|

市场调查报告书

商品编码

1750481

动物肠道健康市场机会、成长动力、产业趋势分析及2025-2034年预测Animal Intestinal Health Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

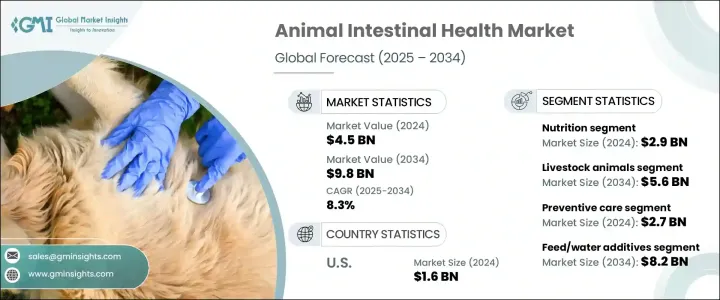

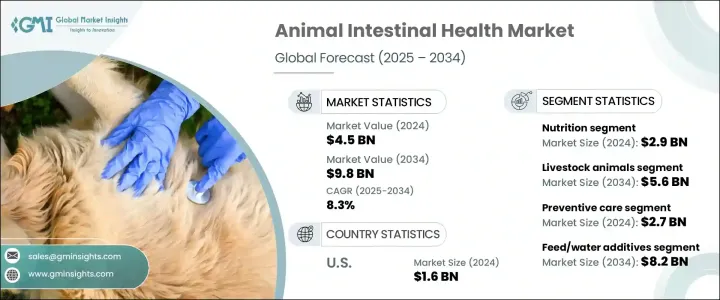

2024年,全球动物肠道健康市场价值45亿美元,预计到2034年将以8.3%的复合年增长率增长,达到98亿美元,原因是动物胃肠道疾病(包括慢性消化系统疾病和发炎相关问题)的激增。随着人们对动物健康的日益关注,对预防性照护的需求也在加速成长,尤其是在畜牧业管理方面。维持最佳的肠道健康不仅对预防疾病至关重要,而且对提高饲料效率和动物整体生产力也至关重要。随着全球肉类、乳製品和蛋类消费量持续成长,尤其是在快速发展的经济体中,对健康牲畜的需求变得更加紧迫和具有商业重要性。

随着全球农业实践逐渐摆脱抗生素依赖,益生菌和益生元等天然替代品正获得巨大发展。这些营养补充品为维持动物的消化平衡和免疫功能提供了永续的解决方案。市场也反映出人们对整体非治疗性畜牧业方法日益增长的兴趣。消化健康如今被视为牲畜和伴侣动物经济效益和生物学性能的核心,它正在推动营养和医学领域的创新和产品开发。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 45亿美元 |

| 预测值 | 98亿美元 |

| 复合年增长率 | 8.3% |

按产品类别划分,2024年营养解决方案占最大份额,创造了29亿美元的收入。这一增长源于农民、宠物主人和兽医对均衡饮食和肠道支持营养素价值的认识不断提高。预防性方法正变得越来越流行,因为它们减少了对药物治疗的依赖。企业加强了对利害关係人的教育力度,使其了解膳食补充剂的长期益处,鼓励商业农场和家庭更多地采用肠道健康增强剂。

依动物种类划分,畜牧业是主要细分市场,预计到2034年将创造56亿美元的产值。畜牧业包括牛、家禽和猪,它们是全球蛋白质供应不可或缺的一部分。健康的牲畜肠道功能可确保更高的生产力、增强的免疫反应和降低的死亡率,因此肠道健康管理是高效养殖的关键环节。随着消费者对肉类和乳製品的需求持续增长,维护牲畜肠道健康对于维持粮食安全和经济稳定至关重要。

2024年,美国动物肠道健康市场规模达16亿美元,这得益于消费者对宠物健康意识的不断提升、伴侣动物领养率的激增以及对预防性兽医护理的日益重视。全美宠物拥有量的稳定成长是推动市场扩张的关键因素。越来越多的家庭将宠物视为家庭成员,并在宠物的健康和营养方面投入资金。由于肠道健康对动物的整体福祉和寿命至关重要,宠物主人在选择肠道支持型饮食、补充剂和功能性产品方面也变得更加积极主动。

市场的主要参与者包括AdvaCarePharma、赢创、Lallemand、硕腾、凯里集团、Phibro Animal Health、建明、嘉吉、ADM、荷兰皇家帝斯曼集团、PetAg、安迪苏、Karyotica Biologicals、PRN Pharmacal和BioChem。这些公司正在投资针对性研发,以开发先进的益生元、合生元和肠道增强酶。许多公司正在透过合作伙伴关係和策略性收购扩大其全球影响力,同时也开展宣传活动,推广动物早期采用预防性肠道健康解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 提高对动物肠道微生物组的认识

