|

市场调查报告书

商品编码

1750470

飞机电线电缆市场机会、成长动力、产业趋势分析及2025-2034年预测Aircraft Wire and Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

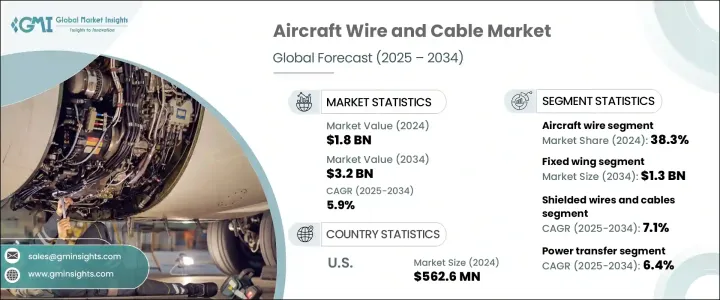

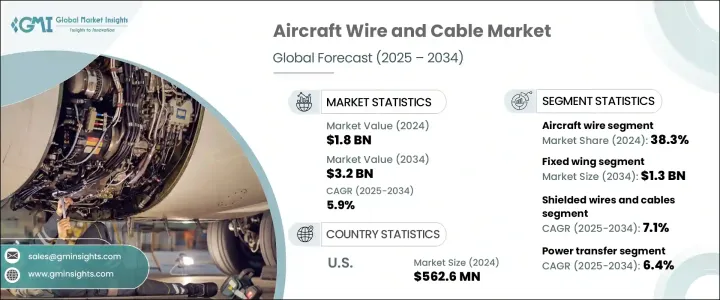

2024年,全球飞机电线电缆市场规模达18亿美元,预计到2034年将以5.9%的复合年增长率成长,达到32亿美元,这得益于飞机产量的激增,以及电动化和城市空中交通平台的快速发展。随着飞机系统复杂化和推进电气化的发展,对创新布线解决方案的需求持续激增。多位利害关係人也指出,随着下一代飞机对高性能电缆的依赖程度不断提高,轻量化、热稳定性和高压布线系统在商用和军用应用中的作用将变得更加关键。

公司官员回忆起早期的贸易限制,特别是对进口铝和钢的关税,如何扰乱了航太价值链。这些政策变化推高了原材料价格,使原始设备製造商 (OEM) 和主要一级供应商的预算编制变得复杂。此外,国际报復性关税扰乱了采购业务,导致重要电缆材料的价格和采购不稳定。拥有全球整合供应链的公司面临最严重的挫折,因为采购延迟和成本上升使製造时间表紧张。正如工程师所指出的,如今的电动飞机和 eVTOL 平台需要为航空电子设备、电池推进和热控制等系统提供复杂的布线。这些应用需要能够承受极端条件同时保持最小重量的电缆。分析师强调,先进的飞机设计趋势促使航太公司加大投资,开发符合下一代航空目标的坚固紧凑的电缆系统。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 18亿美元 |

| 预测值 | 32亿美元 |

| 复合年增长率 | 5.9% |

2024年,电线电缆产品领域的飞机电线占据了38.3%的市场份额,这归因于其在飞机各个系统中传输电力、控制讯号和资料的关键作用。产业供应商强调,对耐热、轻质电线解决方案的需求正在成长,尤其是在飞机专案向下一代电气架构转型并提高自动化程度的背景下。电磁干扰和防火方面的监管压力也影响设计参数,使得先进的电线配置对于适航认证和机队改造至关重要。

预计到2034年,固定翼飞机市场规模将达到13亿美元,这得益于生产线的扩张和老旧机队的持续升级。航空工程师指出,固定翼飞机通常比旋翼飞机或无人机需要更复杂的布线系统,因为它们搭载了更集中的航空电子设备、飞行控制和客舱系统。这些飞机通常需要密集的模组化线束,以支援远程飞行和先进的安全功能。

