|

市场调查报告书

商品编码

1750506

镀锌及涂层钢铁板市场机会、成长动力、产业趋势分析及2025-2034年预测Galvanized And Coated Iron and Steel Sheets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球镀锌和涂层钢铁板市场规模达1628亿美元,预计到2034年将以4.6%的复合年增长率增长,达到2591亿美元,这主要得益于汽车、建筑和消费品等行业需求的激增。已开发经济体和新兴经济体的快速城镇化和工业扩张,推动了对耐用耐腐蚀钢材的需求。这些钢板具有良好的耐用性、结构完整性和成本效益,这对于重型和长期应用至关重要。

此外,先进的表面处理技术不断提升耐腐蚀性、耐用性和美观性,也正在不断扩展镀锌和涂层钢板的应用范围。製造商采用环保涂层配方,减少生产过程中的有毒排放和能源消耗。这符合日益增长的监管压力以及客户对更环保的建筑和製造材料的需求。因此,这些创新不仅提升了性能,还支援符合永续标准,使其在全球建筑、汽车和工业应用中更具吸引力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1628亿美元 |

| 预测值 | 2591亿美元 |

| 复合年增长率 | 4.6% |

在市场上,热浸镀锌钢仍然是应用最广泛的涂层技术。该领域在2024年创造了957亿美元的市场规模,预计2034年将达到1,479亿美元。其主导地位源自于其卓越的耐用性、长期的防腐性能和经济实惠的价格。热浸镀锌製程能够形成锌-钢结合层,在恶劣环境下起到屏蔽作用,使其成为农业、基础设施、交通运输和工业项目中高衝击力应用的理想材料。

镀锌涂层钢捲因其运输便利、库存成本低等特点,在大型用户中依然颇受欢迎。 2024年,钢捲市场占了39.9%的市占率。钢捲可在现场加工成特定尺寸,从而最大限度地减少浪费并优化材料利用率。这些特性使其成为汽车生产线、模组化住宅专案和预製结构中精简操作的理想选择。此外,随着人们对绿色节能建筑日益增长的兴趣,镀锌钢捲作为涂装和美观级建筑构件的关键原料,其需求也日益增长。

2024年,美国镀锌和涂层钢板市场规模达174亿美元,预计到2034年复合年增长率将达到4.9%。强劲的需求源自于美国不断扩张的汽车和基础设施产业,这些产业对耐腐蚀性和延长材料寿命至关重要。桥樑、商业建筑和交通网络项目继续采用这些钢材产品,因为它们在各种环境下都具有良好的韧性和性能。

市场的主要参与者包括浦项製铁、安赛乐米塔尔、宝武钢铁集团、塔塔钢铁和新日铁。这些公司正在透过投资先进的镀锌技术、扩大产能以及与终端用户建立策略合作伙伴关係来增强竞争优势。他们高度重视环保生产方法和自动化製造,以降低成本并支援长期的可扩展性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 镀锌钢和涂层钢:基本原理和发展历程

