|

市场调查报告书

商品编码

1750337

镍钛合金医疗器材市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Nitinol-based Medical Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

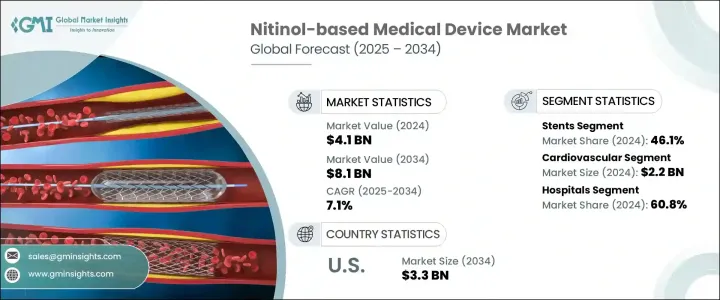

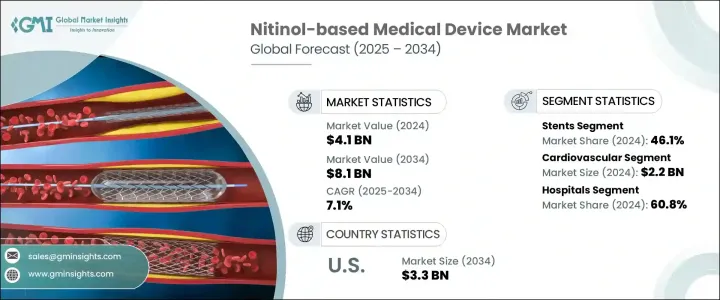

2024年,全球镍钛合金医疗器材市场规模达41亿美元,预计2034年将以7.1%的复合年增长率成长,达到81亿美元。这主要得益于心血管疾病、週边动脉疾病和神经系统疾病等慢性疾病的日益流行,这些疾病需要先进的微创医疗介入。镍钛合金是一种镍钛合金,以其独特的超弹性和形状记忆特性而闻名,在医疗器材中的应用日益广泛,以改善患者的治疗效果。

镍钛合金在变形后能够恢復到预定形状,且具有抗机械应力的特性,使其成为各种医疗应用的理想选择。这些特性尤其适用于支架、导引线和骨科植入物等对柔软度和耐用性至关重要的器械。该材料的生物相容性和耐腐蚀性进一步增强了其长期植入的适用性。这些特性确保镍钛合金器械能够在人体内长期保持其功能性和结构完整性,从而降低排斥或降解的风险。这种可靠性使镍钛合金成为心血管、神经血管和骨科治疗中永久植入物的首选。随着微创手术需求的成长,预计镍钛合金器械的采用率将有所上升,从而促进市场扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 41亿美元 |

| 预测值 | 81亿美元 |

| 复合年增长率 | 7.1% |

2024年,医院领域占据60.8%的市场份额,这得益于旨在缩短手术时间、最大程度减少患者创伤和改善康復效果的先进医疗设备的日益普及。镍钛合金基器械(例如支架、导引线、过滤器和骨科植入物)因其形状记忆和超弹性等独特特性(这些特性在微创介入中至关重要)已成为医院不可或缺的一部分。它们在复杂解剖结构中的导航表现卓越,尤其是在心血管和神经血管手术中,这转化为更高的手术成功率和更短的住院时间。

2024年,支架市场以46.1%的市占率保持领先地位,这得益于血管疾病盛行率的上升以及镍钛合金支架带来的临床优势。这些支架因其自膨胀特性以及与复杂血管通路无缝贴合的能力而备受推崇,尤其适用于週边动脉疾病或冠状动脉阻塞患者。随着医疗保健提供者优先考虑微创、高效的动脉疾病治疗方案,支架需求持续成长。

2024年,北美镍钛合金医疗器材市场占据40%的市场份额,这得益于该地区强大的医疗基础设施、完善的报销体係以及对先进医疗技术的早期采用。领先製造商的出现以及镍钛合金器材在医院和专科诊所的广泛临床整合,进一步巩固了北美在这一快速发展的医疗器材领域的领先地位。

全球镍钛合金医疗器材产业的主要参与者包括波士顿科学公司、美敦力公司、雅培实验室、泰尔茂公司和贝朗梅尔松根股份公司。这些公司专注于研发,以创新和提高镍钛合金器械的性能。由于公司旨在扩大其产品组合和市场范围,因此策略合作、合併和收购很常见。为了巩固其市场地位,镍钛合金医疗器材产业的公司正在采取几项关键策略。这些策略包括投资研发以创新和提高镍钛合金器械的性能。由于公司旨在扩大其产品组合和市场范围,因此策略合作、合併和收购很常见。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 微创手术的需求不断增加

