|

市场调查报告书

商品编码

1750350

AI PC 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测AI PC Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

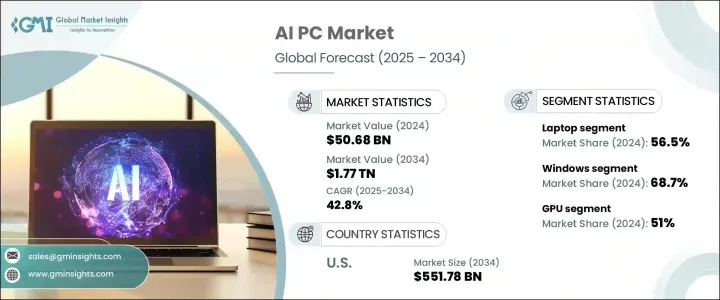

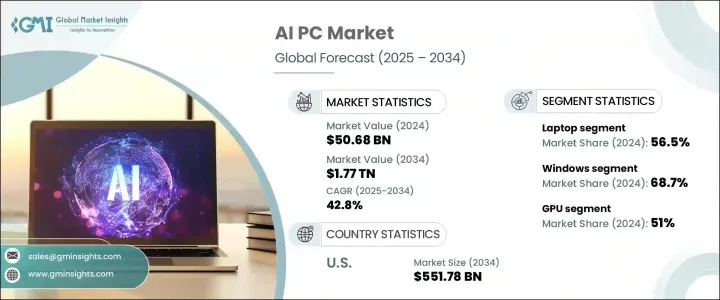

2024年,全球人工智慧PC市场规模达506.8亿美元,预计到2034年将以42.8%的复合年增长率成长,达到1.77兆美元,这得益于神经处理单元(NPU)在运算设备中日益整合的趋势。这些内建的人工智慧加速器正在将PC转变为智慧系统,能够直接在设备上支援先进的低延迟人工智慧功能。一个主要的成长因素源自于使用者对生产力、内容创作、通讯和设备安全等即时人工智慧驱动功能的需求不断增长。这一转变标誌着从传统运算向人工智慧原生基础设施的转变,在这种基础设施中,处理过程被本地化,以获得更好的效能和资料保护。

贸易法规,包括对半导体和高效能处理器等关键零件征收的关税,已经影响了人工智慧个人电脑的成本结构。这些限制不仅导致价格波动、交货时间延长,也扰乱了关键国际技术的取得。作为应对措施,製造商正在重新调整供应链,转向本地生产的零件,以减少对进口的依赖,并确保符合国家科技政策。这种转变与主要经济体的国内晶片製造激励措施一致,从而加强了本土人工智慧生态系统的发展。本地采购也为维持不间断的生产週期和降低全球贸易紧张局势所带来的风险提供了策略优势。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 506.8亿美元 |

| 预测值 | 1.77兆美元 |

| 复合年增长率 | 42.8% |

人工智慧软体在日常运算任务中的日益普及,加速了人工智慧电脑在企业和消费市场的普及。越来越多的设备正在建立以支援设备上的人工智慧应用程序,这些应用程式无需将资料传输到云端即可提升用户体验。这种设定确保了更高的资料隐私性和更快的效能,这在当今的混合工作文化中尤其重要。人工智慧电脑现在充当智慧终端,与边缘和云端运算系统无缝协作,高效管理分散式人工智慧工作负载。全球监管机构正积极推动安全、去中心化人工智慧框架的演进,强调对响应迅速且合规的人工智慧系统的需求。

就硬体设计而言,人工智慧PC市场细分为桌上型电脑、笔记型电脑和工作站。 2024年,笔记型电脑占据最大份额,达到56.5%,这得益于对整合人工智慧功能的便携式运算能力日益增长的需求。这些设备如今配备了专为人工智慧任务设计的处理器,使其成为需要随时随地使用智慧功能的行动用户的理想之选。更长的电池续航力、更灵敏的使用者介面和更强大的多媒体功能也鼓励专业人士和普通消费者升级到支援人工智慧的笔记型电脑。

按作业系统分类,Windows 将在 2024 年以 68.7% 的市占率领先 AI PC 市场。这种优势可以归因于广泛的硬体合作伙伴、完善的软体生态系统以及围绕 Windows 平台构建的企业级采用。随着旧作业系统的逐步淘汰,硬体更新周期不断推进,企业正在投资新的 AI 最佳化 Windows PC,这些 PC 可提供增强的合规性、安全性和生产力功能。