- 镀锌和涂层钢产品的定义和分类

- 涂层技术的历史发展

- 原料及成分

- 基础钢种及性能

- 锌和锌合金

- 铝和铝锌合金

- 聚合物和有机涂层

- 其他涂层材料

- 製造流程

- 热镀锌

- 电镀锌

- 镀锌退火

- 镀铝和镀锌涂层

- 预涂装及彩涂装

- 其他涂层技术

- 比较分析:镀锌钢产品与其他涂层钢产品

- 涂层製程的技术进步

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 2021-2024年主要出口国

- 2021-2024年主要进口国

- 概括

- 市场概况和主要发现

- 市场规模和成长预测

- 关键市场驱动因素与限制因素

- 竞争格局简介

- 投资机会和策略建议

- 未来展望及市场潜力

- 全球镀锌和涂布钢市场概况

- 市场定义和范围

- 市场规模和成长分析

- 市场动态

- 市场驱动因素

- 耐腐蚀材料的需求不断成长

- 扩大建筑和基础设施开发

- 汽车产量上升与轻量化趋势

- 再生能源应用的采用率不断提高

- 市场限制

- 原物料价格波动

- 替代材料的竞争

- 环境问题和监管挑战

- 市场机会

- 新兴市场需求不断成长

- 涂层技术的创新

- 再生能源基础设施扩张

- 市场挑战

- 严格的环境法规

- 供应链中断

- 能源成本波动

- 市场驱动因素

- 新冠疫情的影响及疫情后復苏

- 波特五力分析

- 杵分析

- 价值链分析

- 原物料供应商

- 製造商

- 分销商和零售商

- 最终用户

- 製造和生产分析

- 製造流程概述

- 原料采购与准备

- 基础钢产量

- 表面处理

- 涂层应用工艺

- 涂层后处理

- 品质控制和测试

- 生产成本分析

- 原料成本

- 能源成本

- 劳动成本

- 製造费用

- 成本优化策略

- 製造设施分析

- 主要製造地点

- 生产能力评估

- 设施扩建计划

- 供应链挑战与解决方案

- 製造流程的可持续性

- 能源效率措施

- 减少废弃物的策略

- 节水措施

- 环保涂层技术

- 製造流程概述

- 监管环境和标准

- 全球监理框架

- 区域监理框架

- 北美洲

- ASTM标准

- 建筑规范和法规

- 环境法规

- 欧洲

- EN标准

- CE标誌要求

- 环境法规

- 亚太

- JIS标准(日本)

- GB 标准(中国)

- BIS 标准(印度)

- 世界其他地区

- 北美洲

- 产品认证和标准

- 品质标准

- 安全标准

- 环境标准

- 合规挑战与策略

- 未来监管趋势及其影响

- 环境、社会与治理 (ESG) 分析

- 环境影响评估

- 碳足迹分析

- 生命週期评估(LCA)

