|

市场调查报告书

商品编码

1750512

不銹钢棒材和棒材形状市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Stainless Steel Bars and Bar-Size Shapes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

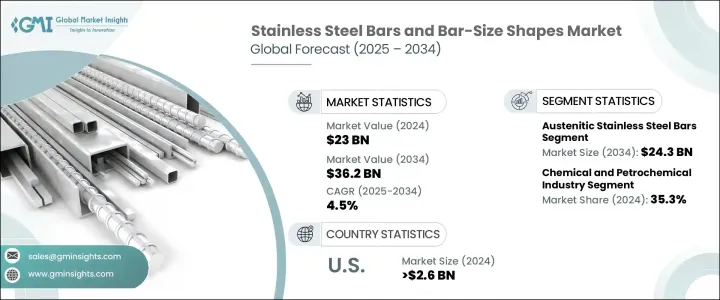

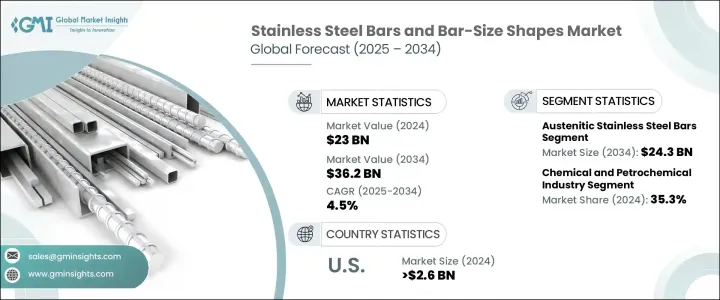

2024年,全球不銹钢棒材和棒材型材市场价值为230亿美元,预计到2034年将以4.5%的复合年增长率增长,达到362亿美元,这主要得益于建筑、汽车、能源和製造等行业对不銹钢需求的快速增长。不銹钢独特的性能——强度高、耐腐蚀、可回收——使其成为现代工业应用的必备材料。其在极端环境下的坚固耐用性以及永续性使其成为全球工业成长的关键参与者。

不銹钢棒材因其优异的抗应力和腐蚀性能,在各个领域都发挥着至关重要的作用。在建筑领域,它们为持久耐用的建筑物和基础设施提供所需的结构完整性。汽车业依赖不銹钢棒材来製造易受磨损和腐蚀的关键部件。同样,能源行业,尤其是石油和天然气行业,也使用不銹钢,因为它在高压和极端条件下具有出色的耐用性。不銹钢在医疗和食品加工行业也至关重要,因为这些行业对卫生标准要求很高。随着不銹钢新应用的不断涌现,棒材和棒材形状的市场持续扩张,从而刺激了对可靠耐用材料的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 230亿美元 |

| 预测值 | 362亿美元 |

| 复合年增长率 | 4.5% |

奥氏体不銹钢棒材市场在2024年达到158亿美元,预计2034年将成长至243亿美元。奥氏体不銹钢,尤其是304和316等牌号,因其出色的抗氧化、抗腐蚀和耐高温性能而备受推崇,使其成为建筑、化学加工和医疗等领域不可或缺的材料。这些棒材也以其高延展性、非磁性和易于加工而闻名,这使得它们能够在不影响强度的情况下被加工成复杂的结构。

化工和石化产业在不銹钢棒材和型材市场中扮演着至关重要的角色,2024年其市场占有率为35.3%。不銹钢棒材和型材在製造反应器、阀门、泵浦、热交换器和管道系统方面不可或缺,这些设备都必须承受腐蚀性化学品、高温和极端压力等严苛条件。这些行业要求材料即使在持续暴露于腐蚀性物质和挥发性化合物的情况下也能保持其结构完整性,因此不銹钢是确保关键操作可靠性和安全性的理想选择。

2024年,美国不銹钢棒材和型材市场规模达到26亿美元,预计到2034年将继续以4.5%的复合年增长率稳步增长,这主要得益于製造业和建筑业的活跃发展以及正在进行的基础设施建设项目。不銹钢部件广泛应用于机械、运输和建筑材料等各个领域,这推动了对耐用、多功能且能够承受恶劣环境的材料的需求。随着美国工业活动保持强劲,预计未来几年不銹钢棒材和型材市场将稳定扩张。

全球不銹钢棒材及棒材形状市场的主要参与者包括奥托昆普、新日铁、阿塞里诺克斯、浦项製铁和金达尔不銹钢。这些公司正在采取多种策略,例如丰富产品线、提升生产能力以及注重永续发展,以巩固其市场地位。透过投资创新生产技术并拓展新兴市场,这些参与者正致力于满足市场对高品质不銹钢产品日益增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 概括

- 市场亮点和主要发现

- 市场规模和成长预测

- 主要市场驱动因素与限制因素

- 竞争格局概览

- 策略建议概览

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业回应

- 供应链重构

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 主要出口国(2021-2024年)

- 主要进口国(2021-2024年)