依计算类型,市场分为 GPU、NPU 和其他。 GPU 在 2024 年占据了最高的市场份额,达到 51%,这得益于其在处理复杂的 AI 演算法和提供高端图形性能方面发挥的重要作用。这些处理器对于处理深度学习、影像处理和即时资料分析等 AI 工作负载尤其重要。先进 GPU 架构的整合正在提升视觉质量,并在各种应用中实现 AI 加速功能。

从区域来看,预计到2034年,美国人工智慧PC市场规模将达到5,517.8亿美元。政府对国内人工智慧和半导体基础设施的大力投资,加上企业对边缘人工智慧解决方案的兴趣,正在推动市场成长。随着越来越多的企业采用基于人工智慧的工具和服务,对高效能运算设备的需求持续成长。企业对技术独立性和数位弹性的追求,正鼓励他们采用符合严格资料保护和效能标准的人工智慧PC。

人工智慧 PC 领域的竞争日益激烈,监管要求和生产力需求成为采购决策的核心。医疗、教育和金融等行业的企业纷纷转向人工智慧 PC,以满足合规标准并维持营运效率。设备上的人工智慧处理功能可以减少对云端储存的依赖,从而符合日益严格的全球资料保护和网路安全法规。随着对生成式人工智慧工具和智慧自动化的需求不断增长,企业正在使用支援人工智慧的系统更新 IT 基础设施,以优化工作流程、减少重复性任务并支援明智的决策。 PC 製造商和软体开发人员之间的合作正在进一步增强人工智慧集成,从而改变用户与个人计算设备的交互方式。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给面影响(服务提供者)

- 关键服务价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(定价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 伺服器提供者重新配置

- 定价和服务策略

- 政策参与

- 展望与未来考虑

- 供给面影响(服务提供者)

- 对贸易的影响

- 产业衝击力

- 成长动力

- 神经处理单元 (NPU) 在 PC 中的集成

- 人工智慧应用激增

- 人工智慧演算法的进步

- 政府对人工智慧的措施和投资

- 云端运算和边缘运算的扩展

- 产业陷阱与挑战

- AI整合硬体组件成本高昂

- 设备端人工智慧处理中的资料隐私和安全问题

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依外形尺寸,2021-2034

- 主要趋势

- 桌面

- 软体

- 工作站

第六章:市场估计与预测:按作业系统,2021-2034 年

- 主要趋势

- 视窗

- MacOS

- 其他的

第七章:市场估计与预测:依计算类型,2021-2034

- 主要趋势

- 图形处理器

- 神经网路处理器

- 其他的

第八章:市场估计与预测:依最终用途,2021-2034

- 消费者

- 企业

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳新银行

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Acer

- Apple Inc.

- ASUSTeK Computer Inc.

- BOXX

- CORSAIR

- Dell Inc.

- GIGA-BYTE Technology Co., Ltd.

- HP Development Company, LP

- Huawei

- Lenovo

- Microsoft

- Micro-Star INT'L CO., LTD.

- NVIDIA Corporation

- Puget Systems

- Razer Inc.

The Global AI PC Market was valued at USD 50.68 billion in 2024 and is estimated to grow at a CAGR of 42.8% to reach USD 1.77 trillion by 2034, fueled by the increasing integration of neural processing units (NPUs) in computing devices. These built-in AI accelerators are transforming PCs into intelligent systems capable of supporting advanced, low-latency AI functions directly on the device. A major growth factor stems from evolving user demands for real-time, AI-driven capabilities across productivity, content creation, communication, and device security. This transition marks a shift from traditional computing to AI-native infrastructure, where processing is localized for better performance and data protection.

Trade regulations, including tariffs on key components like semiconductors and high-performance processors, have impacted the cost structure of AI PCs. These restrictions have not only led to price volatility and increased delivery timelines but have also disrupted access to essential international technologies. As a response, manufacturers are realigning supply chains and turning toward regionally produced components to reduce dependency on imports and ensure compliance with national tech policies. This shift is in line with domestic chip-making incentives across major economies, reinforcing the development of homegrown AI ecosystems. Local sourcing also provides strategic advantages in maintaining uninterrupted production cycles and mitigating risks linked to global trade tensions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $50.68 Billion |

| Forecast Value | $1.77 Trillion |

| CAGR | 42.8% |

The increasing use of AI-enabled software in everyday computing tasks is accelerating the adoption of AI PCs across both business and consumer markets. More devices are being built to support on-device AI applications, which enhance user experience without needing to offload data to the cloud. This setup ensures greater data privacy and quicker performance, which are especially critical in today's hybrid work culture. AI PCs are now acting as intelligent endpoints, working seamlessly with edge and cloud computing systems to manage distributed AI workloads efficiently. The evolution of secure, decentralized AI frameworks is being actively promoted by global regulatory bodies, emphasizing the need for responsive and compliant AI systems.

