|

市场调查报告书

商品编码

1750459

建筑主发电机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Construction Prime Power Generators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

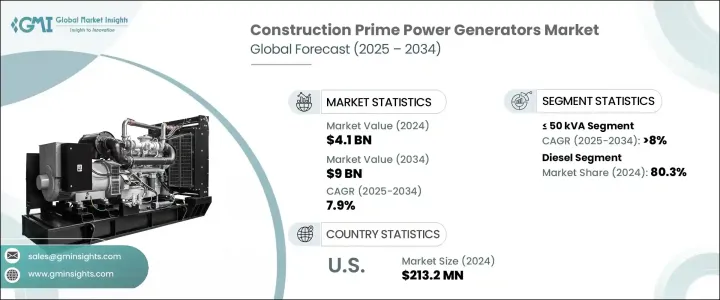

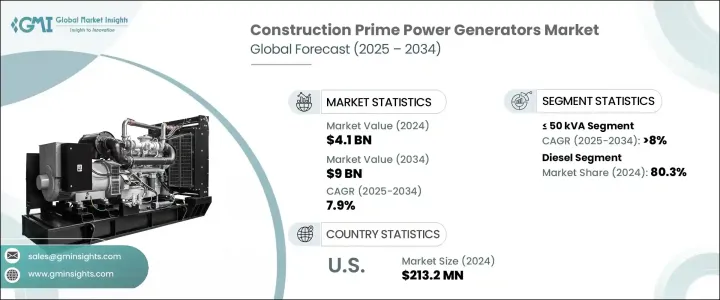

2024年,全球建筑主发电机市场规模达41亿美元,预计2034年将以7.9%的复合年增长率成长,达到90亿美元。建筑业对持续不间断电力供应的需求日益增长,这必将在塑造产业动态方面发挥至关重要的作用。随着新兴经济体工业化和基础建设推动建筑业不断发展,对可靠能源的需求也日益凸显。主发电机作为一种可靠的备用能源解决方案,正日益受到青睐,尤其是在电网连接受限或无法连接的项目中。人们对能源可靠性和效率的日益重视,加上持续整合永续能源替代方案的努力,进一步扩大了该领域的成长潜力。

随着各地区製造设施和工业单位的蓬勃发展,对经济高效且性能稳定的发电解决方案的需求也日益增长。尤其是在都市化地区,建筑活动大幅成长,促进了发电机组的广泛应用。此外,对稳定电力供应以支援关键机械和製程运作的需求,也推动了对先进发电机技术的投资。全球多个地区停电频率的不断上升,加上人们对能源安全的担忧日益加剧,更凸显了建立可靠备用系统的重要性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 41亿美元 |

| 预测值 | 90亿美元 |

| 复合年增长率 | 7.9% |

电气化和基础设施建设投资的不断增长,尤其是在离网和服务不足地区,也推动了该市场的成长动能。随着越来越多的地区,尤其是农村和半城市地区,努力提高能源可近性,发电机组正在部署以弥补供需之间的差距。向老旧电力系统现代化转型,包括更换老化发电机,正在进一步推动市场成长。同样,临时和移动建筑对可扩展发电解决方案的需求,也推动了易于使用和部署灵活的便携式发电机型号的采用。

就额定功率而言,市场分为<= 50 kVA、> 50 kVA - 125 kVA、> 125 kVA - 200 kVA、> 200 kVA - 330 kVA、> 330 kVA - 750 kVA 和 > 750 kVA 三个细分市场。预计<= 50 kVA 细分市场将以更快的速度成长,到 2034 年复合年增长率将超过 8%。这一成长主要源自于市场对紧凑轻便发电系统日益增长的需求,这类系统非常适合中小型建筑专案。其便携性和较低的功耗使其成为预算有限或空间受限项目的理想选择。

市场进一步按燃料类型细分为柴油和天然气。 2024年,柴油驱动的建筑主力发电机占据市场主导地位,占总份额的80.3%。这种主导地位得益于柴油在偏远地区和离网地区的广泛供应,使其成为需要持续能源支援的建筑工地的实用选择。柴油发电机相对较低的前期投资成本也增加了其吸引力,尤其是在预算敏感的建筑环境中。

