|

市场调查报告书

商品编码

1750482

电路监控市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Circuit Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

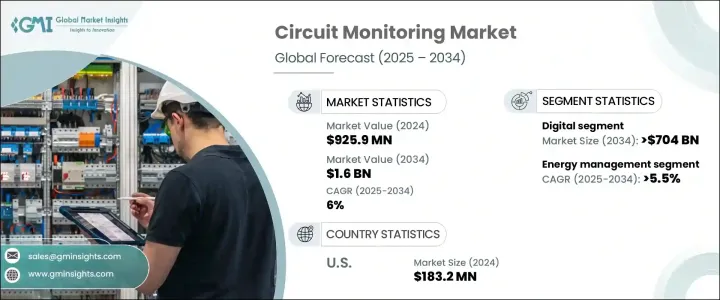

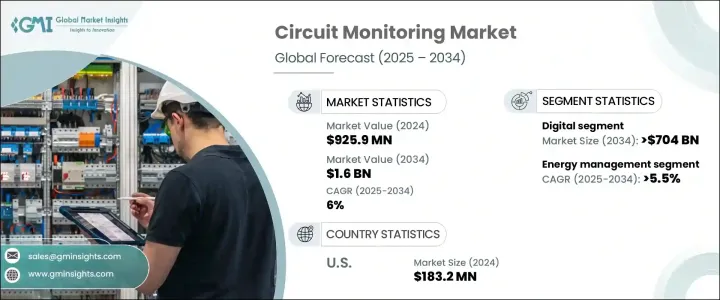

2024年,全球电路监控市场规模达9.259亿美元,预计到2034年将以6%的复合年增长率增长,达到16亿美元,这得益于对先进能源基础设施日益增长的需求,尤其是在城镇化和工业化进程加快的地区。随着清洁能源和永续发展的推动,现代电网整合了智慧电路监控,以优化能源流动、降低效率并降低营运成本。太阳能和风能等再生能源的采用进一步加速了对即时电路监控的需求。随着电网日益复杂,持续监控配电并在潜在问题恶化之前发现它们变得至关重要。

即时诊断、预测分析和基于物联网的监控技术使能源系统更加智慧。配备人工智慧的电路监控解决方案正在提高故障检测的准确性,预测电力负载并确保电网稳定性。全球向智慧城市和能源效率项目的转变也促进了住宅、商业和工业领域对智慧电路监控技术的广泛采用。北美由于较早采用智慧电网和发展完善的能源系统而占据了相当大的市场份额,这支持了智慧电路监控器的广泛部署,从而提高了控制能力和可靠性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.259亿美元 |

| 预测值 | 16亿美元 |

| 复合年增长率 | 6% |

在技术方面,预计到2034年,数位电路监控解决方案细分市场将创造7.04亿美元的市场价值。这些系统旨在提供高速资料收集、远端监控和先进的分析功能,其性能远超传统的模拟系统。数位监控能够侦测低效环节、追踪即时负载并快速启动纠正措施,已成为各行各业避免停机和优化营运的首选方案。

能源管理应用领域持续成长,预计2034年将以5.5%的复合年增长率稳定成长。这一持续成长得益于减少能源浪费、降低碳足迹和提高电力系统效率的持续努力。随着各行各业的企业将永续发展放在首位,他们正在整合智慧电路监控系统,以收集即时资料、分析能源消耗趋势并做出明智的营运决策。这些系统,尤其是与物联网技术和预测分析相结合时,能够实现更优化的资源配置、及早发现低效率问题并主动进行系统调整,最终节省成本并提高生产力。

由于监管压力不断加大、能源政策改革以及企业致力于达到永续发展基准,美国电路监控市场在2024年的估值达到1.832亿美元。美国企业部署智慧电路监控解决方案,以确保合规性、维持不间断营运并支援更广泛的环境目标。对清洁能源的追求以及对更高消费模式透明度的需求,使得电路监控成为美国不断发展的能源基础设施的核心组成部分。

该行业的主要参与者包括伊顿、ABB、欧姆龙公司、Daxten、Accuenergy、Packet Power、Senva Inc.、NHP、罗格朗、Acrel Electric Co. Ltd.、Socomec、MPL Technologies、Anord Mardix 和东芝国际公司。为了巩固市场地位,各公司正在开发创新的监控平台,以与现代能源系统无缝整合。许多公司专注于研发,以提高感测器精度、增强远端连接性并实现人工智慧分析。此外,各公司还与公用事业公司和能源服务提供者建立合作伙伴关係,以提供可扩展的客製化解决方案。此外,不断扩展的全球分销网络和售后支援服务正在帮助製造商巩固长期合作关係,并扩大其在高需求市场的影响力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 模拟

- 数位的

- 支援物联网

第六章:市场规模及预测:依类型,2021 - 2034

- 主要趋势

- 分支电路监控

- 其他的

第七章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 能源管理

- 故障检测

- 预防性维护

- 合规性监控

第八章:市场规模及预测:依最终用途,2021 - 2034

- 主要趋势

- 住宅

- 商业的

- 工业的

第九章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第十章:公司简介

- ABB

- Accuenergy

- Acrel Electric Co. Ltd.

