|

市场调查报告书

商品编码

1750502

船舶交通管理市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Vessel Traffic Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

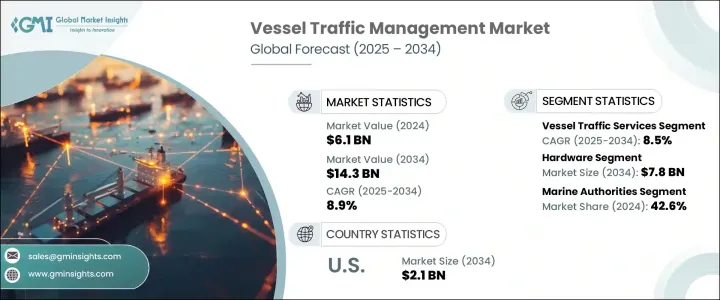

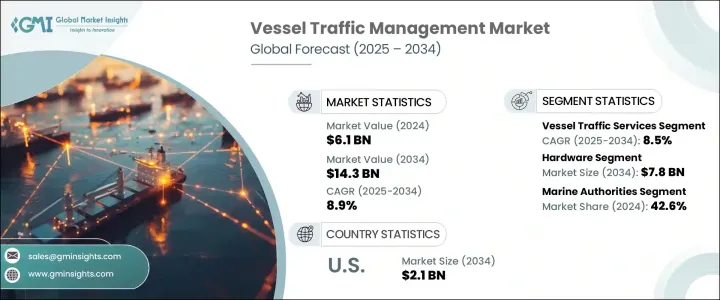

2024年,全球船舶交通管理市场规模达61亿美元,预计2034年将以8.9%的复合年增长率成长,达到143亿美元。这主要得益于对能够高效安全地处理日益增长的船舶流量的更智慧交通系统的需求。由于船舶运输量不断增加,全球港口基础设施面临压力,促使人们采用高性能係统来增强导航能力、减少瓶颈并提升港口营运效率。国际贸易政策和原物料价格波动引发的产业变革促使企业进行在地化生产,并重新思考其供应链策略,以降低地缘政治风险。随着港口拥堵问题日益严重,对能够简化营运并确保符合安全法规的技术的需求比以往任何时候都更加重要。

市场深受拥挤海上航线即时船舶监控需求日益增长的影响。融合雷达、甚高频通讯和自动辨识技术的增强型船舶交通管理系统,对商业和国防海事当局而言都至关重要。这些系统能够实现无缝协调、态势感知,并在高密度交通区域实现更安全的航行。船舶交通服务这一细分市场正受到显着发展,这得益于人们对数位海事基础设施日益增长的兴趣以及对港口安全和监控系统投资的增加。随着人们专注于降低环境风险和改善海上物流,各地区对智慧互联技术的需求正在激增。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 61亿美元 |

| 预测值 | 143亿美元 |

| 复合年增长率 | 8.9% |

从组件角度来看,硬体在船舶交通管理生态系统中占据重要地位,预计到2034年将达到78亿美元。这包括各种资料收集和传输所需的海事设备,例如感测器、雷达和通讯模组。船舶安全监管的加强持续推动了这项需求。儘管硬体占据主导地位,但随着港口寻求包含资料分析、远端管理和预测性维护的整合解决方案,服务领域有望加速成长。

按最终用途划分,海事部门在2024年占42.6%,因其在规范航行安全和环境标准方面发挥的关键作用而占据主导地位。这些部门利用船舶交通系统来加强对船舶交通的管控,并确保国内和国际水域的平稳运作。依靠雷达、AIS和综合通讯系统等即时监控工具,他们能够主动管理海上风险,缓解拥堵,并迅速应对紧急情况。

预计到2034年,美国船舶交通管理市场规模将达到21亿美元,这得益于更严格的安全规程和尖端船舶交通管理系统(VTMS)的部署。联邦政府的授权和海岸防卫队的倡议加速了现代监控系统在高流量区域的推广。此外,美国对港口基础设施升级和人工智慧工具整合的重视,刺激了对智慧船舶交通管理系统(VTM)平台的持续需求。然而,小型港口营运商的预算限制,加上贸易不确定性和地缘政治紧张局势,仍然是某些地区快速扩张的障碍。

为了巩固竞争优势,诺斯罗普·格鲁曼公司、莱昂纳多公司、康斯伯格集团、新科工程公司和萨博公司等公司正大力投资研发和创新。他们利用人工智慧、物联网和预测分析技术,提供更智慧、可扩展的船舶交通管理解决方案。为了进入高潜力市场,他们也优先考虑与政府和港务局的合作。许多公司正在透过端到端船舶交通管理系统 (VTMS) 功能增强其服务组合,以应对全球日益增长的营运复杂性和监管需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 生长

- 全球海上贸易量不断成长

- 港口拥挤加剧,营运效率需求增加

- 人工智慧、机器学习和即时监控技术的进步

- 严格的海事安全与环境法规

- 港口基础建设现代化投资

- 产业陷阱与挑战

- 安装和维护成本高

- 传统系统与现代系统之间的互通性有限

- 生长

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按系统类型,2021 年至 2034 年

- 主要趋势

- 船舶交通服务(VTS)

- 港口管理系统(PMS)

- 自动辨识系统(AIS)

- 基于雷达的系统

第六章:市场估计与预测:按组件,2021 年至 2034 年

- 主要趋势

- 硬体

- 软体

- 服务

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 海事部门

- 港口和海港

- 商业船舶营运商

- 海军

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Elcome International LLC

- Frequentis

- Furuno

- Hensoldt

- Indra Sistemas

- Japan Radio Co. Ltd.

