|

市场调查报告书

商品编码

1750497

一次性手术器材市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Disposable Surgical Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

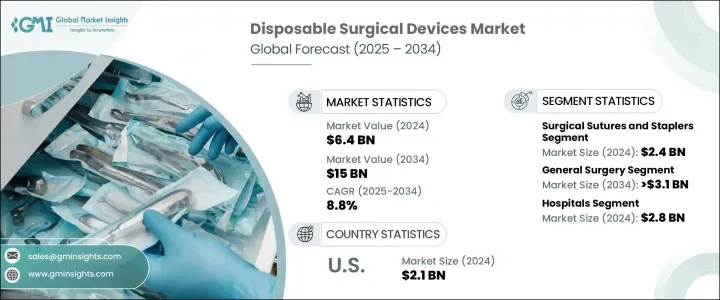

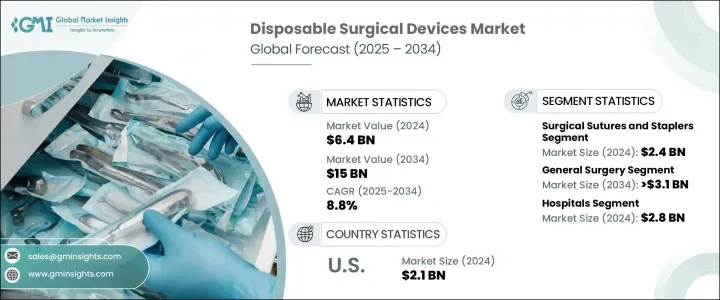

2024年,全球一次性手术器械市场规模达64亿美元,预计2034年将以8.8%的复合年增长率成长,达到150亿美元。这主要得益于手术量的增长、感染控制措施的加强以及全球对微创手术日益增长的偏好。一次性器械因其高效、易用且易于保持无菌状态而日益受到青睐。随着已开发经济体和新兴经济体的医疗保健系统不断精简营运流程并降低交叉污染风险,一次性手术器械正成为当务之急。向自动化和符合人体工学的先进器材的转变进一步推动了其应用,尤其是在高通量医疗环境中。

疫情爆发后,医疗机构遵守更严格的感染控制政策。这加速了一次性手术解决方案的普及,尤其是在择期和急诊手术数量回升的情况下。这些器械在卫生方面具有显着优势,无需消毒步骤,并缩短了手术室的周转时间。它们专为一次性使用场景设计,在註重速度和病人安全的手术环境中发挥着至关重要的作用。从基础工具到先进的缝合器和套管针,一次性器械在确保无菌条件的同时,也能提高手术的一致性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 64亿美元 |

| 预测值 | 150亿美元 |

| 复合年增长率 | 8.8% |

在产品类型中,手术缝线和缝合器领域在2024年以24亿美元的市场规模领先市场。它们在传统和微创手术中均已广泛应用,是不可或缺的医疗工具。这些工具有助于伤口管理,确保伤口缝合牢固,最大限度地减少感染,并促进更快康復。人体工学设计、无需打结的倒钩缝合线以及抗菌涂层等创新技术显着提高了缝合线的安全性和效率,使其成为表现最佳的产品类别。

预计2034年,一般外科手术市场规模将达31亿美元,复合年增长率为8.5%。此类别涵盖多种手术,对一次性手术器械的需求持续成长。门诊和住院干预的增加,以及慢性病和急性病的发生率不断上升,正在推动对这些器械的需求。医疗机构依赖一次性手术器械来确保安全合规并简化患者护理,尤其是在高容量环境中。

美国一次性手术器械市场规模在2024年达到20亿美元,预计复合年增长率为7.7%。强大的监管框架、完善的医疗基础设施以及优惠的报销模式,都为一次性器械的快速普及提供了支援。此外,总部位于美国的大型医疗器材公司也持续推动市场的发展动能。

市场的主要参与者包括史密斯+侄子 (Smith+Nephew)、库博 (CooperSurgical)、Xenco Medical、BD、强生 (Johnson & Johnson)、捷迈 (ZIMMER BIOMET)、贝朗 (B Braun)、美敦力 (Medtronic)、安布 (Ambu)、外科创新 (Surgifications) (Surgcut)、波士顿科学、安布 (Bocut)、外科创新。为了巩固市场地位,各公司优先透过研发投资进行创新,以提高产品的可用性、安全性和性能。许多公司正在扩展产品组合,增加抗菌涂层和无结缝合线等智慧功能。与医院和外科中心的策略合作也有助于确保供应合约并深化市场渗透。此外,製造商利用自动化和精密製造来满足不断增长的需求,同时保持成本效益,从而增强其在全球市场的竞争优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 全球手术量不断上升