- 能源消耗和排放

- 废弃物管理和回收利用

- 社会影响

- 劳动实务和工作条件

- 社区影响力和参与

- 健康和安全考虑

- 治理和道德考虑

- 公司治理实践

- 道德供应链管理

- 透明度和报告

- 关键参与者的 ESG 绩效基准

- ESG风险评估与缓解策略

- 镀锌和涂层钢产业未来 ESG 趋势

- 环境影响评估

- 消费者行为与市场趋势分析

- 消费者偏好与购买模式

- 影响购买决策的因素

- 价格敏感度

- 品质和性能要求

- 环境考虑

- 审美偏好

- 产业特定偏好

- 建筑业偏好

- 汽车产业偏好

- 家电产业偏好

- 消费者行为的区域差异

- 数位转型对消费者参与度的影响

- 未来消费趋势及其影响

- 技术格局与创新分析

- 镀锌和涂层钢的当前技术趋势

- 新兴技术及其潜在影响

- 先进的涂层配方

- 奈米科技应用

- 数位化製造和工业4.0

- 涂层製程中的自动化和机器人技术

- 研发活动与创新中心

- 跨应用程式的技术采用趋势

- 技术准备评估

- 2025-2033年未来技术路线图

- 定价分析与经济因素

- 价格趋势分析

- 历史价格趋势

- 目前定价情景

- 价格预测

- 影响定价的因素

- 原料成本

- 能源价格

- 劳动成本

- 供需动态

- 贸易政策和关税

- 区域价格差异

- 价格价值关係分析

- 影响市场的经济指标

- GDP成长与建筑活动

- 工业生产指数

- 汽车生产趋势

- 基础建设投资

- 主要市场参与者的定价策略

- 价格趋势分析

- 永续性和循环经济

- 可持续的原料采购

- 生产中的能源效率

- 减少废弃物和回收倡议

- 减少碳足迹策略

- 镀锌和涂层钢的循环经济模式

- 产品寿命延长策略

- 临终管理

- 回收和升级改造机会

- 永续实践案例研究

- 产业可持续发展的未来

- 市场机会和策略建议

- 尚未开发的市场机会

- 给市场参与者的策略建议

- 对于製造商

- 对于投资者

- 对于最终用户产业

- 新产品开发机会

- 新参与者的市场进入策略

- 多元化机会

- 策略伙伴关係和合作机会

- 投资分析和市场吸引力

- 目前投资情境

- 按领域分類的投资机会

- 各地区的投资机会

- 投资报酬率分析

- 创投与私募股权格局

- 併购活动分析

- 未来投资展望

- 风险评估和缓解策略

- 市场风险

- 技术风险

- 监理风险

- 竞争风险

- 供应链风险

- 环境和永续性风险

- 风险缓解策略

- 未来展望与市场演变

- 长期市场预测

- 新兴应用和用例

- 技术演进场景

- 未来市场动态

- 潜在的颠覆者和游戏规则改变者

- 未来竞争格局

第四章:竞争格局

- 主要参与者的市占率分析

- 竞争定位矩阵

- 主要参与者所采用的竞争策略

- 产品创新与开发

- 併购

- 伙伴关係和合作

- 扩张策略

- 关键球员的 SWOT 分析

- 主要市场参与者的详细公司简介

- 安赛乐米塔尔

- 新日铁公司

- 浦项製铁

- 塔塔钢铁

- 宝武钢铁集团

- JFE钢铁公司

- 纽柯公司

- 蒂森克虏伯

- 美国钢铁公司

- 克利夫兰悬崖

- 钢铁动态

- 现代化钢铁

- 博思格钢铁

- 金达尔钢铁和电力

- 其他值得注意的球员

- 镀锌和涂层钢市场的新兴企业和新创企业

- 专利分析与智慧财产权格局

- 最近的专利申请

- 专利权属分析

- 基于专利的技术趋势分析

第五章:市场规模及预测:依涂层类型,2021-2034

- 主要趋势

- 热镀锌钢

- 电镀锌钢

- 镀锌钢

- 镀锌铝钢

- 镀铝钢

- 预涂镀锌钢(PPGI)

- 其他

第六章:市场规模及预测:依产品形式,2021-2034

- 主要趋势

- 线圈

- 工作表

- 盘子

- 棒材和线材

- 其他的

第七章:市场规模及预测:依涂层重量,2021-2034

- 主要趋势

- 轻涂层(G30–G60)

- 中等涂层(G90–G235)

- 重涂层(G240以上)

第八章:市场规模及预测:以基础钢种,2021-2034 年

- 主要趋势

- 商业钢材

- 拉拔钢

- 结构钢

- 高强度低合金钢(HSLA)

- 先进高强度钢(AHSS)

