|

市场调查报告书

商品编码

1750349

商用飞机 LED 照明市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Commercial Aircraft LED Lighting Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

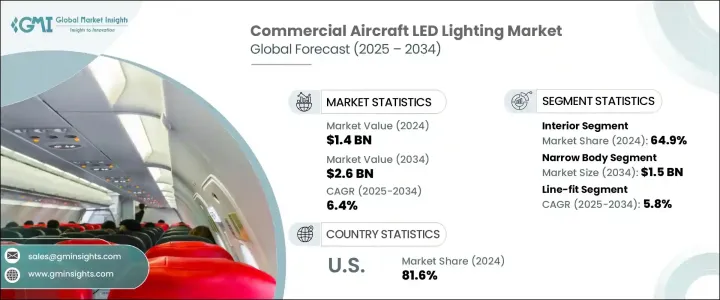

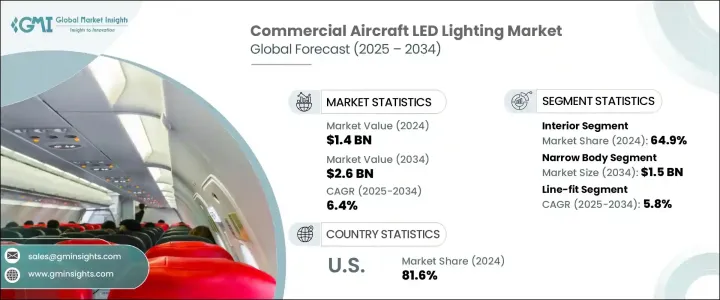

2024年,全球商用飞机LED照明市场规模达14亿美元,预计2034年将以6.4%的复合年增长率成长,达到26亿美元。随着全球商用飞机数量的不断增长以及旅游业的蓬勃发展,该市场的需求正在稳步增长。航空公司优先考虑节能且技术先进的照明系统,以提高营运绩效和乘客满意度。随着机队的扩张和频繁升级,LED照明已成为提供现代化客舱体验和提高燃油效率的重要组成部分。

儘管航空业面临经济和地缘政治方面的不利因素,包括贸易相关的成本压力,但该行业已透过重塑采购策略和多元化供应链稳步适应。这些转变在稳定市场方面发挥了关键作用,有助于维持对飞机照明系统的稳定需求。 LED照明已成为关键解决方案,尤其是在航空公司持续投资现代化内装并寻求降低营运成本的当下。市场参与者如今更加重视在新飞机和正在升级的老旧机队中整合先进、耐用且以人为本的照明技术。这种转变不仅有助于满足不断变化的监管标准,也符合整个航空业设定的环境永续目标。此外,LED系统设计的进步使其能够更好地与机上娱乐系统和航空电子设备集成,从而提升飞机的整体性能和乘客舒适度。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 26亿美元 |

| 复合年增长率 | 6.4% |

就照明类型而言,市场细分为内部照明和外部照明。内部LED照明占市场主导地位,2024年市占率达64.9%。随着航空公司投资昼夜节律和环境照明系统,以满足经济舱和头等舱乘客的需求,对先进客舱照明的需求持续成长。这些系统有助于提高乘客舒适度,提升航空公司品牌形象,并透过智慧照明设计降低功耗。航空公司越来越多地采用动态照明方案,在创造个人化旅行体验的同时,也有助于节能。

根据飞机类型,市场进一步细分为窄体飞机、宽体飞机和支线飞机。其中,预计到2034年,窄体飞机的市场规模将达到15亿美元。人们对中短程航线的日益青睐,推动了窄体飞机的生产和部署。营运这些航线的航空公司正在整合LED照明,将其作为经济高效的选择,以升级内装并提升旅游体验,尤其针对预算有限的旅客。由于航空公司正在寻求在不影响成本效益的情况下提升氛围的方法,新交付的飞机和现有飞机都将受益于这些升级。