註:以上贸易统计仅提供重点国家

- 市场概况与动态

- 市场定义与演变

- 价值链分析

- 市场规模与成长预测(2021-2034)

- 历史市场价值(2021-2024)

- 当前市场估值(2024年)

- 市场预测(2025-2034)

- 市场动态

- 主要成长动力

- 市场限制与挑战

- 市场机会

- 市场力量的影响分析

- 大环境分析

- 波特五力分析

- COVID-19影响评估与恢復分析

- 全球钢铁业概况及其对不銹钢棒市场的影响

- 规范架构和标准

- 全球不銹钢产业法规

- 不銹钢棒材国际标准

- ASTM标准

- ASME标准

- EN标准

- JIS标准

- ISO标准

- 区域监理框架

- 北美法规

- 欧洲法规

- 亚太法规

- 贸易政策和关税

- 进出口法规

- 反倾销措施

- 反补助税

- 保障措施

- 品质认证要求

- 材质认证

- 流程认证

- 品质管理体系

- 环境法规

- 排放标准

- 废弃物管理条例

- 能源效率要求

- 职业安全法规

- 监管影响分析

- 对生产成本的影响

- 对市场进入障碍的影响

- 对定价策略的影响

- 行业趋势和最终用户偏好

- 向高性能不銹钢等级转变

- 耐腐蚀等级

- 高强度等级

- 耐热等级

- 汽车产业趋势

- 车辆轻量化倡议

- 电动汽车影响

- 排放法规的影响

- 安全和性能要求

- 石油和天然气产业趋势

- 深水勘探要求

- 腐蚀环境解决方案

- 高压/高温应用

- 化工产业趋势

- 耐腐蚀要求

- 流程效率改进

- 安全性和可靠性要求

- 食品饮料产业趋势

- 卫生和卫生要求

- 流程自动化的影响

- 监理合规需求

- 医疗产业趋势

- 生物相容性要求

- 精密製造需求

- 灭菌相容性

- 建筑业趋势

- 建筑应用的成长

- 永续建筑实践

- 耐腐蚀基础设施

- 区域最终用途偏好差异

- OEM规格趋势

- 材料选择标准

- 性能要求

- 成本考虑

- 向高性能不銹钢等级转变

- 供应炼和原料分析

- 原物料采购分析

- 铁矿石和废料

- 镍

- 铬

- 钼

- 其他合金元素

- 不銹钢生产流程分析

- 炼钢技术

- 合金工艺

- 轧製和精加工工艺

- 热处理工艺

- 品质控制措施

- 配销通路分析

- 直接销售给原始设备製造商

- 钢铁服务中心

- 分销商和批发商

- 电子商务平台

- 供应链挑战

- 原物料价格波动

- 能源成本波动

- 物流和运输挑战

- 供应链中断

- 供应链优化策略

- 永续供应链实践

- 供应链中的技术整合

- 原物料采购分析

- 定价分析和成本结构

- 依产品类型进行价格点分析

- 奥氏体不銹钢棒定价

- 铁素体不銹钢棒定价

- 马氏体不銹钢棒定价

- 双相不銹钢棒定价

- PH 不銹钢棒定价

- 价格趋势分析(2020-2025)

- 价格预测(2025-2030)

