|

市场调查报告书

商品编码

1750486

医用导管市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Medical Tubing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

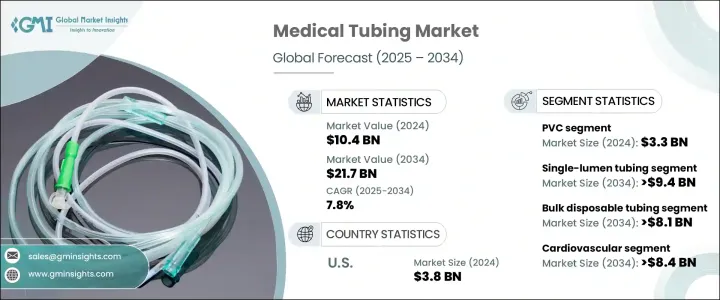

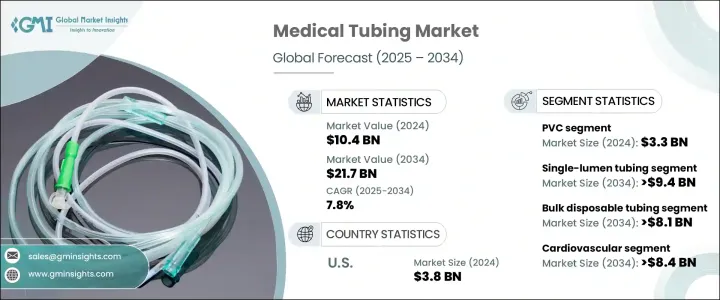

2024年,全球医用导管市场规模达104亿美元,预计到2034年将以7.8%的复合年增长率增长,达到217亿美元,这主要得益于医疗支出的增加、医疗器械製造技术的进步以及全球慢性病的激增。高性能、生物相容性导管材料的日益普及,提高了患者的治疗效果和安全性,使其在外科和诊断程序中广泛应用。随着人们对微创治疗的偏好日益增长,导管插入术和输液治疗等应用对导管的需求也随之增长。全球人口老化也影响了这一趋势,因为老年患者通常需要涉及液体输送和生命征象监测的长期照护解决方案。

一个关键的市场驱动因素是人们对一次性医疗器材的日益青睐。一次性导管如今因其减少交叉污染和医院内感染而备受青睐。家庭医疗保健服务的激增加速了这一需求,尤其是对于需要定期透析、静脉注射治疗或呼吸辅助的患者。弹性体导管和感测器整合结构的进步,拓展了医用导管在现代生物医学和外科技术中的应用。这些趋势,加上聚合物配方和导管设计的持续创新,正在不断重塑医用导管产业的格局。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 104亿美元 |

| 预测值 | 217亿美元 |

| 复合年增长率 | 7.8% |

2024年,PVC市场规模达33亿美元,反映其作为产业首选材料的地位。 PVC的柔韧性、化学稳定性和灭菌相容性使其成为药物输送、透析和导管产品製造商的首选材料。不含DEHP的PVC品种的出现提升了市场兴趣,这些品种符合监管标准,同时保持了良好的性能。 PVC能够支援复杂的管道配置,包括多腔和薄壁类型,这使其在现代医疗保健应用中具有不可估量的价值。

预计医用导管市场中的散装一次性导管细分市场将保持领先地位,复合年增长率为 8.2%,到 2034 年将达到 81 亿美元。此细分市场的优势在于其广泛应用于各种关键医疗程序,包括呼吸治疗、静脉输液和各种液体管理系统。这些导管解决方案在医院和家庭护理环境中不可或缺,在这些环境中,无菌性、安全性和一次性使用功能至关重要。其成本效益和较低的交叉污染风险使其成为高频使用的理想选择,尤其是在易受感染的环境中。

美国医用导管市场规模在2024年达到38亿美元,预计2034年将以7.3%的复合年增长率成长。美国在医疗创新领域的领先地位,支撑着先进导管技术的蓬勃发展,尤其是在诊断影像、导管插入术、微创手术和长期慢性病照护领域。戈尔、科德宝和德尼培等主要产业参与者的加入,进一步推动了这一成长。这些公司专注于研发投入,推动了多腔、微孔和感测器整合导管系统的进步。医院和门诊中心采用此类系统来支援先进的手术、精准的液体管理和个人化的病患治疗。

为了在全球医用导管市场保持强势地位,特瑞堡、宙斯、圣戈班、普特南塑胶和史派克等主要参与者正积极提升自身实力。这些公司在材料科学领域投入大量资金,旨在打造耐久性、生物相容性以及在各种条件下性能更佳的导管。与医疗器材原始设备製造商的策略合作,以及不断扩张的生产基地和无尘室设施,使其能够有效率地满足全球需求。一些公司专注于永续发展,开发可回收或不含邻苯二甲酸二(DEHP)的产品,以适应监管变化和医院采购偏好。此外,强大的研发管道和专有挤出技术的智慧财产权保护,也使其在竞争激烈的市场中脱颖而出。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 心血管疾病和呼吸系统疾病等慢性疾病的盛行率不断上升

- 对微创外科手术的需求不断增长

- 一次性医疗器材的采用激增,以预防感染

- 医用导管在药物传输系统的应用日益增多

- 产业陷阱与挑战

- 先进材料带来的高製造成本

- 与材料相容性和耐久性相关的问题

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 技术格局

- 定价分析

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 聚氯乙烯(PVC)

