|

市场调查报告书

商品编码

1750339

SGLT2 抑制剂市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测SGLT2 Inhibitors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

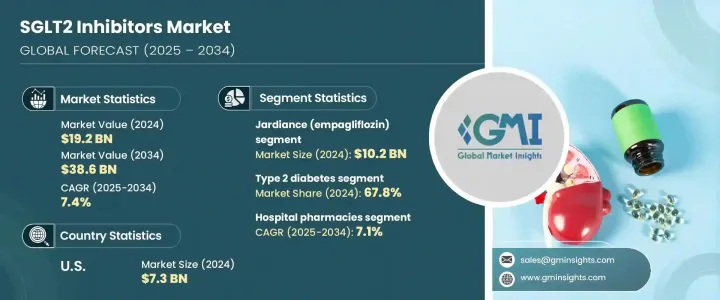

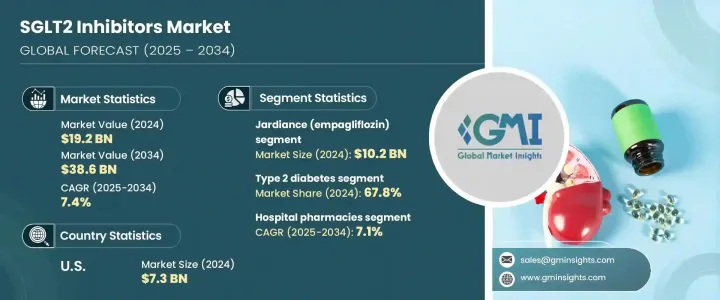

2024年,全球SGLT2抑制剂市场规模达192亿美元,预计到2034年将以7.4%的复合年增长率成长,达到386亿美元。这主要得益于全球第2型糖尿病盛行率的不断上升。由于缺乏运动、人口老化和肥胖率上升等生活方式因素,第2型糖尿病影响数百万患者。这类药物在治疗领域脱颖而出,因为它们除了降低血糖外,还有多种益处,特别适用于心血管和肾臟併发症患者。它们在慢性疾病管理中的作用日益增强,显着扩大了患者群体。

与传统糖尿病药物不同,SGLT2抑制剂透过促进肾臟葡萄糖排泄来降低血糖水平,不仅有助于血糖控制,还有助于保护心血管和肾臟。这使得SGLT2抑制剂成为病患和医护人员的首选。越来越多的临床研究证据表明,SGLT2抑制剂可降低心臟衰竭和肾臟病患者的住院率和死亡率,因此越来越多地将其作为联合疗法的一部分,以提高治疗效果和患者依从性。此外,药物研究的持续进展也进一步加速了创新,并提高了产品的有效性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 192亿美元 |

| 预测值 | 386亿美元 |

| 复合年增长率 | 7.4% |

2024年,第2型糖尿病治疗领域占了67.8%的市场。该领域的主导地位反映出,在日益加重的糖尿病负担下,人们迫切需要有效的解决方案。值得注意的是,许多医生现在倾向于将这些抑制剂与其他口服抗糖尿病药物合併使用,以增强疗效。它们能够同时应对多种疾病因素,已成为现代糖尿病管理的基石。

依配销通路划分,全球SGLT2抑制剂市场分为医院药局、零售药局和线上药局。截至2024年,医院药局市场在2025年至2034年期间的复合年增长率将达到7.1%,这得益于其在住院和门诊环境中提供专业治疗解决方案的核心作用。医院药房的主导地位源于其整合了先进的药房服务,这些服务支持协调的护理路径并改善临床疗效。这些药局在住院患者的药物管理中发挥着至关重要的作用,确保及时给予处方治疗,尤其是在急诊环境中。

美国SGLT2抑制剂市场在2024年占41.1%的市场份额,并将以7.2%的复合年增长率成长至2034年。 2034年,美国SGLT2抑制剂市场规模达73亿美元。美国的成长轨迹得益于其强大的医疗基础设施、广泛的患者可及性以及鼓励处方药使用的强有力报销政策。同时,由于诊断率的提高、医疗投资的增加以及创新疗法的可及性不断扩大,欧洲和亚太市场正展现出显着的吸引力。

全球SGLT2抑制剂产业的知名企业包括默克公司、鲁宾有限公司、格兰马克製药、安斯泰来、勃林格殷格翰国际、Lexicon製药、阿斯特捷利康、强生(杨森製药)、赛诺菲、礼来公司、TheracosBio和百时美施贵宝公司。为了巩固其在全球SGLT2抑制剂市场的地位,各公司正积极投资策略合作伙伴关係、联合行销协议并拓展临床适应症。北美和欧洲的主要企业正在利用研发管线开发先进的製剂,不仅针对糖尿病,也针对心臟衰竭和肾臟疾病。亚太地区的企业正在扩大生产能力并组成分销联盟,以满足不断增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 2型糖尿病盛行率上升

- 扩大治疗适应症

- 患者对口服疗法的偏好增加

- 产业陷阱与挑战

- 与药物相关的副作用

- 来自替代疗法的竞争

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 未来市场趋势

- 管道分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按药物类别,2021 - 2034 年

- 主要趋势

- Jardiance(恩格列净)

