|

市场调查报告书

商品编码

1750431

饼干和薄脆饼干市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Biscuits and Crackers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

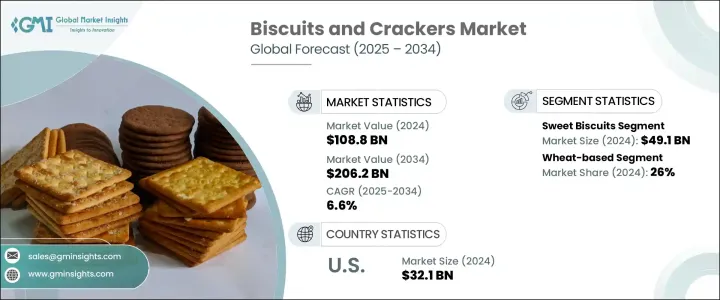

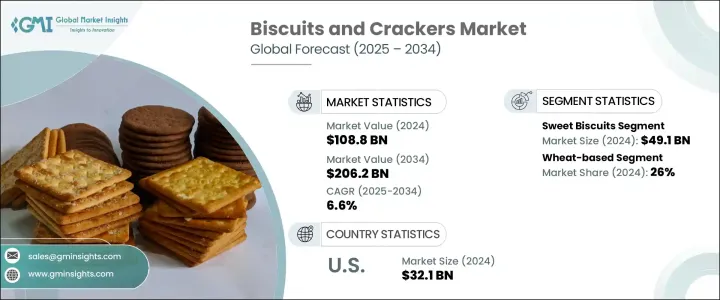

2024年,全球饼干和薄脆饼干市场规模达1,088亿美元,预计到2034年将以6.6%的复合年增长率成长,达到2062亿美元。这得归功于消费者对便捷便携、符合快节奏生活方式的零食日益增长的偏好。都市化进程和包装食品取得管道的不断拓展进一步推动了市场需求,尤其是在发展中地区。西方饮食习惯的普及和城镇人口的不断增长正在加速消费趋势。人们对健康和保健的日益重视,以及人们对功能性和健康零食的偏好,也正在重塑产品开发。

消费者寻求符合特定饮食需求的选择,例如低糖、高蛋白、无麸质和植物性配方,这促使品牌在更清洁的标籤和营养丰富的成分方面进行创新。这种注重健康的趋势也促使人们将超级食物、益生菌和天然甜味剂融入传统点心中,以增强其吸引力。此外,数位商务的蓬勃发展使这些产品更容易被全球更广泛的消费者群体所接受。线上平台不仅扩大了产品覆盖范围,还提供个人化推荐和订阅模式,使製造商能够直接与消费者互动,并在不同人群中建立品牌忠诚度。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1088亿美元 |

| 预测值 | 2062亿美元 |

| 复合年增长率 | 6.6% |

产品多样化继续塑造市场格局,其中甜味饼干市场在2024年将达到491亿美元。儘管人们对糖摄取量的认识日益加深,但凭藉其广泛的吸引力以及在口味和口感上的持续创新,该市场仍占据主导地位。同时,随着注重健康的消费者寻求替代品,咸味饼干,尤其是无麸质和富含蛋白质的饼干,也越来越受到关注。这些品种迎合了那些注重营养又不牺牲口感的消费者的需求,为新品的推出创造了机会。

2024年,小麦饼干和薄脆饼干的市场价值达到285亿美元,占26%的市场。它们的主导地位源于小麦的成本效益、可靠的全球供应以及配方的灵活性,使其能够无缝调整口味。製造商青睐小麦,是因为其口味中性且烘焙特性稳定,适合甜味和咸味的製作。儘管对无麸质和多谷物产品的需求不断增长,但小麦仍然是主要原料,尤其是在价格敏感、经济适用房至关重要的地区。

