|

市场调查报告书

商品编码

1750421

咖啡包市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Coffee Pods Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

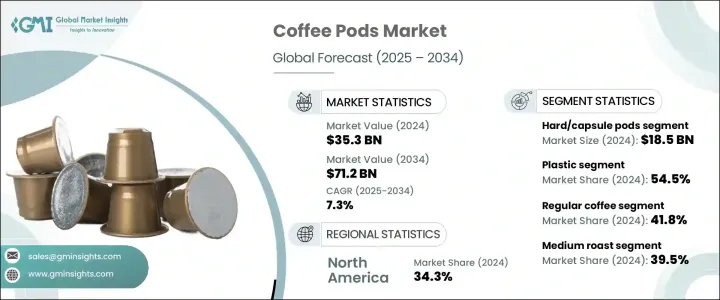

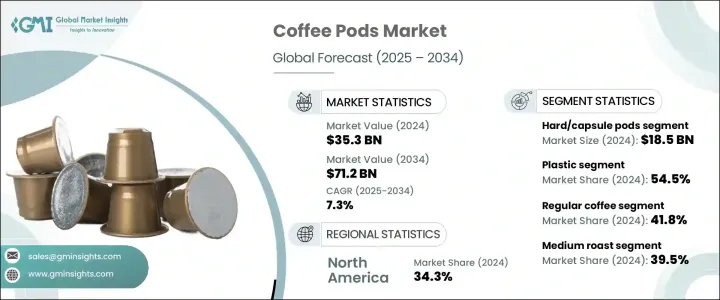

2024年,全球咖啡胶囊市场规模达353亿美元,预计到2034年将以7.3%的复合年增长率成长,达到712亿美元。这得归功于便捷型产品的日益增长的吸引力,尤其是在那些寻求快速便捷地享用优质咖啡的忙碌消费者群体中。随着越来越多的人适应繁忙的日常生活和混合工作环境,单杯咖啡正逐渐成为厨房和工作场所的必备品。密封、预先分装且无需清洁的胶囊,其便利性持续吸引那些寻求在家中享受咖啡馆式咖啡体验的现代消费者。城市家庭正转向紧凑型冲泡方案,这种方案既节省时间,又能保持口味的一致性。

另一个重要的成长因素在于,如今胶囊咖啡机的口味、有机混合和特色选择种类繁多,吸引了形形色色的咖啡爱好者。随着咖啡机在郊区和半城市地区越来越普及,非传统市场的需求也越来越高。虽然北美和欧洲是早期采用胶囊咖啡机的地区,但亚太和拉丁美洲地区现在对高阶胶囊咖啡机表现出浓厚的兴趣。人们日益增长的可持续发展意识为可回收和可生物降解胶囊材料的创新註入了动力,重塑了这个竞争激烈的领域的产品开发和品牌策略。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 353亿美元 |

| 预测值 | 712亿美元 |

| 复合年增长率 | 7.3% |

2024年,硬咖啡或胶囊咖啡包占据全球咖啡市场主导地位,占52.6%,销售额达185亿美元。这类咖啡包吸引了那些偏好浓郁、浓缩咖啡风味、口味始终如一的消费者。越来越多的消费者倾向于在家中享受美食体验,加上专为紧凑型厨房和办公空间设计的单杯咖啡机的兴起,极大地推动了咖啡包的需求。随着越来越多的消费者追求便利性的同时又不牺牲品质,胶囊咖啡包市场持续蓬勃发展。口味、烘焙强度和特色拼配的创新浪潮不断涌现,进一步拓展了这一品类,使其对从普通饮品到咖啡鑑赏家等广泛群体保持着吸引力。

咖啡胶囊生产材料的选择对产品吸引力和永续发展至关重要。 2024年,塑胶胶囊占据了54.5%的市场份额,预计到2034年将以7%的复合年增长率成长。塑胶胶囊的受欢迎程度源自于其耐用性、成本效益和锁鲜性等优势。然而,日益严格的环保审查迫使製造商必须解决不可生物降解包装的生态足迹问题。为此,各公司正在加紧开发环保材料,包括可堆肥和完全可回收的胶囊替代品,以满足消费者的期望和监管要求。

