|

市场调查报告书

商品编码

1750533

藻类成分市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Algae-based Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

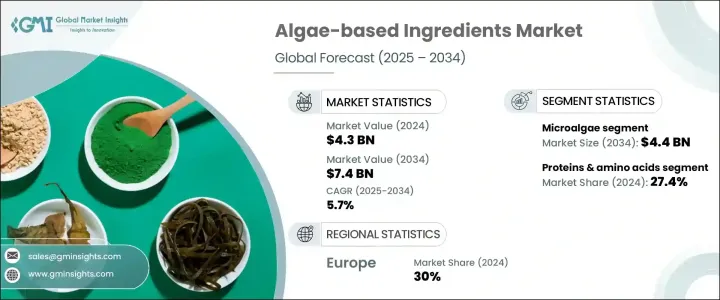

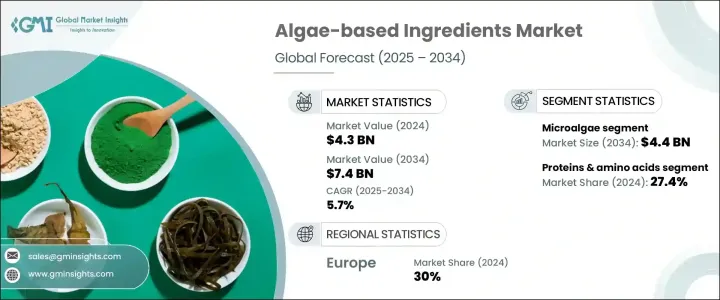

2024年,全球藻类成分市场价值为43亿美元,预计到2034年将以5.7%的复合年增长率成长,达到74亿美元。这主要得益于消费者对植物性和功能性成分日益增长的需求,以及他们日益寻求营养替代品来对抗生活方式相关疾病。不良的饮食习惯和久坐不动的生活方式导致肥胖、心血管疾病和第2型糖尿病等代谢紊乱变得越来越普遍,人们越来越倾向于选择天然的健康成分。藻类衍生化合物具有一系列独特的益处,包括ω-3脂肪酸、抗氧化剂、必需胺基酸和植物蛋白。这些特性使藻类成为功能性食品、膳食补充剂和营养保健品配方中的首选成分。

随着健康成为全球关注的焦点,藻类成分因其在人类健康中的预防和治疗作用而日益受到认可。消费者越来越青睐符合清洁标籤和永续生活趋势的天然植物源解决方案,而藻类恰好契合了这一趋势。这些成分兼具高营养密度、生物活性成分和功能性益处,有助于增强免疫力、心血管健康、认知功能和消炎。其多功能性使其能够应用于各种应用,从膳食补充剂和强化食品到护肤品和药物製剂。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 43亿美元 |

| 预测值 | 74亿美元 |

| 复合年增长率 | 5.7% |

微藻市场预计2034年将达到44亿美元,这得益于其营养丰富且在食品、保健食品和化妆品领域的广泛应用。螺旋藻和虾红素等化合物因其高蛋白、高脂质和高抗氧化剂含量而备受青睐。光生物反应器等培养方法的创新正在提高微藻生产的效率和可扩展性。另一方面,大型藻类因其在水胶体生产中的应用而仍然重要。琼脂、海藻酸盐和卡拉胶等萃取物因其稳定和增稠特性在食品工业中至关重要,这使得大型藻类成为必不可少的原料。

根据产品细分,蛋白质和胺基酸细分市场在2024年占据最大市场份额,达到27.4%,预计到2034年将以5.7%的复合年增长率稳定成长。素食主义和纯素食生活方式的兴起催生了对藻类蛋白质替代品的需求。改进的萃取技术使这些蛋白质能够更有效地与传统的动植物蛋白质竞争。全藻蛋白因其均衡的胺基酸组成和高营养密度而越来越受欢迎。它们在运动营养、代餐和功能性零食中的应用日益广泛。藻类衍生的ω-3脂肪酸也正成为健康产品线中不可或缺的一部分,尤其是在婴儿配方奶粉和心臟健康补充剂中。

2024年,欧洲藻类配料市场占了30%的市场份额,这得益于其在永续发展和绿色技术创新方面的积极立场。该地区的监管框架,例如支持碳中和实践和植物基产品开发的框架,为藻类配料的应用创造了肥沃的环境。各国政府和私人利益相关者正在大力投资生物经济项目,鼓励探索藻类作为合成和动物源性化合物的可行替代品。在食品和饮料领域,製造商正转向藻类,以满足消费者对纯素、无过敏原和营养丰富的配料日益增长的需求。

