|

市场调查报告书

商品编码

1750496

汽车座椅市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Seating Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

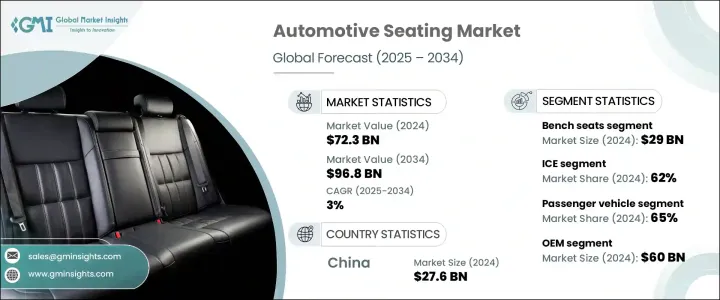

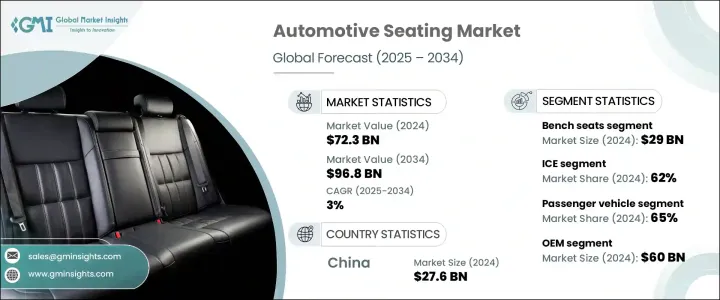

2024年,全球汽车座椅市场规模达723亿美元,预计2034年将以3%的复合年增长率成长,达到968亿美元。这得益于汽车产量的增加、安全法规的日益严格以及消费者对舒适性和便利性的日益增长的期望。汽车製造商正在重新思考座椅系统,不仅要提升美观和乘客体验,还要整合智慧技术和永续材料,以满足不断变化的标准和买家偏好。

汽车座椅产业一个显着的转变是越来越重视人体工学和健康设计。汽车製造商正在增加对先进座椅技术的投资,例如可客製化的腰部支撑、压力感应系统、姿势矫正机制以及智慧座椅监控解决方案。这些功能不仅旨在提升驾驶舒适度,还能透过减少疲劳和改善长途旅行中的脊椎矫正来支持长期健康。轻质复合材料越来越多地被应用于平衡结构强度和减轻车重,从而提高燃油效率和能源效率。这种对智慧人体工学座椅系统的关注,将车内环境转变为更以使用者为中心的环境,帮助製造商满足不断变化的消费者期望。随着即使在中阶车型中,对高端体验的需求也日益增长,座椅已成为品牌差异化和买家决策的决定性因素。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 723亿美元 |

| 预测值 | 968亿美元 |

| 复合年增长率 | 3% |

2024年,内燃机 (ICE) 汽车市场占据了 62% 的市场份额,凭藉其在全球汽车产品线中的广泛布局,将继续占据主导地位。然而,电动车 (EV) 市场正在蓬勃发展,预计在预测期内的复合年增长率约为 4%。虽然 ICE 车型因其多样性和便利性而广受欢迎,但电动车製造商也加入了先进的座椅功能,例如腰部调节、通风和按摩功能,以吸引那些精通科技、注重舒适性的消费者。

2024年,长排座椅市场规模将达290亿美元。长排座椅之所以受欢迎,源自于其在SUV、厢型车和多用途车中的实用性,而这些车型都注重乘客空间的最大化。这些配置可以增加座位容量并实现灵活的布局,使其非常适合家庭和车队用车市场。其流线型结构和经济实惠的价格,使其在发展中市场和成熟市场都继续成为可靠的选择。

2024年,中国汽车座椅市场规模达276亿美元,这得益于汽车製造生态系统的蓬勃发展、人们对高科技内饰功能日益增长的偏好,以及对注重定制化、互联互通和高端体验的座椅系统的新需求。随着电动车和豪华车型的日益普及,通风座椅、电子调节和记忆功能等功能正成为标配。中国汽车製造商正透过快速创新和强化在地化生产来应对这一挑战,进一步巩固了中国在区域座椅产业的主导地位。

塑造这一市场的关键参与者包括 GRAMMER、RECARO Holding、丰田纺织、李尔、MG Seating Systems、安道拓、麦格纳国际、博泽西特、佛吉亚和费希尔公司。为了保持竞争优势,领先的汽车座椅製造商专注于策略性倡议,例如对永续和人体工学材料的研发投资、与原始设备製造商的合作以及区域製造扩张。许多公司整合了数位技术和人工智慧座椅系统,以提升乘客体验、增强品牌形象,并与顶级汽车製造商签订长期合约。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 材料供应商