2024年,北美咖啡胶囊市场占据34.3%的市占率。经济因素影响消费者行为的转变,尤其是在价格敏感的消费者群体中,他们现在选择可重复使用的胶囊作为节省成本的替代品。儘管发生了这种转变,但该地区的整体销售仍然保持强劲。相比之下,欧洲市场则保持了较为稳定的成长势头,受根深蒂固的咖啡传统和对冲泡品质的不断提升的推动,高端胶囊的销量强劲增长。更高的人均消费量和浓缩咖啡的流行有助于维持该地区的成长。

顶级市场参与者包括雀巢公司 (Nestle SA)、Tim Hortons、JAB、Keurig Dr Pepper Inc. 和星巴克公司 (Starbucks Corporation)。为了扩大市场占有率,咖啡胶囊领域的公司正在采取多种策略。主要策略包括:透过植物性和永续胶囊形式扩展产品组合,增强咖啡机相容性,以及提供多样化的口味以满足不同地区的消费者口味。与家电製造商的策略合作有助于加强分销网络,而直销通路和订阅模式则可提升品牌黏性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 製造商

- 经销商

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 供应方影响(原料)

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 消费者对便利、高品质家庭酿造的需求不断增长

- 人们对道德和优质咖啡的兴趣日益浓厚

- 技术进步

- 产业陷阱与挑战

- 供应链中断

- 经济不确定性

- 市场机会

- 成长动力

- 产品概述

- 咖啡包製作过程

- 咖啡加工与包装技术

- 保存期限保存技术

- 风味包封方法

- 监管框架和标准

- 食品安全法规

- 包装和标籤要求

- 有机和公平贸易认证

- 一次性产品的环境法规

- 可回收性标准与合规性

- 製造流程分析

- 咖啡烘焙和研磨

- Pod 组装和填充

- 密封和包装技术

- 品质控制流程

- 原料分析与采购策略

- 定价分析

- 永续性和环境影响评估

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 市占率分析

- 战略框架

- 併购

- 合资与合作

- 新产品开发

- 扩张策略

- 竞争基准测试

- 供应商格局

- 竞争定位矩阵

- 战略仪表板

- 品牌定位与消费者认知分析

- 新参与者的市场进入策略

- 自有品牌分析与策略

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 软荚

- 纸质滤芯

- 网状过滤器舱

- 其他软胶囊

- 硬胶囊

- 塑胶胶囊

- 铝胶囊

- 可堆肥胶囊

- 其他硬胶囊

第六章:市场估计与预测:按材料类型,2021 - 2034 年

- 主要趋势

- 塑胶

- 传统塑料

- 可回收塑料

- 生物塑料

- 铝

- 纸张和纤维

- 可生物降解/可堆肥材料

- 其他的

第七章:市场估计与预测:按咖啡类型,2021 - 2034

- 主要趋势

- 普通咖啡

- 阿拉比卡咖啡

- 罗布斯塔

- 混合

- 有机咖啡

- 调味咖啡

- 香草

- 焦糖

- 榛子

- 巧克力

- 其他口味

- 无咖啡因咖啡

- 特色咖啡

- 单一产地

- 微型手

- 其他特色咖啡

- 公平贸易咖啡

- 其他咖啡类型

第八章:市场估计与预测:按烘焙类型,2021 - 2034 年

- 主要趋势

- 中度烘焙

- 中深烘焙

- 深度烘焙

- 超深烘焙

第九章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 超市和大卖场

- 专卖店

- 便利商店

- 网路零售

- 公司网站

- 电子商务平台

- 订阅服务

- 餐饮服务

- 直接面向消费者

- 其他的

第 10 章:市场估计与预测:按机器相容性,2021 年至 2034 年

- 主要趋势

- 奈斯派索

- 克里格

- 塔西莫

- 森西奥

- 多趣酷思

- 拉瓦札

- 意利

- 多相容pod

- 其他的

第 11 章:市场估计与预测:按价格区间,2021 年至 2034 年

- 主要趋势

- 经济

- 中檔

- 优质的

- 超高端

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十三章:公司简介

- Nestle SA (Nespresso, Nescafe Dolce Gusto)

- Keurig Dr Pepper Inc.