- 影响定价的因素

- 原料成本

- 能源成本

- 劳动成本

- 生产成本

- 运输费用

- 市场竞争

- 贸易政策和关税

- 区域价格差异

- 关键参与者的定价策略

- 成本结构分析

- 原料成本

- 能源成本

- 劳动成本

- 製造成本

- 分销成本

- 行销和销售成本

- 按产品细分的获利能力分析

- 加值服务对定价的影响

- 依产品类型进行价格点分析

- 技术进步与创新

- 近期技术发展

- 先进炼钢技术

- 电弧炉创新

- AOD工艺的进步

- 连续铸造改进

- 合金设计创新

- 精益双相不銹钢

- 高氮不锈钢

- 高级马氏体钢种

- 特种奥氏体钢种

- 加工技术的进步

- 热轧创新

- 冷加工技术的进步

- 热处理创新

- 表面处理技术

- 品质控制和测试创新

- 非破坏性检验的进步

- 自动检测系统

- 材料表征技术

- 不銹钢生产中的数位化集成

- 工业4.0实施

- 人工智慧应用

- 预测性维护系统

- 数位孪生技术

- 永续生产技术

- 能源效率创新

- 减排技术

- 减少废弃物和回收利用

- 专利分析与研发趋势

- 未来技术路线图

- 永续性和环境影响

- 不銹钢生产的环境足迹

- 碳足迹分析

- 能源消耗评估

- 用水和管理

- 废弃物产生和管理

- 不銹钢产业的永续发展倡议

- 碳减排策略

- 能源效率措施

- 循环经济方法

- 回收和材料回收

- 废料利用率

- 安宁疗护

- 闭环製造

- 绿色钢铁生产技术

- 氢基炼钢

- 碳捕获和储存

- 生物质减排

- 永续性的监管压力

- 碳定价机制

- 排放交易体系

- 环境合规要求

- 产业永续发展承诺

- 生命週期评估(LCA)分析

- 永续实践的成本效益分析

- 不銹钢生产的环境足迹

- 市场挑战与机会

- 主要市场挑战

- 原物料价格波动

- 能源成本波动

- 钢铁业产能过剩

- 贸易壁垒与保护主义

- 环境合规成本

- 替代材料的竞争

- 市场机会

- 高性能合金开发

- 新兴市场扩张

- 基础建设发展项目

- 再生能源成长

- 医疗和製药应用

- 增材製造应用

- 宏观经济因素的影响

- 全球经济成长

- 工业生产趋势

- 施工活动

- 石油和天然气产业动态

- 技术机会评估

- 战略机会图

- 主要市场挑战

- 未来市场展望与预测

- 按产品类型分類的市场预测(2025-2030 年)

- 奥氏体不銹钢棒材预测

- 铁素体不銹钢棒材预测

- 马氏体不銹钢棒材预测

- 双相不銹钢棒材预测

- PH不銹钢棒材预测

- 按形状分類的市场预测(2025-2030)

- 圆棒预测

- 方形和矩形条预测

- 六角棒预测

- 其他形状预测

- 按应用分類的市场预测(2025-2030)

- 各地区市场预测(2025-2030)

- 新兴市场趋势

- 未来成长动力

- 市场演变情景

- 乐观情境

- 现实场景

- 悲观情景

- 投资机会评估

- 未来竞争格局预测

- 按产品类型分類的市场预测(2025-2030 年)

- 策略建议

- 市场进入策略

- 产品开发建议

- 区域扩张机会

- 竞争定位策略

- 永续发展实施路线图

- 数位转型策略

- 监理合规策略

- 行销和分销建议

- 风险缓解策略

- 投资优先框架

- 不銹钢与其他材质的比较分析

- 不銹钢与碳钢

- 不銹钢与铝

- 不銹钢与镍合金

- 性能基准化分析

- 成本效益分析

- 应用适用性比较

- 专利分析与创新格局

- 近期专利申请分析

- 技术创新与研发重点领域

- 区域和公司层面的专利趋势

第四章:竞争格局

- 市场结构与集中度分析

- 市场集中度概览

- 市场分散与市场主导地位分析

- 进入障碍和市场准入评估

- 关键参与者的市占率分析

- 顶级製造商的百分比份额

- 跨区域市场主导地位

- 市占率变化的历史趋势

- 竞争定位矩阵

- 根据产品范围和地理位置对主要参与者进行定位

- 战略能力与技术优势对比

- 基于绩效和创新的象限映射

- 主要参与者的详细公司简介

- 奥托昆普

- 阿塞里诺克斯

- 金达尔不銹钢

- 新日铁公司

- 浦项製铁

- 山特维克材料技术

- 卡彭特技术公司

- 瓦尔布鲁纳不锈钢公司

- 奥钢联股份公司

- 青山控股集团

- 竞争策略分析

- 产能扩张计划

- 合併与收购

- 伙伴关係与合作

- 产品开发与创新

- 投资和融资情景

- 近期投资趋势

- 私募股权和创投的参与

- 公共部门资金和激励措施

第五章:市场规模及预测:依等级,2021-2034

- 主要趋势

- 奥氏体不銹钢棒(300系列)

- 304/304l不銹钢

- 316/316l不銹钢

- 321不銹钢

- 347不銹钢

- 其他奥氏体钢种

- 铁素体不锈钢棒材(400系列)

- 430不銹钢

- 409不锈钢

- 446不銹钢

- 其他铁素体钢种

- 马氏体不銹钢棒(400系列)

