|

市场调查报告书

商品编码

1750450

水上自行车市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Hydrobikes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

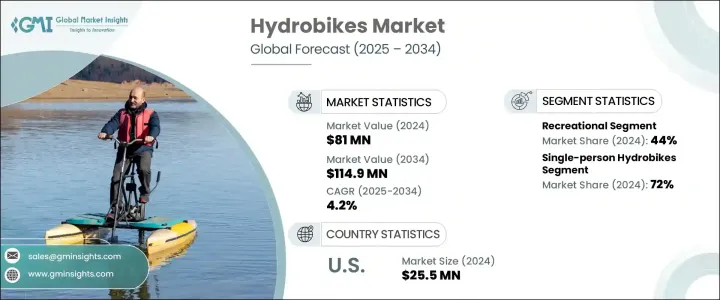

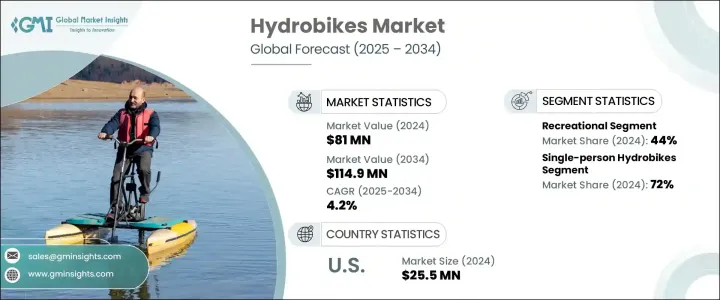

2024 年全球水上自行车市场规模达 8,100 万美元,预计到 2034 年将以 4.2% 的复合年增长率增长至 1.149 亿美元。消费者日益关注健康和保健是推动全球水上自行车需求的主要力量之一。这些水上交通工具提供全身低衝击的锻炼,吸引了寻求传统健身方式替代方案的人士。随着越来越多的人寻求将户外娱乐与身体健康相结合、既有趣又有益于关节健康的活动,水上运动的受欢迎程度持续攀升。随着消费者越来越注重生活方式的选择,他们正在积极转向可持续的、基于自然的健身方式,以支持健康和环境保护。水上自行车产业也受益于更广泛的生活方式转变,包括户外休閒活动和健身旅游的兴起,以及人们越来越重视体验而非物质。所有这些因素都促使不同消费族群越来越多地采用脚踏水上自行车。

环保旅行和户外探险的兴起为水上自行车市场的成长奠定了坚实的基础。随着旅客寻求可持续的沉浸式体验,不依赖燃料或电力的水上休閒设备正变得越来越有吸引力。水上自行车提供了一种引人入胜的方式,可以在不破坏环境的情况下探索湖泊、河流和沿海地区。其零排放设计使其成为游客、家庭和自然爱好者的理想之选,他们希望在享受水上乐趣的同时,保留其自然美景。这种旅游行为的转变不仅提升了人们对环保交通的兴趣,也增加了对符合负责任旅行实践的独特、活跃体验的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 8100万美元 |

| 预测值 | 1.149亿美元 |

| 复合年增长率 | 4.2% |

就应用而言,水上自行车市场分为休閒、健身、旅游和其他类别。休閒类市场在2024年占据44%的市场份额,占据主导地位,预计在此期间的复合年增长率将超过4.5%。水上自行车因其用户友好的设计和多功能性而尤其受到休閒用途的青睐。无论是单人出游还是休閒的家庭娱乐,它们都能让您轻鬆享受水上乐趣,无需事先掌握任何经验或承受体力负荷。这种广泛的吸引力使其在各个年龄层都极具吸引力,并显着巩固了该细分市场的主导地位。

根据产品类型,市场分为单人水上自行车和多人水上自行车。 2024年,单人水上自行车占据了72%的市场份额,预计到2034年将继续以4%以上的复合年增长率成长。其强劲表现主要得益于价格实惠、体积小巧和便利性。这些车型易于存放、运输和操作,吸引了许多普通用户和个人买家。随着越来越多的消费者重视个人健康和单人户外活动,单人骑乘的需求仍然强劲。

按配销通路细分,市场包括线上商店、专卖店、运动用品零售商等。由于快速数位化、更广泛的产品覆盖范围以及对电商平台日益增长的依赖,线上商店在2024年成为领先的销售管道。线上平台通常透过降低营运成本和直销提供更优惠的价格,对注重预算的购物者更具吸引力。此外,促销优惠、快速配送和便利的商品比较服务,为追求便利性和价值的顾客提升了整体购物体验。

