|

市场调查报告书

商品编码

1750432

儿科介入性心臟病学市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Pediatric Interventional Cardiology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

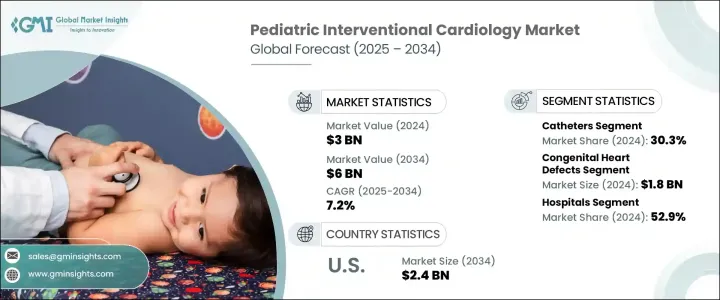

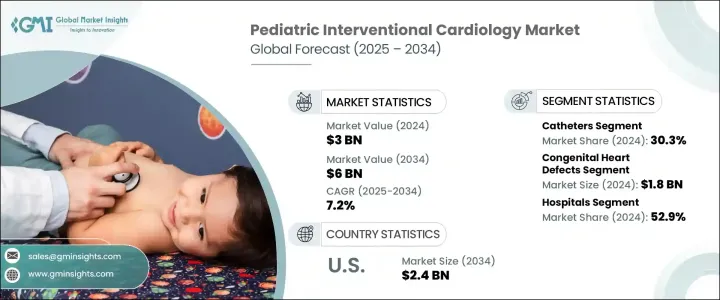

2024年,全球儿科介入性心臟病学市场规模达30亿美元,预计到2034年将以7.2%的复合年增长率增长,达到60亿美元,这主要得益于婴儿先天性心臟缺陷诊断率的上升。目前,医疗专业人员正广泛采用微创经导管手术,这种手术比传统手术更安全、更有效率。这些现代技术有助于提高儿科患者的存活率并加快康復速度,从而进一步扩大市场规模。随着该领域创新的加速,微型工具和先进成像系统的出现,使医生能够进行精准的儿童特异性治疗,并减少併发症。

技术发展改变了治疗瓣膜狭窄和室间隔畸形等先天性缺陷的方法。如今,医疗保健提供者不再依赖侵入性开胸手术,而是更倾向于根据儿科解剖学需求量身定制的导管干预措施。专为幼儿设计的器械比成人专用器械控制性更强,并显着改善了手术效果。导管在这些干预措施中仍然至关重要,它帮助临床医生以最小的创伤和更快的恢復时间进行球囊血管成形术、瓣膜成形术和缺损闭合等手术。诸如可操控、高柔韧性且具有卓越生物相容性的导管等创新技术,推动了其在新生儿和婴儿护理中的广泛应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 30亿美元 |

| 预测值 | 60亿美元 |

| 复合年增长率 | 7.2% |

导管领域在2024年以30.3%的市占率领先市场。新一代儿科专用导管需求的不断增长进一步巩固了这一主导地位。由于能够最大程度地降低手术复杂性并缩短住院时间,这些工具继续成为专科医生的首选。这些设备的设计具有更高的灵活性、更小的直径和更高的生物相容性,能够在新生儿和婴儿的精细血管系统中更安全地导航。其精准度支持从球囊瓣膜成形术到缺损封堵术等干预措施,同时减少创伤并缩短恢復时间。

2024年,先天性心臟缺陷应用领域创造了18亿美元的市场规模,这得益于新生儿筛检工具的改进,从而实现了更早、更准确的诊断。透过非手术方法进行及时介入有助于提高婴儿存活率,使得导管治疗成为许多先天性心臟病 (CHD) 病例的标准治疗方法。胎儿超音波心臟检查和产后诊断工具的进步使临床医生能够更早发现异常,通常能够在婴儿早期就规划和实施相关手术。

2024年,美国儿科介入性心臟病学市场规模达12亿美元,预计2034年将达24亿美元。美国拥有先进的儿科专科医院和学术中心网络,进行大量的介入性心臟病学手术。包括医疗补助和私人健康计划在内的全面保险覆盖,提高了尖端治疗的可及性,并扩大了全球以儿科为中心的心血管服务的覆盖范围。

为了获得竞争优势,雅培实验室、Osypka、Cordis、SMT、Terumo、美敦力和先健科技等公司正大力投资研发,以推出儿科专用介入工具。关键策略包括获得新器械类型的监管批准、建立国际分销合作伙伴关係以及为儿科心臟病专家提供教育和培训项目。客製化设计的导管系统和封堵装置是公司重点关注的领域,旨在增强产品组合和全球市场覆盖率。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 新生儿先天性心臟缺陷盛行率上升

- 儿科介入器材的技术进步

- 家长和医疗保健提供者的意识不断增强

- 增加医疗支出和政府支持倡议

- 产业陷阱与挑战

- 儿科介入性心臟病学手术和设备费用高昂

- 专业技能人才有限

- 成长动力

- 成长潜力分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 技术格局

- 未来市场趋势

- 监管格局

- 专利分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 竞争市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 导管