- 其他的

第九章:市场规模及预测:依最终用途产业,2021-2034

- 主要趋势

- 建筑和基础设施

- 住宅建筑

- 商业建筑

- 工业建筑

- 基础建设发展

- 汽车和运输

- 搭乘用车

- 商用车

- 铁路和地铁系统

- 造船

- 家用电器和电子产品

- 白色家电

- HVAC 系统

- 电子外壳

- 能源和电力

- 太阳能係统

- 风能基础设施

- 输配电

- 农业

- 工业设备和机械

- 其他的

第 10 章:市场规模与预测:按具体应用,2021-2034 年

- 主要趋势

- 屋顶和覆层

- 结构部件

- 汽车车身部件

- 家电外壳

- 电气导管和外壳

- 暖通空调管道系统

- 其他的

第 11 章:市场规模与预测:按配销通路,2021-2034 年

- 主要趋势

- 直销

- 经销商和服务中心

- 零售店

- 电子商务

- 其他的

第 12 章:市场规模与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第十三章:公司简介

- ArcelorMittal

- Nippon Steel Corporation

- POSCO

- Tata Steel

- Baowu Steel

- JFE Steel Corporation

- Nucor Corporation

- ThyssenKrupp

- United States Steel

- Cleveland-Cliffs

- Steel Dynamics

- Hyundai Steel

- BlueScope Steel

- Jindal Steel & Power

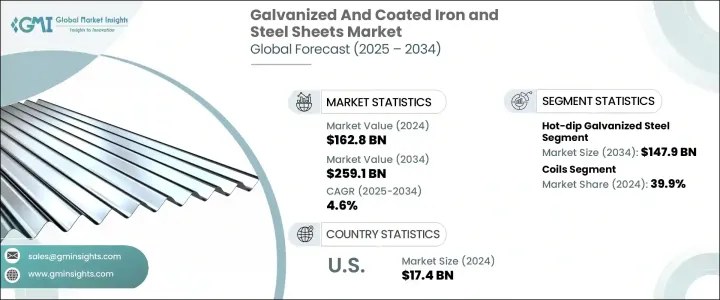

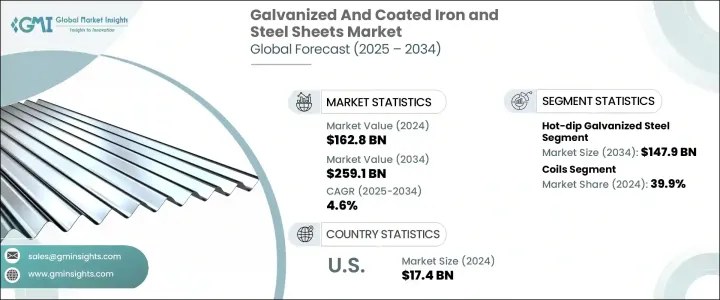

The Global Galvanized And Coated Iron and Steel Sheets Market was valued at USD 162.8 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 259.1 billion by 2034, shaped by the surge in demand from industries such as automotive, construction, and consumer goods. Rapid urbanization and industrial expansion in developed and emerging economies help boost demand for durable and corrosion-resistant steel materials. These sheets offer longevity, structural integrity, and cost-effectiveness, essential in heavy-duty and long-term applications.

Additionally, the development of advanced surface treatments that enhance corrosion resistance, durability, and aesthetic appeal is expanding the application range of galvanized and coated iron and steel sheets. Manufacturers incorporate eco-friendly coating formulations that reduce toxic emissions and energy consumption during production. This aligns with growing regulatory pressures and customer demand for greener building and manufacturing materials. As a result, these innovations not only improve performance but also support compliance with sustainability standards, making them more appealing for use in construction, automotive, and industrial applications globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $162.8 Billion |

| Forecast Value | $259.1 Billion |

| CAGR | 4.6% |

Within the market, hot-dip galvanized steel continues to be the most widely used coating technique. This segment generated USD 95.7 billion in 2024 and is projected to reach USD 147.9 billion by 2034. Its dominance stems from superior durability, long-term corrosion protection, and affordability. The hot-dip process creates a zinc-steel bond that acts as a shield in aggressive environments, making it an ideal material for high-impact use in agriculture, infrastructure, transportation, and industrial projects.

Galvanized and coated steel in coil form remains a popular choice among large-scale users due to its ease of transportation and reduced inventory costs. In 2024, the coils segment accounted for a 39.9% share. Coils can be processed into specific dimensions on-site, minimizing waste and optimizing material usage. These characteristics make them ideal for streamlined operations in automotive production lines, modular housing projects, and prefabricated structures. Additionally, galvanized coils are seeing heightened demand as key raw materials in painted and aesthetic-grade building components, aligning with growing interest in green and energy-efficient construction.

United States Galvanized And Coated Iron and Steel Sheets Market stood at USD 17.4 billion in 2024 and is expected to register a CAGR of 4.9% through 2034. Robust demand is driven by the country's expanding automotive and infrastructure sectors, where corrosion resistance and extended material lifespan are critical requirements. Projects in bridges, commercial buildings, and transport networks continue to adopt these steel products due to their resilience and performance in various environments.

