|

市场调查报告书

商品编码

1750457

抗衰老和长寿补充和替代药物市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Complementary and Alternative Medicine for Anti-Aging and Longevity Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

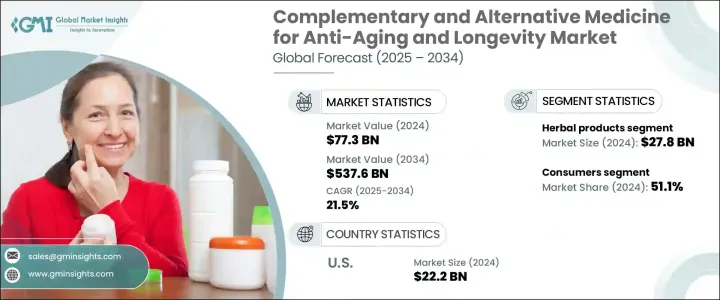

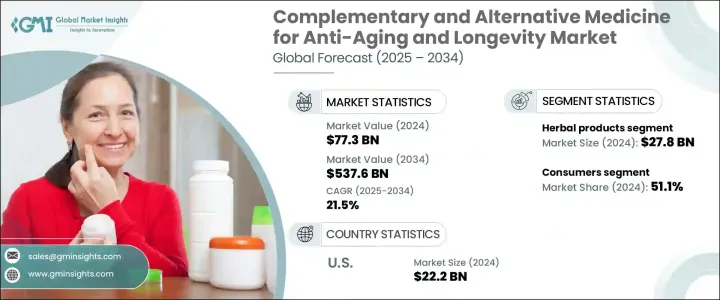

2024年,全球抗老和长寿补充及替代医学市场规模达773亿美元,预计到2034年将以21.5%的复合年增长率增长,达到5376亿美元。这要归功于越来越多的消费者选择非侵入性和整体疗法来应对老化并提升活力。人们对健康和预防的日益重视,也刺激了对支持细胞修復、调节荷尔蒙平衡和缓解压力的补充及替代医学疗法的需求。

全球消费者在应对老化方面日益积极主动,寻求传统药物治疗以外的替代方案。他们转向自然疗法,认为这些疗法不仅有望增强活力、改善容貌,还能延长寿命。随着健康产业日益个人化,客製化养生方案正成为显着趋势,这些方案将古老的疗法与人工智慧和基因组学等尖端技术相结合。这种融合使得针对老化的个人化方法得以实现,比以往任何时候都更精准地满足个人需求。人们对补充和替代医学 (CAM) 日益增长的兴趣是这一趋势的关键驱动因素。这反映了一种更广泛的文化转变,即转向综合健康方法,将整体疗法与传统医学相结合,为老化提供更全面的解决方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 773亿美元 |

| 预测值 | 5376亿美元 |

| 复合年增长率 | 21.5% |

2024年,草药产品市场因其长期使用和日益增长的科学验证而创造了278亿美元的收入。采用植物成分配製的天然产品因其抗氧化和抗发炎特性而备受青睐,有助于促进健康老化。人们对精准萃取技术和智慧配方的兴趣日益浓厚,这提升了产品功效和消费者体验。

抗衰老和长寿补充替代药物市场的消费者群体占据了51%的市场份额,这得益于寻求整体老龄化支持的消费者需求的不断增长。虽然老年人仍然占据主要使用人群,但年轻人也正在加入这一行列,他们采用补充替代药物来管理压力、增强免疫力并延缓老化迹象。这种人口结构的变化是由健康文化、社交媒体的影响以及日益增长的预防性护理而非被动治疗的偏好所驱动的。对长寿的渴望,加上对非药物替代品的认知,影响着所有年龄层的购买行为。

2024年,美国抗老和长寿补充及替代医学市场规模达222亿美元,并将继续成为补充及替代医学应用的关键枢纽。以健康为中心的诊所、疗养水疗中心和整合医疗机构的兴起改变了这一格局。随着人口老化和健康生活意识的不断增强,美国消费者正在增加对整体医疗方案的投资,以支持认知健康、关节活动和皮肤再生。随着补充及替代医学可近性的提高以及与传统医疗的融合,未来十年,美国各地的需求将大幅成长。

全球抗衰老和长寿补充和替代医学市场中的公司正在大力投资个人化健康,扩大全球影响力,并使其天然产品线多样化。 iHerb 和 Dabur India 利用电商平台渗透新地区并扩大分销规模。 Herbivore Botanicals 和雪花秀专注于采用草本配方的高端护肤品,以逆转可见的衰老。 Patanjali Ayurved 和 Kama Ayurveda 强调将传统疗法与现代科学相结合,以满足消费者对清洁标籤解决方案日益增长的需求。同时,Mountain Rose Herbs 和 Rocky Mountain Oils 正在透过针对性补充剂和精油扩展其产品组合。 SEVA Experience 和 Maya Reiki School 等公司正透过体验式健康服务提升品牌忠诚度。这些策略正在重塑市场动态,加剧全球竞争。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 消费者对整体健康和长寿的意识不断提高

