|

市场调查报告书

商品编码

1750347

军用天线市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Military Antenna Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

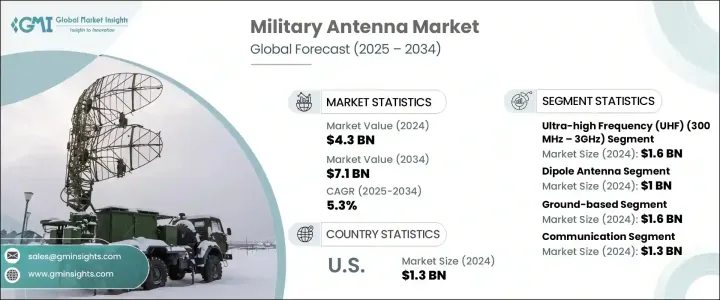

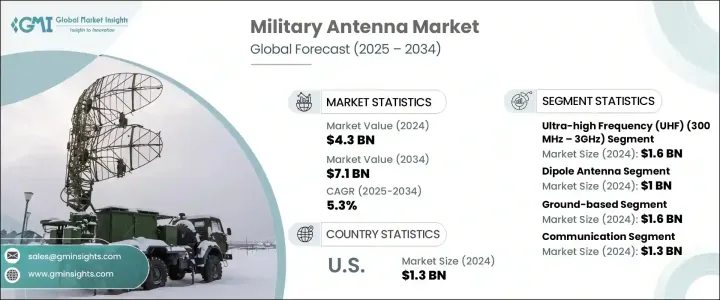

2024年,全球军用天线市场规模达43亿美元,预计2034年将以5.3%的复合年增长率成长,达到71亿美元。这主要得益于全球多个地区国防开支的不断增长以及无人系统部署的激增。现代军事行动需要在陆地、空中和海上进行快速、安全的通信,而天线正是这些要求对任务成功至关重要。随着对互通性、加密和多域整合的日益重视,世界各国政府正在加快对先进天线系统的投资。这些技术支援即时战场协调、远程武器系统和卫星通讯。此外,不断演变的地缘政治紧张局势和军事现代化计划推动了对高度依赖高性能、关键任务通讯组件的先进平台的采购。

美国的政策决策也在重塑市场格局方面发挥了重要作用。川普政府对中国电子产品征收的关税严重影响了全球供应链。射频模组、连接器和电路板等关键零件的成本不断上涨,导致生产时间紧张。美国境内的国防承包商面临采购延迟和成本上升的问题,这迫使他们转向国内供应商和盟友製造合作伙伴。儘管这些措施最初的目标是增强国家安全和国内生产能力,但这些措施暂时中断了关键军用级零件的获取,凸显了国际依赖的脆弱性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 43亿美元 |

| 预测值 | 71亿美元 |

| 复合年增长率 | 5.3% |

在各个频段中,超高频 (UHF) 天线在 2024 年市场占据领先地位,估值达 16 亿美元。这类天线因其可靠性而被广泛应用于高机动性军事通讯系统,尤其是在讯号受阻的区域,例如密集地形或复杂的城市景观。其操作灵活性以及与中短距离通讯需求的兼容性,持续推动多个平台的需求。此外,标准化的频率协议也鼓励对超高频技术的进一步投资。

偶极子天线在产品类型细分市场中位居榜首,2024 年市场收入将达到 10 亿美元。其设计简洁、全向辐射和宽频相容性使其成为整合到行动和地面军事平台的通讯系统的首选。这些天线还经济高效且易于集成,支援现有系统和新部署。

2024年,德国军用天线市场规模达2.434亿美元,这得益于其对软体定义和多标准通讯架构的持续关注,从而对自适应和安全天线系统的需求强劲增长。这一发展趋势得益于空中和地面防御平台的现代化升级,高性能、频率灵活的天线对于即时态势感知和互通性至关重要。数位化战场能力和增强电子战韧性的推动,也促进了德国国内先进天线技术的研发。

全球军用天线市场的领先公司专注于创新、合作和产品扩展,以巩固其市场地位。洛克希德马丁公司和RTX公司大力投资未来作战环境所需的先进通讯系统。泰雷兹公司和BAE系统公司正在扩展其产品线,以支援互通性和模组化。 Viasat公司和L3Harris Technologies公司正在加强其卫星天线产品组合。同时,科巴姆先进电子解决方案公司和罗德与施瓦茨公司正在建立策略合作伙伴关係,以提高生产效率。 MTI Wireless Edge公司和Antcom公司正在开发紧凑、坚固的天线系统,以满足战术需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 关键零件价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 全球国防预算增加

- 武装部队现代化

- 无人机(UAV)的成长

- 电子战(EW)的出现

- 增加边境监视和侦察活动

- 产业陷阱与挑战

- 开发和整合成本高

- 复杂的监管和频率分配问题

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 偶极天线

- 单极天线

- 喇叭天线

- 环形天线

- 阵列天线

- 贴片天线

- 抛物面反射天线

- 其他的

第六章:市场估计与预测:按频段,2021 年至 2034 年

- 主要趋势

- 高频(HF)(3-30 MHz)

- 甚高频(VHF)(30–300 MHz)

- 超高频(UHF)(300 MHz 至 3 GHz)

- 超高频(SHF)(3-30 GHz)

- 极高频(EHF)(30–300 GHz)