将传统柴油或燃气发电机与太阳能或电池储能等再生能源相结合的混合系统也正在蓬勃发展。这种转变是由日益增强的环保意识和不断上涨的燃料成本所推动的,这促使利害关係人采用更节能、更环保的替代方案。这些混合系统越来越被视为减少对化石燃料依赖同时保持高电力传输可靠性的可行解决方案。

在美国,建筑主发电机市场在过去几年中稳步成长,2022 年估值为 1.872 亿美元,2023 年为 2.005 亿美元,2024 年为 2.132 亿美元。推动低排放技术发展的监管框架,以及符合环保标准的节能发电机组需求的不断增长,共同支撑了这一积极趋势。随着美国继续推动建筑实践现代化并整合更智慧的电力系统,预计将保持强劲的成长势头。

引领建筑主发电机市场格局的领导企业包括阿特拉斯·科普柯、阿肖克·利兰、百力通、康明斯、卡特彼勒、迪尔公司、伊蒙妮莎、Generac Power Systems、Kirloskar、三菱重工、马恆达POWEROL、PR INDUSTRIAL、Rehlko、劳斯莱斯、阿堪鲁这些公司正在积极投资技术进步,并扩展其产品组合,以满足不断变化的客户需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依功率等级,2021 - 2034 年

- 主要趋势

- ≤50千伏安

- > 50千伏安 - 125千伏安

- > 125 千伏安 - 200 千伏安

- > 200 千伏安 - 330 千伏安

- > 330 千伏安 - 750 千伏安

- > 750千伏安

第六章:市场规模及预测:依燃料,2021 - 2034 年

- 主要趋势

- 柴油引擎

- 气体

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 俄罗斯

- 英国

- 德国

- 法国

- 西班牙

- 奥地利

- 义大利

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 泰国

- 越南

- 菲律宾

- 缅甸

- 孟加拉

- 中东

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 土耳其

- 伊朗

- 阿曼

- 非洲

- 埃及

- 奈及利亚

- 阿尔及利亚

- 南非

- 安哥拉

- 肯亚

- 莫三比克

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

第八章:公司简介

- Ashok Leyland

- Atlas Copco

- Briggs & Stratton

- Caterpillar

- Cummins

- Deere & Company

- Generac Power Systems

- HIMOINSA

- Kirloskar

- Mahindra POWEROL

- Mitsubishi Heavy Industries

- PR INDUSTRIAL

- Rapid Power Generation

- Rehlko

- Rolls-Royce

- Scania

- Siemens Energy

- Volvo Penta

- Wartsilä

- YANMAR HOLDINGS

The Global Construction Prime Power Generators Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 9 billion by 2034. The rising demand for consistent and uninterrupted power supply across construction activities is set to play a vital role in shaping industry dynamics. As the construction sector continues to evolve, fueled by industrialization and infrastructure development in emerging economies, the need for dependable energy sources is becoming increasingly critical. Prime power generators are gaining traction as a reliable energy backup solution, particularly in projects where grid connectivity is limited or unavailable. The growing emphasis on energy reliability and efficiency, coupled with ongoing efforts to integrate sustainable energy alternatives, is further amplifying growth potential.

With an upswing in the development of manufacturing facilities and industrial units across various regions, the requirement for cost-effective and robust power generation solutions has intensified. Construction activities, particularly in urbanizing areas, are seeing a substantial increase, encouraging wider adoption of generator sets. Additionally, the need for a consistent electricity supply to support the operation of essential machinery and processes is driving investments in advanced generator technologies. The increasing frequency of power disruptions in several parts of the world, combined with rising concerns over energy security, has only reinforced the importance of having reliable backup systems in place.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $9 Billion |

| CAGR | 7.9% |

Growing investments in electrification efforts and infrastructure development, especially in off-grid and underserved areas, are also contributing to the upward momentum of this market. As more regions strive to enhance energy accessibility, particularly in rural and semi-urban locations, generator sets are being deployed to bridge the gap between demand and supply. The shift toward modernizing outdated power systems, including the replacement of aging generators, is adding further impetus to market growth. Likewise, the demand for scalable power generation solutions in temporary and mobile construction setups is fueling the adoption of portable generator models that offer ease of use and deployment flexibility.

