|

市场调查报告书

商品编码

1750361

飞机防火系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Aircraft Fire Protection Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

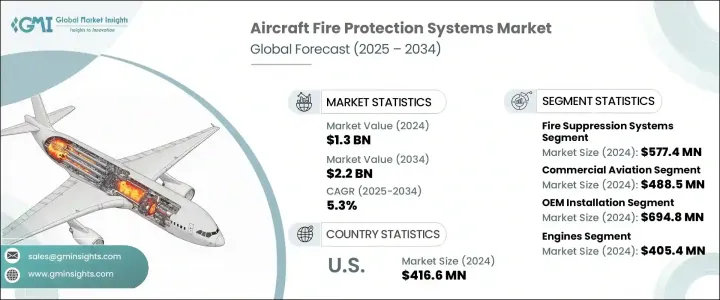

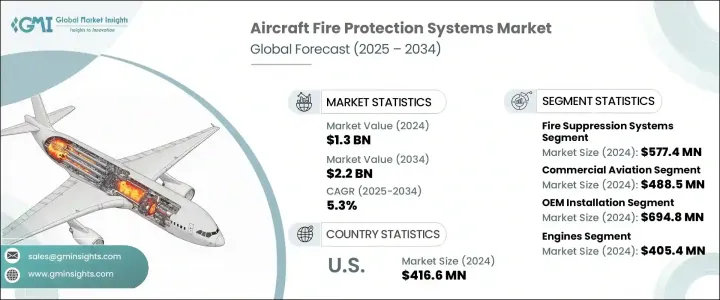

2024年,全球飞机消防系统市场规模达13亿美元,预计2034年将以5.3%的复合年增长率成长,达到22亿美元。这主要得益于全球航空旅行需求的不断增长,以及无人机(UAV)和无人机在国防领域的应用日益广泛。随着全球客运量持续成长,对新飞机的需求也大幅成长,尤其是在亚太、中东和非洲等快速发展的地区。这些地区正经历经济成长、城镇化和中产阶级人口的不断增长,所有这些都推动了航空旅行的需求。因此,航空业的新飞机订单量正在增加,对高效、可靠和先进的消防系统的需求也随之增加,以确保乘客和飞机的安全。

为了满足这些日益增长的需求,製造商专注于提供强大的火灾侦测和灭火技术,例如烟雾侦测器、火焰侦测器以及引擎和货舱灭火系统。这些系统旨在识别和应对潜在的火灾隐患,确保迅速采取行动,保护乘客和飞机本身。客舱灭火器是消防系统的另一个重要组成部分,在控制和扑灭客舱内可能发生的火灾方面也发挥着关键作用,从而提高了商用飞机的整体安全标准。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 22亿美元 |

| 复合年增长率 | 5.3% |

随着航空业的扩张,製造商致力于满足日益增长的消防系统需求。 2024年,商用航空市场创造了4.885亿美元的市场规模。随着全球客运量激增,机队扩张和新飞机交付的需求也随之增加。航空公司和原始设备製造商整合了先进的消防技术,以符合安全法规。此外,电动飞机和垂直起降 (eVTOL) 飞行器的兴起,也推动了对专用灭火系统的需求,以应对锂离子电池带来的风险。

灭火系统市场是最大的细分市场,2024年价值5.774亿美元。这得归功于对飞机生存力和乘客安全的日益重视。长途和超远程飞机的普及也推动了对灭火系统的需求。此外,包括战斗机和无人机在内的军事领域也采用了灭火系统,以确保高效的作战效率和安全性。

2024年,美国飞机消防系统市场规模达4.166亿美元,这得益于庞大的商用和通用航空机队。随着机队的持续现代化,例如新机型的整合,对先进消防技术的需求持续成长。此外,对下一代军用飞机的投资进一步推动了对先进灭火系统的需求。

飞机消防系统市场的主要参与者包括西门子、柯林斯航太、危险控制技术公司、柯蒂斯-莱特和代尔基金会。这些公司专注于提供尖端解决方案,以满足航空业不断变化的需求。为了巩固市场地位,飞机消防系统领域的公司正在采取多种策略。许多公司正在投资研发,以提高其产品性能,特别是在效率、减轻重量以及与基于物联网的监控系统整合方面。与原始设备製造商、军事承包商和航空公司合作是获得长期合约的另一个关键策略。此外,一些公司正致力于提高其消防产品的可回收性和永续性,这吸引了有环保意识的客户。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 关键零件价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 全球航空客运量不断成长

- 注重客舱和货舱安全

- 无人机和无人驾驶飞机在国防领域的应用日益广泛

- 采用电动和混合动力飞机

- 廉价航空(LCCS)的扩张

- 产业陷阱与挑战

- 技术整合的复杂性

- 安装和维护成本高

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 火灾侦测系统

- 烟雾侦测器

- 热探测器

- 火焰侦测器

- 气体探测器

- 其他的

- 警报和警告系统

- 灭火系统

- 消防洒水装置

- 灭火器

- 气体抑制系统

- 泡沫抑制系统

第六章:市场估计与预测:依平台类型,2021 年至 2034 年

- 主要趋势

- 商业航空

- 窄体飞机

- 宽体飞机

- 支线喷射机

- 军事航空

- 战斗机

- 运输和侦察机

- 军用直升机

- 商务及通用航空

- 无人驾驶飞行器(UAV)

第七章:市场估计与预测:依装配,2021 年至 2034 年

- 主要趋势

- OEM安装

- 售后市场

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 飞机货舱

- 引擎

- 辅助动力装置(APU)