- Anord mardix

- Daxten

- Eaton

- Legrand

- MPL technologies

- NHP

- Omron Corporation

- Packet Power

- Senva Inc.

- Socomec

- Toshiba International Corporation

The Global Circuit Monitoring Market was valued at USD 925.9 million in 2024 and is estimated to grow at a CAGR of 6% to reach USD 1.6 billion by 2034, fueled by a rising demand for advanced energy infrastructure, especially in regions with growing urbanization and industrialization. As the push for clean energy and sustainability increases, modern electrical networks integrate smart circuit monitoring to optimize energy flow, reduce inefficiencies, and operational costs. Adopting renewable sources, such as solar and wind, has further accelerated the need for real-time circuit oversight. With grids becoming more complex, the need to continuously monitor power distribution and detect potential issues before they escalate has become essential.

Real-time diagnostics, predictive analytics, and IoT-based monitoring technologies enable smarter energy systems. Circuit monitoring solutions equipped with AI are improving the accuracy of fault detection, forecasting power loads, and ensuring grid stability. The shift toward smart cities and energy efficiency programs globally is also contributing to greater adoption across residential, commercial, and industrial sectors. North America holds a significant market share due to its early adoption of smart grids and well-developed energy systems, supporting widespread deployment of intelligent circuit monitors for better control and reliability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $925.9 Million |

| Forecast Value | $1.6 Billion |

| CAGR | 6% |

In terms of technology, the digital circuit monitoring solutions segment is projected to generate USD 704 million by 2034. These systems are designed to deliver high-speed data collection, remote monitoring, and advanced analytical capabilities that significantly outperform older analog systems. The ability to detect inefficiencies, track real-time loads, and initiate fast corrective actions has made digital monitoring the preferred choice across various industries aiming to avoid downtime and optimize operations.

The energy management application segment continues to gain traction and is forecasted to expand at a steady CAGR of 5.5% through 2034. This sustained growth is fueled by intensifying efforts to reduce energy waste, lower carbon footprints, and enhance the efficiency of power systems. As organizations across industries prioritize sustainability, they are integrating smart circuit monitoring systems to collect real-time data, analyze energy consumption trends, and make informed operational decisions. These systems, especially when combined with IoT technologies and predictive analytics, enable better resource allocation, early detection of inefficiencies, and proactive system adjustments-ultimately resulting in cost savings and improved productivity.

United States Circuit Monitoring Market was valued at USD 183.2 million in 2024 due to mounting regulatory pressure, energy policy reforms, and corporate commitments to meet sustainability benchmarks. U.S. enterprises deploy intelligent circuit monitoring solutions to ensure regulatory compliance, maintain uninterrupted operations, and support broader environmental objectives. The push for cleaner energy and the need for greater transparency in consumption patterns are positioning circuit monitoring as a core component of the country's evolving energy infrastructure.

Key players in the industry include Eaton, ABB, Omron Corporation, Daxten, Accuenergy, Packet Power, Senva Inc., NHP, Legrand, Acrel Electric Co. Ltd., Socomec, MPL Technologies, Anord Mardix, and Toshiba International Corporation. To strengthen their foothold, companies are developing innovative monitoring platforms that integrate seamlessly with modern energy systems. Many focus on R&D to improve sensor precision, enhance remote connectivity, and enable AI-powered analytics. Partnerships with utilities and energy service providers are also being formed to deliver scalable, customized solutions. Additionally, expanding global distribution networks and after-sales support services are helping manufacturers solidify long-term relationships and expand their reach in high-demand markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Analog

- 5.3 Digital

- 5.4 IoT-enabled

Chapter 6 Market Size and Forecast, By Type, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Branch circuit monitoring

- 6.3 Others

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Energy management

- 7.3 Fault detection

- 7.4 Preventive maintenance

- 7.5 Compliance monitoring

Chapter 8 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Italy

- 9.3.5 Russia

- 9.3.6 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Australia

- 9.4.3 India

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Turkey

- 9.5.4 South Africa

- 9.5.5 Egypt

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Accuenergy

- 10.3 Acrel Electric Co. Ltd.

- 10.4 Anord mardix

- 10.5 Daxten

- 10.6 Eaton

- 10.7 Legrand

- 10.8 MPL technologies

- 10.9 NHP

- 10.10 Omron Corporation

- 10.11 Packet Power

- 10.12 Senva Inc.

- 10.13 Socomec

- 10.14 Toshiba International Corporation