Key players in this market include POSCO, ArcelorMittal, Baowu Steel Group, TATA Steel, and Nippon Steel Corporation. These companies are strengthening their competitive edge by investing in advanced galvanizing technology, expanding production capacities, and forming strategic partnerships with end-use industries. A strong emphasis is placed on environmentally responsible methods and automation in manufacturing to reduce costs and support long-term scalability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Report scope and objectives

- 1.2 Research design and approach

- 1.3 Data collection methods

- 1.3.1 Primary research

- 1.3.2 Secondary research

- 1.4 Market estimation and forecasting methodology

- 1.5 Assumptions and limitations

- 1.6 Data validation and triangulation techniques

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Galvanized and coated steel: fundamentals and evolution

- 3.1.1 Definition and classification of galvanized and coated steel products

- 3.1.2 Historical development of coating technologies

- 3.1.3 Raw materials and composition

- 3.1.3.1 Base steel types and properties

- 3.1.3.2 Zinc and zinc alloys

- 3.1.3.3 Aluminum and aluminum-zinc alloys

- 3.1.3.4 Polymers and organic coatings

- 3.1.3.5 Other coating materials

- 3.1.4 Manufacturing processes

- 3.1.4.1 Hot-dip galvanizing

- 3.1.4.2 Electro galvanizing

- 3.1.4.3 Galvannealing

- 3.1.4.4 Aluminizing and galvalume coating

- 3.1.4.5 Pre-painting and color coating

- 3.1.4.6 Other coating technologies

- 3.1.5 Comparative analysis: galvanized vs. Other coated steel products

- 3.1.6 Technological advancements in coating processes

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries, 2021-2024 (USD Mn)

- 3.3.2 Major importing countries, 2021-2024 (USD Mn)