- 组件提供者

- 製造商

- 经销商

- 原始设备製造商

- 技术整合商

- 最终用途

- 利润率分析

- 供应商格局

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 策略产业反应

- 供应链重组

- 对贸易的影响

- 定价和产品策略

- 技术与创新格局

- 当前的技术趋势

- 智慧座椅技术

- 与车辆系统集成

- 减重技术

- 舒适度增强技术

- 新兴技术

- 人工智慧和机器学习应用

- 座椅系统中的物联网集成

- 生物特征感测和监测

- 先进材料科学

- 当前的技术趋势

- 专利分析

- 重要新闻和倡议

- 消费者偏好和行为

- 舒适度期望

- 人口因素对座位偏好的影响

- 消费者对座椅舒适度的看法

- 价格趋势

- 座位

- 地区

- 成本細項分析

- 监管格局

- 衝击力

- 成长动力

- 智慧互联座椅技术的整合

- 轻质和可持续材料的进步

- 电动和自动驾驶汽车内装重新配置的成长

- 透过感测器和安全气囊整合增强安全功能

- 产业陷阱与挑战

- 聚氨酯泡沫和复合材料回收的复杂性

- 先进座椅机构的开发成本高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按座位,2021 - 2034

- 主要趋势

- 折迭座椅

- 桶形座椅

- 长椅座椅

- 分离座椅

- 其他的

第六章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 标准

- 供电

- 通风

- 气候控制

- 按摩

- 其他的

第七章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 真皮

- 合成皮革

- 织物

- 可持续的

- 回收利用

- 生物基

- 植物衍生

第八章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第九章:市场估计与预测:依组件,2021 - 2034

- 主要趋势

- 框架

- 泡棉垫

- 座椅调整器

- 头枕

- 其他的

第十章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 内燃机(ICE)

- 电动车(EV)

- 油电混合车

第 11 章:市场估计与预测:按销售管道,2021 年至 2034 年

- 主要趋势

- 原始设备製造商 (OEM)

- 售后市场

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十三章:公司简介

- Adient

- Brose Sitech

- Camaco-Amvian

- Dura Automotive Systems

- Faurecia

- Fisher and Company

- Freedman Seating

- GRAMMER

- Guelph Manufacturing

- Lear

- Magna International

- MG Seating Systems

- NHK Spring

- RECARO

- TACHI-S

- TM Systems

- Toyota Boshoku

- True Assistive Tech

- TS Tech

- Woodbridge

The Global Automotive Seating Market was valued at USD 72.3 billion in 2024 and is estimated to grow at a CAGR of 3% to reach USD 96.8 billion by 2034, fueled by increasing automobile production, tightening safety regulations, and rising consumer expectations for comfort and convenience. Automakers are rethinking seating systems not only to enhance aesthetics and passenger experience but to integrate smart technologies and sustainable materials that meet evolving standards and buyer preferences.

A noticeable shift in the automotive seating industry is the growing prioritization of ergonomics and health-conscious design. Automakers are ramping up investments in advanced seat technologies such as customizable lumbar support, pressure-sensing systems, posture correction mechanisms, and smart in-seat monitoring solutions. These features are designed not only to elevate driving comfort but also to support long-term health by reducing fatigue and enhancing spinal alignment during extended travel. Lightweight composite materials are increasingly used to balance structural strength with reduced vehicle weight, contributing to greater fuel and energy efficiency. This focus on intelligent, ergonomic seating systems transforms vehicle interiors into more user-centric environments, helping manufacturers meet evolving consumer expectations. As demand rises for premium experiences even in mid-range vehicles, seating has become a defining element of brand distinction and buyer decision-making.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $72.3 Billion |

| Forecast Value | $96.8 Billion |

| CAGR | 3% |

The internal combustion engine (ICE) vehicles segment held a 62% share in 2024, continuing to dominate due to their extensive presence across global automotive lineups. However, the electric vehicle (EV) segment is gaining momentum, projected to grow at approximately 4% CAGR through the forecast period. While ICE models remain popular for their variety and accessibility, EV manufacturers incorporate sophisticated seat functionalities, like lumbar adjustments, ventilation, and massage features, to attract tech-savvy, comfort-driven consumers.

In 2024, the bench seats segment will generate USD 29 billion. Their popularity stems from their practicality in SUVs, vans, and multipurpose vehicles, where maximizing passenger space is essential. These configurations allow for increased seating capacity and versatile layouts, making them well-suited for both family and fleet-oriented vehicle segments. Their streamlined construction and affordability continue to make bench seats a reliable choice in both developing and mature markets.

