|

市场调查报告书

商品编码

1750326

仪表着陆系统与目视着陆辅助系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Instrument Landing System and Visual Landing Aids Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

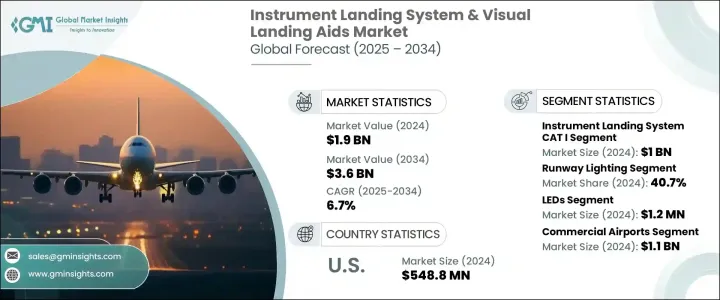

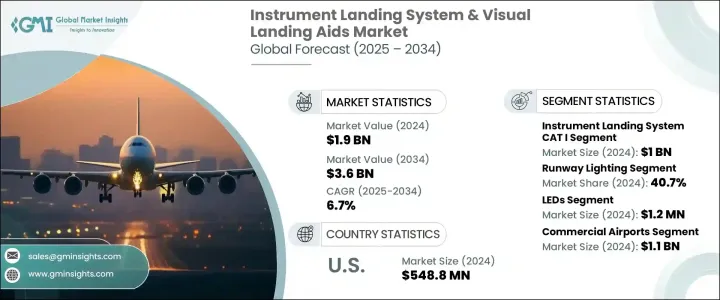

2024 年全球仪表着陆系统和目视着陆辅助设备市场价值为 19 亿美元,预计到 2034 年将以 6.7% 的复合年增长率增长,达到 36 亿美元,这得益于空中交通量的增加、机场基础设施的持续现代化以及智能机场的日益普及。随着全球航空旅行持续激增,主要原因是商用飞机机队不断增加以及乘客数量增加,对精确着陆技术的需求也日益增长。机场正在对先进的着陆系统进行大量投资,以确保低能见度条件下的安全、减少延误并提高营运效率。许多新兴经济体正在建造新机场,而已开发地区正在升级旧设施以达到国际航空标准。随着空中交通量的增加,对 ILS 和目视导引系统的需求也在上升,因为这些技术对于提高安全性和优化机场容量至关重要。

现代化是推动这些系统需求的关键因素。各国政府和其他相关机构正在投资建造和升级航站楼、跑道和空侧设施,以达到国际标准。先进的仪表着陆系统 (ILS) 和目视着陆辅助系统正变得越来越重要,因为它们有助于提高安全性、交通流量以及在各种天气条件下的运作能力。此外,机场营运商致力于改善基础设施以支援更高的交通量,这进一步推动了对这些精密系统的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 19亿美元 |

| 预测值 | 36亿美元 |

| 复合年增长率 | 6.7% |

就仪表着陆系统 (ILS) 类别而言,市场分为 I 类、II 类和 III 类系统。 2024 年,I 类系统市场规模达 10 亿美元,因其成本效益高且能够在大多数天气条件下运行,受到区域机场和中型机场的青睐。 I 类系统可在 200 英尺的决断高度安全着陆,对于希望提高运行可靠性且无需额外安装 II 类或 III 类系统的机场而言,I 类系统是一个切实可行的选择。

该市场还包括跑道、进场和滑行道照明,其中跑道照明市场在2024年将占40.7%的份额。随着机场数量的增长和航班数量的增加,跑道照明对于夜间安全运行和低能见度条件下的着陆至关重要。 LED照明技术的进步使维护更加便利、更具成本效益,从而加速了现代照明系统的普及。符合国际照明标准以及基础设施现代化的推动,也促进了对这些先进系统的需求。

2024年,美国仪表着陆系统和目视着陆辅助系统市场规模达5.488亿美元,这得益于商业航空运输量的復苏以及对老化机场基础设施进行现代化改造的大力推动。美国航空业正在进行全面升级,以适应日益增长的航空旅行量,尤其註重提升安全性和营运效率。诸如美国联邦航空管理局(FAA)的NextGen计画等关键倡议是这些努力的核心,旨在实现空中交通管制的现代化并优化航线系统。

全球仪表着陆系统和目视着陆辅助系统市场的主要参与者包括柯林斯航太(雷神技术公司)、霍尼韦尔国际公司、L3哈里斯技术公司、Indra Sistemas SA 和泰雷兹集团。各公司正在采取产品创新和合作等策略来增强其市场影响力。例如,泰雷兹集团和柯林斯航太正致力于开发先进的降落系统,以提高安全性并降低成本。霍尼韦尔国际公司正大力投资机场基础设施的现代化,而 L3哈里斯技术公司和 Indra Sistemas SA 则专注于整合智慧技术,以提高着陆辅助系统的效率。策略合作和研发投入是在这个快速扩张的市场中获得竞争优势的关键。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 空中交通量激增

- 机场基础设施现代化

- 智慧机场的出现

- 增加军事航空和战术空军基地

- 不断进步的技术

- 产业陷阱与挑战

- 资本和维护成本高

- 复杂性和整合挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依 ILS 类别,2021 年至 2034 年

- 主要趋势

- 仪表着陆系统 CAT I

- 仪表着陆系统 CAT II

- 仪表着陆系统 CAT III

第六章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 跑道照明

- 进场灯光

- 滑行道照明

第七章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 发光二极体

- 白炽灯

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 商业机场

- 军用机场

- 直升机场

- 通用航空

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Advanced Navigation & Positioning Corporation (ANPC)

- Aeronautical & General Instruments Limited

- AGI Holdings LLC

- ATG Airports Ltd

- Carmanah Technologies Corp.