- 410不锈钢

- 416不銹钢

- 420不锈钢

- 440不銹钢

- 其他马氏体牌号

- 双相不銹钢棒材

- 2205双工

- 2507超级双工

- 其他双相不銹钢

- 沉淀硬化不銹钢棒

- 17-4 PH不銹钢

- 15-5 PH不銹钢

- 其他 PH 等级

第六章:市场规模与预测:依形状与尺寸,2021-2034 年

- 主要趋势

- 圆棒

- 方棒

- 六角棒

- 扁钢

- 角度

- 频道

- 其他条形尺寸形状

第七章:市场规模及预测:依加工方法,2021-2034

- 主要趋势

- 热轧不銹钢棒材

- 冷加工不銹钢棒

- 冷拉钢筋

- 冷轧钢筋

- 车削和抛光棒材

- 研磨和抛光棒

第 8 章:市场规模与预测:按应用,2021-2034 年

- 主要趋势

- 汽车和运输

- 排气系统

- 结构部件

- 紧固件和连接器

- 燃油系统部件

- 航太和国防

- 飞机部件

- 紧固件和连接器

- 起落架部件

- 国防装备

- 建筑和基础设施

- 结构部件

- 加固应用

- 建筑应用

- 紧固件和锚固件

- 石油和天然气产业

- 钻井设备

- 探索组件

- 精炼设备

- 海上应用

- 化学和石化工业

- 製程设备零件

- 阀门和配件

- 热交换组件

- 食品和饮料业

- 加工设备

- 储槽和容器

- 输送系统

- 医疗和製药

- 手术器械

- 植入式装置

- 设备组件

- 发电

- 传统发电厂

- 核电厂

- 再生能源设备

- 海洋和造船业

- 结构部件

- 推进系统

- 甲板设备

- 机械设备製造业

- 产业机械

- 纺织机械

- 造纸和纸浆设备

- 其他应用

- 消费品

- 电子产品

- 运动器材

第九章:市场规模及预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Outokumpu

- Acerinox

- Jindal Stainless

- Nippon Steel

- POSCO

- Sandvik Materials Technology

- Carpenter Technology

- Valbruna Stainless

- Voestalpine

- Tsingshan Holding Group

The Global Stainless Steel Bars and Bar-Size Shapes Market was valued at USD 23 billion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 36.2 billion by 2034, driven by the rapid growth in demand for stainless steel across industries like construction, automotive, energy, and manufacturing. Stainless steel's unique properties-strength, corrosion resistance, and recyclability-make it an essential material for modern industrial applications. The material's robustness in extreme environments, along with its sustainability, positions it as a key player in global industrial growth.

Stainless steel bars are crucial in various sectors due to their ability to withstand stress and corrosion. In construction, they provide the structural integrity needed for long-lasting buildings and infrastructure. The automotive industry relies on stainless-steel bars for critical components exposed to wear and corrosion. Similarly, the energy sector, particularly oil and gas, uses stainless steel for its durability under high pressures and extreme conditions. Stainless steel is also vital in the medical and food processing industries, where high hygiene standards are required. As new applications for stainless steel emerge, the market for bars and bar-size shapes continues to expand, bolstering the demand for reliable, durable materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23 Billion |

| Forecast Value | $36.2 Billion |

| CAGR | 4.5% |

The austenitic stainless steel bars segment accounted for USD 15.8 billion in 2024 and is expected to grow to USD 24.3 billion by 2034. Austenitic stainless steel, especially grades like 304 and 316, is prized for its excellent resistance to oxidation, corrosion, and high temperatures, making it indispensable in applications such as construction, chemical processing, and the medical field. These bars are also known for their high ductility, non-magnetic properties, and ease of fabrication, which allows them to be shaped into complex structures without compromising their strength.

The chemical and petrochemical industries play a crucial role in the stainless steel bars and bar-size shapes market, holding a 35.3% share in 2024. Stainless steel bars and shapes are indispensable in manufacturing reactors, valves, pumps, heat exchangers, and piping systems, all of which must endure the demanding conditions of aggressive chemicals, high temperatures, and extreme pressures. These sectors require materials that maintain their structural integrity even under constant exposure to corrosive substances and volatile compounds, making stainless steel an ideal choice for ensuring reliability and safety in critical operations.

U.S. Stainless Steel Bars and Bar-Size Shapes Market reached USD 2.6 billion in 2024 and is projected to continue growing at a steady pace of 4.5% CAGR through 2034, driven by the active manufacturing and construction industries, as well as ongoing infrastructure development projects. Stainless steel components are widely used in various sectors, including machinery, transportation, and building materials, fueling the demand for durable and versatile materials that can withstand harsh environments. As industrial activity in the U.S. remains robust, the market for stainless steel bars and shapes is expected to expand steadily over the coming years.

Key players in the Global Stainless Steel Bars and Bar-Size Shapes Market include Outokumpu, Nippon Steel Corporation, Acerinox, POSCO, and Jindal Stainless. These companies are adopting strategies such as diversifying product offerings, enhancing production capabilities, and focusing on sustainability to strengthen their market position. By investing in innovative production techniques and expanding into emerging markets, these players are looking to meet the increasing demand for high-quality stainless-steel products.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Summary

- 3.1.1 Market Highlights and Key Findings

- 3.1.2 Market Size and Growth Projections

- 3.1.3 Key Market Drivers and Restraints

- 3.1.4 Competitive Landscape Overview

- 3.1.5 Strategic Recommendations Snapshot

- 3.2 Trump Administration Tariffs

- 3.2.1 Impact on Trade

- 3.2.1.1 Trade Volume Disruptions

- 3.2.1.2 Retaliatory Measures

- 3.2.2 Impact on the Industry

- 3.2.2.1 Supply-Side Impact (Raw Materials)

- 3.2.2.1.1 Price Volatility in Key Materials

- 3.2.2.1.2 Supply Chain Restructuring

- 3.2.2.1.3 Production Cost Implications

- 3.2.2.2 Demand-Side Impact (Selling Price)