2024年,美国飞机电线电缆市场规模达5.626亿美元,这得益于商用航太和国防领域雄厚的资金支持。业内人士指出,美国的专案优先考虑恶劣条件下的可靠性和生存能力,这推动了专用电线材料和屏蔽技术的研发。美国仍然是为多电飞机平台设计的高压和光纤布线系统的试验场,这预示着其长期成长潜力。

全球飞机电线电缆市场的公司正在采取多种策略来扩大其市场占有率。阿美特克 (Ametek)、伊顿 (Eaton)、航太( Aerospace Wire & Cable)、卑尔根电缆技术 (Bergen Cable Technology)、安费诺 (Amphenol) 和柯林斯航空航天 (Collins Aerospace )航太航天 (Collins Aerospace)等主要参与者已优先考虑研发投资,以开发更轻、更耐热的电缆电缆解决方案。许多公司正在扩展其全球製造能力,以提高供应链敏捷性并满足不断增长的需求。与飞机原始设备製造商 (OEM) 和系统整合商的合作也在增多,从而能够客製化布线架构,以适应不断发展的飞机设计。此外,各公司正专注于策略性收购和认证,以增强其产品组合和竞争地位。这些措施旨在确保在高度技术化和监管驱动的市场中保持韧性和持续成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 飞机产量和交付量不断上升

- 新兴经济体商业航空的扩张

- 军用飞机采购和升级激增

- 维护、修理和大修(MRO)行业的成长

- 城市空中交通和电动飞机计画的投资不断增加

- 产业陷阱与挑战

- 先进航空级材料成本高昂

- 改造老旧飞机的挑战

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- Pestel 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- 飞机线

- 飞机电缆

- 同轴电缆

- 数据线

- 电源线

- 光纤电缆

- 射频电缆

- 其他的

- 飞机线束

第六章:市场估计与预测:依飞机类型,2021-2034

- 主要趋势

- 固定翼

- 旋翼机

- 无人机

第七章:市场估计与预测:依屏蔽类型,2021-2034

- 主要趋势

- 屏蔽电线和电缆

- 非屏蔽电线和电缆

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 飞行控制系统

- 照明系统

- 资料传输

- 电力传输

- 航空电子设备

- 起落架和煞车系统

- 其他的

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Aerospace Wire & Cable

- Ametek

- Amphenol

- Bergen Cable Technology

- Collins Aerospace

- Eaton

- HUBER+SUHNER

- Lexco Cable

- Miracle Electronics Devices

- Molex

- Nexans

- PIC Wire & Cable

- Prysmian Group

- Radiall

- Sanghvi Aerospace

- TE Connectivity

- Tyler Madison

- WL Gore and Associates

The Global Aircraft Wire and Cable Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 3.2 billion by 2034, driven by the surge in aircraft production volumes, paired with rapid advancements in electric and urban air mobility platforms. As aircraft evolve with complex systems and propulsion electrification, the demand for innovative wiring solutions continues to surge. Several stakeholders also pointed out that as next-generation aircraft become more reliant on high-performance cables, the role of lightweight, thermally stable, and high-voltage wiring systems becomes even more crucial in both commercial and military applications.

Company officials recalled how earlier trade restrictions, particularly the tariffs on imported aluminum and steel, disrupted the aerospace value chain. These policy changes elevated raw material prices, complicating budgeting for OEMs and major tier-1 suppliers. Additionally, international retaliatory tariffs disrupted sourcing operations, leading to instability in pricing and procurement of vital cabling materials. Firms with globally integrated supply chains faced the most severe setbacks, as sourcing delays and elevated costs strained manufacturing timelines. As noted by engineers, electrical aircraft and eVTOL platforms today demand sophisticated wiring for systems like avionics, battery propulsion, and thermal control. These applications require cables that can withstand extreme conditions while keeping weight minimal. Analysts emphasized that advanced aircraft design trends have driven aerospace firms to invest more in developing robust and compact cable systems that align with next-gen aviation goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 5.9% |

The aircraft wire segment in the wire and cable product segment held a 38.3% share in 2024, attributed to its essential role in transmitting power, control signals, and data throughout various aircraft systems. Industry suppliers emphasized that demand is growing for heat-resistant, lightweight wiring solutions, particularly as aircraft programs transition toward next-generation electric architectures and increased automation. Regulatory pressures around electromagnetic interference and fire resistance also shape design parameters, making advanced wire configurations vital for airworthiness certifications and fleet retrofits.