美国饼干和薄脆饼干市场在2024年创收321亿美元,预计到2034年将以6.9%的复合年增长率成长。受高可支配收入、根深蒂固的零食文化以及广泛的零售通路推动,美国仍然是全球最大、最成熟的零食市场之一。随着消费者对健康的关注,对植物性、无过敏原和低碳水化合物饼干的需求也日益增长。连锁超市的自有品牌进一步提升了市场价值,提供与高端品牌互补的优质产品,同时又不牺牲其价格竞争力。

该产业的主要参与者包括宾堡集团、雀巢公司、亿滋国际、不列颠尼亚工业有限公司和家乐氏公司。这些公司正透过多元化投资组合、投资更健康的产品线、区域扩张以及与数位零售商合作等重点策略来巩固其市场地位。透过利用新兴的健康趋势并根据当地口味客製化产品,他们旨在提升品牌忠诚度,同时满足全球消费者不断变化的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 市场介绍

- 产业价值链分析

- 产品概述

- 饼干和薄脆饼干製造过程

- 成分功能

- 保存期限技术

- 风味开发技术

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 供给侧影响(原料)

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 2021-2024年主要出口国

- 2021-2024年主要进口国

註:以上贸易统计仅针对重点国家。

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 食品安全法规

- 标籤要求

- 有机和天然产品认证

- 营养声明法规

- 过敏原标籤要求

- 衝击力

- 成长动力

- 城市零售通路对定量控制和便携饼干包装的需求不断增长。

- 消费者对无麸质、高纤维和富含蛋白质的饼干配方的兴趣日益增加。

- 发展中经济体有组织的零售和电子商务平台的扩张。

- 针对成年消费者的优质和奢华饼干品种的产品创新。

- 产业陷阱与挑战

- 原物料价格波动,尤其是小麦、糖和食用油。

- 烘焙零食产品中糖含量和反式脂肪的监管压力。

- 成长动力

- 製造流程分析

- 麵团製备方法

- 成型和切割技术

- 烘焙技术

- 冷却和包装过程

- 原料分析与采购策略

- 定价分析

- 永续性和环境影响评估

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

- 市占率分析

- 战略框架

- 併购

- 合资与合作

- 新产品开发

- 扩张策略

- 竞争基准化分析

- 供应商格局

- 竞争定位矩阵

- 战略仪表板

- 品牌定位与消费者认知分析

- 新参与者的市场进入策略

- 自有品牌分析与策略

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 甜饼干

- 饼干

- 奶油饼干

- 巧克力饼干

- 酥饼

- 晶圆

- 其他甜饼干

- 咸味饼干和薄脆饼干

- 原味饼干

- 调味饼干

- 起司饼干

- 咸饼干

- 脆麵包

- 其他咸味饼干和薄脆饼干

- 消化饼干

- 普通消化饼干

- 巧克力消化饼干

- 其他消化剂

- 健康饼干

- 高纤维饼干

- 低糖/无糖饼干

- 低脂饼干

- 富含蛋白质的饼干

- 功能性饼干

- 夹心饼干

- 早餐饼干

- 手工和特色饼干

- 其他产品类型

第六章:市场估计与预测:依成分类型,2021-2034

- 主要趋势

- 小麦基

- 精製小麦粉

- 全麦麵粉

- 不含麸质

- 米粉基

- 玉米粉基

- 杏仁粉基

- 其他无麸质麵粉

- 杂粮

- 燕麦基

- 黑麦基

- 有机成分

- 非基因改造成分

- 其他成分类型

第七章:市场估计与预测:依包装类型,2021-2034

- 主要趋势

- 硬包装

- 纸箱

- 塑胶容器

- 金属罐

- 其他硬质包装

- 软包装

- 塑胶袋

- 流动包装

- 纸袋

- 其他软包装

- 托盘和蛤壳

- 多包装格式

- 单份包装

- 永续包装解决方案

- 可生物降解包装

- 可回收包装

- 可堆肥包装

第八章:市场估计与预测:按价格细分,2021-2034 年

- 主要趋势

- 经济

- 中檔

- 优质的

- 超高端手工製品

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 超市和大卖场

- 便利商店

- 专卖店

- 网路零售

- 餐饮服务

- 咖啡馆和餐厅

- 饭店和餐饮

- 机构餐饮

- 自动贩卖机

- 直接面向消费者

- 其他分销管道

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第 11 章:公司简介

- Arnott's Biscuits Limited

- Bahlsen GmbH & Co. KG

- Barilla G. e R. Fratelli SpA

- Britannia Industries Ltd.

