|

市场调查报告书

商品编码

1750490

金属瓶盖市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Metal Closures Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

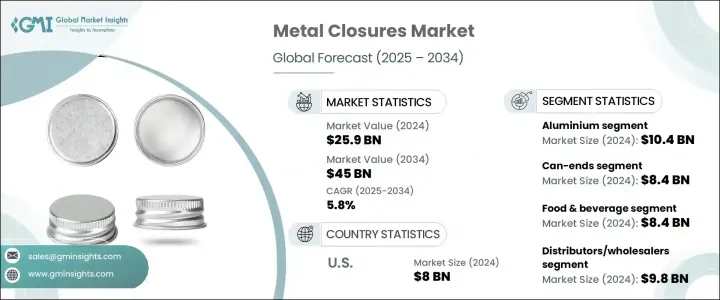

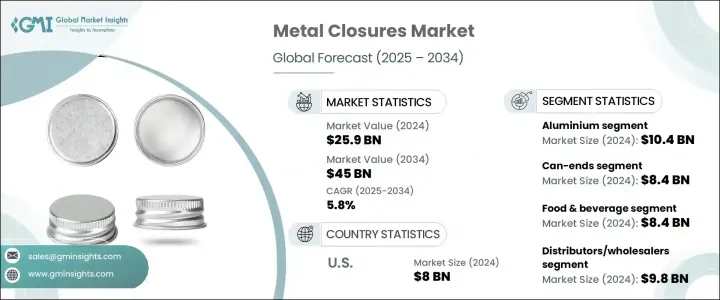

2024年,全球金属瓶盖市场规模达259亿美元,预计到2034年将以5.8%的复合年增长率成长,达到450亿美元。这一成长主要源自于已开发经济体和新兴经济体对包装食品和饮料的需求成长,以及酒精饮料消费量的上升。随着消费者生活方式的快节奏和城市化程度的提高,对便利、耐用、防篡改包装解决方案的需求大幅增长,从而推动了金属瓶盖的普及。金属瓶盖因其能够保持产品完整性、延长保质期并支持可持续包装而备受青睐。近年来,市场参与者纷纷响应不断变化的法规和消费者期望,纷纷加入环保特性并优先考虑可回收材料。

川普政府对进口铝和钢征收关税,对金属产业造成了重大衝击。这些措施导致原物料成本飙升,涨幅高达25%,对依赖进口的製造商造成了广泛影响。国内企业利润率收紧,不得不将更高的成本转嫁给客户。虽然一些本土金属生产商受益于暂时的价格优势,但整个产业面临市场波动加剧和营运成本上升的双重压力。这些挑战也促使企业重新评估采购策略,许多企业转向自动化,并探索替代材料以稳定生产成本。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 259亿美元 |

| 预测值 | 450亿美元 |

| 复合年增长率 | 5.8% |

依材质划分,市场可分为铝、钢、锡和其他材质。铝在2024年占据主导地位,市场规模超过104亿美元。铝製瓶盖因其轻质特性(可降低物流成本)和耐用性(可提供可靠的密封解决方案)而广受青睐。这种材料尤其因其耐腐蚀性和与酸性产品的兼容性而备受青睐。铝与循环经济倡议的契合以及企业对永续发展日益增长的承诺,正在推动其在各行各业的应用。

就产品类型而言,市场包括皇冠盖、罐盖、螺旋盖、旋盖和其他类型的封盖。罐盖类别成为领先细分市场,2024 年市场规模超过 84 亿美元。它们在食品和饮料包装中的应用日益广泛,显着加速了需求成长。这些封盖具有卓越的密封性能,是保鲜和防止污染的理想选择。便捷包装解决方案的普及也促进了该细分市场的快速成长,尤其是在註重耐用性和用户友好性的领域。

根据最终用途,金属瓶盖市场可分为个人护理和化妆品、食品和饮料、消费品、药品和其他。食品和饮料产业在2024年引领市场,估值达84亿美元。消费习惯的改变、对即食食品的偏好增加以及密封容器在加工食品中的广泛使用,都对推动需求成长发挥了至关重要的作用。金属瓶盖具有阻隔性能,可保护内容物免受水分和氧气的侵害,有助于延长保质期并保持品质,特别适用于碳酸饮料和发酵饮料。

