|

市场调查报告书

商品编码

1750336

橘皮组织治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cellulite Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

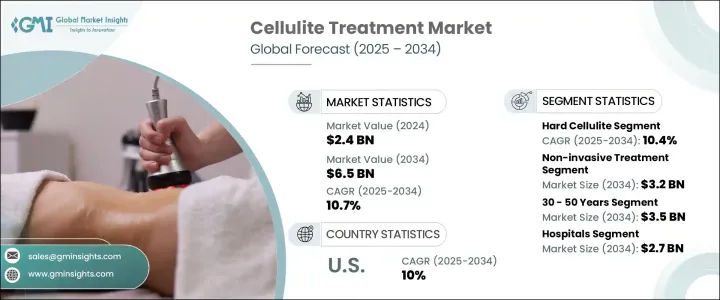

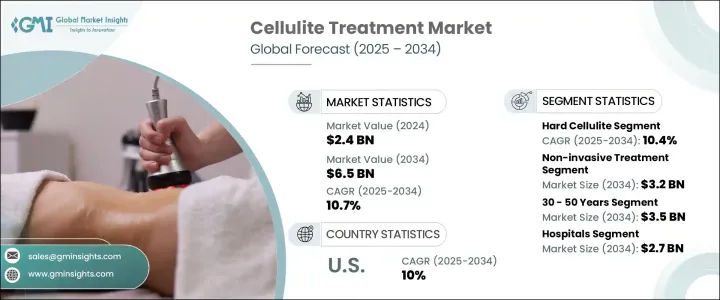

2024年,全球橘皮组织治疗市场规模达24亿美元,预计到2034年将以10.7%的复合年增长率成长,达到65亿美元。这得归功于先进的非侵入性和微创治疗手段日益普及,这些手段能够为消费者提供更有效的解决方案,并最大程度缩短恢復期。此外,消费者对身体美学的认知度不断提升,以及对更安全、微创治疗方案的渴望,进一步推动了此类治疗的需求。橘皮组织是常见的美容问题,常见于大腿、臀部和腹部,导致皮肤出现凹陷或肿块。橘皮组织主要影响女性,老化、荷尔蒙失调和体重增加等多种因素均可诱发或加重橘皮组织。

此外,久坐不动、不良饮食和血液循环不良等生活方式因素也会导致脂肪团的形成。脂肪沉积物突破皮下结缔组织,形成橘皮组织,导致皮肤表面凹凸不平。随着橘皮组织发病率的上升,尤其是在肥胖和衰老人群中,人们对有效治疗方法的需求也日益增长,这些方法可以减少脂肪团的可见度,并恢復更光滑、更紧緻的肌肤。专注于分解脂肪细胞、促进血液循环和促进胶原蛋白生成的疗法越来越受欢迎。这些疗法旨在重塑皮下脂肪的分布,改善受影响区域的整体纹理和肤色。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 24亿美元 |

| 预测值 | 65亿美元 |

| 复合年增长率 | 10.7% |

市场主要细分为各种治疗类型,包括非侵入性治疗、微创治疗和局部治疗。其中,非侵入性治疗占最大市场份额,预计复合年增长率为11.1%,到2034年将达32亿美元。这些非手术治疗,例如雷射疗法、声波疗法、射频疗法和超音波疗法,因其无痛、易于使用和快速恢復而备受青睐。对于希望在不进行复杂手术的情况下减少脂肪团的个人来说,它们是一种首选方案。非侵入性治疗方法不断发展,各公司致力于改进这些方法,以满足消费者对有效、舒适且低风险解决方案日益增长的需求。

2024年,硬性脂肪团市场规模达11亿美元,预计2034年将达30亿美元,复合年增长率达10.4%。硬性脂肪团的特点是组织緻密、纤维丰富,对传统疗法的疗效更差,需要更先进的治疗方法,例如雷射疗法和射频疗法。随着生活方式活跃的年轻人群中硬性脂肪团的盛行率不断上升,推动了对这些专业疗法的需求。这促使旨在解决这种更顽固脂肪团问题的创新有效疗法的发展激增。

2024年,美国橘皮组织治疗市场规模达7.637亿美元,归因于人群中橘皮组织发病率高、人们对现有治疗方法的认知度不断提高,以及对非侵入性治疗方案的强烈偏好。此外,美国拥有完善的医疗基础设施,并且注重美容和医美治疗,这刺激了对橘皮组织减少疗法的需求。