从地区来看,美国在北美市场占据主导地位,约占该地区总收入的81%,2024年的收入约为2,550万美元。美国市场受益于其浓厚的户外和水上休閒文化,以及消费者在健身和休閒设备上的高支出。美国拥有广阔的湖泊、河流和沿海地区网络,加上人们日益增长的可持续休閒意识,为水上自行车的普及提供了肥沃的土壤。鼓励环保交通和公共水利基础设施投资的支持性政策也对此市场的发展起到了推动作用。

目前的市场策略高度重视创新和以使用者为中心的设计。製造商正在积极开发模组化和可折迭的型号,以提高便携性和简化储存。轻量化结构、可互换零件和耐用性是关键的设计要素,旨在降低生产成本并提高供应链效率。此外,订阅和租赁模式正日益受到青睐,尤其是在面向游客和季节性游客的企业中。这些模式为度假村、市政当局和探险公司提供了灵活的使用选择,为直接购买提供了相当吸引人的替代方案。

技术整合是另一个新兴趋势。製造商正在整合GPS导航、应用程式整合和效能追踪等功能,以吸引精通技术的用户,并简化租赁供应商的车队管理。这些数位化增强功能可提供客製化的骑乘体验,并支援营运商进行数据驱动的决策。企业也正在投资包括现场演示、社群拓展和社群媒体活动在内的行销策略,以提升品牌知名度并吸引潜在客户。这些倡议对于建立信任并推动向新兴区域市场扩张至关重要。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 零件製造商

- 水上自行车製造商/组装商

- 分销和销售管道

- 最终用户

- 利润率分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 其他国家的报復措施

- 对产业的影响

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 展望与未来考虑

- 对贸易的影响

- 技术与创新格局

- 价格趋势

- 地区

- 产品

- 成本細項分析

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 健康和健身意识不断增强

- 人们对环保和永续休閒的偏好日益增长

- 水上自行车设计的技术进步

- 扩大探险和生态旅游活动

- 政府对水上旅游和水上运动的支持

- 产业陷阱与挑战

- 水上自行车的初始成本高

- 来自替代船隻的竞争

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 单人水上自行车

- 多人水上自行车

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 休閒娱乐

- 健康

- 旅游

- 其他的

第七章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 铝

- 不銹钢

- 碳纤维

- 塑胶

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 网上商店

- 专卖店

- 体育用品店

- 其他的

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 个人的

- 商业的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Aqua-Cycles

- Aurea Bike

- Austin Water Bikes

- Chiliboats

- Crystal Kayak Company

- Hobie Cat Company

- Hydrobikes

- Manta5

- Mirage Pedalcraft

- Pelican Sport

- Pioner Boats

- Qingdao Haoyang Boat

- Red Shark Bikes

- Ripple Kayaks

- SBK Engineering

- Schiller Bikes

- Seacycle

- Waterbike Italia

- Watercraft Innovations

- Wuxi Funsor Marine Equipment

The Global Hydrobikes Market was valued at USD 81 million in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 114.9 million by 2034. Increasing consumer focus on health and wellness is one of the primary forces fueling demand for hydrobikes worldwide. These watercraft offer a full-body, low-impact workout that attracts individuals looking for alternatives to traditional fitness routines. The popularity of water-based exercises continues to climb as more people seek enjoyable and joint-friendly activities that combine outdoor recreation with physical wellness. As consumers become increasingly conscious of their lifestyle choices, they are actively shifting toward sustainable, nature-based fitness options that support both health and environmental preservation. The hydrobike industry also benefits from broader lifestyle shifts, including the rise of outdoor leisure activities, fitness tourism, and a growing appreciation for experiences over possessions. All these factors contribute to the increased adoption of pedal-powered water bikes across diverse consumer groups.

The rise of eco-conscious travel and outdoor exploration has created a strong foundation for the hydrobikes market to grow. As travelers look for sustainable and immersive experiences, water-based recreational equipment that doesn't rely on fuel or electricity is becoming increasingly attractive. Hydrobikes deliver an engaging way to explore lakes, rivers, and coastal areas without harming the environment. Their zero-emission design makes them ideal for tourists, families, and nature lovers who want to enjoy the water while preserving its natural beauty. This shift in tourism behavior is not only elevating interest in eco-friendly transportation but also increasing demand for unique, active experiences that align with responsible travel practices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $81 Million |

| Forecast Value | $114.9 Million |

| CAGR | 4.2% |

In terms of application, the hydrobikes market is categorized into recreational, fitness, tourism, and others. The recreational segment led the market in 2024 with a 44% share and is projected to expand at a CAGR exceeding 4.5% during the forecast timeframe. Hydrobikes are particularly favored for leisure purposes due to their user-friendly design and versatility. Whether for solo outings or casual family fun, they provide a stress-free way to enjoy water environments without requiring prior experience or physical strain. This widespread appeal makes them highly attractive across age groups and contributes significantly to the segment's dominance.

