|

市场调查报告书

商品编码

1750524

高温工业锅炉市场机会、成长动力、产业趋势分析及2025-2034年预测High Temperature Industrial Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

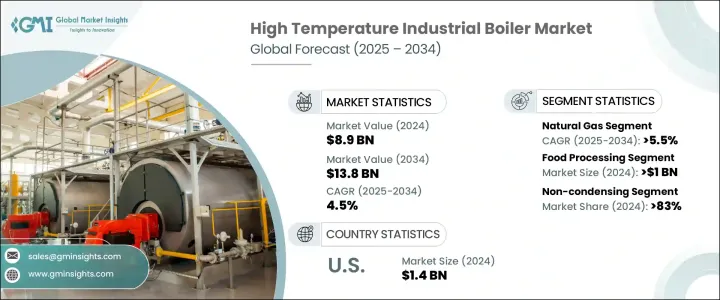

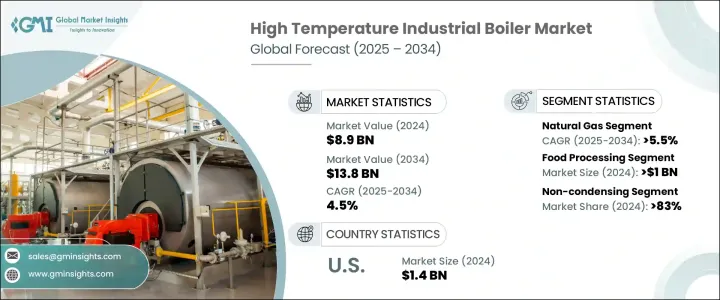

2024年,全球高温工业锅炉市场规模达89亿美元,预计到2034年将以4.5%的复合年增长率增长,达到138亿美元,这得益于发展中国家工业生产的激增和城市化进程的快速推进。随着各国实施更严格的能源效率法规,对先进锅炉技术的需求预计将大幅成长。人口成长影响着消费模式,尤其是商业和工业领域的暖气解决方案。随着基础建设的蓬勃发展和再生能源的日益普及,各行各业面临越来越大的压力,需要更环保、低排放的技术。这些趋势预计将推动对永续高温锅炉系统的需求。

全球范围内对现代製造工艺的投资不断增长以及环保政策的出台也正在塑造该行业。随着排放控製成为优先事项,人们越来越倾向于选择符合气候目标的节能解决方案。各行各业越来越多地采用整合系统,以降低营运成本和能耗,高温工业锅炉市场也因此受益匪浅。能源安全和天然气基础设施的不断完善,持续支持燃气高温锅炉的普及。由于各行各业,尤其是在高热环境下,对可靠的高温蒸汽解决方案的需求日益增长,因此燃气锅炉的业务前景仍然强劲。贸易政策和零件定价是影响全球竞争力的其他因素。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 89亿美元 |

| 预测值 | 138亿美元 |

| 复合年增长率 | 4.5% |

随着各行各业持续转向更清洁的能源,预计到2034年,天然气高温锅炉的复合年增长率将达到5.5%。人们对空气品质的日益关注、天然气供应的不断增加以及配套基础设施的不断扩张,使得这些系统更加可行且更具成本效益。许多政府和私人实体正在积极投资燃气暖气技术,以减少对温室气体排放量更高的煤炭和石油的依赖。天然气锅炉能够提供稳定的高温输出,同时保持较低的排放水平,使其成为製造、加工和化学等能源密集型行业的首选。

非冷凝式高温锅炉市场在2024年占了83%的市占率。这类锅炉因其设计简洁、经久耐用且能够在严苛环境下运作而备受青睐。需要持续供暖的行业高度依赖非冷凝式系统,因为它们保温性能高、响应速度快。儘管环保法规日益严格,但在基础设施或成本因素阻碍转向冷凝式或混合式锅炉的情况下,这类锅炉仍广受欢迎。然而,为了满足不断变化的能源效率标准,製造商正在透过更完善的控制系统和先进的燃烧技术来改进非冷凝式锅炉。

