|

市场调查报告书

商品编码

1750442

光学相干断层扫描市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Optical Coherence Tomography Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

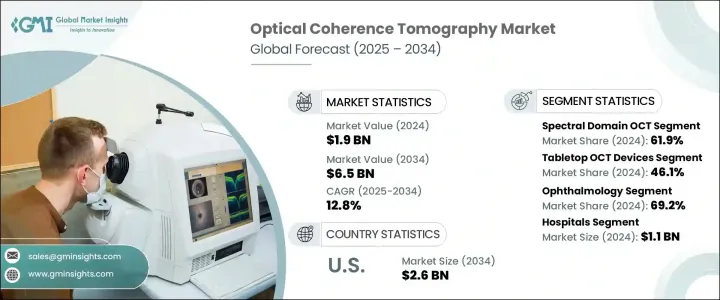

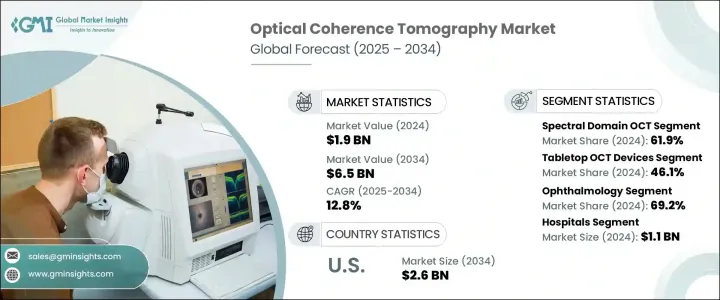

2024年,全球光学相干断层扫描 (OCT) 市场规模达19亿美元,预计到2034年将以12.8%的复合年增长率成长,达到65亿美元。这种成像方法利用低相干光产生生物组织高解析度横断面影像,在诊断眼部疾病方面特别有用。老年性黄斑部病变 (AMD)、糖尿病视网膜病变和青光眼等眼科疾病的发生率不断上升,推动了对OCT系统的需求。随着全球人口老化,尤其是在已开发国家,对慢性眼部疾病精准诊断工具的需求显着增长。

OCT技术的持续进步也促进了市场的成长,其改进包括更高的诊断精度、更强的组织穿透力和更快的成像速度。这些创新有助于临床医师在早期发现疾病,进而为患者提供更佳的治疗效果。研发投入的增加也是推动OCT技术应用的关键因素。随着医疗机构和製造商不断探索OCT的新应用,其应用范围正从传统的眼科扩展到其他医学专科。不断增长的研究和创新正在巩固OCT在世界各地医疗中心和专科诊所的影响力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 19亿美元 |

| 预测值 | 65亿美元 |

| 复合年增长率 | 12.8% |

市场按技术和类型划分。 2024年,频域OCT细分市场占据最大份额,占整个市场的61.9%。该技术因其能够捕捉视网膜和视神经的精细影像而备受青睐,这对于诊断青光眼、糖尿病视网膜病变和AMD等疾病至关重要。频域OCT系统功能多样,可为从术前影像到术后评估等各种应用提供全面的眼部护理解决方案。

桌上型OCT设备在市场上占据主导地位,2024年的市占率为46.1%。这些设备因其高精度、高稳定性以及与各种扫描模式的兼容性,广泛应用于医院、眼科中心和专科诊所。桌上型系统通常与先进的诊断工具(包括扫描雷射检眼镜和眼底照相机)配合使用,使其成为现代眼科诊断的重要组成部分。此外,手持式OCT设备的便携性和灵活性也日益受到青睐,为市场拓展提供了更多机会。

由于美国人口受到黄斑部病变、糖尿病视网膜病变和青光眼等与年龄相关的眼部疾病的影响,光学相干断层扫描 (OCT) 市场在 2024 年的产值达到 7.864 亿美元。 OCT 是这些疾病早期诊断和持续管理的关键工具,有助于预防视力丧失并改善患者的生活品质。该技术能够提供非侵入式即时成像,使其成为美国眼科护理的重要组成部分,确保患者和临床医生都能获得及时、准确的诊断。随着对先进诊断工具的需求不断增长,预计未来几年美国 OCT 设备市场将迅速扩张。

全球光学相干断层扫描 (OCT) 市场中的企业为巩固其市场地位所采取的关键策略包括:透过先进的 OCT 系统扩展产品组合,提高诊断成像的精确度和速度,以及投资于用于自动影像分析的 AI 整合等新技术。佳能医疗系统、蔡司和海德堡工程等领先企业正致力于开发具有卓越影像品质和易用性的 OCT 设备,以满足市场对可靠眼科护理解决方案日益增长的需求。他们也正在扩展全球分销网络,与医疗保健提供者建立策略合作伙伴关係,并利用线上平台扩大覆盖范围和使用范围。这些努力正在推动 OCT 系统在不同医疗环境中的成长和普及。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 眼部疾病盛行率不断上升

