|

市场调查报告书

商品编码

1750452

军用机器狗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Military Robot Dogs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

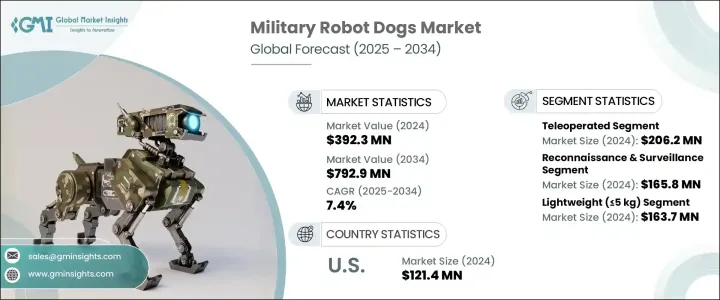

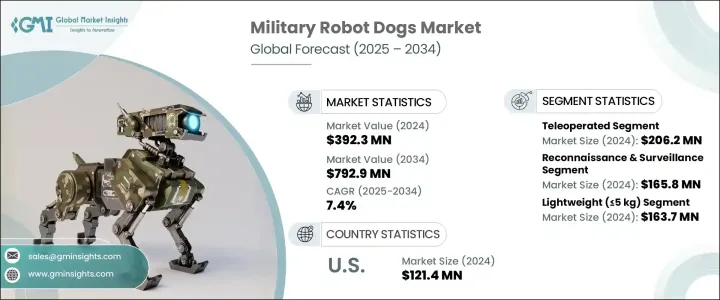

2024年,全球军用机器狗市场价值为3.923亿美元,预计到2034年将以7.4%的复合年增长率增长,达到7.929亿美元,这得益于全球国防预算的不断增加,以及对增强士兵安全和部队防护技术日益增长的需求。军用机器狗的研发备受关注,因为这些机器人可以执行侦察、监视和爆炸物处理 (EOD) 等关键任务。它们能够在城市废墟或化学-生物-放射-核 (CBRN) 区域等危险环境中行动,为军事人员带来巨大益处。

市场也受到贸易紧张等地缘政治因素的影响,导致某些海外零件的生产成本上升。这些干扰促使製造商考虑将生产转移回国内并调整采购策略。由于国防承包商面临着提升技术能力的压力,军用机器狗开发商正专注于自主解决方案和针对特定任务的设计,以满足现代战争不断变化的需求。人们对网路中心战日益增长的兴趣进一步推动了机器狗的应用,这些机器狗可以整合到更大型的军事系统中,从而实现战场上的即时通讯和协调。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.923亿美元 |

| 预测值 | 7.929亿美元 |

| 复合年增长率 | 7.4% |

遥控系统在军用机器狗市场占据主导地位,2024 年市场价值达 2.062 亿美元。这些系统提供手动控制,使操作员能够在炸弹探测、人质救援和其他危险任务等高风险情况下远端管理机器狗。这种能力降低了伤亡的可能性,确保了士兵在关键任务期间的安全。此外,与完全自主的机器狗相比,遥控机器狗的开发速度更快、成本更低,使其成为寻求经济高效可靠方案的国防部队的实用解决方案。它们能够快速部署并用于即时作战,这是它们仍然是军事应用首选的主要原因之一,尤其是在快速反应至关重要的环境中。

就功能而言,军用机器狗的侦察和监视领域在2024年创造了1.658亿美元的市场规模。这些机器人配备了尖端技术,包括光达、夜视技术和人工智慧光学系统,从而增强了它们即时探测和分析潜在威胁的能力。军用机器狗能够发现敌人的动向、简易爆炸装置或狙击手,这在战术行动中发挥着不可估量的作用。由于噪音低且视觉特征清晰,它们具有隐蔽性,非常适合隐蔽行动,因为在隐蔽行动中,避免被发现至关重要。

2024年,德国军用机器狗市场产值达2,220万美元。德国的国防现代化战略与北约的目标和欧洲国防合作一致,正在显着推动机器人系统的普及。军用机器狗越来越多地被用于边境监视、跨境行动和快速反应任务,因为它们在具有挑战性的地形中具有更强的机动性和多功能性。德国致力于技术创新和在PESCO和欧洲防务基金(EDF)等项目下的防务合作,为机器人解决方案在其国防行动中的整合创造了有利环境。

全球军用机器狗产业的主要参与者包括波士顿动力公司 (Boston Dynamics)、宇树机器人公司 (Unitree Robotics)、Addverb Technologies、Ghost Robotics 和 Deep Robotics。这些公司专注于增强机器人性能,整合尖端感测器,并提高其在恶劣环境下的可靠性和耐用性。此外,许多製造商正在强调自主任务专用系统,这些系统可以增强兵力,改善排爆作业 (EOD) 并支援后勤任务。透过投资研发并与国防机构合作,AeroArc 和西安超音速航空技术公司等公司正在巩固其市场地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 关键零件价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 全球军费开支不断增加

- 人工智慧与机器视觉的融合

- 对士兵安全和部队保护的需求不断增长

- 城市战争场景的成长

- 增强战术机动性

- 产业陷阱与挑战

- 网路安全与骇客风险

- 电池寿命和续航限制

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按控制模式,2021 年至 2034 年

- 主要趋势

- 遥控

- 完全自主

- 半自主

第六章:市场估计与预测:依酬载容量,2021 年至 2034 年

- 主要趋势

- 轻便(≤5公斤)