2024年,美国高温工业锅炉市场规模达14亿美元,反映出强劲的国内需求。这一成长主要源自于老旧工业设施中老化低效锅炉系统的更换。随着能源消耗和排放新规日益严格,各行各业都在积极推动营运现代化。联邦和州级的激励措施正在鼓励这种转变,支持企业采用更清洁、更有效率的设备。对永续性的日益关注,加上对能源基础设施的经济投资,正在推动对符合未来能源政策、技术先进的锅炉的需求。

为市场格局做出贡献的领先公司包括西门子、Thermax、三菱重工、赫斯特锅炉和焊接公司、巴布科克和威尔科克斯企业、Sofinter、福布斯马歇尔、通用电气 Vernova、胜利能源运营公司、克利弗-布鲁克斯、菲斯曼、克莱顿工业公司、科克伦、斗山重工业与建筑公司、FONDITALsnagar工业公司、约翰·科克里尔、三浦美国、富尔顿公司、罗伯特·博世、Fonderie Sime 和 Rentech Boilers。为了巩固其在市场中的地位,主要参与者正专注于创新、永续性和策略联盟。本公司投资研发,以开发符合严格排放标准的紧凑、节能锅炉。与政府和其他工业公司的合作有助于扩大业务范围并简化供应链。许多公司增强了数位控制系统,以优化锅炉性能并最大限度地减少停机时间,同时扩大售后服务以建立长期的客户关係。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 自动桌上型牙科高压灭菌器的需求不断增加

- 日益重视感染控制

- 高压釜的技术进步

- 牙齿疾病盛行率上升

- 产业陷阱与挑战

- 采用翻新的牙科高压灭菌器

- 发展中经济体的认知有限

- 成长动力

- 成长潜力分析

- 技术格局

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 各国应对措施

- 对产业的影响

- 供应方影响(製造成本)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(消费者成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(製造成本)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 自动的

- 半自动

- 手动的

第六章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 前后真空

- 重力

第七章:市场估计与预测:按类别,2021 - 2034 年

- 主要趋势

- B类

- N类

- S级

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院和牙科诊所

- 牙科实验室

- 学术和研究机构

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Biolab Scientific

- Bionics Scientific

- Dentsply Sirona

- Flight Dental Systems

- FONA

- Labocon

- Life Steriware

- Matachana

- Midmark Corporation

- NSK

- RAYPA

- Steelco

- Thermo Fisher Scientific

- Tuttnauer

- W&H

The Global High Temperature Industrial Boiler Market was valued at USD 8.9 billion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 13.8 billion by 2034, driven by the surge in industrial production with rapid urban expansion across developing nations. As countries implement stricter regulations to boost energy efficiency, demand for advanced boiler technologies is expected to grow significantly. Rising population levels influence consumption patterns, particularly for heating solutions in commercial and industrial spaces. With infrastructure development gaining momentum and renewable energy integration becoming more widespread, industries are under increased pressure to adopt greener, low-emission technologies. These trends are expected to fuel demand for sustainable high-temperature boiler systems.

The industry is also being shaped by growing investments in modern manufacturing processes and eco-conscious policies at the global level. With emissions control becoming a priority, there's a growing preference for energy-efficient solutions that align with climate goals. The high temperature industrial boiler market is further benefiting from the increased use of integrated systems across sectors seeking to reduce operational costs and energy consumption. Energy security and the expanding availability of natural gas infrastructure continue to support the adoption of gas-powered high-temperature boilers. With industries demanding reliable high-temperature steam solutions, especially in heat-intensive environments, the business outlook remains strong. Trade policies and component pricing are additional factors shaping global competitiveness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.9 Billion |

| Forecast Value | $13.8 Billion |

| CAGR | 4.5% |

Natural gas-fired high temperature boilers are projected to grow at a CAGR of 5.5% through 2034, as industries continue shifting toward cleaner energy sources. Increasing concerns around air quality, rising natural gas availability, and expanding supportive infrastructure make these systems more viable and cost-effective. Many governments and private entities are actively investing in gas-powered heating technologies to reduce dependence on coal and oil, which emit higher levels of greenhouse gases. The ability of natural gas boilers to deliver consistent high-temperature output while maintaining lower emission levels positions them as a preferred option across energy-intensive sectors such as manufacturing, processing, and chemicals.