- 支架

- 气球

- 阀门

- 封闭装置

- 导丝

- 其他产品类型

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 先天性心臟缺陷

- 心律不整

- 肺动脉狭窄

- 心臟瓣膜疾病

- 其他应用

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 专科诊所

- 儿科心臟病中心

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Abbott Laboratories

- B. Braun

- Balton

- Biotronik

- Boston Scientific

- Cordis

- Edwards Lifesciences

- Lepu Medical

- Lifetech Scientific

- Medtronic

- Meril Life Sciences

- Osypka

- Renata Medical

- Terumo

- WL Gore & Associates

The Global Pediatric Interventional Cardiology Market was valued at USD 3 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 6 billion by 2034, driven by the rising diagnoses of congenital heart defects among infants. Medical professionals are now widely adopting minimally invasive transcatheter procedures that offer safer and more efficient alternatives to traditional surgery. These modern techniques contribute to better survival rates and faster recovery for pediatric patients, which continues to expand the market. As innovation in this space accelerates, the availability of miniaturized tools and advanced imaging systems enables physicians to conduct precise and child-specific treatments with fewer complications.

Technological development has transformed the approach to treating congenital defects like valve stenosis and septal malformations. Rather than relying on invasive open-heart procedures, healthcare providers now favor catheter-based interventions tailored to pediatric anatomical requirements. Devices designed specifically for young patients offer better control and significantly improve procedural outcomes compared to adapted adult tools. Catheters remain essential in these interventions, helping clinicians perform tasks such as balloon angioplasty, valvuloplasty, defect closure with minimal trauma and quicker recovery times. Innovations like steerable, highly flexible catheters with superior biocompatibility drive their widespread adoption in neonatal and infant care.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $6 Billion |

| CAGR | 7.2% |

The catheters segment led the market with a 30.3% share in 2024. Increasing demand for next-generation pediatric-specific catheters supports this dominance. The ability to minimize surgical complexity and shorten hospital stays continues to make these tools a preferred choice among specialists. These devices are designed with improved flexibility, smaller diameters, and enhanced biocompatibility, allowing safer navigation through delicate vascular systems in neonates and infants. Their precision supports interventions, from balloon valvuloplasty to defect closures, all while reducing trauma and recovery time.

The congenital heart defects application segment generated USD 1.8 billion in 2024, supported by earlier and more accurate diagnosis through enhanced neonatal screening tools. Timely intervention through non-surgical methods contributes to improved infant survival, making catheter-based treatments the standard approach for many CHD cases. Advancements in fetal echocardiography and postnatal diagnostic tools allow clinicians to detect abnormalities sooner, often enabling procedures to be planned and performed in early infancy.

U.S. Pediatric Interventional Cardiology Market stood at USD 1.2 billion in 2024 and is expected to reach USD 2.4 billion by 2034. The U.S. benefits from an advanced network of pediatric specialty hospitals and academic centers that conduct high volumes of interventional cardiology procedures. Comprehensive insurance coverage, including Medicaid and private health plans, improves access to cutting-edge treatments and expands the reach of pediatric-focused cardiovascular services globally.

To gain a competitive edge, companies like Abbott Laboratories, Osypka, Cordis, SMT, Terumo, Medtronic, and Lifetech Scientific are investing heavily in R&D to launch pediatric-specific interventional tools. Key strategies include regulatory approvals for new device types, international distribution partnerships, and education & training programs for pediatric cardiologists. Custom-designed catheter systems and closure devices are a major focus area, enhancing product portfolios and market reach globally.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of congenital heart defects in newborns

- 3.2.1.2 Technological advancements in pediatric-sized interventional devices

- 3.2.1.3 Growing awareness among parents and healthcare providers

- 3.2.1.4 Increasing healthcare spending and supportive government initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of pediatric interventional cardiology procedures and devices

- 3.2.2.2 Limited availability of skilled professionals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the Industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Regulatory landscape

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Catheters

- 5.3 Stents

- 5.4 Balloons

- 5.5 Valves

- 5.6 Closure devices

- 5.7 Guidewires

- 5.8 Other product types

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Congenital heart defects

- 6.3 Arrhythmias

- 6.4 Pulmonary artery stenosis

- 6.5 Valvular heart disease

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Specialty clinics

- 7.5 Pediatric cardiology centers

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 B. Braun

- 9.3 Balton

- 9.4 Biotronik

- 9.5 Boston Scientific

- 9.6 Cordis

- 9.7 Edwards Lifesciences

- 9.8 Lepu Medical

- 9.9 Lifetech Scientific

- 9.10 Medtronic

- 9.11 Meril Life Sciences

- 9.12 Osypka

- 9.13 Renata Medical

- 9.14 Terumo

- 9.15 W. L. Gore & Associates