- Farxiga(达格列净)

- Invokana(卡格列净)

- Inpefa(索格列净)

- Qtern(达格列净/沙格列汀)

- 其他SGLT2抑制剂

第六章:市场估计与预测:按适应症,2021 - 2034 年

- 主要趋势

- 2型糖尿病

- 心血管疾病

- 慢性肾臟病(CKD)

- 其他适应症

第七章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Astellas

- AstraZeneca

- Boehringer Ingelheim International

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Glenmark Pharmaceuticals

- Johnson & Johnson (Janssen Pharmaceuticals)

- Lexicon Pharmaceuticals

- Lupin Limited

- Merck

- Sanofi

- TheracosBio

The Global SGLT2 Inhibitors Market was valued at USD 19.2 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 38.6 billion by 2034, driven by the increasing global prevalence of type 2 diabetes, a condition affecting millions due to lifestyle factors such as physical inactivity, aging populations, and rising obesity rates. These medications stand out in the therapeutic landscape because they offer multiple benefits beyond lowering blood sugar, particularly for patients with cardiovascular and renal complications. Their expanding role in managing chronic health conditions has significantly broadened their patient base.

Unlike traditional diabetes medications, SGLT2 inhibitors reduce glucose levels by promoting glucose excretion through the kidneys, which not only supports glycemic control but also contributes to cardiovascular and kidney protection. This makes them a preferred option among both patients and healthcare providers. With mounting evidence from clinical studies showing reduced hospitalization rates and mortality in heart failure and kidney disease patients, these drugs are increasingly used as part of combination therapies to improve treatment efficacy and patient compliance. Additionally, ongoing advancements in pharmaceutical research are further accelerating innovation and enhancing product effectiveness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.2 Billion |

| Forecast Value | $38.6 Billion |

| CAGR | 7.4% |

In 2024, the segment for managing type 2 diabetes held a 67.8% share. The dominance of this segment reflects the urgent need for effective solutions amid the growing diabetes burden. Notably, many physicians now favor prescribing these inhibitors alongside other oral antidiabetic agents to amplify therapeutic outcomes. Their ability to address multiple disease factors simultaneously has made them a cornerstone of modern diabetes management.

By distribution channel, the global SGLT2 inhibitors market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. As of 2024, the hospital pharmacies segment will grow at a CAGR of 7.1% from 2025-2034, driven by its central role in delivering specialized treatment solutions across inpatient and outpatient settings. The dominant position of hospital pharmacies stems from their integration of advanced pharmacy services that support coordinated care pathways and improve clinical outcomes. These pharmacies play a crucial role in medication management for hospitalized patients, ensuring the timely administration of prescribed therapies, especially in acute care settings.

United States SGLT2 Inhibitors Market held 41.1% share in 2024 and will grow at a 7.2% CAGR through 2034. United States generated USD 7.3 billion in 2034. The country's growth trajectory is supported by a robust healthcare infrastructure, widespread patient access to treatments, and strong reimbursement policies encouraging prescription adoption. Meanwhile, Europe and the Asia-Pacific markets are showing significant traction due to improved diagnosis rates, rising healthcare investments, and broader access to innovative therapies.

Prominent players in the Global SGLT2 Inhibitors Industry include Merck, Lupin Limited, Glenmark Pharmaceuticals, Astellas, Boehringer Ingelheim International, Lexicon Pharmaceuticals, AstraZeneca, Johnson & Johnson (Janssen Pharmaceuticals), Sanofi, Eli Lilly and Company, TheracosBio, and Bristol-Myers Squibb Company. To strengthen their position in the Global SGLT2 Inhibitors Market, companies are actively investing in strategic partnerships, co-marketing agreements, and expanding clinical indications. Major players in North America and Europe are leveraging R&D pipelines to develop advanced formulations targeting not just diabetes, but also heart failure and kidney disease. Firms in Asia-Pacific are expanding manufacturing capacities and forming distribution alliances to meet rising demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of type 2 diabetes

- 3.2.1.2 Expanding therapeutic indications

- 3.2.1.3 Increased patient preference for oral therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects associated with drugs

- 3.2.2.2 Competition from alternative therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Future market trends

- 3.7 Pipeline analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Jardiance (Empagliflozin)

- 5.3 Farxiga (Dapagliflozin)

- 5.4 Invokana (Canagliflozin)

- 5.5 Inpefa (Sotagliflozin)

- 5.6 Qtern (Dapagliflozin/Saxagliptin)

- 5.7 Other SGLT2 inhibitors

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Type 2 diabetes

- 6.3 Cardiovascular diseases

- 6.4 Chronic kidney disease (CKD)

- 6.5 Other indications

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 Online pharmacies

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Astellas

- 9.2 AstraZeneca

- 9.3 Boehringer Ingelheim International

- 9.4 Bristol-Myers Squibb Company

- 9.5 Eli Lilly and Company

- 9.6 Glenmark Pharmaceuticals

- 9.7 Johnson & Johnson (Janssen Pharmaceuticals)

- 9.8 Lexicon Pharmaceuticals

- 9.9 Lupin Limited

- 9.10 Merck

- 9.11 Sanofi

- 9.12 TheracosBio