Non-condensing high temperature boilers segment held an 83% share in 2024. These boilers are favored for their simple design, durability, and ability to perform in demanding environments. Industries with continuous heating needs rely heavily on non-condensing systems due to their high heat retention and quick response time. Despite growing environmental regulations, these boilers remain popular where infrastructure or cost considerations prevent a shift to condensing or hybrid models. However, to meet changing efficiency standards, manufacturers are enhancing non-condensing models with better control systems and advanced combustion technologies.

United States High Temperature Industrial Boiler Market reached USD 1.4 billion in 2024, reflecting strong domestic demand. A major portion of this growth is attributed to replacing aging and inefficient boiler systems in older industrial facilities. As new regulations on energy consumption and emissions become more stringent, industries modernize their operations. Federal and state-level incentives are encouraging this shift by offering support for the adoption of cleaner, high-efficiency equipment. The increased focus on sustainability, coupled with economic investments in energy infrastructure, is driving the need for technologically advanced boilers that align with future-ready energy policies.

Leading companies contributing to the market landscape include Siemens, Thermax, Mitsubishi Heavy Industries, Hurst Boiler and Welding, Babcock and Wilcox Enterprises, Sofinter, Forbes Marshall, GE Vernova, Victory Energy Operations, Cleaver-Brooks, Viessmann, Clayton Industries, Cochran, Doosan Heavy Industries & Construction, FONDITAL, Bharat Heavy Electricals, FERROLI, Hoval, John Wood Group, Groupe Atlantic, IHI Corporation, Walchandnagar Industries, John Cockerill, Miura America, The Fulton Companies, Robert Bosch, Fonderie Sime, and Rentech Boilers. To reinforce their position in the market, major players are focusing on innovation, sustainability, and strategic alliances. Companies invest in R&D to develop compact, energy-efficient boilers that meet stringent emissions standards. Partnerships with governments and other industrial firms help expand operational reach and streamline supply chains. Many enhance digital control systems to optimize boiler performance and minimize downtime, while expanding aftermarket services to build long-term client relationships.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for automatic bench-top dental autoclaves

- 3.2.1.2 Growing focus on infection control

- 3.2.1.3 Technological advancement in autoclave

- 3.2.1.4 Rising prevalence of dental disorders

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adoption of refurbished dental autoclaves

- 3.2.2.2 Limited awareness in developing economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technological landscape

- 3.5 Regulatory landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Country-wise response

- 3.6.2 Impact on the industry

- 3.6.2.1 Supply-side impact (Cost of manufacturing)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (Cost to consumers)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (Cost of manufacturing)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Automatic

- 5.3 Semi-automatic

- 5.4 Manual

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pre and post vacuum

- 6.3 Gravity

Chapter 7 Market Estimates and Forecast, By Class, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Class B

- 7.3 Class N

- 7.4 Class S

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and dental clinics

- 8.3 Dental laboratories

- 8.4 Academic and research institutes

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Biolab Scientific

- 10.2 Bionics Scientific

- 10.3 Dentsply Sirona

- 10.4 Flight Dental Systems

- 10.5 FONA

- 10.6 Labocon

- 10.7 Life Steriware

- 10.8 Matachana

- 10.9 Midmark Corporation

- 10.10 NSK

- 10.11 RAYPA

- 10.12 Steelco

- 10.13 Thermo Fisher Scientific

- 10.14 Tuttnauer

- 10.15 W&H