|

市场调查报告书

商品编码

1750439

拉臂拖车市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Hooklift Trailer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

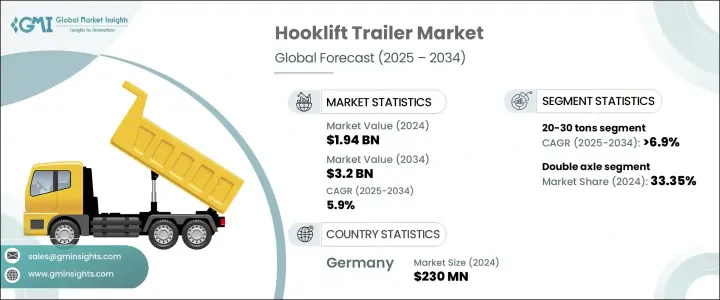

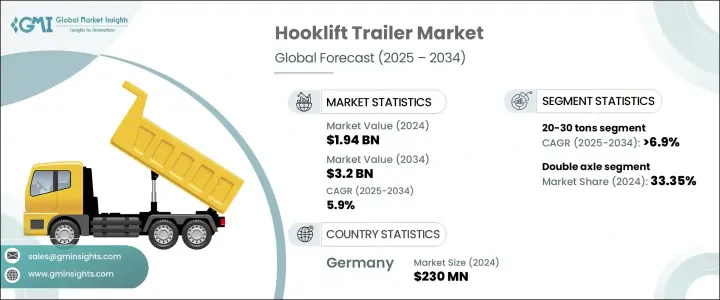

2024年,全球拉钩拖车市场规模达19.4亿美元,预计到2034年将以5.9%的复合年增长率成长,达到32亿美元,这得益于全球建筑、拆除和基础建设的蓬勃发展。这些拖车因其灵活性、耐用性和高效性,日益被视为废弃物处理、农业、采矿和物流领域的重要资产。随着各行各业转向模组化运输系统以优化时间和资源,拉钩拖车具备多功能运输能力,允许使用单一车辆平台运输各种类型的货柜。

这种适应性在工地条件和货物类型差异很大的地区尤其具有吸引力,例如人口稠密的城区、偏远的挖掘区域和广阔的农田。此外,随着营运更加重视减少停机时间和营运成本,先进的液压系统和基于物联网的追踪等智慧技术正成为关键特性。这些整合提供即时诊断和维护警报,提高车队的可靠性和生产力,同时降低整体拥有成本。透过启用远端监控和预测性维护,操作员可以在问题升级之前发现问题,从而减少非计划性停机时间和维修成本。此外,透过这些系统收集的性能资料有助于做出明智的决策,优化燃油使用和驾驶员行为。随着时间的推移,这种可见度水准将有助于改善资产管理、延长设备使用寿命以及提高调度效率和营运效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 19.4亿美元 |

| 预测值 | 32亿美元 |

| 复合年增长率 | 5.9% |

双轴拖车市场在2024年占据了33.35%的市场份额,预计到2034年将以6.7%的复合年增长率成长。双轴拖车以其在承载力和机动性方面的平衡而闻名,在农业、建筑和废物处理等领域备受青睐。其设计确保了即使在严苛条件下也能稳定操控并延长使用寿命。加固的车架和多货柜相容性使这些拖车在日常工业应用中更加高效,而新型节油系统则进一步激发了人们对永续解决方案日益增长的兴趣。

2024年,载重量20-30吨的拉臂拖车占了34.23%的市占率。这个重量等级在有效载荷和多功能性之间实现了关键平衡,使其成为运输城市垃圾、拆除材料和矿产资源的理想选择。此细分市场的成长反映了其在减少行程和降低燃油消耗方面的价值,尤其是在地形和物流需求变化较大的作业中。

2024年,德国拉臂拖车市场产值达2.3亿美元,占28.6%的市占率。该国对智慧垃圾处理系统、永续发展和高效物流的重视,持续支撑拖车市场的需求。 Meiller、Krampe等本土製造商大力推动创新,强调自动化、长期耐用性和符合欧盟运输标准。

为了扩大市场份额,Palfinger、Stellar Industries、SwapLoader、Hiab、Stronga、Hyva Group、VDL Containersystemen 和 Marrel SAS 等主要参与者正在投资产品创新、整合液压系统和远端资讯处理。许多公司正在建立区域合作伙伴关係,加强售后支持,并提供根据不同最终用户需求量身定制的模组化设备选项。这些策略正在帮助企业满足日益增长的需求,同时在全球吊钩拖车领域树立性能标竿。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 零件供应商

- 製造商

- 车队营运商

- 经销商

- 最终用途

- 川普政府关税的影响

- 贸易影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(客户成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 贸易影响