- 人口老化加剧,对年轻外表的需求不断增加

- 天然配方和CAM技术的进步

- 产业陷阱与挑战

- CAM 实务缺乏科学验证

- 专门的抗衰老疗法费用高昂

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按干预类型,2021 - 2034 年

- 主要趋势

- 草本产品

- 阿育吠陀

- 自然疗法

- 中药

- 臟腑理论

- 其他草本产品

- 身心介入

- 瑜珈

- 针灸和按摩

- 脊椎矫正疗法

- 气功和太极拳

- 冥想和正念

- 其他身心干预

- 外部能量疗癒

- 磁疗和电磁疗法

- 脉轮疗癒

- 灵气

- 其他外在能量治疗

- 感官疗癒

- 芳香疗法

- 声音疗癒

第六章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 消费者

- 医疗保健从业者

- 企业健康计划

- 其他最终用途

第七章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Dabur India

- First Natural Brands

- Herb Pharm

- Herbivore Botanicals

- iHerb

- Kama Ayurveda

- Maya Reiki School

- Mountain Rose Herbs

- Patanjali Ayurved

- Rocky Mountain Oils

- SEVA Experience

- Sulwhasoo

- Wei Beauty

The Global Complementary and Alternative Medicine for Anti-Aging and Longevity Market was valued at USD 77.3 billion in 2024 and is estimated to grow at a CAGR of 21.5% to reach USD 537.6 billion by 2034, driven by the rapid growth of consumers increasingly opting for non-invasive and holistic methods to manage aging and boost vitality. The rising emphasis on wellness and prevention has amplified demand for CAM therapies that support cellular repair, hormonal balance, and stress reduction.

Consumers around the globe are becoming increasingly proactive in addressing the aging process, seeking alternatives beyond traditional pharmaceutical treatments. They are turning to natural therapies that promise not only to enhance energy and improve appearance but also to extend their lifespan. As the wellness industry becomes more personalized, there is a notable shift towards customized regimens that blend ancient healing practices with cutting-edge technology, such as AI and genomics. This fusion allows for tailored approaches to aging, targeting individual needs more precisely than ever. The growing interest in complementary and alternative medicine (CAM) is a key driver of this trend. It reflects a broader cultural shift towards integrative approaches to health, where holistic methods work alongside conventional medicine to provide a more comprehensive solution for aging.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $77.3 Billion |

| Forecast Value | $537.6 Billion |

| CAGR | 21.5% |

The herbal products segment generated USD 27.8 billion in 2024 due to their long-standing use and increasing scientific validation. Natural products formulated with plant-based ingredients are favored for their antioxidant and anti-inflammatory properties that promote healthy aging. Growing interest in precision extraction techniques and smart formulations improves product potency and consumer outcomes.

Consumer segment in the complementary and alternative medicine for anti-aging and longevity market held 51% share, driven by the rising demand from consumers seeking holistic aging support. While older adults continue to dominate usage, younger populations are joining in, adopting CAM to manage stress, boost immunity, and slow visible signs of aging. This demographic shift is driven by wellness culture, social media influence, and a growing preference for preventative care rather than reactive treatment. The desire for longevity, combined with awareness of non-drug alternatives, influences buying behavior across all age groups.

United States Complementary and Alternative Medicine for Anti-Aging and Longevity Market was valued at USD 22.2 billion in 2024 and remains a critical hub for CAM adoption. The rise of wellness-focused clinics, therapeutic spas, and integrative healthcare practices has transformed the landscape. With an aging population and growing awareness around healthy living, US consumers are investing more in holistic options to support cognitive health, joint mobility, and skin rejuvenation. As accessibility improves and CAM merges with conventional care, demand across the country will grow significantly over the next decade.

Companies in the Global Complementary and Alternative Medicine for Anti-Aging and Longevity Market are investing heavily in personalized wellness, expanding global reach, and diversifying their natural product lines. iHerb and Dabur India leverage e-commerce platforms to penetrate new regions and scale distribution. Herbivore Botanicals and Sulwhasoo are focusing on premium skincare with herbal formulations to reverse visible aging. Patanjali Ayurved and Kama Ayurveda emphasize traditional remedies infused with modern science to capture the growing preference for clean-label solutions. Meanwhile, Mountain Rose Herbs and Rocky Mountain Oils are expanding their portfolios with targeted supplements and essential oils. Players like SEVA Experience and Maya Reiki School are enhancing brand loyalty through experiential wellness services. These strategies are reshaping market dynamics and intensifying global competition.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer awareness about holistic wellness and longevity

- 3.2.1.2 Growing aging population and rising demand for youthful appearances

- 3.2.1.3 Advancements in natural formulations and CAM techniques

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of scientific validation for CAM practices

- 3.2.2.2 High costs associated with specialized anti-aging therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Intervention Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Herbal products

- 5.2.1 Ayurveda

- 5.2.2 Naturopathic medicine

- 5.2.3 Traditional chinese medicine

- 5.2.4 Zang fu theory

- 5.2.5 Other herbal products

- 5.3 Mind-body intervention

- 5.3.1 Yoga

- 5.3.2 Acupuncture and massage

- 5.3.3 Chiropractic

- 5.3.4 Qigong and tai chi

- 5.3.5 Meditation and mindfulness

- 5.3.6 Other mind-body intervention

- 5.4 External energy healing

- 5.4.1 Magnetic and electromagnetic therapy

- 5.4.2 Chakra healing

- 5.4.3 Reiki

- 5.4.4 Other external energy healing

- 5.5 Sensory healing

- 5.5.1 Aromatherapy

- 5.5.2 Sound healing

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Consumers

- 6.3 Healthcare practitioners

- 6.4 Corporate wellness programs

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Dabur India

- 8.2 First Natural Brands

- 8.3 Herb Pharm

- 8.4 Herbivore Botanicals

- 8.5 iHerb

- 8.6 Kama Ayurveda

- 8.7 Maya Reiki School

- 8.8 Mountain Rose Herbs

- 8.9 Patanjali Ayurved

- 8.10 Rocky Mountain Oils

- 8.11 SEVA Experience

- 8.12 Sulwhasoo

- 8.13 Wei Beauty