- Kongsberg Gruppen

- Leonardo SpA

- Marlink AS

- Northrop Grumman Corporation

- Saab

- ST Engineering

- Terma

- Thales Group

- Wartsilä

The Global Vessel Traffic Management Market was valued at USD 6.1 billion in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 14.3 billion by 2034, driven by the demand for smarter traffic systems capable of handling increasing vessel volumes efficiently and safely. Global port infrastructure is under pressure due to growing ship movements, driving the adoption of high-performance systems that enhance navigation, reduce bottlenecks, and boost port operations. Industry shifts caused by international trade policies and material price volatility prompt companies to localize production and rethink their supply chain strategies to reduce geopolitical risks. As ports face rising congestion, the need for technologies that can streamline operations while ensuring compliance with safety regulations is more important than ever.

The market is heavily influenced by the rising need for real-time ship monitoring in congested sea routes. Enhanced vessel traffic management systems that incorporate radar, VHF communications, and automatic identification technologies are becoming essential for both commercial and defense maritime authorities. These systems enable seamless coordination, situational awareness, and safer navigation through high-density traffic zones. One segment, Vessel Traffic Services, is experiencing significant traction due to growing interest in digital maritime infrastructure and increasing investments in port security and surveillance systems. With a focus on minimizing environmental risk and improving maritime logistics, demand for intelligent and connected technologies is surging across regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.1 Billion |

| Forecast Value | $14.3 Billion |

| CAGR | 8.9% |

From a component standpoint, hardware holds a strong presence in the vessel traffic management ecosystem and is forecasted to hit USD 7.8 billion by 2034. This includes a wide range of maritime equipment necessary for data collection and transmission, such as sensors, radar, and communication modules. Tighter regulatory enforcement for ship safety continues to drive this demand. Although hardware dominates, the services segment is poised for accelerated growth as ports look for integrated solutions that include data analytics, remote management, and predictive maintenance.

Based on end-use, the marine authorities segment accounted for a 42.6% share in 2024, dominating the segment due to their critical role in regulating navigation safety and environmental standards. These authorities turn to vessel traffic systems to enhance control over ship traffic and ensure smooth operations in national and international waters. The reliance on real-time monitoring tools like radar, AIS, and integrated communications systems allows them to proactively manage maritime risks, mitigate congestion, and respond swiftly to emergencies.

U.S. Vessel Traffic Management Market is expected to reach USD 2.1 billion by 2034, supported by the push for stricter safety protocols and cutting-edge VTMS deployments. Federal mandates and Coast Guard initiatives have accelerated the rollout of modern monitoring systems across high-traffic zones. Furthermore, the nation's emphasis on upgrading port infrastructure and integrating AI-driven tools has spurred consistent demand for intelligent VTM platforms. However, budget constraints among smaller port operators, coupled with trade uncertainties and geopolitical tensions, remain barriers to rapid expansion in certain regions.

To solidify their competitive edge, companies like Northrop Grumman Corporation, Leonardo S.p.A., Kongsberg Gruppen, ST Engineering, and Saab AB are investing heavily in research and innovation. They leverage artificial intelligence, IoT, and predictive analytics to deliver smarter, scalable vessel traffic management solutions. Collaborations with governments and port authorities are also prioritized to gain access to high-potential markets. Many players are enhancing their service portfolios with end-to-end VTMS capabilities to address growing operational complexity and regulatory demands globally.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth

- 3.3.1.1.1 Rising global maritime trade volumes

- 3.3.1.1.2 Increasing port congestion and demand for operational efficiency

- 3.3.1.1.3 Advancements in AI, ML, and real-time monitoring technologies

- 3.3.1.1.4 Stringent maritime safety and environmental regulations

- 3.3.1.1.5 Investments in port infrastructure modernization

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1.1 High installation and maintenance costs

- 3.3.2.1.2 Limited interoperability between legacy and modern systems

- 3.3.1 Growth

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By System Type, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Vessel traffic services (VTS)

- 5.3 Port management systems (PMS)

- 5.4 Automatic identification system (AIS)

- 5.5 Radar-based systems

Chapter 6 Market Estimates and Forecast, By Component, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Hardware

- 6.3 Software

- 6.4 Services

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Marine authorities

- 7.3 Ports and harbours

- 7.4 Commercial vessel operators

- 7.5 Naval forces

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Elcome International LLC

- 9.2 Frequentis

- 9.3 Furuno

- 9.4 Hensoldt

- 9.5 Indra Sistemas

- 9.6 Japan Radio Co. Ltd.

- 9.7 Kongsberg Gruppen

- 9.8 Leonardo S.p.A.

- 9.9 Marlink AS

- 9.10 Northrop Grumman Corporation

- 9.11 Saab

- 9.12 ST Engineering

- 9.13 Terma

- 9.14 Thales Group

- 9.15 Wartsilä