|

市场调查报告书

商品编码

1750527

镀锌硬质导管市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Galvanized Rigid Conduit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

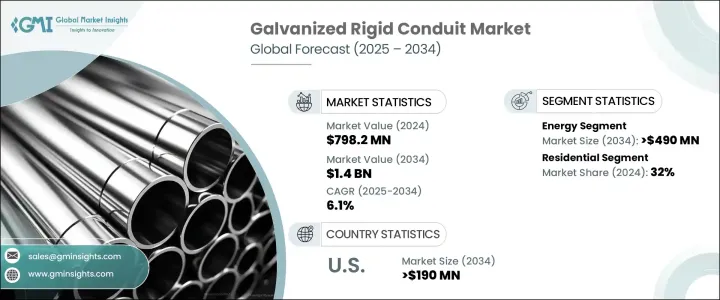

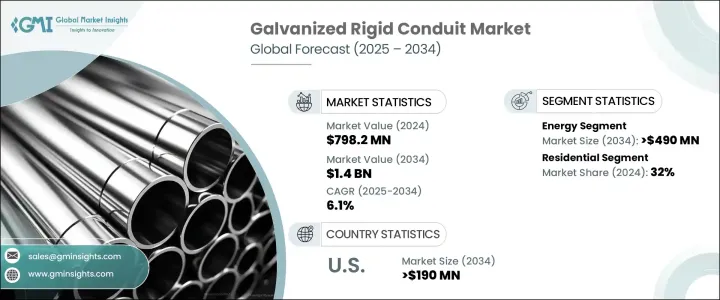

2024年,全球镀锌硬质导管市场规模达7.982亿美元,预计到2034年将以6.1%的复合年增长率增长,达到14亿美元,这得益于建筑技术的进步、基础设施的现代化以及严格的安全法规。商业、机构和工业领域对兼具强度和耐腐蚀性能的防护性电线导管的需求日益增长。涂层和製造流程的创新提升了这些产品的功能性能,使其对消费者更具吸引力。此外,城镇化和工业扩张正在开拓新的市场,而对环境永续性的重视则推动了可回收材料在导管製造中的使用。

儘管有这些正面趋势,市场仍面临原材料价格波动和严格监管控制等挑战,这些因素可能会影响利润率。钢铁关税的征收进一步推高了原料成本,这可能会影响镀锌硬质导管的定价,并为供应链带来波动。然而,持续的基础设施投资和对严格电气安全标准的遵守预计将维持市场成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.982亿美元 |

| 预测值 | 14亿美元 |

| 复合年增长率 | 6.1% |

预计到2034年,能源产业将创造4.9亿美元的产值,主要得益于发电和配电系统对耐用可靠的导管解决方案的需求。这些导管对于保护高压环境中的线路至关重要,并广泛应用于传统能源和再生能源基础设施。随着全球电网现代化专案的推进,对耐腐蚀、耐用的镀锌导管的需求持续成长。

住宅领域在2024年占据了32%的市场份额,到2034年将以5.5%的复合年增长率增长,这得益于建筑活动的增加和对电气安全的日益重视,从而推动了防火导管的采用。智慧家庭的兴起也扩大了对可靠电气系统的需求,进一步促进了市场扩张。现代住宅现在需要安全、大容量的电网来支援数位电器、安防系统和家庭自动化,而镀锌硬导管提供的保护将为所有这些应用提供保障。

由于基础设施现代化、安全法规和电网需求的提升,美国镀锌硬质导管市场在2024年的价值达到1.187亿美元。製造流程的改进和技术进步提高了产品效率,从而支撑了市场成长。强劲的建筑活动、旧建筑改造的增加以及对永续性的更加重视,进一步支撑了国内需求。智慧建筑和再生能源设施的扩张进一步刺激了对镀锌硬质导管的需求。

全球镀锌硬质导管市场的主要参与者包括 Atkore、施耐德电气、罗格朗、纽柯管材产品公司和 Zekelman Industries。这些公司专注于创新、永续发展和客户参与,以增强其市场影响力。其策略方针包括投资先进製造技术、采用环保实践以及扩展产品组合以满足多样化的客户需求。透过顺应市场趋势和监管标准,这些公司致力于在不断发展的镀锌硬质导管市场中保持竞争优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依贸易规模,2021 - 2034 年