- 3.2.2.2.1 Price Transmission to End Markets

- 3.2.2.2.2 Market Share Dynamics

- 3.2.2.2.3 Consumer Response Patterns

- 3.2.2.1 Supply-Side Impact (Raw Materials)

- 3.2.3 Key Companies Impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on Trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major Exporting Countries, 2021-2024 (USD Mn)

- 3.3.2 Major Importing Countries, 2021-2024 (USD Mn)

Note: The above trade statistics will be provided for key countries only

- 3.4 Market Overview and Dynamics

- 3.4.1 Market Definition and Evolution

- 3.4.2 Value Chain Analysis

- 3.4.3 Market Size and Growth Forecast 2021–2034

- 3.4.3.1 Historical Market Value 2021–2024

- 3.4.3.2 Current Market Valuation 2024

- 3.4.3.3 Market Projections 2025–2034

- 3.4.4 Market Dynamics

- 3.4.4.1 Primary Growth Drivers

- 3.4.4.2 Market Restraints and Challenges

- 3.4.4.3 Market Opportunities

- 3.4.4.4 Impact Analysis of Market Forces

- 3.4.5 PESTLE Analysis

- 3.4.6 Porter's Five Forces Analysis

- 3.4.7 COVID-19 Impact Assessment and Recovery Analysis

- 3.4.8 Global Steel Industry Overview and Impact on Stainless Steel Bars Market

- 3.5 Regulatory Framework and Standards

- 3.5.1 Global Stainless Steel Industry Regulations

- 3.5.2 International Standards for Stainless Steel Bars

- 3.5.2.1 ASTM Standards

- 3.5.2.2 ASME Standards

- 3.5.2.3 EN Standards

- 3.5.2.4 JIS Standards

- 3.5.2.5 ISO Standards

- 3.5.3 Regional Regulatory Frameworks

- 3.5.3.1 North American Regulations

- 3.5.3.2 European Regulations

- 3.5.3.3 Asia-Pacific Regulations

- 3.5.4 Trade Policies and Tariffs

- 3.5.4.1 Import/Export Regulations

- 3.5.4.2 Anti-Dumping Measures

- 3.5.4.3 Countervailing Duties

- 3.5.4.4 Safeguard Measures

- 3.5.5 Quality Certification Requirements

- 3.5.5.1 Material Certification

- 3.5.5.2 Process Certification

- 3.5.5.3 Quality Management Systems

- 3.5.6 Environmental Regulations

- 3.5.6.1 Emissions Standards

- 3.5.6.2 Waste Management Regulations

- 3.5.6.3 Energy Efficiency Requirements

- 3.5.7 Occupational Safety Regulations

- 3.5.8 Regulatory Impact Analysis

- 3.5.8.1 Impact on Production Costs

- 3.5.8.2 Impact on Market Entry Barriers

- 3.5.8.3 Impact on Pricing Strategies

- 3.6 Industry Trends and End-User Preferences

- 3.6.1 Shift Towards High-Performance Stainless-Steel Grades

- 3.6.1.1 Corrosion-Resistant Grades

- 3.6.1.2 High-Strength Grades

- 3.6.1.3 Heat-Resistant Grades

- 3.6.2 Automotive Industry Trends

- 3.6.2.1 Vehicle Lightweighting Initiatives

- 3.6.2.2 Electric Vehicle Impact

- 3.6.2.3 Emissions Regulations Impact

- 3.6.2.4 Safety and Performance Requirements

- 3.6.3 Oil and Gas Industry Trends

- 3.6.3.1 Deepwater Exploration Requirements

- 3.6.3.2 Corrosive Environment Solutions

- 3.6.3.3 High-Pressure/High-Temperature Applications

- 3.6.4 Chemical Industry Trends

- 3.6.4.1 Corrosion Resistance Requirements

- 3.6.4.2 Process Efficiency Improvements

- 3.6.4.3 Safety and Reliability Demands

- 3.6.5 Food and Beverage Industry Trends

- 3.6.5.1 Hygiene and Sanitation Requirements

- 3.6.5.2 Process Automation Impact

- 3.6.5.3 Regulatory Compliance Needs

- 3.6.6 Medical Industry Trends

- 3.6.6.1 Biocompatibility Requirements

- 3.6.6.2 Precision Manufacturing Demands

- 3.6.6.3 Sterilization Compatibility

- 3.6.7 Construction Industry Trends

- 3.6.7.1 Architectural Applications Growth

- 3.6.7.2 Sustainable Building Practices

- 3.6.7.3 Corrosion-Resistant Infrastructure

- 3.6.8 Regional End Use Preference Variations

- 3.6.9 OEM Specification Trends

- 3.6.9.1 Material Selection Criteria

- 3.6.9.2 Performance Requirements

- 3.6.9.3 Cost Considerations

- 3.6.1 Shift Towards High-Performance Stainless-Steel Grades

- 3.7 Supply Chain and Raw Material Analysis

- 3.7.1 Raw Material Sourcing Analysis

- 3.7.1.1 Iron Ore and Scrap

- 3.7.1.2 Nickel

- 3.7.1.3 Chromium

- 3.7.1.4 Molybdenum

- 3.7.1.5 Other Alloying Elements

- 3.7.2 Stainless Steel Production Process Analysis

- 3.7.2.1 Steelmaking Technologies