主要市场参与者包括Corbion、Aliga Microalgae、Bioriginal Food and Science Corp、嘉吉公司和Marine Hydrocolloids。这些公司正在积极实施策略,以巩固其市场地位。他们专注于永续的生产实践,并开发环保、可扩展的养殖系统。一些公司正在投资研发,以提高藻类化合物的生物利用度和功能性。他们正在与食品和化妆品品牌建立策略性合作伙伴关係,以扩大产品覆盖范围。此外,一些公司正在探索清洁标籤配方,并推出藻类蛋白粉、强化油和护肤活性成分等创新产品,以吸引更广泛的消费者群体。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 主要製造商

- 经销商

- 整个产业的利润率

- 供应链和分销分析

- 原物料采购

- 生产製造

- 冷链基础设施

- 分销管道

- 供应链挑战与优化

- 永续实践

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 2021-2024年主要出口国

- 2021-2024年主要出口国

註:以上贸易统计仅针对重点国家

- 衝击力

- 成长动力

- 政府采取措施促进藻类产品生产

- 营养保健品产业的利用率不断提高,需求不断成长

- 冷冻技术的进步

- 消费者对藻类产品的认知度和接受度不断提高

- 产业陷阱与挑战

- 冷链基础设施挑战

- 环境对藻类培养的影响

- 市场机会

- 成长动力

- 原料景观

- 製造业趋势

- 技术演进

- 定价分析和成本结构

- 价格趋势(美元/吨)

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东非洲

- 定价因素(原料、能源、劳力)

- 区域价格差异

- 成本结构细分

- 获利能力分析

- 价格趋势(美元/吨)

- 监管框架和标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司热图分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

- Expansion

- Mergers & acquisition

- Collaborations

- New product launches

- Research & development

- 主要参与者的最新发展和影响分析

- 公司分类

- 参与者概述

- 财务表现

- 产品基准测试

第五章:市场估计与预测:按来源,2021 - 2034 年

- 主要趋势

- 微藻

- 螺旋藻(节旋藻)

- 小球藻

- 杜氏藻

- 红球藻

- 裂壶菌

- 拟球藻

- 其他微藻

- 大型藻类(海藻)

- 红藻(红藻门)

- 褐藻(褐藻纲)

- 绿藻(绿藻门)

- 其他大型藻类

- 蓝藻(蓝绿藻)

- 水华束丝藻

- 其他蓝藻

第六章:市场估计与预测:依成分类型,2021 - 2034 年

- 主要趋势

- 蛋白质和胺基酸

- 全藻蛋白

- 蛋白质浓缩物

- 分离蛋白

- 胜肽和胺基酸

- 脂质和脂肪酸

- Omega-3 脂肪酸(DHA/EPA)

- 极性脂质

- 其他脂质

- 碳水化合物和纤维

- 藻酸盐

- 角叉菜胶

- 琼脂

- 褐藻醣胶

- 其他碳水化合物和纤维

- 颜料和抗氧化剂

- 叶绿素

- 藻蓝蛋白

- 虾红素

- 藻黄素

- 其他颜料和抗氧化剂

- 维生素和矿物质

- 全藻类成分

- 其他成分类型

第七章:市场估计与预测:依形式,2021 - 2034

- 主要趋势

- 粉末

- 液体

- 凝胶

- 薄片

- 片剂和胶囊

- 其他形式

第八章:市场估计与预测:依生产方式,2021 - 2034 年

- 主要趋势

- 开放式池塘系统

- 封闭系统

- 光生物反应器

- 发酵槽

- 其他封闭系统

- 混合系统

- 野生采收(大型藻类)

- 其他生产方法

第九章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 食品和饮料

- 烘焙和糖果

- 乳製品和乳製品替代品

- 肉类和海鲜替代品

- 饮料

- 零食和方便食品

- 酱汁、调味品和调味品

- 其他食品应用

- 膳食补充剂

- 蛋白质补充剂

- Omega-3补充剂

- 抗氧化补充剂

- 一般保健品

- 其他补充剂类型

- 动物饲料

- 水产饲料

- 家禽饲料

- 猪饲料

- 宠物食品

- 其他动物饲料

- 化妆品和个人护理

- 保养品

- 护髮

- 其他化妆品应用

- 製药

- 生物燃料和生物能源

- 其他应用

第 10 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 食品饮料业

- 营养保健品产业

- 动物饲料工业

- 化妆品和个人护理行业

- 製药业

- 能源产业

- 其他最终用途产业

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十二章:公司简介

- AEP Colloids

- AgarGel

- Aliga Microalgae

- Bioriginal Food & Science Corp

- Cargill Inc.