In terms of power rating, the market is categorized into <= 50 kVA > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, and > 750 kVA segments. The <= 50 kVA segment is forecasted to grow at a faster pace, with a CAGR exceeding 8% through 2034. This growth is being propelled by the increasing need for compact and lightweight power generation systems, which are ideal for small to medium-scale construction projects. Their portability and lower power consumption make them an attractive option for projects with constrained budgets or spatial limitations.

The market is further segmented by fuel type into diesel and gas. Diesel-powered construction prime power generators dominated the market in 2024, accounting for 80.3% of the total share. This dominance is supported by the widespread availability of diesel fuel in remote and off-grid areas, making it a practical choice for construction sites that require continuous energy support. The relatively lower upfront investment cost of diesel generators also adds to their appeal, particularly in budget-sensitive construction environments.

Hybrid systems that combine traditional diesel or gas-powered generators with renewable energy sources such as solar or battery storage are gaining momentum as well. This shift is driven by growing environmental awareness and rising fuel costs, encouraging stakeholders to adopt more energy-efficient and eco-friendly alternatives. These hybrid systems are increasingly seen as a viable solution to reduce dependency on fossil fuels while maintaining high reliability in power delivery.

In the United States, the construction prime power generators market has shown steady growth over the past few years, with valuations of USD 187.2 million in 2022, USD 200.5 million in 2023, and USD 213.2 million in 2024. This positive trend is being supported by regulatory frameworks promoting lower-emission technologies alongside rising demand for energy-efficient gensets that align with environmental standards. The country is expected to maintain a strong growth trajectory as it continues to modernize its construction practices and integrate smarter power systems.

Leading players shaping the construction prime power generators landscape include Atlas Copco, Ashok Leyland, Briggs & Stratton, Cummins, Caterpillar, Deere & Company, HIMOINSA, Generac Power Systems, Kirloskar, Mitsubishi Heavy Industries, Mahindra POWEROL, PR INDUSTRIAL, Rehlko, Rolls-Royce, Scania, Rapid Power Generation, Siemens Energy, Wartsila, Volvo Penta, and YANMAR HOLDINGS. These companies are actively investing in technological advancements and expanding their portfolios to cater to evolving customer needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 ≤ 50 kVA

- 5.3 > 50 kVA - 125 kVA

- 5.4 > 125 kVA - 200 kVA

- 5.5 > 200 kVA - 330 kVA

- 5.6 > 330 kVA - 750 kVA

- 5.7 > 750 kVA

Chapter 6 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 Gas

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Germany

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Austria

- 7.3.7 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Vietnam

- 7.4.10 Philippines

- 7.4.11 Myanmar

- 7.4.12 Bangladesh

- 7.5 Middle East

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Turkey

- 7.5.5 Iran

- 7.5.6 Oman

- 7.6 Africa

- 7.6.1 Egypt

- 7.6.2 Nigeria

- 7.6.3 Algeria

- 7.6.4 South Africa

- 7.6.5 Angola

- 7.6.6 Kenya

- 7.6.7 Mozambique

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Mexico

- 7.7.3 Argentina

- 7.7.4 Chile

Chapter 8 Company Profiles

- 8.1 Ashok Leyland

- 8.2 Atlas Copco

- 8.3 Briggs & Stratton

- 8.4 Caterpillar

- 8.5 Cummins

- 8.6 Deere & Company

- 8.7 Generac Power Systems

- 8.8 HIMOINSA

- 8.9 Kirloskar

- 8.10 Mahindra POWEROL

- 8.11 Mitsubishi Heavy Industries

- 8.12 PR INDUSTRIAL

- 8.13 Rapid Power Generation

- 8.14 Rehlko

- 8.15 Rolls-Royce

- 8.16 Scania

- 8.17 Siemens Energy

- 8.18 Volvo Penta

- 8.19 Wartsilä

- 8.20 YANMAR HOLDINGS