The fixed-wing aircraft segment is anticipated to reach USD 1.3 billion by 2034, driven by expanding production lines and continued upgrades to aging fleets. Aviation engineers pointed out that fixed-wing designs generally require more intricate cabling systems than rotary-wing or unmanned aerial vehicles, as they host a greater concentration of avionics, flight control, and cabin systems. These aircraft typically demand dense, modular wiring harnesses that support long-range operations and advanced safety features.

United States Aircraft Wire and Cable Market generated USD 562.6 million in 2024, underpinned by strong funding for the commercial aerospace and defense sectors. Industry insiders noted that U.S.-based programs prioritize reliability and survivability under harsh conditions, prompting the development of specialized wire materials and shielding technologies. The country remains a testing ground for high-voltage and fiber-optic cabling systems designed for more electric aircraft platforms, signaling long-term growth potential.

Companies operating in the Global Aircraft Wire and Cable Market are adopting multiple strategies to bolster their market footprint. Key players such as Ametek, Eaton, Aerospace Wire & Cable, Bergen Cable Technology, Amphenol, and Collins Aerospace have prioritized R&D investments to develop lighter, more thermally stable cable solutions. Many firms are expanding their global manufacturing capabilities to improve supply chain agility and meet growing demand. Collaborations with aircraft OEMs and system integrators are also rising, enabling tailored wiring architectures that align with evolving aircraft designs. In addition, companies are focusing on strategic acquisitions and certifications that enhance their product portfolios and competitive standing. These moves aim to ensure resilience and sustained growth in a highly technical and regulation-driven market.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising aircraft production and deliveries

- 3.3.1.2 Expansion of commercial aviation in emerging economies

- 3.3.1.3 Surge in military aircraft procurement and upgrades

- 3.3.1.4 Growth of the maintenance, repair, and overhaul (mro) sector

- 3.3.1.5 Rising investments in urban air mobility and electric aircraft programs

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High cost of advanced aerospace-grade materials

- 3.3.2.2 Challenges in retrofitting legacy aircraft

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 Pestel analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Aircraft wire

- 5.3 Aircraft cable

- 5.3.1 Coaxial cables

- 5.3.2 Data cables

- 5.3.3 Power cables

- 5.3.4 Fiber optic cables

- 5.3.5 RF cables

- 5.3.6 Others

- 5.4 Aircraft harness

Chapter 6 Market Estimates & Forecast, By Aircraft Type, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Fixed wing

- 6.3 Rotary wing

- 6.4 Unmanned aerial vehicles

Chapter 7 Market Estimates & Forecast, By Shielding Type, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Shielded wires and cables

- 7.3 Unshielded wires and cables

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Flight control systems

- 8.3 Lighting systems

- 8.4 Data transfer

- 8.5 Power transfer

- 8.6 Avionics

- 8.7 Landing gear & braking systems

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Aerospace Wire & Cable

- 10.2 Ametek

- 10.3 Amphenol

- 10.4 Bergen Cable Technology

- 10.5 Collins Aerospace

- 10.6 Eaton

- 10.7 HUBER+SUHNER

- 10.8 Lexco Cable

- 10.9 Miracle Electronics Devices

- 10.10 Molex

- 10.11 Nexans

- 10.12 PIC Wire & Cable

- 10.13 Prysmian Group

- 10.14 Radiall

- 10.15 Sanghvi Aerospace

- 10.16 TE Connectivity

- 10.17 Tyler Madison

- 10.18 WL Gore and Associates