- 技术创新迅速

- 严格的感染控制标准有利于一次性设备

- 微创手术日益受到青睐

- 产业陷阱与挑战

- 环境永续性议题

- 成本和报销障碍

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 手术缝合线和缝合器

- 手持式手术设备

- 免洗内视镜设备

- 电外科设备

第六章:市场估计与预测:按程序,2021 - 2034 年

- 主要趋势

- 一般外科

- 整形外科

- 骨科手术

- 心血管外科

- 神经外科

- 妇产科

- 伤口闭合

- 其他程式

第七章:市场估计与预测:依最终用途 2021 - 2034

- 主要趋势

- 医院

- 门诊手术中心

- 专科诊所

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Accutome

- Ambu

- B Braun

- BD

- Boston Scientific

- CooperSurgical

- Johnson & Johnson

- Medtronic

- Smith+Nephew

- Surgical Innovations

- Xenco Medical

- ZIMMER BIOMET

The Global Disposable Surgical Devices Market was valued at USD 6.4 billion in 2024 and is estimated to grow at a CAGR of 8.8% to reach USD 15 billion by 2034, driven by increasing surgical volumes, heightened infection control measures, and the rising global preference for minimally invasive procedures. Disposable instruments are gaining traction due to their efficiency, ease of use, and ability to maintain sterile conditions. As healthcare systems across developed and emerging economies look to streamline operations and reduce the risk of cross-contamination, single-use surgical tools are becoming a top priority. The shift toward automation and ergonomically advanced tools further supports adoption, particularly in high-throughput medical settings.

In the wake of the pandemic, healthcare providers adhere to stricter infection control policies. This has accelerated the move toward disposable surgical solutions, particularly as the number of elective and emergency procedures rebounds. These instruments offer clear benefits in hygiene, eliminate sterilization steps, and reduce turnaround times in operating rooms. Designed for single-use scenarios, they are proving vital in surgical environments that demand both speed and patient safety. From basic tools to advanced staplers and trocars, disposables ensure sterile conditions while improving procedural consistency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.4 Billion |

| Forecast Value | $15 Billion |

| CAGR | 8.8% |

Among product types, the surgical sutures and staplers segment led the market with USD 2.4 billion in 2024. Their consistent usage in both traditional and minimally invasive procedures makes them indispensable. These tools help in wound management, ensuring proper closure, minimizing infections, and aiding faster recovery. Innovations like ergonomic designs, barbed sutures requiring no knots, and antimicrobial coatings have significantly enhanced their safety and efficiency, making them the top-performing product category.

The general surgery segment is projected to reach USD 3.1 billion by 2034, growing at a CAGR of 8.5%. This category covers several procedures, contributing to consistent demand for disposable surgical tools. The increasing rate of outpatient and inpatient interventions, along with the growing prevalence of chronic and acute conditions, is boosting demand for these devices. Medical institutions rely on single-use surgical tools for safety compliance and streamlined patient care, especially in high-volume environments.

U.S. Disposable Surgical Devices Market accounted for USD 2 billion in 2024 and is expected to grow at a CAGR of 7.7%. A strong regulatory framework, sophisticated healthcare infrastructure, and favorable reimbursement models all support rapid adoption of disposable instruments. Additionally, major medical device companies headquartered in the U.S. continue to drive market momentum.

Key players in this market include Smith+Nephew, CooperSurgical, Xenco Medical, BD, Johnson & Johnson, ZIMMER BIOMET, B Braun, Medtronic, Ambu, Surgical Innovations, Accutome, and Boston Scientific. To strengthen their foothold, companies prioritize innovation through R&D investments to enhance usability, safety, and performance. Many are expanding product portfolios with smart features such as antimicrobial coatings and knotless sutures. Strategic collaborations with hospitals and surgical centers are also helping secure supply contracts and deepen market penetration. Furthermore, manufacturers leverage automation and precision manufacturing to meet growing demand while maintaining cost-efficiency, enhancing their competitive edge across global markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global surgical volume

- 3.2.1.2 Rapid technological innovation

- 3.2.1.3 Stringent infection control standards favoring disposable devices

- 3.2.1.4 Rising preference for minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Environmental sustainability concerns

- 3.2.2.2 Cost and reimbursement barriers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Surgical sutures and staplers

- 5.3 Handheld surgical devices

- 5.4 Disposable endoscopy devices

- 5.5 Electrosurgical devices

Chapter 6 Market Estimates and Forecast, By Procedure, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 General surgery

- 6.3 Plastic and reconstructive Surgery

- 6.4 Orthopedic surgery

- 6.5 Cardiovascular surgery

- 6.6 Neurosurgery

- 6.7 Obstetrics and gynecology

- 6.8 Wound closure

- 6.9 Other procedures

Chapter 7 Market Estimates and Forecast, By End Use 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Specialty clinics

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Accutome

- 9.2 Ambu

- 9.3 B Braun

- 9.4 BD

- 9.5 Boston Scientific

- 9.6 CooperSurgical

- 9.7 Johnson & Johnson

- 9.8 Medtronic

- 9.9 Smith+Nephew

- 9.10 Surgical Innovations

- 9.11 Xenco Medical

- 9.12 ZIMMER BIOMET