- 客舱和盥洗室

- 驾驶舱

- 其他的

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Advanced Aircraft Extinguishers

- Amerex

- Collins Aerospace

- Curtiss-Wright

- Diehl Stiftung

- FFE

- Gielle Group

- H3R Aviation

- Hazard Control Technologies

- Meggitt

- Siemens

- Southern Electronics

The Global Aircraft Fire Protection Systems Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 2.2 billion by 2034, driven by the rising global demand for air travel and the increasing use of unmanned aerial vehicles (UAVs) and drones in defense applications. As global passenger traffic continues to rise, there is a significant surge in the demand for new aircraft, especially in rapidly expanding regions like Asia Pacific, the Middle East, and Africa. These regions are experiencing economic growth, urbanization, and an increasing middle-class population, all driving the demand for air travel. Consequently, the aviation industry is seeing a higher volume of new aircraft orders, increasing the need for efficient, reliable, and advanced fire protection systems to ensure passenger and aircraft safety.

To meet these rising demands, manufacturers focus on providing robust fire detection and suppression technologies, such as smoke detectors, flame detectors, and engine and cargo fire suppression systems. These systems are designed to identify and respond to potential fire hazards, ensuring swift action to protect both passengers and the aircraft itself. Cabin fire extinguishers, another essential component of fire protection systems, also play a critical role in controlling and extinguishing fires that may occur in the cabin, enhancing the overall safety standards of commercial aircraft.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.2 Billion |

| CAGR | 5.3% |

With the expansion of the aviation industry, manufacturers are focused on meeting the growing demand for fire protection systems. The commercial aviation segment generated USD 488.5 million in 2024. As global passenger traffic surges, there is a greater need for fleet expansion and the delivery of new aircraft. Airlines and OEMs integrate advanced fire protection technologies to comply with safety regulations. Additionally, the rise of electric aircraft and vertical takeoff and landing (eVTOL) vehicles is driving demand for specialized fire suppression systems to address the risks posed by lithium-ion batteries.

The fire suppression systems market was the largest segment, valued at USD 577.4 million in 2024. This is driven by increasing emphasis on aircraft survivability and passenger safety. The demand for fire suppression systems is also rising due to the adoption of long-haul and ultra-long-range aircraft. Furthermore, the military sector, including combat aircraft and UAVs, incorporates fire suppression systems to ensure high operational efficiency and safety.

United States Aircraft Fire Protection Systems Market accounted for USD 416.6 million in 2024, supported by a large commercial and general aviation fleet. With continuous fleet modernization, such as the integration of new aircraft models, there is ongoing demand for advanced fire protection technologies. Additionally, investments in next-generation military aircraft further contribute to the demand for state-of-the-art fire suppression systems.

Key players in the aircraft fire protection systems market include Siemens, Collins Aerospace, Hazard Control Technologies, Curtiss-Wright, and Diehl Stiftung. These companies are focused on offering cutting-edge solutions to meet the evolving needs of the aviation industry. To strengthen their market position, companies in the aircraft fire protection systems sector are adopting several strategies. Many are investing in research and development to enhance the performance of their products, particularly in terms of efficiency, weight reduction, and integration with IoT-based monitoring systems. Collaboration with OEMs, military contractors, and airlines is another key strategy to secure long-term contracts. Additionally, some companies are focusing on improving the recyclability and sustainability of their fire protection products, which appeals to environmentally conscious customers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising global air passenger traffic

- 3.3.1.2 Focus on cabin and cargo compartment safety

- 3.3.1.3 Growing use of UAVs and drones in defense

- 3.3.1.4 Adoption of electric and hybrid aircraft

- 3.3.1.5 Expansion of low-cost carriers (LCCS)

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Technological integration complexity

- 3.3.2.2 High installation and maintenance costs

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Fire detection systems

- 5.2.1 Smoke detectors

- 5.2.2 Heat detectors

- 5.2.3 Flame detectors

- 5.2.4 Gas detectors

- 5.2.5 Others

- 5.3 Alarm & warning systems

- 5.4 Fire suppression systems

- 5.4.1 Fire sprinkler

- 5.4.2 Fire extinguishers

- 5.4.3 Gas-based suppression systems

- 5.4.4 Foam-based suppression systems

Chapter 6 Market Estimates and Forecast, By Platform Type, 2021 – 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Commercial aviation

- 6.2.1 Narrow-body aircraft

- 6.2.2 Wide-body aircraft

- 6.2.3 Regional jets

- 6.3 Military aviation

- 6.3.1 Fighter jets

- 6.3.2 Transport & reconnaissance aircraft

- 6.3.3 Military helicopters

- 6.4 Business & general aviation

- 6.5 Unmanned aerial vehicles (UAVs)

Chapter 7 Market Estimates and Forecast, By Fitment, 2021 – 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 OEM installation

- 7.3 Aftermarket

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 Aircraft cargo compartments

- 8.3 Engines

- 8.4 Auxiliary power units (APU)

- 8.5 Cabins & lavatories

- 8.6 Cockpits

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Advanced Aircraft Extinguishers

- 10.2 Amerex

- 10.3 Collins Aerospace

- 10.4 Curtiss-Wright

- 10.5 Diehl Stiftung

- 10.6 FFE

- 10.7 Gielle Group

- 10.8 H3R Aviation

- 10.9 Hazard Control Technologies

- 10.10 Meggitt

- 10.11 Siemens

- 10.12 Southern Electronics