- 3.4 Summary

- 3.4.1 Market overview and key findings

- 3.4.2 Market size and growth projections

- 3.4.3 Key market drivers and restraints

- 3.4.4 Competitive landscape snapshot

- 3.4.5 Investment opportunities and strategic recommendations

- 3.4.6 Future outlook and market potential

- 3.5 Global galvanized and coated steel market overview

- 3.5.1 Market definition and scope

- 3.5.2 Market size and growth analysis

- 3.5.3 Market dynamics

- 3.5.3.1 Market drivers

- 3.5.3.1.1 Growing demand for corrosion-resistant materials

- 3.5.3.1.2 Expansion in construction and infrastructure development

- 3.5.3.1.3 Rising automotive production and lightweight trends

- 3.5.3.1.4 Increasing adoption in renewable energy applications

- 3.5.3.2 Market restraints

- 3.5.3.2.1 Volatility in raw material prices

- 3.5.3.2.2 Competition of alternative materials

- 3.5.3.2.3 Environmental concerns and regulatory challenges

- 3.5.3.3 Market opportunities

- 3.5.3.3.1 Growing demand in emerging markets

- 3.5.3.3.2 Innovations in coating technologies

- 3.5.3.3.3 Expansion in renewable energy infrastructure

- 3.5.3.4 Market challenges

- 3.5.3.4.1 Stringent Environmental Regulations

- 3.5.3.4.2 Supply chain disruptions

- 3.5.3.4.3 Fluctuating energy costs

- 3.5.3.1 Market drivers

- 3.5.4 Impact of covid-19 and post-pandemic recovery

- 3.5.5 Porter's five forces analysis

- 3.5.6 Pestle analysis

- 3.5.7 Value chain analysis

- 3.5.7.1 Raw material suppliers

- 3.5.7.2 Manufacturers

- 3.5.7.3 Distributors and retailers

- 3.5.7.4 End users

- 3.6 Manufacturing and production analysis

- 3.6.1 Manufacturing process overview

- 3.6.1.1 Raw material procurement and preparation

- 3.6.1.2 Base steel production

- 3.6.1.3 Surface preparation

- 3.6.1.4 Coating application processes

- 3.6.1.5 Post-coating treatments

- 3.6.1.6 Quality control and testing

- 3.6.2 Production cost analysis

- 3.6.2.1 Raw material costs

- 3.6.2.2 Energy costs

- 3.6.2.3 Labor costs

- 3.6.2.4 Manufacturing overheads

- 3.6.2.5 Cost optimization strategies

- 3.6.3 Manufacturing facilities analysis

- 3.6.3.1 Key manufacturing locations

- 3.6.3.2 Production capacity assessment

- 3.6.3.3 Facility expansion plans

- 3.6.4 Supply chain challenges and solutions

- 3.6.5 Sustainability in manufacturing processes

- 3.6.5.1 Energy efficiency measures

- 3.6.5.2 Waste reduction strategies

- 3.6.5.3 Water conservation practices

- 3.6.5.4 Eco-friendly coating technologies

- 3.6.1 Manufacturing process overview

- 3.7 Regulatory landscape and standards

- 3.7.1 Global regulatory framework

- 3.7.2 Regional regulatory frameworks

- 3.7.2.1 North America

- 3.7.2.1.1 ASTM standards

- 3.7.2.1.2 Building codes and regulations

- 3.7.2.1.3 Environmental regulations

- 3.7.2.2 Europe

- 3.7.2.2.1 EN standards

- 3.7.2.2.2 CE marking requirements

- 3.7.2.2.3 Environmental regulations

- 3.7.2.3 Asia-pacific

- 3.7.2.3.1 JIS standards (Japan)

- 3.7.2.3.2 GB standards (China)

- 3.7.2.3.3 BIS standards (India)

- 3.7.2.4 Rest of the world

- 3.7.2.1 North America

- 3.7.3 Product certification and standards

- 3.7.3.1 Quality standards

- 3.7.3.2 Safety standards

- 3.7.3.3 Environmental standards

- 3.7.4 Compliance challenges and strategies

- 3.7.5 Future regulatory trends and their implications

- 3.8 Environmental, social, and governance (ESG) analysis

- 3.8.1 Environmental impact assessment

- 3.8.1.1 Carbon footprint analysis

- 3.8.1.2 Life cycle assessment (LCA)