- Burton's Biscuit Company

- Campbell Soup Company (Pepperidge Farm)

- Dare Foods Limited

- Fox's Biscuits (2 Sisters Food Group)

- General Mills, Inc.

- Grupo Bimbo

- ITC Limited

- Kellogg Company

- Keebler (Ferrero)

- Kind LLC

- Kashi Company (Kellogg)

- Lotus Bakeries

- Lotte Confectionery Co., Ltd.

- Mary's Gone Crackers

- Meiji Holdings Co., Ltd.

- Mondelez International, Inc.

- Nairn's Oatcakes Limited

- Nestle SA

- Orion Corporation

- Parle Products Pvt. Ltd.

- PepsiCo, Inc. (Frito-Lay)

- Ryvita Company Limited (ABF)

- Snyder's-Lance, Inc. (Campbell Soup Company)

- United Biscuits (pladis)

- Walkers Shortbread Ltd.

- Yildiz Holding (Ulker)

The Global Biscuits and Crackers Market was valued at USD 108.8 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 206.2 billion by 2034, fueled by consumers' rising preference for convenient and portable snack options that align with fast-paced lifestyles. Urbanization and evolving access to packaged food further push market demand, especially in developing regions. Increased exposure to Western eating habits and a rising urban population are accelerating consumption trends. A growing emphasis on health and wellness, paired with a shift toward functional and better-for-you snacks, is also reshaping product development.

Consumers seek options that align with specific dietary needs, such as low-sugar, high-protein, gluten-free, and plant-based formulations, pushing brands to innovate with cleaner labels and nutrient-rich ingredients. This health-conscious trend is also encouraging the incorporation of superfoods, probiotics, and natural sweeteners into traditional snack profiles to enhance their appeal. Additionally, the surge in digital commerce is making these products more accessible to a broader consumer base globally. Online platforms are not only expanding product reach but also offering personalized recommendations and subscription models, allowing manufacturers to engage directly with consumers and build brand loyalty across diverse demographics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $108.8 Billion |

| Forecast Value | $206.2 Billion |

| CAGR | 6.6% |

Product diversification continues to shape the market, with the sweet biscuits segment generating USD 49.1 billion in 2024. This segment remains dominant due to its widespread appeal and continuous innovation in flavor and texture, despite growing awareness around sugar intake. Meanwhile, savory crackers are witnessing increased attention, particularly gluten-free and protein-enriched options, as health-conscious consumers seek alternatives. These varieties cater to those prioritizing nutrition without sacrificing taste, creating opportunities for new launches.

Wheat-based biscuits and crackers secured USD 28.5 billion market value in 2024, holding a 26% share. Their dominance stems from wheat's cost-effectiveness, reliable global supply, and flexibility in formulation, which allows for seamless flavor adaptation. Manufacturers favor wheat for its neutral taste and consistent baking properties, which support sweet and savory applications. While demand for gluten-free and multi-grain offerings rises, wheat remains the staple base, especially in price-sensitive regions where affordability is critical.

U.S. Biscuits and Crackers Market generated USD 32.1 billion in 2024 and is set to grow at a 6.9% CAGR through 2034. The country remains one of the largest and most mature snack markets in the world, driven by high disposable income, an ingrained snacking culture, and widespread retail availability. Demand for plant-based, allergen-free, and low-carb biscuit options is also gaining traction, aligning with consumer focus on wellness. Private labels in grocery chains have further contributed to market value, providing quality offerings that complement premium brands without sacrificing affordability.

