|

市场调查报告书

商品编码

1750422

光纤雷射器市场机会、成长动力、产业趋势分析及2025-2034年预测Fiber Laser Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

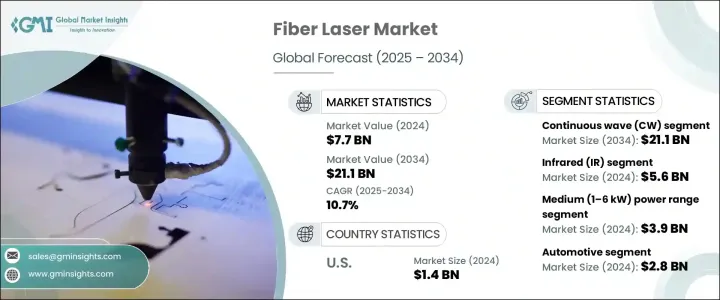

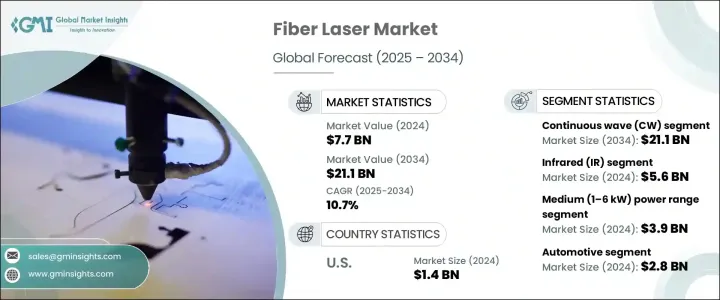

2024年,全球光纤雷射器市场规模达77亿美元,预计到2034年将以10.7%的复合年增长率成长,达到211亿美元。这得归功于汽车、航太、电子和医疗等各行各业对光纤雷射的日益普及。市场对高精度、节能、低维护雷射系统的需求推动市场的发展。此外,电动车(EV)的兴起和製造技术的进步也促进了光纤雷射市场的扩张。

与传统雷射系统相比,光纤雷射具有许多优势,例如更高的光束品质、更高的效率以及处理各种材料的能力。这些特性使其成为切割、焊接和打标等对精度和速度要求高的应用的理想选择。光纤雷射的多功能性使其能够应用于各种波长,包括红外线 (IR)、紫外线 (UV) 和可见光,从而满足特定的工业需求。连续波 (CW) 光纤雷射器市场预计将占据主导地位,因为它们适用于高功率应用,并且能够以更快的速度处理厚材料。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 77亿美元 |

| 预测值 | 211亿美元 |

| 复合年增长率 | 10.7% |

2024年,红外线 (IR) 光纤雷射器市场规模达到56亿美元,凭藉其在众多工业应用中的适应性和卓越性能,继续保持主导地位。红外线光纤雷射在焊接、熔覆和高速切割等重型金属加工製程中尤其有效。其输出功率高达30千瓦,加上卓越的光束质量,能够深度穿透金属,确保获得干净、精确的加工效果。这些特性使其成为航太和电动车製造等高需求领域的必备技术,因为这些领域的精度、耐用性和性能至关重要。

2024年,中功率(1-6千瓦)光纤雷射器市场规模达39亿美元,反映出製造商对高性能和低能耗的强烈需求。这类雷射在精度和价格之间实现了切实的平衡,尤其适用于汽车钣金加工、中型航太加工和高级3D列印。它们在电动车电池托盘和结构部件製造中的应用,有助于快速生产并最大程度地减少材料浪费。随着轻质金属和高性能合金在製造业中的日益普及,中功率光纤雷射为可扩展、清洁的加工提供了理想的解决方案。

2024年,美国光纤雷射器市场规模达14亿美元。美国高度重视研发,加上其先进的製造能力,支撑着光纤雷射市场的成长。政府在国防、医疗技术和电子等领域的倡议和投资进一步推动了对光纤雷射系统的需求。专注于高功率工业雷射和用于半导体应用的超快雷射的公司在市场扩张中发挥重要作用。

全球光纤雷射市场的主要参与者包括通快 (TRUMPF)、相干公司 (Coherent Corporation)、恩莱特 (nLIGHT, Inc.)、Lumentum Operations LLC 和 IPG Photonics Corporation。这些公司走在创新的前沿,不断开发新技术以满足各行各业不断变化的需求。他们的策略包括扩大产品组合、增强技术能力以及探索新应用,以保持市场竞争优势。为了巩固市场地位,光纤雷射产业的公司正在采取几项关键策略。首先,他们大力投资研发,以创新和提高产品性能。这包括开发具有更高功率输出、更好光束品质和更高能效的雷射。其次,各公司正在建立策略伙伴关係,以扩大市场范围并进入新的客户群。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 电动车和轻质材料需求不断增长

- 航太和国防应用的成长

- 5G与消费性电子产品的扩展

- 工业自动化与智慧製造

- 产业陷阱与挑战

- 初始成本高

- 技术复杂性

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按系统,2021 - 2034 年

- 主要趋势

- 连续波(CW)光纤雷射器

- 脉衝光纤雷射

- 其他的

第六章:市场估计与预测:依波长,2021 - 2034

- 主要趋势

- 红外线(IR)

- 紫外线(UV)

- 可见波长

- 中红外线

第七章:市场估计与预测:依功率范围,2021 - 2034 年

- 主要趋势

- 低(≤1 kW)

- 中(1-6千瓦)

- 高(>6千瓦)

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 汽车

- 航太

- 电子产品

- 医疗的

- 活力

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- IPG Photonics Corporation

- TRUMPF

- Coherent Corp.

