|

市场调查报告书

商品编码

1750499

临床实验室测试市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Clinical Laboratory Tests Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

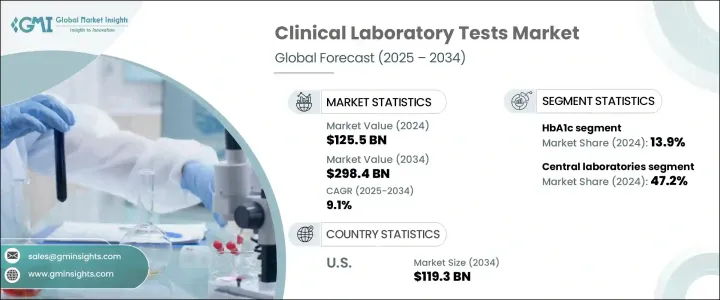

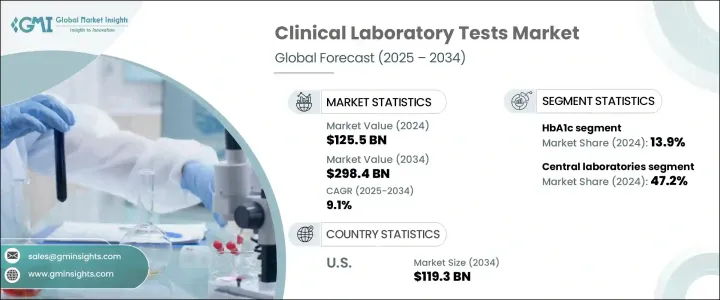

2024年,全球临床实验室检测市场规模达1,255亿美元,预计到2034年将以9.1%的复合年增长率成长,达到2,984亿美元。这主要得益于慢性病病例的增加、全球人口老化以及对诊断检测在早期发现和治疗监测方面的日益依赖。实验室检测有助于医疗决策,大多数诊断工作流程依赖试剂、分析仪和检体采集系统等工具。老龄化人口,尤其是发达地区的老龄化人口,由于其易患心臟病、癌症和糖尿病等慢性疾病,对检测需求贡献巨大。

人工智慧和自动化的应用提高了检测的周转时间和准确性。现代实验室如今将机器学习和机器人技术融入工作流程,以减少人为错误,提高营运效率,并管理不断增长的样本量。个人化医疗的发展推动了对精准诊断和多分析物检测的需求。临床检测已成为全球预防性医疗保健策略的常规组成部分,即使在新兴经济体中,定期健康筛检也变得越来越普遍。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1255亿美元 |

| 预测值 | 2984亿美元 |

| 复合年增长率 | 9.1% |

2024年,糖化血红蛋白(HbA1c)检测占据最大市场份额,贡献了总收入的13.9%。这些检测对于监测长期血糖控制至关重要,尤其对于糖尿病患者而言。便携式分析仪和自动化系统等技术进步使HbA1c检测更加便捷有效率。公众对早期诊断和疾病管理意识的不断提升也推动了这些检测的频率。随着全球糖尿病病例的增加,对定期监测的需求持续激增,推动了该领域的持续成长。

2024年,中心实验室市场占据最大份额,达到472亿美元,这得益于其高通量诊断能力、完善的基础设施以及与医院和研究机构的紧密整合。这些实验室配备齐全,能够处理包括基因和分子诊断在内的复杂检测,并能在广泛的地理网络中保持结果的一致性。其经济高效的解决方案和可靠性使其成为满足大规模检测需求的首选。

2024年,美国临床实验室检测市场规模达508亿美元,预计2034年将达到1,193亿美元,主要得益于多种结构性因素和技术因素。高昂的人均医疗保健支出使得尖端诊断技术能够广泛地应用于医院、诊所和研究实验室。慢性病、传染病和与年龄相关的健康状况的发病率不断上升,进一步加剧了对及时准确的实验室检测的需求。对分子诊断、个人化医疗和早期疾病检测工具的日益依赖正在重塑全国的临床工作流程。

该领域的主要参与者包括西门子医疗、生物梅里埃、安捷伦科技、Illumina、赛默飞世尔科技、雅培实验室、Hologic、Bio-Rad Laboratories、凯杰、丹纳赫和珀金埃尔默。为了增强市场影响力,各公司正专注于与医疗服务提供者建立合作关係,扩展实验室自动化,并投资以人工智慧为基础的平台。他们也致力于实现检测菜单的多样化,收购规模较小的诊断公司,并扩大全球分销网络。在不断变化的诊断领域,合规性、产品创新和经济高效的解决方案对于保持竞争力仍然至关重要。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性病和传染病症率不断上升

- 诊断技术的进步

- 老年人口不断增加

- 产业陷阱与挑战

- 缺乏熟练的实验室人员

- 严格的监管情景

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 各国应对措施

- 对产业的影响

- 供应方影响(製造成本)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(消费者成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(製造成本)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按测试类型,2021 年至 2034 年