Key players in the industry include Grupo Bimbo, Nestle S.A., Mondelez International Inc., Britannia Industries Limited, and Kellogg Company. These companies are strengthening their market position through focused strategies such as portfolio diversification, investment in healthier product lines, regional expansion, and partnerships with digital retailers. By tapping into emerging wellness trends and customizing offerings for local tastes, they aim to boost brand loyalty while meeting the dynamic needs of global consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research methodology

- 1.3 Research scope & assumptions

- 1.4 List of data sources

- 1.5 Market estimation technique

- 1.6 Market segmentation & breakdown

- 1.7 Research limitations

Chapter 2 Executive Summary

- 2.1 Segment highlights

- 2.2 Competitive landscape snapshot

- 2.3 Regional market outlook

- 2.4 Key market trends

- 2.5 Future market outlook

Chapter 3 Industry Insights

- 3.1 Market introduction

- 3.2 Industry value chain analysis

- 3.3 Product overview

- 3.3.1 Biscuit & cracker manufacturing process

- 3.3.2 Ingredient functionality

- 3.3.3 Shelf-life technologies

- 3.3.4 Flavor development techniques

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Demand-side impact (selling price)

- 3.4.3.1 Price transmission to end markets

- 3.4.3.2 Market share dynamics

- 3.4.3.3 Consumer response patterns

- 3.4.4 Key companies impacted

- 3.4.5 Strategic industry responses

- 3.4.5.1 Supply chain reconfiguration

- 3.4.5.2 Pricing and product strategies

- 3.4.5.3 Policy engagement

- 3.4.6 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Trade statistics (HS code)

- 3.5.1 Major exporting countries, 2021-2024 (kilo tons)

- 3.5.2 Major importing countries, 2021-2024 (kilo tons)

Note: the above trade statistics will be provided for key countries only.

- 3.6 Supplier landscape

- 3.7 Profit margin analysis

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.9.1 Food safety regulations

- 3.9.2 Labeling requirements

- 3.9.3 Organic & natural product certifications

- 3.9.4 Nutritional claim regulations

- 3.9.5 Allergen labeling requirements

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising demand for portion-controlled and on-the-go biscuit packs in urban retail channels.

- 3.10.1.2 Increased consumer interest in gluten-free, high-fiber, and protein-enriched biscuit formulations.

- 3.10.1.3 Expansion of organized retail and e-commerce platforms in developing economies.

- 3.10.1.4 Product innovation in premium and indulgent biscuit varieties targeting adult consumers.

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Volatility in raw material prices, especially wheat, sugar, and edible oils.

- 3.10.2.2 Regulatory pressures around sugar content and trans fats in baked snack products.

- 3.10.1 Growth drivers

- 3.11 Manufacturing process analysis

- 3.11.1 Dough preparation methods

- 3.11.2 Forming & cutting techniques

- 3.11.3 Baking technologies

- 3.11.4 Cooling & packaging processes

- 3.12 Raw material analysis & procurement strategies

- 3.13 Pricing analysis

- 3.14 Sustainability & environmental impact assessment

- 3.15 Growth potential analysis

- 3.16 Porter's analysis

- 3.17 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Market Share Analysis