- 动物保健产品需求不断增长

- 动物肠道疾病发生率上升

- 产业陷阱与挑战

- 监管挑战和可靠性问题

- 宠物主人和饲养者缺乏意识

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 营养成分

- 益生菌

- 益生元

- 合生元

- 酵素

- 免疫调节剂

- 其他营养

- 製药

- 抗生素

- 其他药品

第六章:市场估计与预测:依动物类型,2021 年至 2034 年

- 主要趋势

- 伴侣动物

- 狗

- 猫

- 马匹

- 其他伴侣动物

- 牲畜

- 牛

- 猪

- 家禽

- 其他牲畜

第七章:市场估计与预测:按功能,2021 年至 2034 年

- 主要趋势

- 预防保健

- 疾病治疗

第八章:市场估计与预测:依管理模式,2021 年至 2034 年

- 主要趋势

- 饲料/水添加剂

- 其他给药方式

第九章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 兽医院

- 电子商务

- 零售药局

- 其他分销管道

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Adisseo

- ADM

- AdvaCarePharma

- BioChem

- Cargill

- Evonik

- Karyotica Biologicals

- Kemin

- Kerry Group

- Koninklijke DSM

- Lallemand

- PetAg

- Phibro Animal Health

- PRN Pharmacal

- Zoetis

The Global Animal Intestinal Health Market was valued at USD 4.5 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 9.8 billion by 2034 due to a surge in gastrointestinal conditions among animals, including chronic digestive disorders and inflammation-related issues. With growing concerns around animal wellness, the demand for preventive care is accelerating, especially in livestock management. Maintaining optimal gut health has become a crucial factor not just for disease prevention but also for improving feed efficiency and overall animal productivity. As meat, dairy, and egg consumption continues to rise globally, particularly in fast-developing economies, demand for healthy livestock has become more urgent and commercially important.

As global agricultural practices shift away from antibiotic-heavy treatments, natural alternatives such as probiotics and prebiotics are gaining substantial momentum. These nutritional supplements offer sustainable solutions for maintaining digestive balance and immune performance in animals. The market also reflects a growing interest in holistic, non-therapeutic approaches to animal husbandry. Digestive health, now viewed as central to the economic and biological performance of livestock and companion animals alike, is driving innovation and product development across nutritional and pharmaceutical segments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 Billion |

| Forecast Value | $9.8 Billion |

| CAGR | 8.3% |

Based on product category, nutrition-based solutions held the largest share in 2024, generating USD 2.9 billion in revenue. This growth stems from increasing awareness among farmers, pet owners, and veterinarians about the value of balanced diets and gut-supporting nutrients. Preventive approaches are becoming more popular as they reduce the dependency on drug-based treatments. Companies have ramped up efforts to educate stakeholders on the long-term benefits of dietary supplementation, encouraging greater adoption of gut health enhancers in both commercial farms and homes.

Livestock animals represent the leading segment by animal type are projected to generate USD 5.6 billion by 2034. This segment includes cattle, poultry, and swine integral to the global protein supply. Healthy intestinal function in livestock ensures higher productivity, improved immune response, and reduced mortality, making gut health management a key part of efficient farming. As consumer demand for meat and dairy continues to climb, maintaining intestinal well-being in livestock becomes essential to sustaining food security and economic stability.

United States Animal Intestinal Health Market generated USD 1.6 billion in 2024, driven by increasing consumer awareness about pet health, a surge in companion animal adoption, and the growing emphasis on preventive veterinary care. The steady rise in pet ownership across the country is a key factor contributing to the expansion of the market. More households treat pets as family members, spending on their wellness and nutrition. With intestinal health playing a vital role in the overall well-being and longevity of animals, pet owners are becoming more proactive in choosing gut-supportive diets, supplements, and functional products.

Key players in the market include AdvaCarePharma, Evonik, Lallemand, Zoetis, Kerry Group, Phibro Animal Health, Kemin, Cargill, ADM, Koninklijke DSM, PetAg, Adisseo, Karyotica Biologicals, PRN Pharmacal, and BioChem. These companies are investing in targeted R&D for developing advanced prebiotics, synbiotics, and gut-boosting enzymes. Many are expanding their global presence through partnerships and strategic acquisitions, while also launching awareness campaigns to promote early adoption of preventive gut health solutions in animals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing awareness of animal gut microbiome

- 3.2.1.2 Growing demand for animal healthcare products

- 3.2.1.3 Rising prevalence of animal intestinal diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory challenges and reliability concerns

- 3.2.2.2 Lack of awareness among pet owners and farmers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Nutritions

- 5.2.1 Probiotics

- 5.2.2 Prebiotics

- 5.2.3 Synbiotics

- 5.2.4 Enzymes

- 5.2.5 Immunomodulators

- 5.2.6 Other nutrition

- 5.3 Pharmaceuticals

- 5.3.1 Antibiotics

- 5.3.2 Other pharmaceuticals

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Companion animals

- 6.2.1 Dogs

- 6.2.2 Cats

- 6.2.3 Horses

- 6.2.4 Other companion animals

- 6.3 Livestock animals

- 6.3.1 Cattle

- 6.3.2 Swine

- 6.3.3 Poultry

- 6.3.4 Other livestock animals

Chapter 7 Market Estimates and Forecast, By Function, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Preventive care

- 7.3 Disease treatment

Chapter 8 Market Estimates and Forecast, By Mode of Administration, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Feed/water additives

- 8.3 Other modes of administration

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospitals

- 9.3 E-commerce

- 9.4 Retail pharmacies

- 9.5 Other distribution channels

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Adisseo

- 11.2 ADM

- 11.3 AdvaCarePharma

- 11.4 BioChem

- 11.5 Cargill

- 11.6 Evonik

- 11.7 Karyotica Biologicals

- 11.8 Kemin

- 11.9 Kerry Group

- 11.10 Koninklijke DSM

- 11.11 Lallemand

- 11.12 PetAg

- 11.13 Phibro Animal Health

- 11.14 PRN Pharmacal

- 11.15 Zoetis