|

市场调查报告书

商品编码

1750418

人工智慧训练资料集市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测AI Training Dataset Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

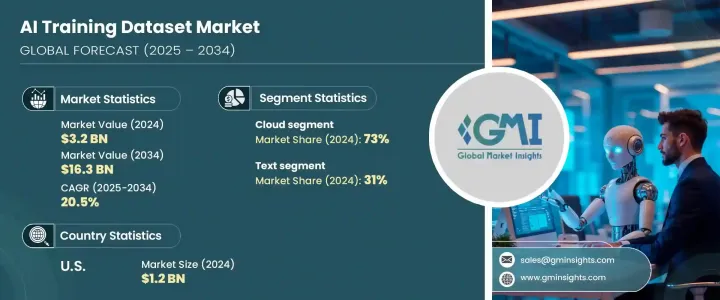

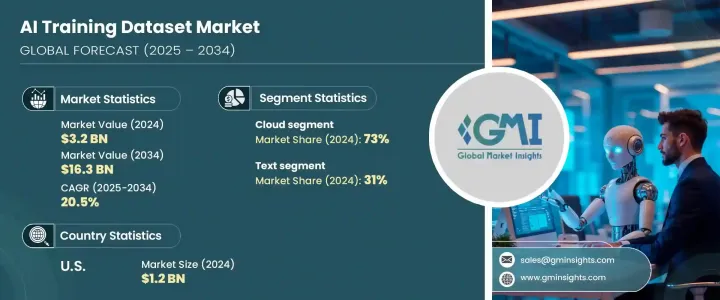

2024年,全球人工智慧训练资料集市场规模达32亿美元,预计到2034年将以20.5%的复合年增长率成长,达到163亿美元,这得益于各行各业对人工智慧日益增长的依赖。随着人工智慧应用的日益先进,对精准、高品质标註资料集的需求也日益凸显。从机器人、医疗保健到金融和自动化,企业都在整合人工智慧,以简化营运流程并减少对人工的依赖。这种转变加剧了对精准训练资料的需求,以建立能够在现实环境中运行的模型,尤其是在生物医学研究和工业自动化等高风险应用中。

随着各行各业努力提升营运效率和预测能力,对客製化资料集的需求持续成长。客製化、特定领域的资料对于训练必须在高度专业化的环境中精准运行的人工智慧系统至关重要。无论是优化供应链物流、实现更智慧的医疗诊断,或是改善自主导航,组织都需要不仅规模庞大、标籤准确且与情境相关的资料集。随着人工智慧模型日益复杂,对高品质、结构化且无偏见资料的需求也变得愈发重要。客製化资料集有助于缩短模型训练时间、提高准确性,并确保人工智慧解决方案能够适应实际环境。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 32亿美元 |

| 预测值 | 163亿美元 |

| 复合年增长率 | 20.5% |

2024年,以文字内容为基础的资料集以31%的市占率领先市场,预计到2034年将以21%的复合年增长率成长。这一领域的主导地位源自于自然语言处理在商业智慧、通讯工具和客户互动平台中的广泛应用。数位通讯的蓬勃发展创造了大量的原始文字内容,各组织现在正在将这些内容转换为适合训练基于语言的人工智慧模型的结构化格式。高阶语言模型的成长进一步扩大了对高品质、多语言文本资料集的需求。

2024年,基于云端的部署领域占据了73%的份额,这归功于其灵活性、可扩展性和成本效益。云端解决方案提供了丰富的资源,用于储存、管理和标记大量资料,同时支援远端协作以及与高级资料处理工具的无缝整合。这些功能对于组织建立复杂的AI系统并保持敏捷运作至关重要。此外,云端服务提供的安全性、可存取性和适应性使其成为处理训练资料集的首选。

2024年,美国人工智慧训练资料集市场占据88%的市场份额,产值达12.3亿美元。美国强大的技术基础设施、早期的人工智慧应用以及大量的公共和私营部门投资,为资料训练领域的创新创造了良好的环境。联邦政府的资助以及产学合作也有助于促进市场成长。

市场的主要参与者包括TELUS International、IBM、亚马逊网路服务、Lionbridge AI、CloudFactory、Google、微软、NVIDIA、Appen和iMerit。为了增强竞争优势,人工智慧训练资料集市场中的公司专注于几项核心策略。许多公司正在大力投资用于资料标记和合成资料生成的自动化工具,以降低成本并提高效率。与学术机构和研究实验室的策略合作有助于扩大对多样化和专业化资料集的存取。企业也正在采用垂直特定的资料解决方案,以满足医疗保健、汽车和零售等领域日益增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 资料发起者/收集者

- 数据聚合器和市场

- 资料註释和标籤服务提供者

- 技术和基础设施提供商

- 最终用户

- 利润率分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 其他国家的报復措施

- 对产业的影响

- 主要材料价格波动

- 供应链重组

- 资料模态成本影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和资料模式策略

- 展望与未来考虑

- 对贸易的影响

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 各行各业对人工智慧和机器学习的采用日益增多

- 电脑视觉和自然语言处理 (NLP) 应用的成长

- 资料註释外包激增

- 自动驾驶汽车和机器人技术的进步

- 增加对人工智慧新创公司和基础设施的投资

- 产业陷阱与挑战

- 资料标记的成本高且耗时

- 资料隐私和安全问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依资料形态,2021 - 2034 年