On the basis of product type, the market is divided into single-person hydrobikes and multi-person hydrobikes. In 2024, single-person hydrobikes held a commanding 72% share and are expected to continue growing at a CAGR above 4% through 2034. Their strong performance is largely driven by affordability, compact size, and convenience. These models are easy to store, transport, and operate, which appeals to casual users and individual buyers. As more consumers prioritize personal wellness and solo outdoor activities, demand for single-rider options remains strong.

When segmented by distribution channel, the market includes online stores, specialty stores, sporting goods retailers, and others. Online stores emerged as the leading sales channel in 2024, supported by rapid digitalization, broader product reach, and increasing reliance on e-commerce platforms. Online platforms often offer better pricing through reduced overheads and direct sales, making them more appealing to budget-conscious shoppers. Additionally, promotional offers, fast delivery, and easy comparisons enhance the overall buying experience for customers seeking convenience and value.

Regionally, the United States led the North American market with around 81% of regional revenue and generated approximately USD 25.5 million in 2024. The U.S. market benefits from a strong culture of outdoor and water-based recreation, as well as high consumer spending on fitness and leisure equipment. The country's vast network of lakes, rivers, and coastal areas, combined with growing awareness about sustainable recreation, provides fertile ground for hydrobike adoption. Supportive policies that encourage environmentally friendly transportation and investments in public water infrastructure also play a role in promoting this market.

Current market strategies focus heavily on innovation and user-centric design. Manufacturers are actively developing modular and foldable models that enhance portability and simplify storage. Lightweight construction, interchangeable parts, and durability are key design elements aimed at reducing production costs and improving supply chain efficiency. In addition, subscription-based and leasing models are gaining traction, particularly among businesses that cater to tourists and seasonal visitors. These models offer flexible usage options for resorts, municipalities, and adventure companies, providing an attractive alternative to outright purchases.

Technology integration is another emerging trend. Manufacturers are incorporating features such as GPS navigation, app integration, and performance tracking to engage tech-savvy users and streamline fleet management for rental providers. These digital enhancements offer a customized riding experience and support data-driven decisions for operators. Companies are also investing in marketing strategies that include live demonstrations, community outreach, and social media campaigns to create brand visibility and educate potential customers. These initiatives are key to building trust and driving expansion into emerging regional markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Hydrobike manufacturers/assemblers

- 3.2.4 Distribution and sales channels

- 3.2.5 End users

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.6.1 Region

- 3.6.2 Product

- 3.7 Cost breakdown analysis

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising health and fitness consciousness

- 3.11.1.2 Growing preference for eco-friendly and sustainable recreation

- 3.11.1.3 Technological advancements in hydrobike design

- 3.11.1.4 Expansion of adventure and eco-tourism activities

- 3.11.1.5 Government support for water-based tourism and sports

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial cost of hydrobikes

- 3.11.2.2 Competition from alternative watercraft

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Single-person hydrobikes

- 5.3 Multi-person hydrobikes

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Recreational

- 6.3 Fitness

- 6.4 Tourism

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Aluminum

- 7.3 Stainless steel

- 7.4 Carbon fiber

- 7.5 Plastic

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Online stores

- 8.3 Specialty stores

- 8.4 Sporting goods stores

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Personal

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aqua-Cycles

- 11.2 Aurea Bike

- 11.3 Austin Water Bikes

- 11.4 Chiliboats

- 11.5 Crystal Kayak Company

- 11.6 Hobie Cat Company

- 11.7 Hydrobikes

- 11.8 Manta5

- 11.9 Mirage Pedalcraft

- 11.10 Pelican Sport

- 11.11 Pioner Boats

- 11.12 Qingdao Haoyang Boat

- 11.13 Red Shark Bikes

- 11.14 Ripple Kayaks

- 11.15 SBK Engineering

- 11.16 Schiller Bikes

- 11.17 Seacycle

- 11.18 Waterbike Italia

- 11.19 Watercraft Innovations

- 11.20 Wuxi Funsor Marine Equipment