|

市场调查报告书

商品编码

1750412

预测性基因检测与消费者基因体学市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Predictive Genetic Testing and Consumer Genomics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

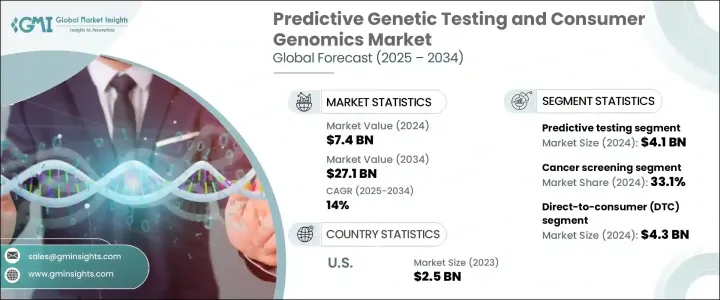

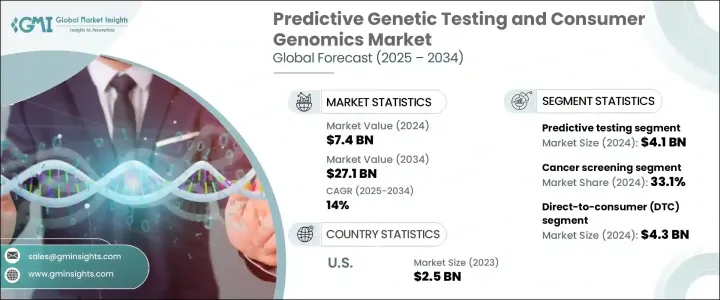

2024年,全球预测性基因检测和消费者基因体学市场价值74亿美元,预计到2034年将以14%的复合年增长率成长,达到271亿美元。这得归功于消费者对个人化医疗日益增长的兴趣、基因检测技术的进步以及人们转向主动预防性健康策略。直接面向消费者 (DTC) 的基因检测使获取基因资讯的管道更加民主化,使个人无需医疗保健提供者的参与即可探索其祖先、生活方式特征和潜在的健康风险。

技术突破,尤其是在新一代定序 (NGS) 和人工智慧驱动的基因组解读方面,显着提高了检测精度并降低了成本,拓宽了消费者的可及性。基因检测公司与医疗保健提供者之间的合作进一步促进了这些进步,促进了基因组资料与临床护理的整合。随着慢性病盛行率的上升,以及医疗保健领域越来越多地采用预测性和精准医疗,北美预计将在这一不断变化的格局中继续保持全球领先地位。直接面向消费者 (DTC) 的基因检测应用日益广泛,显着影响了市场发展势头,使个人能够立即获得健康风险洞察、血统分析以及与生活方式相关的遗传特征。随着精通科技且注重健康的人需求激增,这些服务正变得越来越主流。此外,政府透过各种措施和美国国立卫生研究院 (NIH) 等机构的研究资金的大力支持,为基因组工具的开发和应用奠定了坚实的基础。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 74亿美元 |

| 预测值 | 271亿美元 |

| 复合年增长率 | 14% |

预测性检测领域在2024年引领市场,价值41亿美元。这些检测根据个体的基因组成评估其患有特定疾病或病症的可能性,从而实现早期干预和个人化医疗策略。癌症筛检应用占据了相当大的市场份额,利用基因分析检测与各种癌症相关的突变,促进早期诊断和有针对性的预防措施。

2024年,DTC细分市场引领全球预测基因检测与消费者基因体学市场,产值达43亿美元,预计到2034年将达到145亿美元,这得益于消费者无需医疗专业人员参与即可便捷地获取基因洞察。对个人化健康和保健解决方案日益增长的需求,推动了DTC检测服务的普及。这些检测使个人能够在家中舒适地探索自己的血统、生活方式特征和潜在健康风险。凭藉用户友好的平台和经济高效的试剂盒,DTC公司正在推动已开发市场和新兴市场的主流消费者参与。