- 心血管和骨科疾病盛行率上升

- 医疗器材製造的技术进步

- 全球老年人口不断增长

- 产业陷阱与挑战

- 镍钛合金基装置成本高

- 严格的监管审批流程

- 成长动力

- 成长潜力分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑川普政府关税

- 对贸易的影响

- 技术格局

- 未来市场趋势

- 监管格局

- 专利分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 竞争市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 支架

- 导丝

- 导管

- 其他产品

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 心血管

- 骨科

- 牙科

- 神经系统

- 泌尿科

- 其他应用

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 专科诊所

- 研究和学术机构

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Abbott Laboratories

- Acandis

- Admedes Schuessler

- Arthrex

- B Braun

- Becton, Dickinson and Company

- Biotronik

- Boston Scientific

- Cook Medical

- Endosmart

- Jotec

- Medtronic

- MicroPort

- Stryker

- Terumo

The Global Nitinol-based Medical Device Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 8.1 billion by 2034 driven by the increasing prevalence of chronic diseases such as cardiovascular conditions, peripheral artery disease, and neurological disorders, which necessitate advanced, minimally invasive medical interventions. Nitinol, a nickel-titanium alloy known for its unique properties of superelasticity and shape memory, is increasingly utilized in medical devices to improve patient outcomes.

Nitinol's ability to return to a predetermined shape after deformation and its resistance to mechanical stress make it ideal for various medical applications. These properties are particularly beneficial in devices like stents, guidewires, and orthopedic implants, where flexibility and durability are crucial. The material's biocompatibility and corrosion resistance further enhance its suitability for long-term implantation. These properties ensure that nitinol devices maintain their functionality and structural integrity within the human body over extended periods, reducing the risk of rejection or degradation. This reliability makes nitinol a preferred choice for permanent implants used in cardiovascular, neurovascular, and orthopedic treatments. As the demand for minimally invasive procedures grows, the adoption of nitinol-based devices is expected to rise, contributing to the market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $8.1 Billion |

| CAGR | 7.1% |

The hospital segment held a 60.8% share in 2024, driven by the increasing incorporation of advanced medical devices aimed at reducing operative time, minimizing patient trauma, and improving recovery outcomes. Nitinol-based devices-such as stents, guidewires, filters, and orthopedic implants-have become integral to hospitals due to their unique properties like shape memory and super-elasticity, which are critical in minimally invasive interventions. Their superior performance in navigating complex anatomies, particularly during cardiovascular and neurovascular procedures, translates into higher procedural success rates and reduced length of hospital stays.

In 2024, the stents segment maintained its leading position with a 46.1% share, fueled by the rising prevalence of vascular disorders and the clinical advantages provided by nitinol stents. These stents are valued for their self-expanding properties and ability to conform seamlessly to complex vascular pathways, especially in patients with peripheral artery disease or coronary blockages. The demand continues to rise as healthcare providers prioritize less invasive, highly effective treatment options for managing arterial conditions.

North America Nitinol-based Medical Device Market held 40% share in 2024, attributed to the region's robust healthcare infrastructure, well-established reimbursement systems, and early adoption of advanced medical technologies. The presence of leading manufacturers and widespread clinical integration of nitinol-based tools in hospitals and specialty clinics has further reinforced North America's stronghold in this rapidly evolving medical device space.

Key players in the Global Nitinol-Based Medical Device Industry include Boston Scientific Corporation, Medtronic plc, Abbott Laboratories, Terumo Corporation, and B. Braun Melsungen AG. These companies are focusing on research and development to innovate and enhance the performance of nitinol-based devices. Strategic collaborations, mergers, and acquisitions are common as companies aim to expand their product portfolios and market reach. To strengthen their market position, companies in the nitinol-based medical device industry are adopting several key strategies. These include investing in research and development to innovate and improve the performance of nitinol-based devices. Strategic collaborations, mergers, and acquisitions are common as companies aim to expand their product portfolios and market reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for minimally invasive surgeries

- 3.2.1.2 Rising prevalence of cardiovascular and orthopedic disorders

- 3.2.1.3 Technological advancements in medical device manufacturing

- 3.2.1.4 Growing geriatric population globally

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of nitinol-based devices

- 3.2.2.2 Stringent regulatory approval processes

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the Industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerationsTrump administration tariffs

- 3.4.1 Impact on trade

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Regulatory landscape

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Stents

- 5.3 Guidewires

- 5.4 Catheters

- 5.5 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cardiovascular

- 6.3 Orthopedic

- 6.4 Dental

- 6.5 Neurological

- 6.6 Urology

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Specialty clinics

- 7.5 Research and academic institutes

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Acandis

- 9.3 Admedes Schuessler

- 9.4 Arthrex

- 9.5 B Braun

- 9.6 Becton, Dickinson and Company

- 9.7 Biotronik

- 9.8 Boston Scientific

- 9.9 Cook Medical

- 9.10 Endosmart

- 9.11 Jotec

- 9.12 Medtronic

- 9.13 MicroPort

- 9.14 Stryker

- 9.15 Terumo