- 中等体重(5-10公斤)

- 重型(>10 公斤)

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 侦察和监视

- 夜间巡逻

- 前瞻性观察

- 在敌对地形进行隐身监视

- 战斗支援

- 搜救

- 爆炸物处理(EOD)

- 地雷探测

- CBRN环境评估

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Addverb Technologies

- AeroArc

- Boston Dynamics

- Deep Robotics

- Edith Defense Systems

- Ghost Robotics

- Svaya Robotics

- Unitree Robotics

- Xian Supersonic Aviation Technology

The Global Military Robot Dogs Market was valued at USD 392.3 million in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 792.9 million by 2034, driven by the increasing defense budgets worldwide and the growing demand for technologies that enhance soldier safety and force protection. The development of military robot dogs has gained significant attention, as these robots can perform critical tasks such as reconnaissance, surveillance, and explosive ordnance disposal (EOD) operations. Their ability to operate in hazardous environments, including urban ruins or chemical-biological-radiological-nuclear (CBRN) zones, offers substantial benefits to military personnel.

The market is also influenced by geopolitical factors such as trade tensions, which have led to higher production costs for certain components sourced from overseas. These disruptions have prompted manufacturers to consider reshoring production and adjusting procurement strategies. As defense contractors are under pressure to enhance their technological capabilities, military robot dog developers are focusing on autonomous solutions and mission-specific designs to meet the evolving demands of modern warfare. The growing interest in network-centric warfare has further propelled the adoption of robot dogs that can be integrated into larger military systems, allowing for real-time communication and coordination on the battlefield.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $392.3 Million |

| Forecast Value | $792.9 Million |

| CAGR | 7.4% |

Teleoperated control systems dominate the military robot dogs market, valued at USD 206.2 million in 2024. These systems provide manual control, enabling operators to remotely manage robot dogs in high-risk situations like bomb detection, hostage rescue, and other hazardous missions. This capability reduces the potential for human casualties, ensuring soldiers' safety during critical tasks. Additionally, teleoperated robot dogs are quicker and more affordable to develop compared to their fully autonomous counterparts, making them a practical solution for defense forces looking for cost-effective and reliable options. Their ability to be swiftly deployed and used in real-time operations is one of the main reasons they remain the preferred choice for military applications, particularly in environments where rapid response is essential.

In terms of functionality, the reconnaissance and surveillance segment in military robot dogs generated USD 165.8 million in 2024. These robots are equipped with cutting-edge technologies, including LiDAR, night vision, and AI-powered optics, that enhance their ability to detect and analyze potential threats in real time. Military robot dogs can spot enemy movements, IEDs, or snipers, making them invaluable in tactical operations. Their stealthy nature, due to their low noise and visual signature, makes them perfect for covert operations, where avoiding detection is paramount.

Germany Military Robot Dogs Market generated USD 22.2 million in 2024. Germany's defense modernization strategy, in line with NATO's objectives and European defense collaborations, is significantly driving the adoption of robotic systems. Military robot dogs are increasingly being used for border surveillance, cross-border operations, and rapid-response missions, as they offer enhanced mobility and versatility in challenging terrains. Germany's commitment to technological innovation and defense cooperation under programs like PESCO and the European Defence Fund (EDF) has created a favorable environment for the integration of robotic solutions in its defense operations.

Key players in the Global Military Robot Dogs Industry include Boston Dynamics, Unitree Robotics, Addverb Technologies, Ghost Robotics, and Deep Robotics. These companies are focusing on enhancing robot capabilities, integrating cutting-edge sensors, and improving reliability and durability in harsh environments. Additionally, many manufacturers are emphasizing autonomous mission-specific systems that can provide force multiplication, improve EOD operations, and support logistics tasks. By investing in R&D and collaborating with defense organizations, companies like AeroArc and Xian Supersonic Aviation Technology are strengthening their positions in the market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising military expenditures globally

- 3.3.1.2 Integration of AI and machine vision

- 3.3.1.3 Growing demand for soldier safety and force protection

- 3.3.1.4 Growth in urban warfare scenarios

- 3.3.1.5 Enhanced tactical mobility

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Cybersecurity and hacking risks

- 3.3.2.2 Battery life and endurance limitations

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Control Mode, 2021 – 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Teleoperated

- 5.3 Fully autonomous

- 5.4 Semi-autonomous

Chapter 6 Market Estimates and Forecast, By Payload Capacity, 2021 – 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Lightweight (≤5 kg)

- 6.3 Medium weight (5–10 kg)

- 6.4 Heavy duty (>10 kg)

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Reconnaissance and surveillance

- 7.2.1 Night-time patrols

- 7.2.2 Forward observation

- 7.2.3 Stealth surveillance in hostile terrain

- 7.3 Combat Support

- 7.4 Search and rescue

- 7.5 Explosive ordnance disposal (EOD)

- 7.5.1 Mine detection

- 7.5.2 CBRN environment assessment

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Addverb Technologies

- 9.2 AeroArc

- 9.3 Boston Dynamics

- 9.4 Deep Robotics

- 9.5 Edith Defense Systems

- 9.6 Ghost Robotics

- 9.7 Svaya Robotics

- 9.8 Unitree Robotics

- 9.9 Xian Supersonic Aviation Technology