- 3.8.1.3 Energy consumption and emissions

- 3.8.1.4 Waste management and recycling

- 3.8.2 Social implications

- 3.8.2.1 Labor practices and working conditions

- 3.8.2.2 Community impact and engagement

- 3.8.2.3 Health and safety considerations

- 3.8.3 Governance and ethical considerations

- 3.8.3.1 Corporate governance practices

- 3.8.3.2 Ethical supply chain management

- 3.8.3.3 Transparency and reporting

- 3.8.4 ESG performance benchmarking of key players

- 3.8.5 ESG risk assessment and mitigation strategies

- 3.8.6 Future ESG trends in the galvanized and coated steel industry

- 3.8.1 Environmental impact assessment

- 3.9 Consumer behavior and market trends analysis

- 3.9.1 Consumer preferences and purchasing patterns

- 3.9.2 Factors influencing purchase decisions

- 3.9.2.1 Price sensitivity

- 3.9.2.2 Quality and performance requirements

- 3.9.2.3 Environmental considerations

- 3.9.2.4 Aesthetic preferences

- 3.9.3 Industry-specific preferences

- 3.9.3.1 Construction industry preferences

- 3.9.3.2 Automotive industry preferences

- 3.9.3.3 Appliance industry preferences

- 3.9.4 Regional variations in consumer behavior

- 3.9.5 Impact of digital transformation on consumer engagement

- 3.9.6 Future consumer trends and their implications

- 3.10 Technological landscape and innovation analysis

- 3.10.1 Current technological trends in galvanized and coated steel

- 3.10.2 Emerging technologies and their potential impact

- 3.10.2.1 Advanced coating formulations

- 3.10.2.2 Nanotechnology applications

- 3.10.2.3 Digital manufacturing and industry 4.0

- 3.10.2.4 Automation and robotics in coating processes

- 3.10.3 R&D activities and innovation hubs

- 3.10.4 Technology adoption trends across applications

- 3.10.5 Technology readiness assessment

- 3.10.6 Future technology roadmap 2025–2033

- 3.11 Pricing analysis and economic factors

- 3.11.1 Pricing trends analysis

- 3.11.1.1 Historical price trends

- 3.11.1.2 Current pricing scenario

- 3.11.1.3 Price forecast

- 3.11.2 Factors affecting pricing

- 3.11.2.1 Raw material costs

- 3.11.2.2 Energy prices

- 3.11.2.3 Labor costs

- 3.11.2.4 Supply-demand dynamics

- 3.11.2.5 Trade policies and tariffs

- 3.11.3 Regional price variations

- 3.11.4 Price-value relationship analysis

- 3.11.5 Economic indicators impacting the market

- 3.11.5.1 GDP growth and construction activity

- 3.11.5.2 Industrial production index

- 3.11.5.3 Automotive production trends

- 3.11.5.4 Infrastructure investment

- 3.11.6 Pricing strategies for key market players

- 3.11.1 Pricing trends analysis

- 3.12 Sustainability and circular economy

- 3.12.1 Sustainable sourcing of raw materials

- 3.12.2 Energy efficiency in production

- 3.12.3 Waste reduction and recycling initiatives

- 3.12.4 Carbon footprint reduction strategies

- 3.12.5 Circular economy models in galvanized and coated steel

- 3.12.5.1 Product life extension strategies

- 3.12.5.2 End-of-life management

- 3.12.5.3 Recycling and upcycling opportunities

- 3.12.6 Case studies of sustainable practices

- 3.12.7 Future of sustainability in the industry

- 3.13 Market opportunities and strategic recommendations

- 3.13.1 Untapped market opportunities

- 3.13.2 Strategic recommendations for market participants

- 3.13.2.1 For manufacturers

- 3.13.2.2 For investors

- 3.13.2.3 For end-user industries

- 3.13.3 New product development opportunities

- 3.13.4 Market entry strategies for new players

- 3.13.5 Diversification opportunities

- 3.13.6 Strategic partnerships and collaboration opportunities

- 3.14 Investment analysis and market attractiveness

- 3.14.1 Current investment scenario

- 3.14.2 Investment opportunities by segment

- 3.14.3 Investment opportunities by region

- 3.14.4 Roi analysis

- 3.14.5 Venture capital and private equity landscape

- 3.14.6 M&A activity analysis

- 3.14.7 Future investment outlook

- 3.15 Risk assessment and mitigation strategies

- 3.15.1 Market risks

- 3.15.2 Technological risks

- 3.15.3 Regulatory risks

- 3.15.4 Competitive risks

- 3.15.5 Supply chain risks

- 3.15.6 Environmental and sustainability risks

- 3.15.7 Risk mitigation strategies

- 3.16 Future outlook and market evolution

- 3.16.1 Long-term market forecast