In terms of hardware design, the AI PC market is segmented into desktops, laptops, and workstations. In 2024, laptops accounted for the largest share at 56.5%, driven by growing demand for portable computing power integrated with AI capabilities. These devices now come equipped with processors specifically designed for AI tasks, making them ideal for mobile users who need intelligent features on the go. Improved battery life, responsive user interfaces, and enhanced multimedia functions are also encouraging professionals and general consumers to upgrade to AI-powered laptops.

When categorized by operating systems, Windows leads the AI PC market with a share of 68.7% in 2024. This dominance can be attributed to the widespread presence of hardware partners, software ecosystems, and enterprise adoption built around the Windows platform. Ongoing hardware refresh cycles, driven by the phasing out of older operating systems, are pushing organizations to invest in new AI-optimized Windows PCs that offer enhanced compliance, security, and productivity features.

By compute type, the market is divided into GPUs, NPUs, and others. GPUs held the highest market share at 51% in 2024, owing to their vital role in processing complex AI algorithms and delivering high-end graphics performance. These processors are particularly important for handling AI workloads such as deep learning, image processing, and real-time data analysis. The integration of advanced GPU architectures is enhancing visual quality and enabling AI-accelerated features across a wide range of applications.

In regional terms, the U.S. AI PC market is expected to reach USD 551.78 billion by 2034. Strong government investments in domestic AI and semiconductor infrastructure, combined with corporate interest in edge AI solutions, are driving market growth. As more companies embrace AI-based tools and services, the need for high-performance computing devices continues to grow. The shift toward technology independence and digital resilience is encouraging businesses to adopt AI PCs that meet stringent data protection and performance standards.

Competition in the AI PC space is intensifying, with regulatory requirements and productivity demands becoming central to purchasing decisions. Organizations across industries such as healthcare, education, and finance are turning to AI PCs to meet compliance standards while maintaining operational efficiency. On-device AI processing enables reduced reliance on cloud storage, aligning with increasing global data protection and cybersecurity regulations. As demand for generative AI tools and intelligent automation grows, companies are refreshing IT infrastructure with AI-ready systems to optimize workflows, cut down on repetitive tasks, and support informed decision-making. Collaborative efforts between PC manufacturers and software developers are further enhancing AI integration, transforming the way users interact with personal computing devices.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-side impact (service providers)

- 3.2.1.3.1.1 Price volatility in key services

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-side impact (pricing)

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 Market share dynamics

- 3.2.1.3.2.3 Consumer response patterns

- 3.2.1.3.3 Key companies impacted

- 3.2.1.3.4 Strategic industry responses

- 3.2.1.3.4.1 Server provider reconfiguration

- 3.2.1.3.4.2 Pricing and service strategies

- 3.2.1.3.4.3 Policy engagement

- 3.2.1.3.5 Outlook and future considerations

- 3.2.1.3.1 Supply-side impact (service providers)

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Integration of Neural Processing Units (NPUs) in PCs

- 3.3.1.2 Surge in AI-powered applications

- 3.3.1.3 Advancements in AI algorithms

- 3.3.1.4 Government initiatives and investments in AI

- 3.3.1.5 Expansion of cloud and edge computing

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High cost of AI-integrated hardware components

- 3.3.2.2 Data privacy and security concerns in on-device AI processing

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Form Factor, 2021-2034 (USD Billion & units)

- 5.1 Key trends

- 5.2 Desktop

- 5.3 Software

- 5.4 Workstation

Chapter 6 Market Estimates & Forecast, By Operating System, 2021-2034 (USD Billion & units)

- 6.1 Key trends

- 6.2 Windows

- 6.3 MacOS

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Compute Type, 2021-2034 (USD Billion & units)

- 7.1 Key trends

- 7.2 GPU

- 7.3 NPU

- 7.4 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion & units)

- 8.1 Consumers

- 8.2 Enterprises

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion & units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 ANZ

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Acer

- 10.2 Apple Inc.

- 10.3 ASUSTeK Computer Inc.

- 10.4 BOXX

- 10.5 CORSAIR

- 10.6 Dell Inc.

- 10.7 GIGA-BYTE Technology Co., Ltd.

- 10.8 HP Development Company, L.P

- 10.9 Huawei

- 10.10 Lenovo

- 10.11 Microsoft

- 10.12 Micro-Star INT'L CO., LTD.

- 10.13 NVIDIA Corporation

- 10.14 Puget Systems

- 10.15 Razer Inc.