- 3.7.2.2 Alloying Processes

- 3.7.2.3 Rolling and Finishing Processes

- 3.7.2.4 Heat Treatment Processes

- 3.7.2.5 Quality Control Measures

- 3.7.3 Distribution Channel Analysis

- 3.7.3.1 Direct Sales to OEMs

- 3.7.3.2 Steel Service Centers

- 3.7.3.3 Distributors and Wholesalers

- 3.7.3.4 E-commerce Platforms

- 3.7.4 Supply Chain Challenges

- 3.7.4.1 Raw Material Price Volatility

- 3.7.4.2 Energy Cost Fluctuations

- 3.7.4.3 Logistics and Transportation Challenges

- 3.7.4.4 Supply Chain Disruptions

- 3.7.5 Supply Chain Optimization Strategies

- 3.7.6 Sustainable Supply Chain Practices

- 3.7.7 Technology Integration in the Supply Chain

- 3.7.1 Raw Material Sourcing Analysis

- 3.8 Pricing Analysis and Cost Structure

- 3.8.1 Price Point Analysis by Product Type

- 3.8.1.1 Austenitic Stainless Steel Bars Pricing

- 3.8.1.2 Ferritic Stainless Steel Bars Pricing

- 3.8.1.3 Martensitic Stainless Steel Bars Pricing

- 3.8.1.4 Duplex Stainless Steel Bars Pricing

- 3.8.1.5 PH Stainless Steel Bars Pricing

- 3.8.2 Price Trend Analysis 2020-2025

- 3.8.3 Price Forecast 2025-2030

- 3.8.4 Factors Affecting Pricing

- 3.8.4.1 Raw Material Costs

- 3.8.4.2 Energy Costs

- 3.8.4.3 Labor Costs

- 3.8.4.4 Production Costs

- 3.8.4.5 Transportation Costs

- 3.8.4.6 Market Competition

- 3.8.4.7 Trade Policies and Tariffs

- 3.8.5 Regional Price Variations

- 3.8.6 Pricing Strategies for Key Players

- 3.8.7 Cost Structure Analysis

- 3.8.7.1 Raw Material Costs

- 3.8.7.2 Energy Costs

- 3.8.7.3 Labor Costs

- 3.8.7.4 Manufacturing Costs

- 3.8.7.5 Distribution Costs

- 3.8.7.6 Marketing and Sales Costs

- 3.8.8 Profitability Analysis by Product Segment

- 3.8.9 Value-Added Services Impact on Pricing

- 3.8.1 Price Point Analysis by Product Type

- 3.9 Technological Advancements and Innovations

- 3.9.1 Recent technological developments

- 3.9.2 Advanced steelmaking technologies

- 3.9.2.1 Electric arc furnace innovations

- 3.9.2.2 AOD process advancements

- 3.9.2.3 Continuous casting improvements

- 3.9.3 Alloy design innovations

- 3.9.3.1 Lean duplex stainless steel

- 3.9.3.2 High-nitrogen stainless steels

- 3.9.3.3 Advanced martensitic grades

- 3.9.3.4 Specialty austenitic grades

- 3.9.4 Processing technology advancements

- 3.9.4.1 Hot-rolling innovations

- 3.9.4.2 Cold-finishing advancements

- 3.9.4.3 Heat treatment innovations

- 3.9.4.4 Surface treatment technologies

- 3.9.5 Quality control and testing innovations

- 3.9.5.1 Non-destructive testing advancements

- 3.9.5.2 Automated inspection systems

- 3.9.5.3 Material characterization technologies

- 3.9.6 Digital integration in stainless steel production

- 3.9.6.1 Industry 4.0 implementation

- 3.9.6.2 Artificial intelligence applications

- 3.9.6.3 Predictive maintenance systems

- 3.9.6.4 Digital twin technology

- 3.9.7 Sustainable production technologies

- 3.9.7.1 Energy efficiency innovations

- 3.9.7.2 Emissions reduction technologies

- 3.9.7.3 Waste reduction and recycling

- 3.9.8 Patent analysis and R&D trends

- 3.9.9 Future technology roadmap

- 3.10 Sustainability and Environmental Impact

- 3.10.1 Environmental footprint of stainless-steel production

- 3.10.1.1 Carbon footprint analysis

- 3.10.1.2 Energy consumption assessment

- 3.10.1.3 Water usage and management

- 3.10.1.4 Waste generation and management

- 3.10.2 Sustainability initiatives in stainless steel industry

- 3.10.2.1 Carbon reduction strategies

- 3.10.2.2 Energy efficiency measures

- 3.10.2.3 Circular economy approaches

- 3.10.3 Recycling and material recovery

- 3.10.3.1 Scrap utilization rates

- 3.10.3.2 End-of-life considerations

- 3.10.3.3 Closed-loop manufacturing

- 3.10.4 Green steel production technologies

- 3.10.4.1 Hydrogen-based steelmaking

- 3.10.4.2 Carbon capture and storage

- 3.10.4.3 Biomass-based reduction

- 3.10.5 Regulatory pressures for sustainability

- 3.10.5.1 Carbon pricing mechanisms

- 3.10.5.2 Emissions trading systems

- 3.10.5.3 Environmental compliance requirements

- 3.10.6 Industry sustainability commitments