全球橘皮组织治疗市场中的公司正在采取产品创新、合作伙伴关係以及扩大地域覆盖范围等策略,以巩固其市场地位。 Venus Concept、Soliton(艾伯维)和 Cynosure 等公司正致力于利用尖端技术增强其产品线,以满足日益增长的有效治疗需求。与医疗保健提供者和美容诊所的合作,以及策略性行销活动,使这些公司得以扩大其业务范围。此外,他们还在研发方面投入资金,以创造更先进、更有效率的橘皮组织治疗方法,确保其在市场上保持竞争优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 人们对美容手术的认识和需求不断增加

- 非侵入性和微创技术日益进步

- 越来越倾向于非侵入性和微创手术

- 扩大皮肤科和美容诊所

- 产业陷阱与挑战

- 治疗费用高

- 对潜在副作用的担忧日益增加

- 严格的监管审批

- 成长动力

- 成长潜力分析

- 管道分析

- 技术格局

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按橘皮组织类型,2021 - 2034 年

- 主要趋势

- 硬脂肪团

- 软脂肪团

- 水肿性橘皮组织

第六章:市场估计与预测:按治疗类型,2021 - 2034 年

- 主要趋势

- 非侵入性治疗

- 雷射治疗

- 声波疗法

- 射频治疗

- 超音波治疗

- 微创治疗

- 切开术

- 冷冻溶脂

- 其他微创治疗

- 局部治疗

- 口服补充剂

第七章:市场估计与预测:依性别,2021 - 2034 年

- 主要趋势

- 女性

- 男性

第八章:市场估计与预测:按年龄组,2021 - 2034 年

- 主要趋势

- 30岁以下

- 30 - 50年

- 50岁以上

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 皮肤科诊所

- 美容与健康中心

- 家庭使用

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Air Sculpt

- Alma Lasers

- Bausch Health

- Bionov

- Candela

- Cutera

- Cynosure

- El En. Group

- Endo International

- Hologic

- Merz Pharma

- Mesoestetic

- Revelle Aesthetics

- Sirona Biochem

- Soliton (Abbvie)

- Ulthera

- Zimmer Aesthetics

The Global Cellulite Treatment Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 10.7% to reach USD 6.5 billion by 2034, driven by the increasing popularity of advanced non-invasive and minimally invasive treatments, which offer consumers more effective solutions with minimal downtime. Additionally, heightened consumer awareness regarding body aesthetics and the desire for safer, less invasive treatments have further fueled the demand for these procedures. Cellulite is a widespread cosmetic concern, commonly seen around the thighs, hips, and abdomen, resulting in the appearance of dimpled or lumpy skin. It primarily affects women and can be triggered or worsened by various factors, such as aging, hormonal imbalances, and weight gain.

Additionally, lifestyle factors like a sedentary routine, poor diet, and insufficient circulation can contribute to its development. As cellulite forms when fat deposits push through the connective tissue beneath the skin, it creates an uneven surface appearance. With the rising incidence of cellulite, especially among those affected by obesity and the aging process, there is an increased demand for effective treatments that can reduce its visibility and restore smoother, firmer skin. Treatments that focus on breaking down fat cells, stimulating blood flow, and boosting collagen production are gaining popularity. These treatments aim to reshape the fat distribution beneath the skin, improving the overall texture and tone of the affected areas.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $6.5 Billion |

| CAGR | 10.7% |

The market is primarily segmented into various treatment types, including non-invasive, minimally invasive, and topical treatments. Among these, the non-invasive segment holds the largest market share, projected to grow at a CAGR of 11.1%, reaching USD 3.2 billion by 2034. These non-surgical treatments, such as laser therapy, acoustic wave therapy, radiofrequency therapy, and ultrasound therapy, are highly favored due to their painless nature, ease of use, and rapid recovery times. They provide a preferred option for individuals looking to minimize cellulite without undergoing extensive procedures. The non-invasive treatments continue to evolve, with companies focusing on improving these methods to meet increasing consumer demand for effective, comfortable, and low-risk solutions.