2024年,北美预测性基因检测和消费者基因组学市场占据42%的市场份额,这得益于其完善的医疗基础设施、基因技术的早期应用,以及向个人化和预防性医疗的强劲文化转变。受消费者意识不断增强、教育水平不断提高以及数位化健康参与度不断提升的推动,该地区的消费者越来越多地将基因组检测作为日常健康保健实践的一部分。

全球预测性基因检测和消费者基因组学产业的主要参与者包括雅培实验室、安捷伦科技、奥雅纳工程公司、华大基因、伯乐实验室、丹纳赫、EasyDNA、罗氏製药、Illumina、Myriad Genetics、凯杰、Quest Diagnostics、赛默飞世尔科技和Variantyx。预测性基因检测和消费者基因组学市场中的公司采用各种策略来增强其市场影响力。这些策略包括:投资研发以提高检测准确性并扩展服务范围;与医疗保健提供者建立策略合作伙伴关係以将基因检测整合到临床实践中;以及扩展直接面向消费者的服务以提高可及性。此外,公司还注重法规合规性,以赢得消费者信任并确保其检测的可靠性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 个人化医疗意识不断增强

- 基因定序技术进步

- 消费者对血统和健康的兴趣日益浓厚

- 产业陷阱与挑战

- 关于基因资料的伦理和隐私问题

- 测试技术成本高

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 需求面影响(售价)

- 价格传导至终端市场

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 需求面影响(售价)

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按测试类型,2021-2034

- 主要趋势

- 预测测试

- 遗传易感性检测

- 预测诊断

- 人口筛检

- 消费者基因体学

- 健康基因组学

- 海狸鼠遗传学

- 皮肤和代谢遗传学

- 其他健康基因组学

第六章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 癌症筛检

- 心血管筛检

- 肌肉骨骼筛检

- 糖尿病筛检和监测

- 帕金森/阿兹海默症筛检

- 其他应用

第七章:市场估计与预测:按设置,2021-2034

- 主要趋势

- 直接面向消费者(DTC)

- 医院和诊所

- 诊断实验室

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Abbott Laboratories

- Agilent Technologies

- ARUP Laboratories

- BGI Genomics

- Bio-Rad Laboratories

- Danaher

- EasyDNA

- F. Hoffmann-La Roche

- Illumina

- Myriad Genetics

- QIAGEN

- Quest Diagnostics

- Thermo Fisher Scientific

- Variantyx

The Global Predictive Genetic Testing and Consumer Genomics Market was valued at USD 7.4 billion in 2024 and is estimated to grow at a CAGR of 14% to reach USD 27.1 billion by 2034, attributed to heightened consumer interest in personalized healthcare, advancements in genetic testing technologies, and a shift towards proactive, preventative health strategies. Direct-to-consumer (DTC) genetic testing has democratized access to genetic information, allowing individuals to explore their ancestry, lifestyle traits, and potential health risks without healthcare provider involvement.

Technological breakthroughs, particularly in next-generation sequencing (NGS) and AI-powered genomic interpretation, have dramatically improved test precision and lowered costs, broadening consumer access. These advancements are further complemented by partnerships between genetic testing firms and healthcare providers, facilitating the integration of genomic data into clinical care. As the prevalence of chronic illnesses rises, and healthcare increasingly adopts predictive and precision medicine, North America is positioned to remain the global leader in this evolving landscape. The expanding use of direct-to-consumer (DTC) genetic tests has significantly influenced market momentum, offering individuals immediate access to health risk insights, ancestry breakdowns, and lifestyle-related genetic traits. With a surge in demand from a tech-savvy and health-conscious population, these offerings are becoming more mainstream. Additionally, strong governmental backing through initiatives and research funding from institutions like the NIH has created a robust foundation for the development and application of genomic tools.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.4 Billion |

| Forecast Value | $27.1 Billion |

| CAGR | 14% |

The predictive testing segment led the market in 2024, valued at USD 4.1 billion. These tests assess the likelihood of individuals developing specific diseases or conditions based on their genetic makeup, enabling early intervention and personalized healthcare strategies. The cancer screening application accounted for a significant market share, utilizing genetic analysis to detect mutations associated with various cancers, facilitating early diagnosis and targeted prevention measures.

