|

市场调查报告书

商品编码

1750360

前葡萄膜炎治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Anterior Uveitis Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

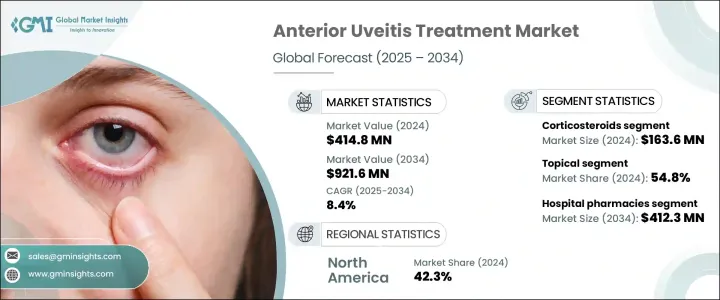

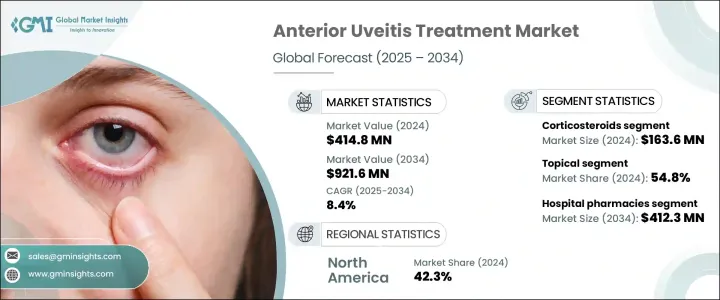

2024年,全球前葡萄膜炎治疗市场规模达4.148亿美元,预计到2034年将以8.4%的复合年增长率成长,达到9.216亿美元。这得益于对前葡萄膜炎自体免疫和发炎机制的深入了解,这凸显了早期和有针对性的医疗干预的必要性。诊断工具和影像技术的进步正在帮助临床医生做出更快、更准确的评估,从而加速治疗决策。患者群体的扩大,加上自体免疫疾病和传染病的增多,进一步刺激了对可靠治疗方法的需求。

基因检测和人工智慧辅助诊断等技术的进步正在为更个人化的治疗方案铺平道路,为医疗服务提供者和製造商带来新的机会。这些创新能够更准确地辨识患者的具体需求,进而改善治疗效果。此外,全球人口老化,尤其是在美国,导致发炎性眼部疾病的发生率上升,这反过来又刺激了对老年患者需求的专门治疗的需求。这种人口结构的变化凸显了开发针对性治疗方案以应对此类疾病日益增长的盛行率的重要性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.148亿美元 |

| 预测值 | 9.216亿美元 |

| 复合年增长率 | 8.4% |

2024年,皮质类固醇市场收入达1.636亿美元。其强大的抗发炎特性和快速缓解症状的能力,巩固了其作为治疗眼部发炎和预防危及视力併发症的一线治疗药物的地位。这些药物用途广泛,有全身性用药和局部用药两种剂型,可根据发炎的严重程度和部位进行选择。全身性用药通常用于治疗严重或后段炎症,而局部用药仍是局部性前段疾病的首选方案。数十年的疗效资料支持其广泛的临床应用,使其成为眼科护理的基石。

2024年,局部用皮质类固醇药物的市占率达到54.8%,反映出其在医疗保健提供者和患者中的日益普及。局部给药具有局部治疗效果,全身性吸收极少,与口服或註射剂型相比,显着降低了不良反应的风险。这种给药方式尤其适用于前葡萄膜炎和其他眼前部发炎性疾病,使用方便、缓解较快,且患者遵从性较高。各种剂量选择和剂型(例如软膏、凝胶和眼药水)的出现,进一步提升了用药的便利性,有助于提高依从性并改善患者疗效。

2024年,美国前葡萄膜炎治疗市场规模达1.595亿美元。该国强大的医疗基础设施和高发生率的自体免疫疾病,加剧了人们对眼部疾病的关注。皮质类固醇、免疫抑制剂和生物製剂等药物仍然是治疗方案的核心,而临床研究也越来越多地探索基于生物製剂的新型治疗方案。监管部门对远距医疗和数位化工具的开放性,优化了患者获得早期评估和持续护理的管道,增强了该地区的整体治疗管道。

全球前葡萄膜炎治疗市场的主要参与者包括辉瑞、Aldeyra Therapeutics、Tarsier Pharma、诺华、Clearside Biomedical、UCB、艾伯维、安进、Kiora Pharmaceuticals、爱尔康、EyePoint Pharmaceuticals、太阳製药和参天製药。为了巩固其在前葡萄膜炎治疗市场的地位,Clearside Biomedical、爱尔康和参天製药等公司正在大力投资研发,以期更快地将创新疗法推向市场。 EyePoint Pharmaceuticals 和安进等公司优先考虑先进的给药技术,以提高治疗效果并方便患者使用。包括辉瑞和诺华在内的大型製药公司与生技创新者之间的合作已成为扩大治疗组合的策略。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 提高对葡萄膜炎相关併发症的认识