- JAB Holding Company (Jacobs Douwe Egberts)

- Luigi Lavazza SpA

- The JM Smucker Company

- Starbucks Corporation

- Kraft Heinz Company

- Dunkin' Brands Group, Inc.

- Illycaffe SpA

- Melitta Group

- Dualit Ltd.

- Gourmesso

- Ethical Coffee Company

- Caffe Vergnano SpA

- Peet's Coffee & Tea, Inc.

- Caribou Coffee Company

- Tchibo GmbH

- UCC Ueshima Coffee Co., Ltd.

- Strauss Group Ltd.

- Cameron's Coffee

- San Francisco Bay Coffee

- Cafe Bustelo (JM Smucker)

- Cafe Royal

- Luckin Coffee Inc.

- Trung Nguyen Group

- Tim Hortons Inc. (Restaurant Brands International)

- Segafredo Zanetti (Massimo Zanetti Beverage Group)

- Reily Foods Company (Community Coffee)

- Rogers Family Company

- Puroast Coffee Company

The Global Coffee Pods Market was valued at USD 35.3 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 71.2 billion by 2034, driven by the increasing appeal of convenience-driven products, especially among busy consumers seeking fast, premium coffee without the effort. With more people adapting to hectic routines and hybrid work environments, single-serve coffee formats are becoming a staple in kitchens and workplaces. The convenience of sealed, pre-portioned pods with minimal cleanup continues to attract modern consumers looking for a cafe-style coffee experience at home. Urban households shift towards compact brewing solutions that save time while maintaining taste consistency.

Another important growth factor lies in the broad variety of flavors, organic blends, and specialty options now available in pod format, attracting a diverse group of coffee drinkers. Demand rises in non-traditional markets as coffee machines become more accessible across suburban and semi-urban areas. While North America and Europe have been early adopters, the Asia Pacific and Latin American regions are now showing robust interest in premium pod-based coffee formats. The growing consciousness around sustainability has added momentum to innovations in recyclable and biodegradable pod materials, reshaping product development and branding strategies in this competitive space.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $35.3 Billion |

| Forecast Value | $71.2 Billion |

| CAGR | 7.3% |

In 2024, hard or capsule coffee pods dominated the global market by product type, accounting for a 52.6% share and generating USD 18.5 billion in sales. This category appeals to consumers who prefer bold, espresso-style brews with consistent strength and flavor. The growing inclination toward gourmet experiences at home, combined with the rise in single-serve coffee machines tailored for compact kitchens and office spaces, has driven demand significantly. As more consumers seek convenience without sacrificing quality, the capsule pod segment continues flourishing. A surge in innovation across flavor profiles, roast intensities, and specialty blends expands this category, keeping it attractive to a broad audience ranging from casual drinkers to coffee connoisseurs.

The choice of material in coffee pod production significantly affects product appeal and sustainability performance. Plastic-based pods segment held a 54.5% share in 2024 and is expected to grow at a CAGR of 7% through 2034. Their popularity stems from benefits such as durability, cost-effectiveness, and the ability to lock in freshness. Yet, increasing environmental scrutiny has pressurized manufacturers to address the ecological footprint of non-biodegradable packaging. In response, companies are stepping up development of eco-friendly materials, including compostable and fully recyclable pod alternatives, to meet both consumer expectations and regulatory demands.