The DTC segment led the global predictive genetic testing and consumer genomics market in 2024, generating USD 4.3 billion and is projected to reach USD 14.5 billion by 2034, driven by offering consumers convenient access to genetic insights without the involvement of healthcare professionals. The growing demand for personalized health and wellness solutions is fueling the adoption of DTC testing services. These tests empower individuals to explore their ancestry, lifestyle traits, and potential health risks from the comfort of their homes. With user-friendly platforms and cost-effective kits, DTC companies are driving mainstream consumer engagement across both developed and emerging markets.

North America Predictive Genetic Testing and Consumer Genomics Market held 42% share in 2024 driven by a sophisticated healthcare infrastructure, early adoption of genetic technologies, and a strong cultural shift toward personalized and preventative medicine. Consumers in the region are increasingly embracing genomic testing as part of routine health and wellness practices, spurred by growing awareness, higher education levels, and digital health engagement.

Key players in the Global Predictive Genetic Testing and Consumer Genomics Industry include Abbott Laboratories, Agilent Technologies, ARUP Laboratories, BGI Genomics, Bio-Rad Laboratories, Danaher, EasyDNA, F. Hoffmann-La Roche, Illumina, Myriad Genetics, QIAGEN, Quest Diagnostics, Thermo Fisher Scientific, and Variantyx. Companies in the predictive genetic testing and consumer genomics market employ various strategies to strengthen their market presence. These include investing in research and development to enhance test accuracy and expand service offerings, forming strategic partnerships with healthcare providers to integrate genetic testing into clinical practices, and expanding direct-to-consumer services to increase accessibility. Additionally, companies are focusing on regulatory compliance to gain consumer trust and ensure the reliability of their tests.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising awareness about personalized medicine

- 3.2.1.2 Technological advancements in genetic sequencing

- 3.2.1.3 Growing consumer interest in ancestry and wellness

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Ethical and privacy concerns about genetic data

- 3.2.2.2 High cost of testing technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Demand-side impact (selling price)

- 3.5.1.1 Price transmission to end markets

- 3.5.2 Key companies impacted

- 3.5.3 Strategic industry responses

- 3.5.3.1 Supply chain reconfiguration

- 3.5.3.2 Pricing and product strategies

- 3.5.3.3 Policy engagement

- 3.5.4 Outlook and future considerations

- 3.5.1 Demand-side impact (selling price)

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Test Type, 2021-2034 ($ Mn)

- 5.1 Key trends

- 5.2 Predictive testing

- 5.2.1 Genetic susceptibility test

- 5.2.2 Predictive diagnostics

- 5.2.3 Population screening

- 5.3 Consumer genomics

- 5.4 Wellness genomics

- 5.4.1 Nutria genetics

- 5.4.2 Skin and metabolism genetics

- 5.4.3 Other wellness genomics

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cancer screening

- 6.3 Cardiovascular screening

- 6.4 Musculoskeletal screening

- 6.5 Diabetic screening and monitoring

- 6.6 Parkinsons/Alzheimer disease screening

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By Setting, 2021-2034 ($ Mn)

- 7.1 Key trends

- 7.2 Direct-to-consumer (DTC)

- 7.3 Hospitals and clinics

- 7.4 Diagnostic laboratories

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Agilent Technologies

- 9.3 ARUP Laboratories

- 9.4 BGI Genomics

- 9.5 Bio-Rad Laboratories

- 9.6 Danaher

- 9.7 EasyDNA

- 9.8 F. Hoffmann-La Roche

- 9.9 Illumina

- 9.10 Myriad Genetics

- 9.11 QIAGEN

- 9.12 Quest Diagnostics

- 9.13 Thermo Fisher Scientific

- 9.14 Variantyx