就分销通路而言,市场细分为直销、分销商/批发商、零售商和电商。 2024年,分销商和批发商占据了最高的市场份额,达到98亿美元。这一细分市场的成长归功于各行各业製造商的批量采购,从而确保了可靠的供应链连续性。这些分销商通常面向中型企业,提供灵活的订单规模和客製化选项,使其能够满足利基市场和特殊包装的需求。

2024年,美国占据该地区最大的市场份额,价值达80亿美元。该国强大的药品生产基础设施,加上严格的安全和包装标准,推动了先进封盖系统的采用。具有防篡改和儿童安全功能的金属封盖对于合规性和消费者安全日益重要。高端包装商品的日益普及以及酒精饮料消费的增加也推动了对封盖的需求,所有这些都需要安全高效的密封技术。

金属瓶盖产业竞争激烈,全球和地区製造商均有参与。 2024年,前三名的公司——Silgan Holdings Inc.、Crown Holdings Inc. 和 Guala Closures Group——合计占据超过12.8%的市场。领先企业持续投入研发,推出专注于轻量化材料、增强可回收性和创新密封机制的新一代产品。随着企业寻求提升消费者参与度、可追溯性和产品安全性,配备二维码和NFC晶片的智慧瓶盖等功能正日益受到青睐。此外,健康意识和可追溯包装的重要性日益提升,促使製造商开发采用BPA-NI衬里和高阻隔技术等特性的瓶盖。线上零售、直销品牌和各行各业的手工生产日益普及,也加剧了对兼具功能性和美观性的可客製化、短期生产瓶盖的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 包装食品和饮料的需求不断增长

- 蓬勃发展的製药业

- 酒精饮料消费量增加

- 保存期限长且密封性佳

- 永续性和可回收性的吸引力

- 产业陷阱与挑战

- 原物料价格波动

- 轻质软包装替代

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 铝

- 钢

- 锡

- 其他的

第六章:市场估计与预测:按类型,2021 - 2034 年(百万美元和十亿单位)

- 主要趋势

- 王冠

- 罐盖

- 拧紧

- 捻

- 其他的

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 食品和饮料

- 製药

- 消费品

- 个人护理和化妆品

- 其他的

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直销

- 分销商/批发商

- 零售商

- 电子商务

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Amcor

- AptarGroup

- Berry Global

- CL Smith

- Closure Systems International

- Crown Holdings

- Finn-Korkki

- Guala Closures

- MJS Packaging

- Metal Closures

- Nippon Closures

- O. Berk

- Pelliconi

- Silgan Holdings

- Sonoco Products

- Tecnocap

The Global Metal Closures Market was valued at USD 25.9 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 45 billion by 2034. This growth is primarily driven by the increasing demand for packaged food and beverages, along with rising consumption of alcoholic drinks across both developed and emerging economies. As consumer lifestyles become more fast-paced and urbanized, the need for convenient, durable, and tamper-proof packaging solutions has grown substantially, fueling the adoption of metal closures. These closures are favored due to their ability to preserve product integrity, offer extended shelf life, and support sustainable packaging efforts. In recent years, market players have responded to evolving regulations and consumer expectations by incorporating environmentally friendly features and prioritizing recyclable materials.

The imposition of tariffs on imported aluminum and steel under the Trump administration significantly impacted the industry. These measures led to raw material cost surges-up to 25%-causing widespread disruptions for manufacturers reliant on imports. Domestic players faced tightened margins and had to pass on higher costs to customers. While some local metal producers benefited from the temporary pricing advantage, the broader industry dealt with heightened volatility and rising operational expenses. These challenges also encouraged firms to re-evaluate sourcing strategies, with many shifting towards automation and exploring alternative materials to stabilize production costs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.9 Billion |

| Forecast Value | $45 Billion |

| CAGR | 5.8% |

By material, the market is segmented into aluminum, steel, tin, and others. The aluminum segment dominated in 2024, generating over USD 10.4 billion. Aluminum closures are widely chosen for their lightweight nature, which reduces logistics expenses, and their durability, which provides reliable sealing solutions. This material is especially favored for its resistance to corrosion and compatibility with acidic products. Its alignment with circular economy initiatives and rising corporate commitments toward sustainability are boosting its adoption across various industries.