- 3.10.7 Lifecycle assessment (LCA) analysis

- 3.10.8 Cost-benefit analysis of sustainable practices

- 3.10.1 Environmental footprint of stainless-steel production

- 3.11 Market Challenges and Opportunities

- 3.11.1 Key market challenges

- 3.11.1.1 Raw material price volatility

- 3.11.1.2 Energy cost fluctuations

- 3.11.1.3 Overcapacity in the steel industry

- 3.11.1.4 Trade barriers and protectionism

- 3.11.1.5 Environmental compliance costs

- 3.11.1.6 Competition of alternative materials

- 3.11.2 Market opportunities

- 3.11.2.1 High-performance alloy development

- 3.11.2.2 Emerging markets expansion

- 3.11.2.3 Infrastructure development projects

- 3.11.2.4 Renewable energy growth

- 3.11.2.5 Medical and pharmaceutical applications

- 3.11.2.6 Additive manufacturing applications

- 3.11.3 Impact of macro-economic factors

- 3.11.3.1 Global economic growth

- 3.11.3.2 Industrial production trends

- 3.11.3.3 Construction activity

- 3.11.3.4 Oil and gas industry dynamics

- 3.11.4 Technological opportunity assessment

- 3.11.5 Strategic opportunity mapping

- 3.11.1 Key market challenges

- 3.12 Future Market Outlook and Forecast

- 3.12.1 Market forecast by product type 2025-2030

- 3.12.1.1 Austenitic stainless-steel bars forecast

- 3.12.1.2 Ferritic stainless-steel bars forecast

- 3.12.1.3 Martensitic stainless-steel bars forecast

- 3.12.1.4 Duplex stainless-steel bars forecast

- 3.12.1.5 PH stainless steel bars forecast

- 3.12.2 Market forecast by shape 2025-2030

- 3.12.2.1 Round bars forecast

- 3.12.2.2 Square and rectangular bars forecast

- 3.12.2.3 Hexagonal bars forecast

- 3.12.2.4 Other shapes forecast

- 3.12.3 Market forecast by application 2025-2030

- 3.12.4 Market forecast by region 2025-2030

- 3.12.5 Emerging market trends

- 3.12.6 Future growth drivers

- 3.12.7 Market evolution scenarios

- 3.12.7.1 Optimistic scenario

- 3.12.7.2 Realistic scenario

- 3.12.7.3 Pessimistic scenario

- 3.12.8 Investment opportunities assessment

- 3.12.9 Future competitive landscape projection

- 3.12.1 Market forecast by product type 2025-2030

- 3.13 Strategic Recommendations

- 3.13.1 Market entry strategies

- 3.13.2 Product development recommendations

- 3.13.3 Regional expansion opportunities

- 3.13.4 Competitive positioning strategies

- 3.13.5 Sustainability implementation roadmap

- 3.13.6 Digital transformation strategies

- 3.13.7 Regulatory compliance strategies

- 3.13.8 Marketing and distribution recommendations

- 3.13.9 Risk mitigation strategies

- 3.13.10 Investment prioritization framework

- 3.14 Comparative Analysis of Stainless Steel vs. Other Materials

- 3.14.1 Stainless Steel vs. Carbon Steel

- 3.14.2 Stainless Steel vs. Aluminum

- 3.14.3 Stainless Steel vs. Nickel Alloys

- 3.14.4 Performance Benchmarking

- 3.14.5 Cost-Benefit Analysis

- 3.14.6 Application Suitability Comparison

- 3.15 Patent Analysis and Innovation Landscape

- 3.15.1 Analysis of recent patent filings

- 3.15.2 Technological innovations and R&D focus areas

- 3.15.3 Regional and company-level patent trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Market Structure and Concentration Analysis

- 4.1.1 Overview of market concentration levels

- 4.1.2 Analysis of market fragmentation vs. dominance

- 4.1.3 Assessment of entry barriers and market access

- 4.2 Market Share Analysis of Key Players

- 4.2.1 Percentage share of top manufacturers

- 4.2.2 Market dominance across regions

- 4.2.3 Historical trends in market share shifts

- 4.3 Competitive Positioning Matrix

- 4.3.1 Positioning of major players by product range and geographic presence

- 4.3.2 Comparison of strategic capabilities and technological edge

- 4.3.3 Quadrant mapping based on performance and innovation

- 4.4 Detailed Company Profiles of Major Players

- 4.4.1 Outokumpu

- 4.4.2 Acerinox

- 4.4.3 Jindal Stainless

- 4.4.4 Nippon Steel Corporation

- 4.4.5 POSCO

- 4.4.6 Sandvik Materials Technology

- 4.4.7 Carpenter Technology Corporation

- 4.4.8 Valbruna Stainless Inc.