North America Coffee Pods Market held a 34.3% share in 2024. The economic factors influence a shift in consumer behavior, particularly among price-sensitive buyers now opting for reusable pods as a cost-saving alternative. Despite this shift, the region continues to maintain strong overall sales volumes. In contrast, European markets have remained more consistent, with robust sales of premium pods driven by deep-rooted coffee traditions and a refined appreciation for brewing quality. Higher per-capita consumption and the popularity of espresso-based drinks help sustain growth in this region.

Top market players include Nestle SA, Tim Hortons, JAB, Keurig Dr Pepper Inc., and Starbucks Corporation. To enhance their market footprint, companies in the coffee pods segment are leveraging a mix of strategies. Key approaches include expanding product portfolios with plant-based and sustainable pod formats, enhancing machine compatibility, and diversifying flavor offerings to cater to regional palates. Strategic collaborations with appliance manufacturers help strengthen distribution networks, while direct-to-consumer channels and subscription models increase brand stickiness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Methodology and Scope

- 1.2 Research methodology

- 1.3 Research scope & assumptions

- 1.4 List of data sources

- 1.5 Market estimation technique

- 1.6 Research limitations

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Manufacturers

- 3.1.4 Distributors

- 3.1.5 Impact on trade

- 3.1.6 Trade volume disruptions

- 3.2 Retaliatory Measures

- 3.3 Impact on the Industry

- 3.3.1 Supply-Side impact (Raw Materials)

- 3.3.1.1 Price volatility in key materials

- 3.3.1.2 Supply chain restructuring

- 3.3.1.3 Production cost implications

- 3.3.1 Supply-Side impact (Raw Materials)

- 3.4 Demand-Side Impact (Selling Price)

- 3.4.1 Price transmission to end markets

- 3.4.2 Market share dynamics

- 3.4.3 Consumer response patterns

- 3.5 Key companies impacted

- 3.6 Strategic industry responses

- 3.6.1 Supply chain reconfiguration

- 3.6.2 Pricing and product strategies

- 3.6.3 Policy engagement

- 3.7 Outlook and future considerations

- 3.8 Supplier landscape

- 3.9 Profit margin analysis

- 3.10 Key news & initiatives

- 3.11 Regulatory landscape

- 3.12 Impact forces

- 3.12.1 Growth drivers

- 3.12.1.1 Rising consumer demand for convenient and high-quality home brewing

- 3.12.1.2 Growing interest in ethical and premium coffee options

- 3.12.1.3 Technological advancements

- 3.12.2 Industry pitfalls & challenges

- 3.12.2.1 Supply chain disruptions

- 3.12.2.2 Economic uncertainty

- 3.12.3 Market Opportunities

- 3.12.1 Growth drivers

- 3.13 Product Overview

- 3.13.1 Coffee pod manufacturing process

- 3.13.2 Coffee processing & packaging technologies

- 3.13.3 Shelf-life preservation techniques

- 3.13.4 Flavor encapsulation methods

- 3.14 Regulatory framework & standards

- 3.14.1 Food safety regulations

- 3.14.2 Packaging & labeling requirements

- 3.14.3 Organic & fair trade certifications

- 3.14.4 Environmental regulations for single-use products

- 3.14.5 Recyclability standards & compliance

- 3.15 Manufacturing process analysis

- 3.15.1 Coffee roasting & grinding

- 3.15.2 Pod assembly & filling

- 3.15.3 Sealing & packaging technologies

- 3.15.4 Quality control processes

- 3.16 Raw material analysis & procurement strategies

- 3.17 Pricing Analysis

- 3.18 Sustainability & environmental impact assessment

- 3.19 Growth potential analysis

- 3.20 Porter's analysis

- 3.21 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Market share analysis