- Collins Aerospace (Raytheon Technologies)

- HENAME Co., Ltd

- Honeywell International Inc.

- Indra Sistemas SA

- Intelcan Technosystems Inc.

- L3Harris Technologies

- NEC Corporation

- Normarc Flight Systems AS (a brand under Indra)

- Systems Interface Ltd

- Thales Group

The Global Instrument Landing System and Visual Landing Aids Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 3.6 billion by 2034, driven by the rise in air traffic, the ongoing modernization of airport infrastructures, and the increasing prevalence of smart airports. As global air travel continues to surge, largely due to the growing fleet of commercial jets and more passengers, there is a growing need for precision landing technologies. Airports are making significant investments in advanced landing systems to ensure safety during low-visibility conditions, reduce delays, and improve operational efficiency. Many emerging economies are constructing new airports, while developed regions are upgrading older facilities to meet international aviation standards. With the increase in air traffic, the demand for ILS and visual guidance systems is rising, as these technologies are critical to enhancing safety and optimizing airport capacity.

Modernization is a key factor fueling the demand for these systems. Governments and other relevant bodies are investing in the construction and upgrading of terminals, runways, and airside facilities to meet international standards. Advanced ILS and visual landing aids are becoming more essential as they help improve safety, traffic flow, and the ability to operate in all weather conditions. Additionally, airport operators are focused on improving infrastructure to support higher traffic volumes, further driving the need for these precision systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.6 Billion |

| CAGR | 6.7% |

In terms of ILS categories, the market is divided into CAT I, CAT II, and CAT III systems. In 2024, the CAT I segment accounted for USD 1 billion, as it is favored by regional and mid-sized airports for its cost-effectiveness and ability to operate in most weather conditions. CAT I systems provide safe landings at decision heights of 200 feet, making them a practical choice for airports looking to enhance operational reliability without the added costs of CAT II or CAT III installations.

The market also includes runway, approach, and taxiway lighting, with the runway lighting segment holding a 40.7% share in 2024. As airports grow and the number of flights increases, runway lighting becomes critical for safe nocturnal operations and landings in poor visibility. Advances in LED lighting technology have made maintenance easier and more cost-effective, accelerating the adoption of modern lighting systems. Compliance with international lighting standards and the push for infrastructure modernization are contributing to the demand for these advanced systems.

U.S. Instrument Landing System & Visual Landing Aids Market was valued at USD 548.8 million in 2024, driven by the resurgence in commercial airline traffic and significant efforts to modernize aging airport infrastructure. The country's aviation industry is undergoing a comprehensive upgrade to accommodate the increasing volume of air travel, with a particular emphasis on enhancing safety and operational efficiency. Key initiatives, such as the FAA's NextGen program, are central to these efforts, designed to modernize air traffic control and optimize flight routing systems.

Key players in the Global Instrument Landing System & Visual Landing Aids Market include Collins Aerospace (Raytheon Technologies), Honeywell International Inc., L3Harris Technologies, Indra Sistemas S.A., and Thales Group. Companies are adopting strategies such as product innovation and partnerships to strengthen their market presence. For instance, Thales Group and Collins Aerospace are focusing on developing advanced landing systems to enhance safety and reduce costs. Honeywell International Inc. is investing heavily in the modernization of airport infrastructure, while L3Harris Technologies and Indra Sistemas S.A. are concentrating on integrating smart technologies to improve the efficiency of landing aids. Strategic collaborations and investments in research and development are key to gaining a competitive edge in this rapidly expanding market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Surge in air traffic growth

- 3.7.1.2 Modernization of airport infrastructure

- 3.7.1.3 Emergence of smart airports

- 3.7.1.4 Increasing military aviation & tactical airbases

- 3.7.1.5 Rising technological advancements

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High capital and maintenance costs

- 3.7.2.2 Complexity and integration challenges

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By ILS Category, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Instrument Landing System CAT I

- 5.3 Instrument Landing System CAT II

- 5.4 Instrument Landing System CAT III

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Runway lighting

- 6.3 Approach lighting

- 6.4 Taxiway lighting

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 LEDs

- 7.3 Incandescent lamps

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Commercial airports

- 8.3 Military airports

- 8.4 Heliports

- 8.5 General aviation

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Advanced Navigation & Positioning Corporation (ANPC)

- 10.2 Aeronautical & General Instruments Limited

- 10.3 AGI Holdings LLC

- 10.4 ATG Airports Ltd

- 10.5 Carmanah Technologies Corp.

- 10.6 Collins Aerospace (Raytheon Technologies)

- 10.7 HENAME Co., Ltd

- 10.8 Honeywell International Inc.

- 10.9 Indra Sistemas S.A.

- 10.10 Intelcan Technosystems Inc.

- 10.11 L3Harris Technologies

- 10.12 NEC Corporation

- 10.13 Normarc Flight Systems AS (a brand under Indra)

- 10.14 Systems Interface Ltd

- 10.15 Thales Group