- 主要趋势

- 文字

- 影像

- 音讯和语音

- 影片

- 多式联运

第六章:市场估计与预测:依部署模式,2021 - 2034 年

- 主要趋势

- 本地

- 云

第七章:市场估计与预测:依资料类型,2021 - 2034 年

- 主要趋势

- 结构化资料

- 非结构化资料

- 半结构化资料

第八章:市场估计与预测:依资料蒐集方法,2021 - 2034 年

- 主要趋势

- 公共资料集

- 私有资料集

- 合成资料

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 卫生保健

- 汽车

- 金融服务业

- 零售与电子商务

- IT和电信

- 政府和国防

- 製造业

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Amazon Web Services

- Appen

- Clickworker

- CloudFactory

- Cogito Tech

- DataLoop

- Dataturks

- IBM

- iMerit

- Innodata

- Lionbridge AI

- LXT

- Microsoft

- NVIDIA

- Sama

- Scale AI

- TELUS International

- TransPerfect

- Trillium Data

The Global AI Training Dataset Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 20.5% to reach USD 16.3 billion by 2034, fueled by the increasing reliance on artificial intelligence across multiple sectors. As AI applications become more advanced, the need for precise and high-quality labeled datasets becomes increasingly critical. From robotics and healthcare to finance and automation, businesses are integrating AI to streamline operations and reduce human dependency. This shift intensifies the need for accurate training data to build models capable of navigating real-world environments, especially in high-stakes applications like biomedical research and industrial automation.

The demand for tailored datasets continues to rise, as industries strive to enhance operational efficiency and predictive capabilities. Customized, domain-specific data is becoming essential for training AI systems that must operate with precision in highly specialized environments. Whether it's optimizing supply chain logistics, enabling smarter healthcare diagnostics, or improving autonomous navigation, organizations require datasets that are not only large but also accurately labeled and contextually relevant. As AI models become more complex, the need for high-quality, structured, and unbiased data grows even more critical. Tailored datasets help reduce model training time, increase accuracy, and ensure AI solutions are adaptable to real-world conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $16.3 Billion |

| CAGR | 20.5% |

In 2024, datasets based on textual content led the market with a 31% share and are expected to grow at a CAGR of 21% through 2034. The dominance of this segment stems from the wide adoption of natural language processing in business intelligence, communication tools, and customer interaction platforms. The boom in digital communications has created an abundance of raw textual content, which organizations are now converting into structured formats suitable for training language-based AI models. The growth of advanced language models has only amplified the requirement for high-quality, multilingual text datasets.

The cloud-based deployment segment held a 73% share in 2024, attributed to its flexibility, scalability, and cost-efficiency. Cloud solutions offer extensive resources for storing, managing, and labeling enormous data volumes while enabling remote collaboration and seamless integration with advanced tools for data processing. These features are essential for organizations to build sophisticated AI systems while maintaining agile operations. Moreover, the security, accessibility, and adaptability provided by cloud services continue to make them the preferred choice for handling training datasets.

United States AI Training Dataset Market held 88% share in 2024, generating USD 1.23 billion. The country's strong technological infrastructure, early AI adoption, and substantial private and public sector investment have created an environment conducive to innovation in data training. Federal funding and collaborative efforts between academia and industry help foster market growth.

Key players in the market include TELUS International, IBM, Amazon Web Services, Lionbridge AI, CloudFactory, Google, Microsoft, NVIDIA, Appen, and iMerit. To enhance their competitive edge, companies in the AI training dataset market focus on several core strategies. Many are investing heavily in automation tools for data labeling and synthetic data generation to cut costs and improve efficiency. Strategic collaborations with academic institutions and research labs are helping expand access to diverse and specialized datasets. Firms are also adopting vertical-specific data solutions to meet the rising demand in sectors such as healthcare, automotive, and retail.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Data originators/collectors

- 3.2.2 Data aggregators & marketplaces

- 3.2.3 Data annotation & labeling service providers

- 3.2.4 Technology & infrastructure providers

- 3.2.5 End-users

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Data Modality cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and Data Modality strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising adoption of AI and machine learning across industries

- 3.9.1.2 Growth of computer vision and natural language processing (NLP) applications

- 3.9.1.3 Surge in data annotation outsourcing

- 3.9.1.4 Advancements in autonomous vehicles and robotics

- 3.9.1.5 Increasing investment in AI startups and infrastructure

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High cost and time-intensive nature of data labeling

- 3.9.2.2 Data privacy and security concerns

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Data Modality, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Text

- 5.3 Image

- 5.4 Audio & speech

- 5.5 Video

- 5.6 Multimodal

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By Data Type, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Structured data

- 7.3 Unstructured data

- 7.4 Semi-structured data

Chapter 8 Market Estimates & Forecast, By Data Collection Method, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Public datasets

- 8.3 Private datasets

- 8.4 Synthetic data

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Healthcare

- 9.3 Automotive

- 9.4 BFSI

- 9.5 Retail & e-commerce

- 9.6 IT and telecom

- 9.7 Government and defense

- 9.8 Manufacturing

- 9.9 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Amazon Web Services

- 11.2 Appen

- 11.3 Clickworker

- 11.4 CloudFactory

- 11.5 Cogito Tech

- 11.6 DataLoop

- 11.7 Dataturks

- 11.8 Google

- 11.9 IBM

- 11.10 iMerit

- 11.11 Innodata

- 11.12 Lionbridge AI

- 11.13 LXT

- 11.14 Microsoft

- 11.15 NVIDIA

- 11.16 Sama

- 11.17 Scale AI

- 11.18 TELUS International

- 11.19 TransPerfect

- 11.20 Trillium Data