- 利润率分析

- 技术与创新格局

- 专利分析

- 价格趋势

- 地区

- 轴

- 成本細項分析

- 重要新闻和倡议

- 监管格局

- 对部队的影响

- 成长动力

- 建筑和拆除活动增加

- 都市化和基础设施发展

- 对高效率物流的需求

- 政府对公共基础建设的投资

- 产业陷阱与挑战

- 初期投资成本高

- 维护和操作复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按车桥,2021 - 2034 年

- 主要趋势

- 单轴

- 双轴

- 三轴

- 多轴

第六章:市场估计与预测:按载客量,2021 - 2034

- 主要趋势

- 10吨以下

- 10–20吨

- 20–30吨

- 30吨以上

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 建筑与拆除

- 城市废弃物管理

- 回收作业

- 农业

- 采矿和采石

- 物流与运输

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第九章:公司简介

- Fahrzeugbau KEMPF

- Fliegl Agrartechnik

- Fors MW

- Fortuna Fahrzeugbau GmbH

- Hiab Corporation

- Hyva Group

- Joskin

- Krampe Fahrzeugbau

- Marrel SAS

- Meiller Group

- Metaltech

- MS DORSE

- Palfinger AG

- Palmse Metall

- Peeters Group

- Peter Kroger GmbH

- Stellar Industries

- Stronga

- SwapLoader USA

- VDL Containersystemen BV

The Global Hooklift Trailer Market was valued at USD 1.94 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 3.2 billion by 2034, driven by the surge in construction, demolition, and infrastructure development worldwide. These trailers are increasingly viewed as essential assets in waste handling, agriculture, mining, and logistics due to their flexibility, durability, and efficiency. As industries shift toward modular transport systems to optimize time and resources, hooklift trailers offer multi-functional hauling capabilities, allowing the use of various container types with a single vehicle platform.

This adaptability is particularly appealing in areas where jobsite conditions and cargo types vary widely, including dense urban locations, remote excavation areas, and expansive farmland. Additionally, as operations focus more on reducing downtime and operational costs, advanced hydraulic systems and smart technologies like IoT-based tracking are becoming key features. These integrations provide real-time diagnostics and maintenance alerts, improving fleet reliability and productivity while lowering total cost of ownership. By enabling remote monitoring and predictive maintenance, operators can identify issues before they escalate, reducing unplanned downtime and repair costs. Additionally, performance data collected through these systems allows for informed decision-making, optimizing fuel usage and driver behavior. Over time, this level of visibility supports better asset management, longer equipment lifespans, and more efficient scheduling and operational efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.94 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 5.9% |

The double axle trailers segment held a prominent 33.35% share in 2024 and is projected to grow at a CAGR of 6.7% through 2034. Known for balancing load-bearing strength with maneuverability, they're highly favored across sectors like agriculture, construction, and waste processing. Their design ensures stable handling and extended lifespan, even under demanding conditions. Reinforced frames and multi-container compatibility have made these trailers more effective for daily industrial use, while new fuel-efficient systems further support growing interest in sustainable solutions.

Hooklift trailers with a 20-30 ton capacity secured a 34.23% market share in 2024. This weight class strikes a critical balance between payload and versatility, making it ideal for transporting municipal waste, demolition materials, and mined resources. The segment's growth reflects its value in minimizing trips and reducing fuel consumption across operations with variable terrain and logistical needs.

Germany Hooklift Trailer Market generated USD 230 million and held 28.6% market share in 2024. The country's focus on smart waste systems, sustainable development, and efficient logistics continues to support trailer demand. Local manufacturers like Meiller, Krampe, and others have pushed innovations that emphasize automation, long-term durability, and compliance with EU transport standards.

To expand market presence, key players like Palfinger, Stellar Industries, SwapLoader, Hiab, Stronga, Hyva Group, VDL Containersystemen, and Marrel SAS are investing in product innovation, integrated hydraulics, and telematics. Many are forming regional partnerships, enhancing after-sales support, and offering modular equipment options tailored to diverse end-user needs. These strategies are helping companies meet growing demand while setting performance benchmarks in the global hooklift trailer space.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 Manufacturers

- 3.2.3 Fleet operators

- 3.2.4 Distributors

- 3.2.5 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Price trend

- 3.7.1 Region

- 3.7.2 Axle

- 3.8 Cost breakdown analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact on forces

- 3.11.1 Growth drivers

- 3.11.1.1 Increase in construction and demolition activities

- 3.11.1.2 Urbanization and infrastructure development

- 3.11.1.3 Demand for efficient logistics

- 3.11.1.4 Government investments in public infrastructure

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial investment cost

- 3.11.2.2 Maintenance and operational complexity

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Axle, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Single axle

- 5.3 Double axle

- 5.4 Triple axle

- 5.5 Multi- axle

Chapter 6 Market Estimates & Forecast, By Load Capacity, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Below 10 tons

- 6.3 10–20 tons

- 6.4 20–30 tons

- 6.5 Above 30 tons

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Construction & demolition

- 7.3 Municipal waste management

- 7.4 Recycling operations

- 7.5 Agriculture

- 7.6 Mining & quarrying

- 7.7 Logistics & transportation

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 Saudi Arabia

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Fahrzeugbau KEMPF

- 9.2 Fliegl Agrartechnik

- 9.3 Fors MW

- 9.4 Fortuna Fahrzeugbau GmbH

- 9.5 Hiab Corporation

- 9.6 Hyva Group

- 9.7 Joskin

- 9.8 Krampe Fahrzeugbau

- 9.9 Marrel SAS

- 9.10 Meiller Group

- 9.11 Metaltech

- 9.12 MS DORSE

- 9.13 Palfinger AG

- 9.14 Palmse Metall

- 9.15 Peeters Group

- 9.16 Peter Kroger GmbH

- 9.17 Stellar Industries

- 9.18 Stronga

- 9.19 SwapLoader USA

- 9.20 VDL Containersystemen BV