The hard cellulite segment was valued at USD 1.1 billion in 2024 and is expected to reach USD 3 billion by 2034, growing at a CAGR of 10.4%. Hard cellulite, which is characterized by dense, fibrous tissue and is more resistant to traditional treatments, requires more advanced treatment methods, such as laser therapy and radiofrequency. The increasing prevalence of hard cellulite among younger individuals who lead active lifestyles has driven demand for these specialized treatments. This has led to a surge in the development of innovative and effective therapies aimed at addressing this more stubborn form of cellulite.

U.S. Cellulite Treatment Market was valued at USD 763.7 million in 2024, attributed to the high occurrence of cellulite in the population, the growing awareness of available treatments, and the strong preference for non-invasive options. Furthermore, the U.S. benefits from a well-established healthcare infrastructure and a focus on cosmetic and aesthetic treatments, which have boosted the demand for cellulite reduction therapies.

Companies in the Global Cellulite Treatment Market are adopting strategies such as product innovation, partnerships, and expanding their geographic presence to strengthen their market position. Firms like Venus Concept, Soliton (AbbVie), and Cynosure are focusing on enhancing their product offerings with cutting-edge technology to meet the growing demand for effective treatments. Collaborations with healthcare providers and cosmetic clinics, along with strategic marketing campaigns, have enabled these companies to expand their reach. Additionally, they are investing in research and development to create more advanced and efficient cellulite treatments, ensuring they maintain a competitive edge in the market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing awareness and demand for aesthetic procedures

- 3.2.1.2 Growing advancement in non-invasive and minimally invasive technologies

- 3.2.1.3 Increasing preference for non-invasive and minimally invasive procedures

- 3.2.1.4 Expansion of dermatology and aesthetic clinics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment costs

- 3.2.2.2 Growing concerns related to potential side effects

- 3.2.2.3 Strict regulatory approvals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Technology landscape

- 3.6 Regulatory landscape

- 3.7 Trump administration tariffs

- 3.7.1 Impact on trade

- 3.7.1.1 Trade volume disruptions

- 3.7.1.2 Retaliatory measures

- 3.7.2 Impact on the Industry

- 3.7.2.1 Supply-side impact (raw materials)

- 3.7.2.1.1 Price volatility in key materials

- 3.7.2.1.2 Supply chain restructuring

- 3.7.2.1.3 Production cost implications

- 3.7.2.2 Demand-side impact (selling price)

- 3.7.2.2.1 Price transmission to end markets

- 3.7.2.2.2 Market share dynamics

- 3.7.2.2.3 Consumer response patterns

- 3.7.2.1 Supply-side impact (raw materials)

- 3.7.3 Key companies impacted

- 3.7.4 Strategic industry responses

- 3.7.4.1 Supply chain reconfiguration

- 3.7.4.2 Pricing and product strategies

- 3.7.4.3 Policy engagement

- 3.7.5 Outlook and future considerations

- 3.7.1 Impact on trade

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Cellulite Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hard cellulite

- 5.3 Soft cellulite

- 5.4 Edematous cellulite

Chapter 6 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Non-invasive treatment

- 6.2.1 Laser treatment

- 6.2.2 Acoustic wave therapy

- 6.2.3 Radiofrequency therapy

- 6.2.4 Ultrasound therapy

- 6.3 Minimally invasive treatment

- 6.3.1 Subcision

- 6.3.2 Cryolipolysis

- 6.3.3 Other minimally invasive treatment

- 6.4 Topical treatments

- 6.5 Oral supplements

Chapter 7 Market Estimates and Forecast, By Gender, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Female

- 7.3 Male

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Below 30 years

- 8.3 30 - 50 years

- 8.4 Above 50 years

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Dermatology clinics

- 9.4 Beauty and wellness centers

- 9.5 Home-use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Air Sculpt

- 11.2 Alma Lasers

- 11.3 Bausch Health

- 11.4 Bionov

- 11.5 Candela

- 11.6 Cutera

- 11.7 Cynosure

- 11.8 El En. Group

- 11.9 Endo International

- 11.10 Hologic

- 11.11 Merz Pharma

- 11.12 Mesoestetic

- 11.13 Revelle Aesthetics

- 11.14 Sirona Biochem

- 11.15 Soliton (Abbvie)

- 11.16 Ulthera

- 11.17 Zimmer Aesthetics