- 4.3 Strategic framework

- 4.3.1 Mergers & acquisitions

- 4.3.2 Joint ventures & collaborations

- 4.3.3 New product developments

- 4.3.4 Expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Vendor landscape

- 4.6 Competitive positioning matrix

- 4.7 Strategic dashboard

- 4.8 Brand positioning & consumer perception analysis

- 4.9 Market entry strategies for new players

- 4.10 Private label analysis & strategies

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Soft pods

- 5.2.1 Paper filter pods

- 5.2.2 Mesh filter pods

- 5.2.3 Other soft pods

- 5.3 Hard/Capsule pods

- 5.3.1 Plastic capsules

- 5.3.2 Aluminum capsules

- 5.3.3 Compostable capsules

- 5.3.4 Other hard pods

Chapter 6 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Plastic

- 6.2.1 Conventional plastic

- 6.2.2 Recyclable plastic

- 6.2.3 Bioplastic

- 6.3 Aluminum

- 6.4 Paper & fiber

- 6.5 Biodegradable/Compostable materials

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Coffee Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Regular coffee

- 7.2.1 Arabica

- 7.2.2 Robusta

- 7.2.3 Blends

- 7.3 Organic coffee

- 7.4 Flavored coffee

- 7.4.1 Vanilla

- 7.4.2 Caramel

- 7.4.3 Hazelnut

- 7.4.4 Chocolate

- 7.4.5 Other Flavors

- 7.5 Decaffeinated coffee

- 7.6 Specialty coffee

- 7.6.1 Single Origin

- 7.6.2 Micro-Lot

- 7.6.3 Other specialty coffee

- 7.7 Fair trade coffee

- 7.8 Other coffee types

Chapter 8 Market Estimates and Forecast, By Roast Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Medium roast

- 8.3 Medium-dark roast

- 8.4 Dark roast

- 8.5 Extra dark roast

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Supermarkets & Hypermarkets

- 9.3 Specialty stores

- 9.4 Convenience stores

- 9.5 Online retail

- 9.5.1 Company websites

- 9.5.2 E-commerce platforms

- 9.5.3 Subscription services

- 9.6 Foodservice

- 9.7 Direct-to-consumer

- 9.8 Others

Chapter 10 Market Estimates and Forecast, By Machine Compatibility, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 Nespresso

- 10.3 Keurig

- 10.4 Tassimo

- 10.5 Senseo

- 10.6 Dolce Gusto

- 10.7 Lavazza

- 10.8 Illy

- 10.9 Multi-compatible pods

- 10.10 Others

Chapter 11 Market Estimates and Forecast, By Price Range, 2021 - 2034 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 Economy

- 11.3 Mid-Range

- 11.4 Premium

- 11.5 Super-Premium

Chapter 12 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 Saudi Arabia

- 12.6.2 South Africa

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Nestle S.A. (Nespresso, Nescafe Dolce Gusto)

- 13.2 Keurig Dr Pepper Inc.

- 13.3 JAB Holding Company (Jacobs Douwe Egberts)

- 13.4 Luigi Lavazza S.p.A.

- 13.5 The J.M. Smucker Company

- 13.6 Starbucks Corporation

- 13.7 Kraft Heinz Company

- 13.8 Dunkin' Brands Group, Inc.

- 13.9 Illycaffe S.p.A.

- 13.10 Melitta Group

- 13.11 Dualit Ltd.

- 13.12 Gourmesso

- 13.13 Ethical Coffee Company

- 13.14 Caffe Vergnano S.p.A.

- 13.15 Peet's Coffee & Tea, Inc.

- 13.16 Caribou Coffee Company

- 13.17 Tchibo GmbH

- 13.18 UCC Ueshima Coffee Co., Ltd.

- 13.19 Strauss Group Ltd.

- 13.20 Cameron's Coffee

- 13.21 San Francisco Bay Coffee

- 13.22 Cafe Bustelo (J.M. Smucker)

- 13.23 Cafe Royal

- 13.24 Luckin Coffee Inc.

- 13.25 Trung Nguyen Group

- 13.26 Tim Hortons Inc. (Restaurant Brands International)

- 13.27 Segafredo Zanetti (Massimo Zanetti Beverage Group)

- 13.28 Reily Foods Company (Community Coffee)

- 13.29 Rogers Family Company

- 13.30 Puroast Coffee Company