- OCT技术的进步

- 非侵入性诊断技术的采用日益增多

- 新兴经济体医疗保健投资和意识的增加

- 产业陷阱与挑战

- OCT设备及其维护成本高昂

- 缺乏经过训练、能够操作和解读 OCT 系统的熟练专业人员

- 成长动力

- 成长潜力分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑川普政府关税

- 对贸易的影响

- 技术格局

- 未来市场趋势

- 监管格局

- 专利分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争仪錶板

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 频域OCT

- 扫频源OCT

- 时域OCT

第六章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 桌上型 OCT 设备

- 基于导管的OCT设备

- 手持式OCT设备

- 多普勒OCT设备

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 眼科

- 心臟病学

- 皮肤科

- 肿瘤学

- 其他应用

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 诊断影像中心

- 门诊手术中心

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Abbott Laboratories

- Agfa-Gevaert

- Canon Medical Systems

- Carl Zeiss Meditec

- Danaher

- Heidelberg Engineering

- Michelson Diagnostics

- NIDEK

- Novacam Technologies

- OPTOPOL Technology

- Optos

- Santec

- Thorlabs

- Topcon

- ZD Medical

The Global Optical Coherence Tomography Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 12.8% to reach USD 6.5 billion by 2034, as the imaging method that uses low-coherence light to produce high-resolution cross-sectional images of biological tissues is especially useful in diagnosing eye-related conditions. The rising prevalence of ophthalmic diseases, such as age-related macular degeneration (AMD), diabetic retinopathy, and glaucoma, is driving the demand for OCT systems. As the global population ages, particularly in developed countries, the need for accurate diagnostic tools for chronic eye conditions has increased significantly.

The continued advancements in OCT technology are also contributing to market growth, with improvements that offer better diagnostic precision, enhanced tissue penetration, and faster imaging. These innovations are helping clinicians detect diseases at earlier stages, providing patients with better treatment outcomes. Increased investments in research and development are also a key factor driving the adoption of OCT technology. As healthcare providers and manufacturers continue to explore new applications for OCT, its usage is expanding beyond traditional ophthalmology to other medical specialties. This growing body of research and innovation is reinforcing OCT's presence in medical centers and specialty clinics around the world.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $6.5 Billion |

| CAGR | 12.8% |

The market is divided based on technology and type. The spectral domain OCT segment held the largest share in 2024, accounting for 61.9% of the total market. This technology is in high demand due to its ability to capture detailed images of the retina and optic nerve, crucial for diagnosing conditions like glaucoma, diabetic retinopathy, and AMD. Spectral domain OCT systems are also versatile, offering comprehensive eye care solutions for a wide range of applications, from pre-surgical imaging to post-operative assessments.

Tabletop OCT devices dominate the market by type, holding a market share of 46.1% in 2024. These devices are widely used in hospitals, ophthalmic centers, and specialty clinics due to their high precision, stability, and compatibility with various scanning modalities. Tabletop systems are often used alongside advanced diagnostic tools, including scanning laser ophthalmoscopy and fundus cameras, making them a vital part of modern eye care diagnostics. Additionally, the portability and flexibility of handheld OCT devices are also gaining traction, providing further opportunities for market expansion.

U.S. Optical Coherence Tomography Market generated USD 786.4 million in 2024 as the population is affected by age-related eye diseases such as macular degeneration, diabetic retinopathy, and glaucoma. OCT is a critical tool in the early diagnosis and ongoing management of these conditions, helping to prevent vision loss and improve the quality of life for affected individuals. The technology's ability to provide non-invasive, real-time imaging makes it an essential component of eye care in the U.S., ensuring that both patients and clinicians benefit from timely, accurate diagnoses. As demand for advanced diagnostic tools grows, the market for OCT devices in the U.S. is expected to expand rapidly in the coming years.

Key strategies adopted by companies in the Global Optical Coherence Tomography Market to strengthen their position include expanding their product portfolios with advanced OCT systems, enhancing the precision and speed of diagnostic imaging, and investing in new technologies like AI integration for automated image analysis. Leading players like Canon Medical Systems, Zeiss, and Heidelberg Engineering are focusing on developing OCT devices with superior image quality and ease of use, catering to the growing demand for reliable eye care solutions. They are also expanding their global distribution networks, forming strategic partnerships with healthcare providers, and leveraging online platforms for wider reach and access. These efforts are driving the growth and adoption of OCT systems across different healthcare settings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of eye disorders

- 3.2.1.2 Advancements in OCT technology

- 3.2.1.3 Rising adoption of non-invasive diagnostic techniques

- 3.2.1.4 Increasing healthcare investments and awareness in emerging economies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated to OCT devices and its maintenance

- 3.2.2.2 Shortage of skilled professionals trained to operate and interpret OCT systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the Industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerationsTrump administration tariffs

- 3.4.1 Impact on trade

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Regulatory landscape

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive dashboard

- 4.4 Company matrix analysis

- 4.5 Competitive analysis of major market players

- 4.6 Competitive positioning matrix

- 4.7 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Spectral domain OCT

- 5.3 Swept-source OCT

- 5.4 Time domain OCT

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Tabletop OCT devices

- 6.3 Catheter based OCT devices

- 6.4 Handheld OCT devices

- 6.5 Doppler OCT devices

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Ophthalmology

- 7.3 Cardiology

- 7.4 Dermatology

- 7.5 Oncology

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Diagnostic imaging centers

- 8.4 Ambulatory surgical centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 Japan

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Mexico

- 9.5.2 Brazil

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Agfa-Gevaert

- 10.3 Canon Medical Systems

- 10.4 Carl Zeiss Meditec

- 10.5 Danaher

- 10.6 Heidelberg Engineering

- 10.7 Michelson Diagnostics

- 10.8 NIDEK

- 10.9 Novacam Technologies

- 10.10 OPTOPOL Technology

- 10.11 Optos

- 10.12 Santec

- 10.13 Thorlabs

- 10.14 Topcon

- 10.15 ZD Medical