- 3.16.2 Emerging applications and use cases

- 3.16.3 Technological evolution scenarios

- 3.16.4 Future market dynamics

- 3.16.5 Potential disruptors and game-changers

- 3.16.6 Future competitive landscape

Chapter 4 Competitive Landscape, 2024

- 4.1 Market share analysis of key players

- 4.2 Competitive positioning matrix

- 4.3 Competitive strategies adopted by key players

- 4.3.1 Product innovation and development

- 4.3.2 Mergers and acquisitions

- 4.3.3 Partnerships and collaborations

- 4.3.4 Expansion strategies

- 4.4 Swot analysis of key players

- 4.5 Detailed company profiles of major market players

- 4.5.1 ArcelorMittal

- 4.5.2 Nippon steel corporation

- 4.5.3 POSCO

- 4.5.4 Tata steel

- 4.5.5 Baowu steel group

- 4.5.6 JFE steel corporation

- 4.5.7 Nucor corporation

- 4.5.8 Thyssenkrupp

- 4.5.9 United States steel corporation

- 4.5.10 Cleveland-cliffs

- 4.5.11 Steel dynamics

- 4.5.12 Hyundai steel

- 4.5.13 Bluescope steel

- 4.5.14 Jindal steel & power

- 4.5.15 Other notable players

- 4.6 Emerging players and startups in galvanized and coated steel market

- 4.7 Patent analysis and intellectual property landscape

- 4.7.1 Recent patent filings

- 4.7.2 Patent ownership analysis

- 4.7.3 Technology trend analysis based on patents

Chapter 5 Market Size and Forecast, By Coating Type, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Hot-dip galvanized steel

- 5.3 Electrogalvanized steel

- 5.4 Galvannealed steel

- 5.5 Galvalume (zinc-aluminum coated) steel

- 5.6 Aluminized steel

- 5.7 Pre-painted galvanized steel (PPGI)

- 5.8 Other

Chapter 6 Market Size and Forecast, By Product Form, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Coils

- 6.3 Sheets

- 6.4 Plates

- 6.5 Bars and wires

- 6.6 Others

Chapter 7 Market Size and Forecast, By Coating Weight, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Light coating (G30–G60)

- 7.3 Medium coating (G90–G235)

- 7.4 Heavy coating (G240 and above)

Chapter 8 Market Size and Forecast, By Base Steel Grade, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 Commercial steel

- 8.3 Drawing steel

- 8.4 Structural steel

- 8.5 High-strength low-alloy steel (HSLA)

- 8.6 Advanced high-strength steel (AHSS)

- 8.7 Others

Chapter 9 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Million) (Tons)

- 9.1 Key trends

- 9.2 Construction and infrastructure

- 9.2.1 Residential construction

- 9.2.2 Commercial construction

- 9.2.3 Industrial construction

- 9.2.4 Infrastructure development

- 9.3 Automotive and transportation

- 9.3.1 Passenger vehicles

- 9.3.2 Commercial vehicles

- 9.3.3 Railway and metro systems

- 9.3.4 Shipbuilding

- 9.4 Home appliances and electronics

- 9.4.1 White goods

- 9.4.2 HVAC systems

- 9.4.3 Electronic enclosures

- 9.5 Energy and power

- 9.5.1 Solar energy systems

- 9.5.2 Wind energy infrastructure

- 9.5.3 Power transmission and distribution

- 9.6 Agriculture

- 9.7 Industrial equipment and machinery

- 9.8 Others

Chapter 10 Market Size and Forecast, By Specific Applications, 2021-2034 (USD Million) (Tons)

- 10.1 Key trends

- 10.2 Roofing and cladding

- 10.3 Structural components

- 10.4 Automotive body parts

- 10.5 Appliance casings

- 10.6 Electrical conduits and enclosures

- 10.7 HVAC ductwork

- 10.8 Others

Chapter 11 Market Size and Forecast, By Distribution Channel, 2021-2034 (USD Million) (Tons)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Distributors and service centers

- 11.4 Retail outlets

- 11.5 E-commerce

- 11.6 Others

Chapter 12 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Rest of Europe

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.4.6 Rest of Asia Pacific

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Rest of Latin America

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

- 12.6.4 Rest of Middle East & Africa

Chapter 13 Company Profiles

- 13.1 ArcelorMittal

- 13.2 Nippon Steel Corporation

- 13.3 POSCO

- 13.4 Tata Steel

- 13.5 Baowu Steel

- 13.6 JFE Steel Corporation

- 13.7 Nucor Corporation

- 13.8 ThyssenKrupp

- 13.9 United States Steel

- 13.10 Cleveland-Cliffs

- 13.11 Steel Dynamics

- 13.12 Hyundai Steel

- 13.13 BlueScope Steel

- 13.14 Jindal Steel & Power