 - 2034 年

- 主要趋势

- 印刷铝箔

- 未印刷的铝箔

- 层压铝箔

- 背衬铝箔

- 其他的

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 包包和小袋

- 捲饼和麵包卷

- 水泡

- 盖子

- 层压管

- 托盘

- 其他的

第八章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 食品和饮料

- 烘焙和糖果

- 即食食品

- 乳製品

- 饮料

- 其他的

- 製药

- 吸塑包装

- 条状包装

- 其他的

- 个人护理和化妆品

- 家庭

- 工业的

- 绝热

- 电气应用

- 其他的

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- MEA 其余地区

第十章:公司简介

- Alcoa Corporation

- Aleris Corporation

- Alufoil Products

- Amco India

- Amcor

- Assan Aluminyum

- China Hongqiao Group

- Constellium

- Ess Dee Aluminium

- Eurofoil

- Hindalco Industries

- Huawei Aluminum

- Norsk Hydro

- Novelis

- Reynolds Consumer Products

- Symetal Aluminium Foil Industry

- UACJ Corporation

- United Company RUSAL

- Xiamen Xiashun Aluminium Foil

- Zhejiang Junma Aluminium Industry

The Global Aluminum Foil Market was valued at USD 29.3 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 50.6 billion by 2034. This growth is primarily fueled by rising demand across the food and pharmaceutical packaging sectors, as well as increasing applications in industrial insulation and automotive thermal shielding. As aluminum foil is known for its lightweight nature, strong barrier properties, and recyclability, it has become a key material in modern packaging solutions, especially as the focus on sustainable materials gains momentum worldwide. In developing nations, the surge in consumption of packaged foods is further contributing to market expansion, pushing manufacturers and suppliers to meet evolving packaging standards.

A combination of factors is accelerating this growth, including compliance with environmental and packaging regulations, consumer preference for convenient and easy-to-use products, and growing attention to the recyclability of packaging materials. Particularly in the pharmaceutical space, aluminum foil plays a vital role due to strict requirements surrounding product shelf life and contamination prevention. The demand for foil laminates is expected to climb in this context. Additionally, technological advancements are unlocking new market opportunities, such as active and biodegradable foil solutions, nano-laminated products, and foil-based composites, all of which offer greater performance and sustainability benefits. Meanwhile, industries such as construction and automotive are turning to lighter, more energy-efficient materials, further widening the use of aluminum foil beyond packaging.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.3 Billion |

| Forecast Value | $50.6 Billion |

| CAGR | 5.6% |

Investments focused on cleaner production processes, such as green energy-powered smelting and recycling capabilities, are also contributing to reduced environmental impact. These efforts are likely to reshape the value chain, enhancing the overall sustainability of aluminum foil manufacturing. As countries modernize production facilities and shift toward eco-conscious operations, the long-term benefits will continue to support growth in the sector.

When segmented by thickness, the aluminum foil market includes categories such as 0.007 mm - 0.09 mm, 0.09 mm - 0.2 mm, 0.2 mm - 0.4 mm, and others. Among these, the 0.007 mm - 0.09 mm segment accounted for the largest revenue share, generating USD 11.3 billion in 2024. This segment is forecast to reach USD 19.7 billion by 2034, growing at a CAGR of 5.8%. Its dominance is attributed to its adaptability across various applications, including food packaging, pharmaceutical products, household wraps, and industrial insulation. The balance of cost-effectiveness, barrier strength, and flexibility makes it a preferred choice for both consumer and commercial needs. It is especially valued for its ability to shield contents from moisture, oxygen, and light, making it ideal for single-use items and recyclable formats.

In terms of end-use industries, the market is categorized into food and beverages, pharmaceuticals, personal care and cosmetics, household, industrial, and others. The food and beverages segment held the largest share in 2024, accounting for 43.1% of global market revenue. The widespread use of foil in this sector is driven by its effective protection against external elements such as moisture, light, and air. It helps extend shelf life, maintain product freshness, and ensure safety-key requirements in the packaged food industry. Foil finds extensive use in flexible pouches, lids, containers, and laminated wraps, serving a variety of consumable products.