- 硅酮

- 聚烯烃

- 聚碳酸酯

- 其他材料

第六章:市场估计与预测:依结构,2021 - 2034 年

- 主要趋势

- 单腔管

- 多腔管

- 共挤管

- 其他结构

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 散装一次性管

- 导管和套管

- 药物输送系统

- 其他应用

第八章:市场估计与预测:按指标 2021 - 2034

- 主要趋势

- 心血管

- 呼吸系统

- 胃肠道

- 其他适应症

第九章:市场估计与预测:依最终用途 2021 - 2034

- 主要趋势

- 医院和诊所

- 门诊手术中心

- 诊断实验室

- 其他最终用途

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- AdvantaPURE

- AngioDynamics

- AP Technologies

- mdc

- FREUDENBERG

- Nordson

- Parker

- POLYZEN

- Putnam Plastics

- raumedic

- SAINT-GOBAIN

- SPECTRUM

- TRELLEBORG

- GORE

- ZEUS

The Global Medical Tubing Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 21.7 billion by 2034, propelled by increasing healthcare expenditures, technological advancements in medical device manufacturing, and the global surge in chronic illnesses. Rising adoption of high-performance, biocompatible tubing materials enhances patient outcomes and safety, supporting widespread use in surgical and diagnostic procedures. As the preference for less invasive treatments grows, so does the demand for tubing in applications like catheterization and infusion therapy. The aging global population influences this trend, since older patients often require long-term care solutions involving tubes for fluid transfer and vital monitoring.

One key market driver is the increasing preference for disposable medical devices. Single-use tubing is now favored for reducing cross-contamination and hospital-acquired infections. The surge in home healthcare services accelerates this demand, especially for patients needing regular dialysis, IV therapies, or respiratory assistance. Advancements in elastomer-based tubing and sensor-integrated structures have expanded medical tubing applications in modern biomedicine and surgical technologies. These trends, along with ongoing innovation in polymer formulations and tubing design, continue to reshape the landscape of the medical tubing industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $21.7 Billion |

| CAGR | 7.8% |

PVC segment accounted for USD 3.3 billion in 2024, reflecting its role as a highly preferred material in the industry. Its flexibility, chemical stability, and compatibility with sterilization make it a go-to choice for manufacturers across drug delivery, dialysis, and catheter products. Market interest has been boosted by the emergence of DEHP-free PVC variants, which comply with regulatory standards while maintaining performance. PVC's ability to support intricate tubing configurations, including multi-lumen and thin-wall types, makes it invaluable for modern healthcare applications.

The bulk disposable tubing segment in the medical tubing market is forecast to maintain its lead with a CAGR of 8.2%, generating USD 8.1 billion by 2034. This segment's strength lies in its extensive use across a wide range of critical healthcare procedures, including respiratory therapy, IV fluid delivery, and various fluid management systems. These tubing solutions are indispensable in hospital and home care environments, where sterility, safety, and single-use functionality are paramount. Their cost-effectiveness and reduced risk of cross-contamination make them ideal for high-frequency usage, particularly in infection-sensitive settings.

United States Medical Tubing Market reached USD 3.8 billion in 2024 and is projected to grow at a CAGR of 7.3% through 2034. The country's leadership in healthcare innovation supports robust adoption of sophisticated tubing technologies, especially in diagnostic imaging, catheterization, minimally invasive procedures, and long-term chronic care. The presence of key industry players such as Gore, Freudenberg, and Tekni-Plex bolsters this growth. These companies focus on R&D investments, leading to advancements in multi-lumen, microbore, and sensor-integrated tubing systems. Hospitals and outpatient centers adopt such systems to support advanced surgeries, precise fluid management, and tailored patient therapies.

To maintain a strong position in the Global Medical Tubing Market, key players like Trelleborg, Zeus, Saint-Gobain, Putnam Plastics, and Spectrum are actively enhancing their capabilities. These companies invest significantly in material science to create tubing with improved durability, biocompatibility, and performance under various conditions. Strategic collaborations with medical device OEMs, along with expanding production sites and cleanroom facilities, allow them to meet global demand efficiently. Several firms focus on sustainability by developing recyclable or DEHP-free options to align with regulatory shifts and hospital procurement preferences. Additionally, robust R&D pipelines and IP protections for proprietary extrusion technologies are helping them differentiate in a competitive market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases, such as cardiovascular and respiratory conditions

- 3.2.1.2 Growing demand for minimally invasive surgical procedures

- 3.2.1.3 Surging adoption of single-use medical devices to prevent infections

- 3.2.1.4 Rising use of medical tubing in drug delivery systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs associated with advanced materials

- 3.2.2.2 Issues related to material compatibility and durability

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technology landscape

- 3.7 Pricing analysis

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Polyvinyl chloride (PVC)

- 5.3 Silicone

- 5.4 Polyolefins

- 5.5 Polycarbonates

- 5.6 Other materials

Chapter 6 Market Estimates and Forecast, By Structure, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Single-lumen tubing

- 6.3 Multi-lumen tubing

- 6.4 Co-extruded tubing

- 6.5 Other structures

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bulk disposable tubing

- 7.3 Catheters and cannulas

- 7.4 Drug delivery systems

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By Indication 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Cardiovascular

- 8.3 Respiratory

- 8.4 Gastrointestinal

- 8.5 Other indications

Chapter 9 Market Estimates and Forecast, By End Use 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and clinics

- 9.3 Ambulatory surgical centers

- 9.4 Diagnostic laboratories

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AdvantaPURE

- 11.2 AngioDynamics

- 11.3 AP Technologies

- 11.4 mdc

- 11.5 FREUDENBERG

- 11.6 Nordson

- 11.7 Parker

- 11.8 POLYZEN

- 11.9 Putnam Plastics

- 11.10 raumedic

- 11.11 SAINT-GOBAIN

- 11.12 SPECTRUM

- 11.13 TRELLEBORG

- 11.14 GORE

- 11.15 ZEUS