China Automotive Seating Market generated USD 27.6 billion in 2024, driven by the vehicle manufacturing ecosystem, a rising preference for high-tech interior features, and the new demand for seating systems prioritizing customization, connectivity, and premium feel. As electric vehicles and luxury models gain traction, features like ventilated seating, electronic adjustability, and memory functions are becoming standard expectations. China's automakers are responding with rapid innovation and enhanced local production, further reinforcing the country's dominance in the regional seating industry.

Key players shaping this market include GRAMMER, RECARO Holding, Toyota Boshoku, Lear, MG Seating Systems, Adient, Magna International, Brose Sitech, Faurecia, and Fisher and Company. To maintain a competitive edge, leading automotive seating manufacturers focus on strategic moves such as R&D investments in sustainable and ergonomic materials, collaborations with OEMs, and regional manufacturing expansion. Many integrate digital technology and AI-enabled seating systems to elevate passenger experience, strengthen brand identity, and secure long-term contracts with top automakers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Distributors

- 3.1.1.5 OEMs

- 3.1.1.6 Technology integrators

- 3.1.1.7 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.1 Impact on trade

- 3.3 Pricing and product strategies

- 3.4 Technology & innovation landscape

- 3.4.1 Current technological trends

- 3.4.1.1 Smart seating technologies

- 3.4.1.2 Integration with vehicle systems

- 3.4.1.3 Weight reduction technologies

- 3.4.1.4 Comfort enhancement technologies

- 3.4.2 Emerging Technologies

- 3.4.2.1 AI and Machine Learning Applications

- 3.4.2.2 IoT integration in seating systems

- 3.4.2.3 Biometric sensing and monitoring

- 3.4.2.4 Advanced material sciences

- 3.4.1 Current technological trends

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Consumer preferences and behavior

- 3.7.1 Comfort expectations

- 3.7.2 Demographic influences on seating preferences

- 3.7.3 Consumer perception of seating comfort

- 3.8 Price trend

- 3.8.1 Seat

- 3.8.2 Region

- 3.9 Cost breakdown analysis

- 3.10 Regulatory landscape

- 3.11 Impacting forces

- 3.11.1 Growth drivers

- 3.11.1.1 Integration of smart and connected seating technologies

- 3.11.1.2 Advancements in lightweight and sustainable materials

- 3.11.1.3 Growth in electric and autonomous vehicle interior reconfigurations

- 3.11.1.4 Enhanced safety features with sensor and airbag integrations

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Complexity in recycling polyurethane foams and composites

- 3.11.2.2 High development costs for advanced seat mechanisms

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Seat, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Folding seat

- 5.3 Bucket seat

- 5.4 Bench seat

- 5.5 Split seat

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Standard

- 6.3 Powered

- 6.4 Ventilated

- 6.5 Climate-Controlled

- 6.6 Massage

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Genuine leather

- 7.3 Synthetic leather

- 7.4 Fabric

- 7.5 Sustainable

- 7.5.1 Recycled

- 7.5.2 Bio-based

- 7.5.3 Plant-derived

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Passenger vehicles

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUVs

- 8.3 Commercial vehicles

- 8.3.1 Light commercial vehicles (LCVs)

- 8.3.2 Medium commercial vehicles (MCV)

- 8.3.3 Heavy commercial vehicles (HCVs)

Chapter 9 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Frames

- 9.3 Foam padding

- 9.4 Seat adjuster

- 9.5 Headrests

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Internal combustion engine (ICE)

- 10.3 Electric vehicles (EVs)

- 10.4 Hybrid vehicles

Chapter 11 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 Original equipment manufacturers (OEMs)

- 11.3 Aftermarket

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 12.1 Key Trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Southeast Asia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 Saudi Arabia

- 12.6.3 South Africa

Chapter 13 Company Profiles

- 13.1 Adient

- 13.2 Brose Sitech

- 13.3 Camaco-Amvian

- 13.4 Dura Automotive Systems

- 13.5 Faurecia

- 13.6 Fisher and Company

- 13.7 Freedman Seating

- 13.8 GRAMMER

- 13.9 Guelph Manufacturing

- 13.10 Lear

- 13.11 Magna International

- 13.12 MG Seating Systems

- 13.13 NHK Spring

- 13.14 RECARO

- 13.15 TACHI-S

- 13.16 TM Systems

- 13.17 Toyota Boshoku

- 13.18 True Assistive Tech

- 13.19 TS Tech

- 13.20 Woodbridge