根据安装方式,市场可分为原厂安装和改装。预计到2034年,原厂安装的复合年增长率将达到5.8%。新飞机在製造阶段越来越多地配备LED照明系统,製造商与照明解决方案提供商密切合作,以确保顺利整合。这种方法不仅减少了未来改装的需求,还确保照明系统符合最新的技术标准和客舱管理系统。

从地区来看,美国在2024年占据了全球商用飞机LED照明市场超过81.6%的份额。美国强大的飞机製造生态系统和对技术创新的高度重视,推动了智慧照明系统的广泛应用。美国国内航空公司机队持续的改造计划以及对客舱内饰现代化的推动,进一步推动了该地区市场的成长。不断变化的客户期望以及航空公司营运成本管理改善的需求,推动了对持久高效照明解决方案的需求。

商用飞机LED照明市场竞争激烈,前五大厂商合计占超过60%的市占率。市场领导者正在投资符合以乘客为中心的设计原则的下一代照明技术。各公司正透过与飞机製造商建立长期合作伙伴关係,实现生产过程中的无缝组装集成,从而巩固其市场地位。随着航空公司希望延长机队寿命并提昇机上体验,老旧飞机的改装也日益兴起。为了满足日益增长的全球需求,製造商正在加大研发投入,扩大其国际影响力,并高度重视满足合规标准和实现永续发展目标。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 商用飞机扩张

- 对乘客舒适度和客舱美观度的需求不断增长

- 改造和升级专案的成长

- 智慧座舱系统的应用日益广泛

- 旅游业的成长

- 产业陷阱与挑战

- 初期投资改造成本高

- 严格的监管标准和认证延迟

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- Pestel 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依明类型,2021 - 2034 年

- 主要趋势

- 内部的

- 标誌和阅读

- 天花板和壁灯

- 外部的

- 紧急状况

- 防撞

- 探照灯

第六章:市场估计与预测:依飞机类型,2021 - 2034 年

- 主要趋势

- 窄体

- 宽体

- 支线喷射机

第七章:市场估计与预测:按拟合,2021 - 2034 年

- 主要趋势

- 线拟合

- 改造

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Aero Dynamix

- AeroLEDs

- Aerospace

- Aircraft Lighting International

- American Bright

- Astronics

- Bruce Aerospace

- Cobalt Aerospace Group

- Collins Aerospace

- Diehl Stiftung

- Honeywell International

- Luminator Aerospace

- Lumitex

- Oxley Group

- Prizm Lighting

- PWI

- Safran

- SELA

- Whelen Aerospace Technologies

The Global Commercial Aircraft LED Lighting Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 2.6 billion by 2034. The market is witnessing a steady surge in demand due to the growing number of commercial aircraft in operation and a thriving tourism industry worldwide. Airlines are prioritizing energy-efficient and technologically advanced lighting systems to enhance both operational performance and passenger satisfaction. As fleets expand and undergo frequent upgrades, LED lighting has become an essential component in delivering modern cabin experiences and improving fuel efficiency.

While the industry has faced economic and geopolitical headwinds, including trade-related cost pressures, it has steadily adapted by reshaping sourcing strategies and diversifying supply chains. These shifts have played a key role in stabilizing the market, helping to maintain a consistent demand for aircraft lighting systems. LED lighting has emerged as a critical solution, especially as airlines continue to invest in modern interiors and seek to reduce operational costs. Market participants are now more focused on integrating advanced, durable, and human-centric lighting technologies in both new aircraft and older fleets undergoing upgrades. This shift is not only helping meet evolving regulatory standards but also aligning with environmental sustainability goals set across the aviation sector. Furthermore, advancements in LED system design are enabling better integration with in-flight entertainment systems and avionics, enhancing overall aircraft performance and passenger comfort.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 6.4% |

In terms of light type, the market is segmented into interior and exterior lighting. Interior LED lighting dominated the market with a share of 64.9% in 2024. The demand for advanced cabin lighting continues to rise as airlines invest in circadian rhythm and ambient lighting systems that cater to both economy and premium class passengers. These systems are helping improve passenger comfort, boost airline brand image, and lower power consumption through intelligent lighting designs. Airlines are increasingly adopting dynamic lighting schemes that create personalized travel experiences while also contributing to energy savings.