- 4.4.9 Voestalpine AG

- 4.4.10 Tsingshan Holding Group

- 4.5 Competitive Strategies Analysis

- 4.5.1 Capacity Expansion Initiatives

- 4.5.2 Mergers and Acquisitions

- 4.5.3 Partnerships and Collaborations

- 4.5.4 Product Development and Innovation

- 4.6 Investment and Funding Scenario

- 4.6.1 Recent investment trends

- 4.6.2 Private equity and venture capital involvement

- 4.6.3 Public sector funding and incentives

Chapter 5 Market Size and Forecast, By Grade, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Austenitic stainless-steel bars (300 series)

- 5.2.1 304/304l stainless steel

- 5.2.2 316/316l stainless steel

- 5.2.3 321 stainless steel

- 5.2.4 347 stainless steel

- 5.2.5 Other austenitic grades

- 5.3 Ferritic stainless-steel bars (400 series)

- 5.3.1 430 stainless steel

- 5.3.2 409 stainless steel

- 5.3.3 446 stainless steel

- 5.3.4 Other ferritic grades

- 5.4 Martensitic stainless-steel bars (400 series)

- 5.4.1 410 stainless steel

- 5.4.2 416 stainless steel

- 5.4.3 420 stainless steel

- 5.4.4 440 stainless steel

- 5.4.5 Other martensitic grades

- 5.5 Duplex stainless-steel bars

- 5.5.1 2205 duplex

- 5.5.2 2507 super duplex

- 5.5.3 Other duplex grades

- 5.6 Precipitation hardening stainless steel bars

- 5.6.1 17-4 PH stainless steel

- 5.6.2 15-5 PH stainless steel

- 5.6.3 Other PH Grades

Chapter 6 Market Size and Forecast, By Shape & Dimension, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Round bars

- 6.3 Square bars

- 6.4 Hexagonal bars

- 6.5 Flat bars

- 6.6 Angles

- 6.7 Channels

- 6.8 Other bar-size shapes

Chapter 7 Market Size and Forecast, By Processing Method, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Hot-rolled stainless-steel bars

- 7.3 Cold-finished stainless-steel bars

- 7.3.1 Cold-drawn bars

- 7.3.2 Cold-rolled bars

- 7.3.3 Turned and polished bars

- 7.3.4 Ground and polished bars

Chapter 8 Market Size and Forecast, By Application, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 Automotive and transportation

- 8.2.1 Exhaust systems

- 8.2.2 Structural components

- 8.2.3 Fasteners and connectors

- 8.2.4 Fuel system components

- 8.3 Aerospace and defense

- 8.3.1 Aircraft components

- 8.3.2 Fasteners and connectors

- 8.3.3 Landing gear components

- 8.3.4 Defense equipment

- 8.4 Construction and infrastructure

- 8.4.1 Structural components

- 8.4.2 Reinforcement applications

- 8.4.3 Architectural applications

- 8.4.4 Fasteners and anchors

- 8.5 Oil and gas industry

- 8.5.1 Drilling equipment

- 8.5.2 Exploration components

- 8.5.3 Refining equipment

- 8.5.4 Offshore applications

- 8.6 Chemical and petrochemical industry

- 8.6.1 Process equipment components

- 8.6.2 Valves and fittings

- 8.6.3 Heat exchange components

- 8.7 Food and beverage industry

- 8.7.1 Processing equipment

- 8.7.2 Storage tanks and vessels

- 8.7.3 Conveying systems

- 8.8 Medical and pharmaceutical

- 8.8.1 Surgical instruments

- 8.8.2 Implantable devices

- 8.8.3 Equipment components

- 8.9 Power generation

- 8.9.1 Conventional power plants

- 8.9.2 Nuclear power plants

- 8.9.3 Renewable energy equipment

- 8.10 Marine and shipbuilding

- 8.10.1 Structural components

- 8.10.2 Propulsion systems

- 8.10.3 Deck equipment

- 8.11 Machinery and equipment manufacturing

- 8.11.1 Industrial machinery

- 8.11.2 Textile machinery

- 8.11.3 Paper and pulp equipment

- 8.12 Other applications

- 8.12.1 Consumer goods

- 8.12.2 Electronics

- 8.12.3 Sporting equipment

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Outokumpu

- 10.2 Acerinox

- 10.3 Jindal Stainless

- 10.4 Nippon Steel

- 10.5 POSCO

- 10.6 Sandvik Materials Technology

- 10.7 Carpenter Technology

- 10.8 Valbruna Stainless

- 10.9 Voestalpine

- 10.10 Tsingshan Holding Group