第七章:市场估计与预测:按平台,2021 年至 2034 年

- 主要趋势

- 地面

- 海军

- 空降

- 空间

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 监视与侦察

- 卫星通讯

- 电子战

- 遥测

- 沟通

- 其他的

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Antcom

- BAE Systems

- Cobham Advanced Electronic Solutions

- Comrod Communication

- Eylex

- General Dynamics Mission Systems

- Hascall-Denke

- Honeywell International

- L3Harris Technologies

- Lockheed Martin

- MTI Wireless Edge

- Rohde and Schwarz

- RTX

- Saab

- Thales

- Viasat

The Global Military Antenna Market was valued at USD 4.3 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 7.1 billion by 2034, driven by the rising defense spending across multiple regions, as well as a surge in the deployment of unmanned systems. Modern military operations demand rapid, secure communication across land, air, and sea domains-requirements that make antennas central to mission success. With increased focus on interoperability, encryption, and multi-domain integration, governments worldwide are accelerating investments in advanced antenna systems. These technologies support real-time battlefield coordination, remote weapon systems, and satellite communications. Furthermore, evolving geopolitical tensions and military modernization programs fuel the procurement of advanced platforms that rely heavily on high-performance, mission-critical communication components.

U.S. policy decisions have also played a major role in reshaping the market landscape. Tariffs imposed on Chinese electronics under the Trump administration significantly impacted global supply chains. Costs of essential components like RF modules, connectors, and circuit boards escalated, straining production timelines. Defense contractors within the United States faced procurement delays and rising expenses, which forced a pivot toward domestic suppliers and allied manufacturing partnerships. While the original goal was to boost national security and domestic capability, these actions temporarily disrupted access to critical military-grade parts, highlighting the vulnerability of international dependency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.3 Billion |

| Forecast Value | $7.1 Billion |

| CAGR | 5.3% |

Among the frequency segments, ultra-high frequency (UHF) antennas led the market in 2024 with a valuation of USD 1.6 billion. These antennas are widely adopted for their reliability in high-mobility military communication systems, particularly in areas with signal obstruction like dense terrain or complex urban landscapes. Their operational flexibility and compatibility with short-to-mid-range communication needs continue to drive demand across multiple platforms. Additionally, standardized frequency protocols are encouraging further investment in UHF technologies.

Dipole antennas topped the product type segment, generating revenues of USD 1 billion in 2024. Their simple design, omnidirectional radiation, and broad frequency compatibility make them a preferred option in communication systems integrated into mobile and ground-based military platforms. These antennas are also cost-efficient and easy to integrate, supporting long-standing systems and new deployments.

Germany Military Antenna Market generated USD 243.4 million in 2024, driven by advancing its focus on software-defined and multi-standard communication architectures, creating robust demand for adaptive and secure antenna systems. This evolution is fueled by modernization efforts across both aerial and terrestrial defense platforms, where high-performance, frequency-agile antennas are essential for real-time situational awareness and interoperability. The push toward digital battlefield capabilities and enhanced electronic warfare resilience encourages domestic R&D in advanced antenna technologies.

Leading companies in the Global Military Antenna Market focus on innovation, partnerships, and product expansion to secure their market position. Lockheed Martin and RTX invest heavily in advanced communication systems for future combat environments. Thales and BAE Systems are expanding their product lines to support interoperability and modularity. Viasat and L3Harris Technologies are strengthening their satellite-based antenna portfolios. Meanwhile, Cobham Advanced Electronic Solutions and Rohde & Schwarz are forming strategic partnerships to increase production efficiency. MTI Wireless Edge and Antcom are developing compact, rugged antenna systems to meet tactical demands.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increased defense budgets worldwide

- 3.3.1.2 Modernization of armed forces

- 3.3.1.3 Growth in unmanned aerial vehicles (UAVs)

- 3.3.1.4 Emergence of electronic warfare (EW)

- 3.3.1.5 Increase in border surveillance and reconnaissance activities

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High development and integration costs

- 3.3.2.2 Complex regulatory and frequency allocation issues

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Dipole antenna

- 5.3 Monopole antennas

- 5.4 Horn antennas

- 5.5 Loop antenna

- 5.6 Array antenna

- 5.7 Patch antennas

- 5.8 Parabolic reflector antennas

- 5.9 Others

Chapter 6 Market Estimates and Forecast, By Frequency Band, 2021 – 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 High frequency (HF) (3–30 MHz)

- 6.3 Very high frequency (VHF) (30–300 MHz)

- 6.4 Ultra high frequency (UHF) (300 MHz–3 GHz)

- 6.5 Super high frequency (SHF) (3–30 GHz)

- 6.6 Extremely high frequency (EHF) (30–300 GHz)

Chapter 7 Market Estimates and Forecast, By Platform, 2021 – 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Ground-based

- 7.3 Naval

- 7.4 Airborne

- 7.5 Space

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 Surveillance & reconnaissance

- 8.3 Satcom

- 8.4 Electronic warfare

- 8.5 Telemetry

- 8.6 Communication

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Antcom

- 10.2 BAE Systems

- 10.3 Cobham Advanced Electronic Solutions

- 10.4 Comrod Communication

- 10.5 Eylex

- 10.6 General Dynamics Mission Systems

- 10.7 Hascall-Denke

- 10.8 Honeywell International

- 10.9 L3Harris Technologies

- 10.10 Lockheed Martin

- 10.11 MTI Wireless Edge

- 10.12 Rohde and Schwarz

- 10.13 RTX

- 10.14 Saab

- 10.15 Thales

- 10.16 Viasat