The market is further divided by aircraft type into narrow body, wide body, and regional jets. Among these, narrow body aircraft are projected to reach USD 1.5 billion by 2034. The growing preference for short to medium-haul routes is prompting increased production and deployment of narrow body jets. Airlines operating on these routes are integrating LED lighting as a cost-effective option to upgrade interiors and elevate the travel experience, especially for budget travelers. Both newly delivered and existing aircraft are benefiting from these upgrades as airlines seek ways to enhance ambiance without compromising on cost efficiency.

Based on fitting, the market is classified into line fit and retrofit. Line-fit installations are estimated to grow at a CAGR of 5.8% through 2034. New aircraft are increasingly being equipped with LED lighting systems during the manufacturing phase, with manufacturers working closely with lighting solution providers to ensure smooth integration. This approach not only reduces the need for future retrofitting but also ensures that the lighting systems are aligned with the latest technological standards and cabin management systems.

Regionally, the United States captured over 81.6% of the global commercial aircraft LED lighting market in 2024. The country's robust aircraft manufacturing ecosystem and a strong focus on technological innovation have led to the wide-scale adoption of smart lighting systems. Continuous retrofitting initiatives across domestic airline fleets and the push toward modernizing cabin interiors have further propelled market growth in the region. The demand for long-lasting and high-efficiency lighting solutions is being driven by evolving customer expectations and the need to improve cost management across airline operations.

The commercial aircraft LED lighting market is highly competitive, with the top five players holding a collective share of over 60%. Market leaders are investing in next-generation lighting technologies that align with passenger-centric design principles. Companies are strengthening their market positions by forging long-term partnerships with aircraft manufacturers, enabling seamless line-fit integration during production. The push toward retrofitting older aircraft is also gaining momentum, as airlines look to extend fleet life while enhancing onboard experience. To meet growing global demand, manufacturers are ramping up research and development investments and expanding their international footprint, with a sharp focus on meeting compliance standards and addressing sustainability targets.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Commercial aircraft expansion

- 3.3.1.2 Rising demand for passenger comfort and cabin aesthetics

- 3.3.1.3 Growth in retrofit and upgrade programs

- 3.3.1.4 Increasing adoption of smart cabin systems

- 3.3.1.5 Growth in tourism industry

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial investment and retrofit costs

- 3.3.2.2 Stringent regulatory standards and certification delays

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 Pestel analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Light Type, 2021 - 2034 (USD Million & units)

- 5.1 Key trends

- 5.2 Interior

- 5.2.1 Signage & reading

- 5.2.2 Ceiling & wall lights

- 5.3 Exterior

- 5.3.1 Emergency

- 5.3.2 Anti-collision

- 5.3.3 Search lights

Chapter 6 Market Estimates & Forecast, By Aircraft Type, 2021 - 2034 (USD Million & units)

- 6.1 Key trends

- 6.2 Narrow body

- 6.3 Wide body

- 6.4 Regional jets

Chapter 7 Market Estimates & Forecast, By Fitting, 2021 - 2034 (USD Million & units)

- 7.1 Key trends

- 7.2 Line-fit

- 7.3 Retrofit

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Aero Dynamix

- 9.2 AeroLEDs

- 9.3 Aerospace

- 9.4 Aircraft Lighting International

- 9.5 American Bright

- 9.6 Astronics

- 9.7 Bruce Aerospace

- 9.8 Cobalt Aerospace Group

- 9.9 Collins Aerospace

- 9.10 Diehl Stiftung

- 9.11 Honeywell International

- 9.12 Luminator Aerospace

- 9.13 Lumitex

- 9.14 Oxley Group

- 9.15 Prizm Lighting

- 9.16 PWI

- 9.17 Safran

- 9.18 SELA

- 9.19 Whelen Aerospace Technologies