In terms of product type, the market includes crown, can-ends, screw, twist, and other closures. The can-ends category emerged as the leading segment, surpassing USD 8.4 billion in 2024. Their increasing use in the packaging of food and beverages has significantly accelerated demand. These closures provide excellent sealing performance, making them ideal for maintaining freshness and preventing contamination. The popularity of convenient packaging solutions has also contributed to the rapid growth of this segment, especially in sectors where longevity and user-friendliness are essential.

Based on end-use, the metal closures market is divided into personal care and cosmetics, food and beverage, consumer goods, pharmaceuticals, and others. The food and beverage sector led the market in 2024 with a valuation of USD 8.4 billion. Changing consumption habits, increased preference for ready-to-eat meals, and the widespread use of airtight containers in processed food have all played a vital role in driving demand. Metal closures offer barrier properties that protect contents from moisture and oxygen, helping extend shelf life and maintain quality, especially for carbonated and fermented beverages.

Regarding distribution channels, the market is segmented into direct sales, distributors/wholesalers, retailers, and e-commerce. Distributors and wholesalers accounted for the highest market share in 2024, reaching USD 9.8 billion. The growth of this segment is attributed to bulk purchasing by manufacturers across various industries, ensuring reliable supply chain continuity. These distributors often cater to mid-sized firms with flexible order sizes and custom options, enabling them to meet the needs of niche markets and specialty packaging requirements.

The United States held the largest regional share in 2024, valued at USD 8 billion. The country's robust pharmaceutical production infrastructure, combined with stringent safety and packaging standards, has driven the adoption of advanced closure systems. Metal closures designed with tamper-evident and child-resistant features have become increasingly important for compliance and consumer safety. Demand is also being fueled by the rising popularity of premium packaged goods, along with increased consumption of alcohol-based beverages, all of which require secure and efficient sealing technologies.

Competition in the metal closures industry is intense, with the presence of both global and regional manufacturers. The top three companies- Silgan Holdings Inc., Crown Holdings Inc., and Guala Closures Group-together held a market share of over 12.8% in 2024. Leading firms continue to invest in research and development to introduce next-generation products focusing on lightweight materials, enhanced recyclability, and innovative sealing mechanisms. Features such as smart closures equipped with QR codes and NFC chips are gaining momentum as companies look to boost consumer engagement, traceability, and product safety. Additionally, the rising importance of health-conscious and traceable packaging is prompting manufacturers to develop closures with features like BPA-NI linings and high-barrier technologies. The growing popularity of online retail, direct-to-consumer brands, and craft production across industries is also amplifying the need for customizable, short-run closures that combine functionality with aesthetic appeal.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for packaged food & beverages

- 3.3.1.2 Booming pharmaceutical industry

- 3.3.1.3 Increasing alcoholic beverage consumption

- 3.3.1.4 Long shelf life and hermetic sealing

- 3.3.1.5 Sustainability & recyclability appeal

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Volatility in raw material prices

- 3.3.2.2 Substitution by lightweight flexible packaging

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Million and Billion Units)

- 5.1 Key trends

- 5.2 Aluminum

- 5.3 Steel

- 5.4 Tin

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million and Billion Units)

- 6.1 Key trends

- 6.2 Crown

- 6.3 Can-ends

- 6.4 Screw

- 6.5 Twist

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million and Billion Units)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceuticals

- 7.4 Consumer goods

- 7.5 Personal care & cosmetics

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million and Billion Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Distributors / wholesalers

- 8.4 Retailer

- 8.5 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million and Billion Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amcor

- 10.2 AptarGroup

- 10.3 Berry Global

- 10.4 CL Smith

- 10.5 Closure Systems International

- 10.6 Crown Holdings

- 10.7 Finn-Korkki

- 10.8 Guala Closures

- 10.9 MJS Packaging

- 10.10 Metal Closures

- 10.11 Nippon Closures

- 10.12 O. Berk

- 10.13 Pelliconi

- 10.14 Silgan Holdings

- 10.15 Sonoco Products

- 10.16 Tecnocap