- 主要趋势

- ½ 比 1

- 1.25 至 2

- 2.5 到 3

- 3到4

- 5到6

- 其他的

第六章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 铁路基础设施

- 生产设施

- 造船和海上设施

- 加工厂

- 活力

- 其他的

第七章:市场规模及预测:依最终用途,2021 - 2034

- 主要趋势

- 住宅

- 商业的

- 工业的

- 公用事业

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 法国

- 德国

- 义大利

- 英国

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- American Conduit

- Anamet Electrical

- Atkore

- BEC Conduits

- Gibson Stainless & Specialty

- Goodluck India

- HellermannTyton

- Legrand

- Lowe's

- McMaster-Carr

- Nucor Tubular Products

- Pittsburgh Pipe

- Representative Material Company

- Schneider Electric

- SMC Electric

- Techno Flex

- Weifang East Steel Pipe

- Yale Electrical Supply

- Zekelman Industries

The Global Galvanized Rigid Conduit Market was valued at USD 798.2 million in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 1.4 billion by 2034, propelled by advancements in construction techniques, infrastructure modernization, and stringent safety regulations. The demand for protective electrical conduits that offer strength and corrosion resistance is increasing across commercial, institutional, and industrial sectors. Innovations in coating and manufacturing processes have enhanced the functional performance of these products, making them more appealing to customers. Additionally, urbanization and industrial expansion are opening new markets, while the emphasis on environmental sustainability is driving the use of recyclable materials in conduit manufacturing.

Despite these positive trends, the market faces challenges such as fluctuations in raw material prices and strict regulatory controls that can impact profit margins. The imposition of steel tariffs has further increased raw material costs, potentially affecting the pricing of galvanized rigid conduits and introducing volatility into supply chains. However, continued investment in infrastructure and adherence to rigorous electrical safety standards are expected to sustain market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $798.2 Million |

| Forecast Value | $1.4 Billion |

| CAGR | 6.1% |

The energy sector is anticipated to generate USD 490 million by 2034, driven by the need for durable and reliable conduit solutions in power generation and distribution systems. These conduits are crucial for protecting wiring in high-voltage environments and are adopted in both traditional and renewable energy infrastructure. As grid modernization projects gain momentum globally, the demand for corrosion-resistant, long-lasting galvanized conduits continues to grow.

The residential segment accounted for a 32% share in 2024 and will grow at a CAGR of 5.5% through 2034, fueled by increased construction activities and a heightened focus on electrical safety, leading to the adoption of fire-resistant conduits. The rise of smart homes has also amplified the demand for dependable electrical systems, further contributing to market expansion. Modern residences now require secure, high-capacity electrical networks to support digital appliances, security systems, and home automation, all of which benefit from the protection provided by galvanized rigid conduits.

United States Galvanized Rigid Conduit Market was valued at USD 118.7 million in 2024 due to infrastructure modernization, safety regulations, and electrical grid requirements. Manufacturing improvements and technological advancements have enhanced product efficiency, supporting market growth. Domestic demand is further supported by robust construction activity, increased retrofitting of old structures, and a stronger emphasis on sustainability. The expansion of smart building construction and renewable energy installations further bolsters the demand for galvanized rigid conduits.

Key players in the Global Galvanized Rigid Conduit Market include Atkore, Schneider Electric, Legrand, Nucor Tubular Products, and Zekelman Industries. These companies are focusing on innovation, sustainability, and customer engagement to strengthen their market presence. Strategic approaches include investment in advanced manufacturing technologies, adoption of eco-friendly practices, and expansion of product portfolios to meet diverse customer needs. By aligning with market trends and regulatory standards, these companies aim to maintain a competitive edge in the evolving galvanized rigid conduit market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Trade Size, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 ½ to 1

- 5.3 1 ¼ to 2

- 5.4 2 ½ to 3

- 5.5 3 to 4

- 5.6 5 to 6

- 5.7 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Rail infrastructure

- 6.3 Manufacturing facilities

- 6.4 Shipbuilding & offshore facilities

- 6.5 Process plants

- 6.6 Energy

- 6.7 Others

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

- 7.5 Utility

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 France

- 8.3.2 Germany

- 8.3.3 Italy

- 8.3.4 UK

- 8.3.5 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 American Conduit

- 9.2 Anamet Electrical

- 9.3 Atkore

- 9.4 B.E.C. Conduits

- 9.5 Gibson Stainless & Specialty

- 9.6 Goodluck India

- 9.7 HellermannTyton

- 9.8 Legrand

- 9.9 Lowe's

- 9.10 McMaster-Carr

- 9.11 Nucor Tubular Products

- 9.12 Pittsburgh Pipe

- 9.13 Representative Material Company

- 9.14 Schneider Electric

- 9.15 SMC Electric

- 9.16 Techno Flex

- 9.17 Weifang East Steel Pipe

- 9.18 Yale Electrical Supply

- 9.19 Zekelman Industries