|

市场调查报告书

商品编码

1750444

储能钠离子电池市场机会、成长动力、产业趋势分析及2025-2034年预测Energy Storage Sodium Ion Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-- 2034 |

||||||

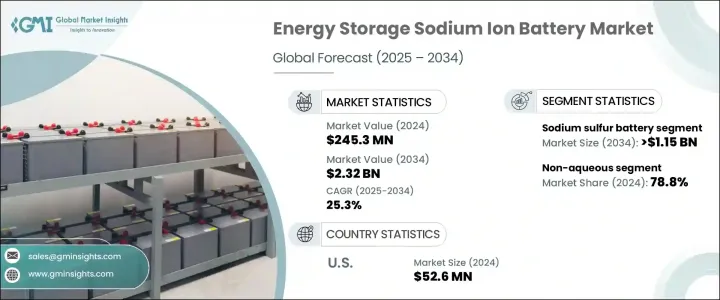

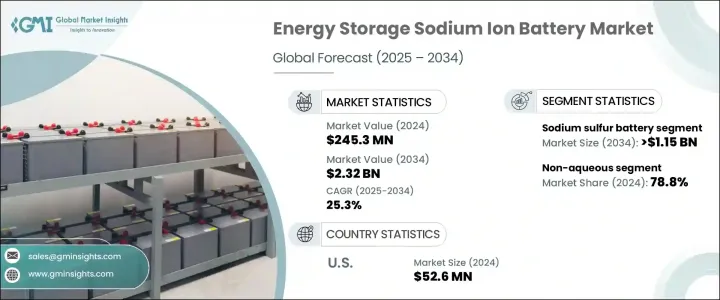

2024年,全球储能钠离子电池市场规模达2.453亿美元,预计到2034年将以25.3%的复合年增长率成长,达到23.2亿美元,这得益于对经济实惠且可持续的储能解决方案日益增长的需求。钠是地球上第六大元素,是一种环保的锂替代品,可降低电池生产的成本和供应链挑战。钠离子电池因其更安全的特性而日益普及,因为它们不易过热和热失控,非常适合大规模储能应用。

钠离子电池在稳定电网方面变得越来越重要,因为它们能够储存来自太阳能和风能等再生能源的多余能量,并在用电高峰期提供关键的备用电源。这些电池对于电网级储能尤其重要,因为它们能够承受长时间放电和深度循环,从而发挥重要作用。随着对可持续且经济高效的储能解决方案的需求不断增长,研发投入正在稳步提升钠离子电池的性能,并提高其效率和耐用性。这项进展使钠离子电池成为未来各种储能应用的有希望的替代方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.453亿美元 |

| 预测值 | 23.2亿美元 |

| 复合年增长率 | 25.3% |

钠离子电池市场种类繁多,目前已有多种不同类型电池正在针对特定应用进行开发。钠硫电池市场预计将大幅成长,预计到2034年市场价值将达到11.5亿美元。这类电池能量密度极高,循环寿命长达4,500次以上,是需要高温运转的固定式储能係统的理想选择。钠硫电池通常在300°C至350°C的温度下运行,特别适用于效率和可靠性至关重要的大规模电网级储能和备用电源系统。

非水钠离子电池是市场成长的另一个关键贡献因素。这类电池在2024年占据78.8%的市场份额,与其他类型的电池相比,其更高的耐温性和更优异的能量性能备受青睐。它们能够在从电网储能到移动出行的各种环境下运行,使其成为能源公司和电动车製造商的理想解决方案,用途广泛。

北美储能钠离子电池市场在2024年占据23.2%的市场份额,预计未来几年将大幅成长。钠离子电池作为一种经济高效且国产化的替代能源,正日益受到青睐,而锂离子电池则依赖进口。钠的丰富资源和相对较低的成本,为能源安全和开发更永续的能源解决方案提供了战略优势。人们对钠离子电池日益增长的兴趣凸显了其透过减少对进口材料的依赖并增强能源产业整体可持续性来改变储能格局的潜力。

全球储能钠离子电池市场的领先公司包括Faradion Limited、Northvolt、Tiamat、Altris和CATL。这些公司正在积极开发新技术,以提高钠离子电池在大规模储能应用中的性能、可扩展性和安全性。为了巩固市场地位,Faradion Limited和Northvolt等钠离子电池行业的公司正致力于透过提高效率和循环寿命来改进其电池技术。他们正在大力投资研发,以开发更永续和成本效益的解决方案,以满足日益增长的储能需求。此外,与再生能源供应商的策略合作伙伴关係以及政府支持的措施正在帮助这些公司扩大市场影响力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依类型,2021 - 2034