- 主要趋势

- 全血球计数

- 糖化血红素

- 代谢组

- 肝臟检查

- 肾臟检查

- 脂质组

- 心血管小组

- 其他测试类型

第六章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 中央实验室

- 基层诊所

- 医院

- 其他最终用途

第七章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第八章:公司简介

- Abbott Laboratories

- Agilent Technologies

- Beckman Coulter

- Becton, Dickinson and Company

- bioMerieux

- Bio-Rad Laboratories

- F. Hoffmann-La Roche

- Grifols

- Hologic

- Illumina

- PerkinElmer

- QIAGEN

- QuidelOrtho

- Siemens Healthineers

- Thermo Fisher Scientific

The Global Clinical Laboratory Tests Market was valued at USD 125.5 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 298.4 billion by 2034, fueled by rising chronic disease cases, the aging global population, and the increasing reliance on diagnostic testing for early detection and treatment monitoring. Laboratory testing helps in medical decision-making, with most diagnostic workflows depending on tools like reagents, analyzers, and specimen collection systems. Aging populations, especially in developed regions, contribute significantly to testing demand due to their susceptibility to chronic illnesses such as heart disease, cancer, and diabetes.

Adoption of AI and automation has improved test turnaround time and accuracy. Modern laboratories now integrate machine learning and robotics into workflows to reduce manual errors, boost operational efficiency, and manage rising sample volumes. The move toward personalized medicine pushes demand for precise diagnostics and multi-analyte tests. Clinical testing has become a regular part of preventive healthcare strategies worldwide, and regular health screenings are becoming increasingly common, even in emerging economies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $125.5 Billion |

| Forecast Value | $298.4 Billion |

| CAGR | 9.1% |

In 2024, HbA1c tests accounted for the largest market share, contributing 13.9% of total revenue. These tests are essential for monitoring long-term blood glucose control, particularly in patients with diabetes. Technological improvements such as portable analyzers and automated systems have made HbA1c testing more accessible and efficient. Growing public awareness around early diagnosis and disease management has also pushed the frequency of these tests. With diabetes cases rising globally, demand for regular monitoring continues to surge, driving sustained growth for this segment.

The central laboratories segment held the largest share in 2024, accounting for USD 47.2 billion, supported by high-throughput diagnostic capabilities, well-established infrastructure, and strong integration with hospitals and research institutions. These labs are equipped to handle complex tests, including genetic and molecular diagnostics, and maintain consistency in results across wide geographical networks. Their cost-effective solutions and reliability make them the preferred option for large-scale testing needs.

U.S. Clinical Laboratory Tests Market was valued at USD 50.8 billion in 2024 and is projected to reach USD 119.3 billion by 2034, driven by multiple structural and technological factors. High per capita healthcare spending enables widespread integration of cutting-edge diagnostic technologies across hospitals, clinics, and research labs. The rising incidence of chronic illnesses, infectious diseases, and age-related health conditions further amplifies the need for timely and accurate laboratory testing. Increasing reliance on molecular diagnostics, personalized medicine, and early disease detection tools is reshaping clinical workflows nationwide.

Key players in this space include Siemens Healthineers, bioMerieux, Agilent Technologies, Illumina, Thermo Fisher Scientific, Abbott Laboratories, Hologic, Bio-Rad Laboratories, QIAGEN, Danaher, and PerkinElmer. To strengthen market presence, companies are focusing on partnerships with healthcare providers, expanding laboratory automation, and investing in AI-based platforms. They also aim to diversify test menus, acquire smaller diagnostic firms, and increase their global distribution networks. Regulatory compliance, product innovation, and cost-effective solutions remain critical to staying competitive in the evolving diagnostic landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic and infectious diseases

- 3.2.1.2 Advancements in diagnostic technologies

- 3.2.1.3 Growing geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Shortage of skilled laboratory personnel

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Complete blood count

- 5.3 HbA1c

- 5.4 Metabolic panel

- 5.5 Liver panel

- 5.6 Renal panel

- 5.7 Lipid panel

- 5.8 Cardiovascular panel

- 5.9 Other test types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Central laboratories

- 6.3 Primary clinics

- 6.4 Hospitals

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Abbott Laboratories

- 8.2 Agilent Technologies

- 8.3 Beckman Coulter

- 8.4 Becton, Dickinson and Company

- 8.5 bioMerieux

- 8.6 Bio-Rad Laboratories

- 8.7 F. Hoffmann-La Roche

- 8.8 Grifols

- 8.9 Hologic

- 8.10 Illumina

- 8.11 PerkinElmer

- 8.12 QIAGEN

- 8.13 QuidelOrtho

- 8.14 Siemens Healthineers

- 8.15 Thermo Fisher Scientific