Regionally, the market in China recorded a revenue of USD 5.9 billion in 2024 and is projected to reach USD 10.4 billion by 2034, registering a CAGR of 5.8%. China continues to dominate global production, accounting for roughly 60% of the world's aluminum foil output by 2025. Domestic production levels have also witnessed significant growth, reflecting a broader trend toward increased consumption. In response to challenges like overcapacity and environmental concerns, the country is steering away from expanding primary smelting operations and moving toward greener alternatives. These include utilizing renewable energy sources and enhancing recycling capabilities, with a targeted goal to recycle over 15 million tons of aluminum annually by 2027.

The global aluminum foil industry remains moderately consolidated, with five leading companies collectively holding over 40% market share as of 2024. Many businesses are focusing on emerging markets to meet the growing demand for advanced foil types across industries like healthcare, insulation, and electronics. This strategic shift emphasizes not just expansion in output but also innovation in product offerings, including premium foils with features like embossing, multi-layering, and increased hardness. As the market evolves, competitive dynamics are likely to be shaped by sustainability, technological innovation, and global trade alignment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact of trump administration tariffs - structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Fluctuating raw material prices

- 3.7.1.2 Competition from alternative packaging materials

- 3.7.1.3 Environmental concerns

- 3.7.1.4 Health concerns related to aluminum leaching

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Fluctuating raw material prices

- 3.7.2.2 Competition from alternative packaging materials

- 3.7.2.3 Environmental concerns

- 3.7.2.4 Health concerns related to aluminum leaching

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Value chain analysis

- 3.11.1 Raw material suppliers

- 3.11.2 Aluminum foil manufacturers

- 3.11.3 Converters & processors

- 3.11.4 Distributors

- 3.11.5 End use

- 3.12 Pricing analysis

- 3.12.1 Cost structure analysis

- 3.12.2 Price trends analysis

- 3.12.3 Price forecast

- 3.13 Technology landscape

- 3.13.1 Manufacturing process overview

- 3.13.1.1 Casting

- 3.13.1.2 Hot rolling

- 3.13.1.3 Cold rolling

- 3.13.1.4 Annealing

- 3.13.1.5 Finishing & slitting

- 3.13.2 Technological advancements

- 3.13.3 Automation in aluminum foil production

- 3.13.4 Quality control technologies

- 3.13.1 Manufacturing process overview

- 3.14 Regulatory framework

- 3.14.1 Food contact materials regulations

- 3.14.2 Fda regulations (us)

- 3.14.3 Eu regulations

- 3.14.4 Other regional regulations

- 3.15 Environmental regulations

- 3.15.1 Trade policies & tariffs

- 3.15.2 Impact of regulations on market growth

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Thickness, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 0.007 mm - 0.09 mm

- 5.3 0.09 mm - 0.2 mm

- 5.4 0.2 mm - 0.4 mm

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Foil Type, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Printed aluminum foil

- 6.3 Unprinted aluminum foil

- 6.4 Laminated aluminum foil

- 6.5 Backed aluminum foil

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Bags & pouches

- 7.3 Wraps & rolls

- 7.4 Blisters

- 7.5 Lids

- 7.6 Laminated tubes

- 7.7 Trays

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.1.1 Food & beverages

- 8.1.2 Bakery & confectionery

- 8.1.3 Ready-to-eat meals

- 8.1.4 Dairy products

- 8.1.5 Beverages

- 8.1.6 Others

- 8.2 Pharmaceuticals

- 8.2.1 Blister packaging

- 8.2.2 Strip packaging

- 8.2.3 Others

- 8.3 Personal care & cosmetics

- 8.4 Household

- 8.5 Industrial

- 8.5.1 Heat insulation

- 8.5.2 Electrical applications

- 8.5.3 Others

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of MEA

Chapter 10 Company Profiles

- 10.1 Alcoa Corporation

- 10.2 Aleris Corporation

- 10.3 Alufoil Products

- 10.4 Amco India

- 10.5 Amcor

- 10.6 Assan Aluminyum

- 10.7 China Hongqiao Group

- 10.8 Constellium

- 10.9 Ess Dee Aluminium

- 10.10 Eurofoil

- 10.11 Hindalco Industries

- 10.12 Huawei Aluminum

- 10.13 Norsk Hydro

- 10.14 Novelis

- 10.15 Reynolds Consumer Products

- 10.16 Symetal Aluminium Foil Industry

- 10.17 UACJ Corporation

- 10.18 United Company RUSAL

- 10.19 Xiamen Xiashun Aluminium Foil

- 10.20 Zhejiang Junma Aluminium Industry