- 诊断工具的技术进步

- 生物製剂和生物相似药的开发

- 产业陷阱与挑战

- 先进治疗方案成本高昂

- 发展中地区医疗保健服务有限

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按治疗类型,2021-2034

- 主要趋势

- 皮质类固醇

- 睫状肌麻痹剂

- 抗TNF药物

- 免疫抑制剂

- 其他治疗类型

第六章:市场估计与预测、管理途径,2021-2034

- 主要趋势

- 口服

- 外用

- 注射剂

第七章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- AbbVie

- Alcon

- Aldeyra Therapeutics

- Amgen

- Clearside Biomedical

- EyePoint Pharmaceuticals

- Kiora Pharmaceuticals

- Novartis

- Pfizer

- Santen Pharmaceutical

- Sun Pharmaceutical Industries

- Tarsier Pharma

- UCB

The Global Anterior Uveitis Treatment Market was valued at USD 414.8 million in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 921.6 million by 2034, driven by deeper insights into the autoimmune and inflammatory underpinnings of anterior uveitis, which underscore the need for early and targeted medical intervention. Advancements in diagnostic tools and imaging technologies are helping clinicians make faster and more accurate assessments, which is accelerating treatment decisions. The expanding patient pool, linked to rising autoimmune and infectious diseases, further fuels demand for reliable therapeutic approaches.

Advancements in technologies such as genetic testing and AI-assisted diagnostics are paving the way for more personalized treatment options, offering new opportunities for both healthcare providers and manufacturers. These innovations allow for more accurate identification of specific patient needs, enhancing treatment outcomes. Furthermore, the aging global population, especially in the U.S., is driving a higher incidence of inflammatory eye conditions, which in turn is fueling the demand for specialized therapies tailored to meet the needs of older patients. This demographic shift underscores the importance of developing targeted treatments to address the growing prevalence of such conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $414.8 Million |

| Forecast Value | $921.6 Million |

| CAGR | 8.4% |

The corticosteroids segment generated USD 163.6 million in 2024. Their potent anti-inflammatory properties and ability to deliver rapid symptom relief have cemented their role as the first-line therapy for managing ocular inflammation and preventing vision-threatening complications. These drugs are versatile, available in systemic and topical formulations, and are selected based on the severity and location of inflammation. Systemic corticosteroids are commonly used for severe or posterior segment inflammation, while topical agents remain the go-to option for more localized anterior segment conditions. Their widespread clinical use is supported by decades of efficacy data, making them a cornerstone in ophthalmic care.

The topical corticosteroid segment held a 54.8% share in 2024, reflecting its growing preference among healthcare providers and patients. Topical administration offers a localized therapeutic effect with minimal systemic absorption, significantly lowering the risk of adverse reactions compared to oral or injectable forms. This delivery method is especially suitable for anterior uveitis and other front-of-eye inflammatory disorders, offering ease of use, faster relief, and better patient compliance. The availability of various dosing options and formulations, such as ointments, gels, and eye drops, has further enhanced convenience, contributing to higher adherence rates and improved patient outcomes.

United States Anterior Uveitis Treatment Market reached USD 159.5 million in 2024. The country's strong healthcare infrastructure and high prevalence of autoimmune disorders have amplified attention to ocular diseases. Pharmaceuticals such as corticosteroids, immunosuppressants, and biologics remain central to therapeutic protocols, while clinical research increasingly explores novel biologic-based options. Regulatory openness toward telehealth and digital tools optimizes patient access to early evaluations and ongoing care, strengthening the overall treatment pipeline in the region.

Prominent players active in the Global Anterior Uveitis Treatment Market include Pfizer, Aldeyra Therapeutics, Tarsier Pharma, Novartis, Clearside Biomedical, UCB, AbbVie, Amgen, Kiora Pharmaceuticals, Alcon, EyePoint Pharmaceuticals, Sun Pharmaceutical Industries, and Santen Pharmaceutical. To strengthen their position in the anterior uveitis treatment market, companies such as Clearside Biomedical, Alcon, and Santen Pharmaceutical are heavily investing in research and development to bring innovative therapies to market faster. Players like EyePoint Pharmaceuticals and Amgen prioritize advanced drug delivery technologies to boost treatment efficacy and patient convenience. Collaborations between large pharma firms, including Pfizer and Novartis, with biotech innovators have emerged as a strategy to expand therapeutic portfolios.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing awareness about uveitis-related complications

- 3.2.1.2 Technological advancements in diagnostic tools

- 3.2.1.3 Development of biologics and biosimilars

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced treatment options

- 3.2.2.2 Limited access to healthcare in developing regions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2021-2034 ($ Mn)

- 5.1 Key trends

- 5.2 Corticosteroids

- 5.3 Cycloplegic agents

- 5.4 Anti-TNF agents

- 5.5 Immunosuppressants

- 5.6 Other treatment types

Chapter 6 Market Estimates and Forecast, Route of Administration, 2021-2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Topical

- 6.4 Injectable

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021-2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 Online pharmacies

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AbbVie

- 9.2 Alcon

- 9.3 Aldeyra Therapeutics

- 9.4 Amgen

- 9.5 Clearside Biomedical

- 9.6 EyePoint Pharmaceuticals

- 9.7 Kiora Pharmaceuticals

- 9.8 Novartis

- 9.9 Pfizer

- 9.10 Santen Pharmaceutical

- 9.11 Sun Pharmaceutical Industries

- 9.12 Tarsier Pharma

- 9.13 UCB