- 主要趋势

- 钠硫电池

- 钠盐电池

- 钠空气电池

第六章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 水性

- 非水性

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 世界其他地区

第八章:公司简介

- Altris

- CATL

- China BAK Battery

- Faradion Limited

- HiNa Battery Technology

- Li-FUN Technology

- Northvolt

- Natron Energy

- SVOLT

- Tiamat

The Global Energy Storage Sodium Ion Battery Market was valued at USD 245.3 million in 2024 and is estimated to grow at a CAGR of 25.3% to reach USD 2.32 billion by 2034, driven by the increasing demand for affordable and sustainable energy storage solutions. Sodium, being the sixth most abundant element on Earth, offers an environmentally friendly alternative to lithium, reducing both the cost and supply chain challenges associated with battery production. Sodium-ion batteries are gaining popularity due to their safer properties, as they are less prone to overheating and thermal runaway, making them suitable for large-scale energy storage applications.

Sodium-ion batteries are becoming increasingly essential in stabilizing power grids, as they store excess energy from renewable sources such as solar and wind and provide critical backup power during peak demand periods. These batteries are especially valuable for grid-level energy storage, where their ability to handle long discharge cycles and deep cycling can make a significant impact. As the demand for sustainable and cost-effective energy storage solutions grows, investments in research and development are steadily improving the performance of sodium-ion batteries, enhancing their efficiency and durability. This progress positions sodium-ion batteries as a promising alternative for a variety of energy storage applications in the future.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $245.3 Million |

| Forecast Value | $2.32 Billion |

| CAGR | 25.3% |

The sodium-ion battery market is diverse, with several distinct types being developed for specific applications. The sodium-sulfur battery segment is expected to witness substantial growth, with projections indicating a market value of USD 1.15 billion by 2034. These batteries offer exceptional energy density and long cycle life, capable of more than 4,500 cycles, making them ideal for stationary energy storage systems that require high-temperature operation. Typically operating at temperatures ranging from 300°C to 350°C, sodium-sulfur batteries are particularly well-suited for large-scale grid-level storage and backup power systems, where efficiency and reliability are critical.

The non-aqueous sodium-ion battery segment is another key contributor to the market's growth. These batteries, which account for 78.8% share in 2024, are favored for their enhanced temperature tolerance and superior energy performance compared to other battery types. Their ability to operate in diverse environments, ranging from grid storage to mobility applications, makes them a versatile and highly desirable solution for energy companies and electric vehicle manufacturers.

North America Energy Storage Sodium Ion Battery Market held a 23.2% share in 2024 and is expected to grow significantly in the coming years. Sodium-ion batteries are gaining traction as a cost-effective and domestically produced alternative to lithium-ion batteries, dependent on imports. The abundant availability of sodium, combined with its relatively lower cost, provides a strategic advantage in energy security and the development of more sustainable energy solutions. This growing interest in sodium-ion batteries underscores their potential to transform the energy storage landscape by reducing reliance on imported materials and enhancing the overall sustainability of the energy sector.

Leading companies in the Global Energy Storage Sodium Ion Battery Market include Faradion Limited, Northvolt, Tiamat, Altris, and CATL. These companies are actively developing new technologies to enhance the performance, scalability, and safety of sodium-ion batteries for large-scale energy storage applications. To strengthen their market presence, companies in the sodium-ion battery industry, such as Faradion Limited and Northvolt, are focusing on advancing their battery technologies by improving efficiency and cycle life. They are investing heavily in research to develop more sustainable and cost-effective solutions to meet the growing demand for energy storage. Additionally, strategic partnerships with renewable energy providers and government-backed initiatives are helping these companies expand their market footprint.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Sodium sulfur battery

- 5.3 Sodium salt battery

- 5.4 Sodium air battery

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Aqueous

- 6.3 Non aqueous

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 UK

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 South Korea

- 7.4.4 India

- 7.5 Rest of World

Chapter 8 Company Profiles

- 8.1 Altris

- 8.2 CATL

- 8.3 China BAK Battery

- 8.4 Faradion Limited

- 8.5 HiNa Battery Technology

- 8.6 Li-FUN Technology

- 8.7 Northvolt

- 8.8 Natron Energy

- 8.9 SVOLT

- 8.10 Tiamat