- nLIGHT, Inc.

- Lumentum Operations LLC

- Thorlabs, Inc.

- Wuhan Raycus Fiber Laser Technologies Co., Ltd.

- FANUC CORPORATION

- EO Technics Co., Ltd.

- Laserax

- Fujikura Ltd.

- AdValue Photonics

- Keopsys Group

- Calmar Laser

- Laser Photonics

- NKT Photonics A/S

- LUMIBIRD

The Global Fiber Laser Market was valued at USD 7.7 billion in 2024 and is estimated to grow at a CAGR of 10.7% to reach USD 21.1 billion by 2034, driven by the increasing adoption of fiber lasers across various industries, including automotive, aerospace, electronics, and medical sectors. The demand for high-precision, energy-efficient, and low-maintenance laser systems propels the market forward. Additionally, the rise of electric vehicles (EVs) and advancements in manufacturing technologies are contributing to the expansion of the fiber laser market.

Fiber lasers offer several advantages over traditional laser systems, such as higher beam quality, greater efficiency, and the ability to process a wide range of materials. These characteristics make them ideal for applications requiring precision and speed, such as cutting, welding, and marking. The versatility of fiber lasers allows them to be used in various wavelengths, including infrared (IR), ultraviolet (UV), and visible light, catering to specific industrial needs. The continuous wave (CW) fiber lasers segment is expected to dominate the market due to their suitability for high-power applications and their ability to process thick materials at faster speeds.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.7 Billion |

| Forecast Value | $21.1 Billion |

| CAGR | 10.7% |

The infrared (IR) fiber laser market reached USD 5.6 billion in 2024, maintaining its dominant position due to its adaptability and strong performance in vast industrial applications. IR fiber lasers are especially effective in heavy-duty metalworking processes such as welding, cladding, and high-speed cutting. Their ability to deliver high output power, reaching up to 30 kW, combined with excellent beam quality, allows for deep penetration into metals, ensuring clean, precise results. These features make them an essential technology in high-demand sectors like aerospace and electric vehicle manufacturing, where accuracy, durability, and performance are paramount.

The medium-power (1-6 kW) segment of the fiber laser market stood at USD 3.9 billion in 2024, reflecting strong demand from manufacturers seeking optimal performance without excessive power consumption. These lasers strike a practical balance between precision and affordability, making them particularly attractive for automotive sheet metal processing, mid-scale aerospace work, and advanced 3D printing. Their application in fabricating EV battery trays and structural components supports rapid production with minimal material waste. As lightweight metals and high-performance alloys become more common in manufacturing, medium-power fiber lasers offer the ideal solution for scalable, clean processing.

United States Fiber Laser Market was valued at USD 1.4 billion in 2024. The country's strong focus on research and development, coupled with its advanced manufacturing capabilities, supports the growth of the fiber laser market. Government initiatives and investments in sectors such as defense, medical technology, and electronics further drive the demand for fiber laser systems. Companies specializing in high-power industrial and ultrafast lasers for semiconductor applications play a significant role in the market's expansion.

Key players in the Global Fiber Laser Market include TRUMPF, Coherent Corporation, nLIGHT, Inc., Lumentum Operations LLC, and IPG Photonics Corporation. These companies are at the forefront of innovation, continuously developing new technologies to meet the evolving needs of various industries. Their strategies involve expanding product portfolios, enhancing technological capabilities, and exploring new applications to maintain a competitive edge in the market. To strengthen their market position, companies in the fiber laser industry are adopting several key strategies. First, they are investing heavily in research and development to innovate and improve the performance of their products. This includes developing lasers with higher power outputs, better beam quality, and greater energy efficiency. Second, companies are forming strategic partnerships and collaborations to expand their market reach and access new customer segments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for electric vehicles (evs) and lightweight materials

- 3.2.1.2 Growth in aerospace and defense applications

- 3.2.1.3 Expansion of 5g and consumer electronics

- 3.2.1.4 Industrial automation and smart manufacturing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial costs

- 3.2.2.2 Technical complexity

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By System, 2021 - 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Continuous wave (CW) fiber lasers

- 5.3 Pulsed fiber lasers

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Wavelength, 2021 - 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Infrared (IR)

- 6.3 Ultraviolet (UV)

- 6.4 Visible wavelength

- 6.5 Mid-infrared

Chapter 7 Market Estimates & Forecast, By Power Range, 2021 - 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Low (≤1 kW)

- 7.3 Medium (1–6 kW)

- 7.4 High (>6 kW)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Aerospace

- 8.4 Electronics

- 8.5 Medical

- 8.6 Energy

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 IPG Photonics Corporation

- 10.2 TRUMPF

- 10.3 Coherent Corp.

- 10.4 nLIGHT, Inc.

- 10.5 Lumentum Operations LLC

- 10.6 Thorlabs, Inc.

- 10.7 Wuhan Raycus Fiber Laser Technologies Co., Ltd.

- 10.8 FANUC CORPORATION

- 10.9 EO Technics Co., Ltd.

- 10.10 Laserax

- 10.11 Fujikura Ltd.

- 10.12 AdValue Photonics

- 10.13 Keopsys Group

- 10.14 Calmar Laser

- 10.15 Laser Photonics

- 10.16 NKT Photonics A/S

- 10.17 LUMIBIRD