- 4.6 Strategic Framework

- 4.6.1 Mergers & Acquisitions

- 4.6.2 Joint Ventures & Collaborations

- 4.6.3 New Product Developments

- 4.6.4 Expansion Strategies

- 4.7 Competitive Benchmarking

- 4.8 Vendor Landscape

- 4.9 Competitive Positioning Matrix

- 4.10 Strategic Dashboard

- 4.11 Brand Positioning & Consumer Perception Analysis

- 4.12 Market Entry Strategies for New Players

- 4.13 Private Label Analysis & Strategies

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Sweet biscuits

- 5.2.1 Cookies

- 5.2.2 Cream-filled biscuits

- 5.2.3 Chocolate-coated biscuits

- 5.2.4 Shortbread

- 5.2.5 Wafers

- 5.2.6 Other sweet biscuits

- 5.3 Savory biscuits & crackers

- 5.3.1 Plain crackers

- 5.3.2 Flavored crackers

- 5.3.3 Cheese crackers

- 5.3.4 Saltines

- 5.3.5 Crispbreads

- 5.3.6 Other savory biscuits & crackers

- 5.4 Digestive biscuits

- 5.4.1 Plain digestives

- 5.4.2 Chocolate-coated digestives

- 5.4.3 Other digestives

- 5.5 Health & wellness biscuits

- 5.5.1 High-fiber biscuits

- 5.5.2 Low-sugar/sugar-free biscuits

- 5.5.3 Low-fat biscuits

- 5.5.4 Protein-enriched biscuits

- 5.5.5 Functional biscuits

- 5.6 Sandwich biscuits

- 5.7 Breakfast biscuits

- 5.8 Artisanal & specialty biscuits

- 5.9 Other product types

Chapter 6 Market Estimates & Forecast, By Ingredient Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Wheat-based

- 6.2.1 Refined wheat flour

- 6.2.2 Whole wheat flour

- 6.3 Gluten-free

- 6.3.1 Rice flour-based

- 6.3.2 Corn flour-based

- 6.3.3 Almond flour-based

- 6.3.4 Other gluten-free flours

- 6.4 Multi-grain

- 6.5 Oat-based

- 6.6 Rye-based

- 6.7 Organic ingredients

- 6.8 Non-GMO ingredients

- 6.9 Other ingredient types

Chapter 7 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Rigid packaging

- 7.2.1 Paperboard boxes

- 7.2.2 Plastic containers

- 7.2.3 Metal tins

- 7.2.4 Other rigid packaging

- 7.3 Flexible packaging

- 7.3.1 Plastic pouches

- 7.3.2 Flow wraps

- 7.3.3 Paper bags

- 7.3.4 Other flexible packaging

- 7.4 Trays & clamshells

- 7.5 Multi-pack formats

- 7.6 Single-serve packaging

- 7.7 Sustainable packaging solutions

- 7.7.1 Biodegradable packaging

- 7.7.2 Recyclable packaging

- 7.7.3 Compostable packaging

Chapter 8 Market Estimates & Forecast, By Price Segment, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Economy

- 8.3 Mid-range

- 8.4 Premium

- 8.5 Super-premium & artisanal

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Supermarkets & hypermarkets

- 9.3 Convenience stores

- 9.4 Specialty stores

- 9.5 Online retail

- 9.6 Foodservice

- 9.6.1 Cafes & restaurants

- 9.6.2 Hotels & catering

- 9.6.3 Institutional catering

- 9.7 Vending machines

- 9.8 Direct-to-consumer

- 9.9 Other distribution channels

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.3.7 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Arnott's Biscuits Limited

- 11.2 Bahlsen GmbH & Co. KG

- 11.3 Barilla G. e R. Fratelli S.p.A.

- 11.4 Britannia Industries Ltd.

- 11.5 Burton's Biscuit Company

- 11.6 Campbell Soup Company (Pepperidge Farm)

- 11.7 Dare Foods Limited

- 11.8 Fox's Biscuits (2 Sisters Food Group)

- 11.9 General Mills, Inc.

- 11.10 Grupo Bimbo

- 11.11 ITC Limited

- 11.12 Kellogg Company

- 11.13 Keebler (Ferrero)

- 11.14 Kind LLC

- 11.15 Kashi Company (Kellogg)

- 11.16 Lotus Bakeries

- 11.17 Lotte Confectionery Co., Ltd.

- 11.18 Mary's Gone Crackers

- 11.19 Meiji Holdings Co., Ltd.

- 11.20 Mondelez International, Inc.

- 11.21 Nairn's Oatcakes Limited

- 11.22 Nestle S.A.

- 11.23 Orion Corporation

- 11.24 Parle Products Pvt. Ltd.

- 11.25 PepsiCo, Inc. (Frito-Lay)

- 11.26 Ryvita Company Limited (ABF)

- 11.27 Snyder's-Lance, Inc. (Campbell Soup Company)

- 11.28 United Biscuits (pladis)

- 11.29 Walkers Shortbread Ltd.

- 11.30 Yildiz Holding (Ulker)