- Corbion

- CP Kelco US Inc

- Gino Biotech

- Hispanagar SA

- KIMICA

- Marine Hydrocolloids

- Taiwan Chlorella Manufacturing Company

- Triton

The Global Algae-based Ingredients Market was valued at USD 4.3 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 7.4 billion by 2034, driven by the rising demand for plant-based and functional ingredients, as consumers increasingly seek nutritional alternatives to combat lifestyle-related diseases. With metabolic disorders such as obesity, cardiovascular conditions, and type 2 diabetes becoming more common due to poor eating habits and sedentary lifestyles, there's a growing preference for natural health-supportive ingredients. Algae-derived compounds offer a unique set of benefits, including omega-3 fatty acids, antioxidants, essential amino acids, and plant-based proteins. These properties have positioned algae as a go-to ingredient in functional foods, dietary supplements, and nutraceutical formulations.

As wellness becomes a global priority, algae-based ingredients continue gaining recognition for their preventative and therapeutic roles in human health. Consumers are increasingly drawn to natural, plant-derived solutions that align with clean-label and sustainable living trends, and algae fits perfectly into this narrative. These ingredients offer a rare combination of high nutritional density, bioactive compounds, and functional benefits that support immunity, cardiovascular health, cognitive function, and inflammation reduction. Their versatility allows them to be incorporated across various applications, from dietary supplements and fortified foods to skincare and pharmaceutical formulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.3 Billion |

| Forecast Value | $7.4 Billion |

| CAGR | 5.7% |

The microalgae segment is expected to reach USD 4.4 billion by 2034, due to their nutrient-rich profile and broad application across food, nutraceutical, and cosmetic products. Compounds like spirulina and astaxanthin are gaining traction thanks to their high protein, lipid, and antioxidant content. Innovations in cultivation methods, such as photobioreactors, are improving the efficiency and scalability of microalgae production. On the other hand, macroalgae remain relevant due to their utility in hydrocolloid production. Extracts like agar, alginate, and carrageenan are vital in the food industry for their stabilizing and thickening properties, making macroalgae an essential raw material.

Based on product segmentation, the proteins and amino acids segment held the largest market share in 2024, accounting for 27.4%, and is expected to grow steadily at a CAGR of 5.7% through 2034. The surge in vegetarian and vegan lifestyles creates demand for algae-based protein alternatives. Improved extraction technologies have allowed these proteins to compete more effectively with conventional animal- and plant-based proteins. Whole algae proteins are becoming increasingly popular due to their balanced amino acid profile and high nutrient density. Their presence is growing in sports nutrition, meal replacements, and functional snacks. Algae-derived omega-3 fatty acids are also becoming integral in health-focused product lines, especially for infant formulas and heart health supplements.

Europe Algae-based Ingredients Market held a 30% share in 2024, driven by its proactive stance on sustainability and innovation in green technologies. Regulatory frameworks across the region, such as those supporting carbon-neutral practices and plant-based product development, have created a fertile environment for adopting algae-based ingredients. Governments and private stakeholders are investing heavily in bioeconomy initiatives, encouraging the exploration of algae as a viable alternative to synthetic and animal-derived compounds. In the food and beverage sector, manufacturers are turning to algae to meet rising consumer demand for vegan, allergen-free, and nutrient-dense ingredients.

Key market participants include Corbion, Aliga Microalgae, Bioriginal Food and Science Corp, Cargill Inc, and Marine Hydrocolloids. These companies are pursuing aggressive strategies to strengthen their market position. They are focusing on sustainable production practices and developing eco-friendly, scalable cultivation systems. Several firms are investing in R&D to enhance the bioavailability and functionality of algae-based compounds. Strategic partnerships with food and cosmetic brands are being formed to expand product reach. Additionally, players are exploring clean-label formulations and launching innovative products such as algae protein powders, fortified oils, and skincare actives to appeal to a broader consumer base.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Key manufacturers

- 3.1.2 Distributors

- 3.1.3 Profit margins across the industry

- 3.1.4 Supply chain and distribution analysis

- 3.1.4.1 Raw material sourcing

- 3.1.4.2 Production and manufacturing

- 3.1.4.3 Cold chain infrastructure

- 3.1.4.4 Distribution channels

- 3.1.4.5 Supply chain challenges and optimization

- 3.1.4.6 Sustainable practices

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.3.2 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Government initiatives to boost algae products production

- 3.4.1.2 Increasing utilization and growing demand from nutraceutical industry

- 3.4.1.3 Technological advancements in freezing techniques

- 3.4.1.4 Rising consumer awareness and acceptance of algae-based product

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 Cold chain infrastructure challenges

- 3.4.2.2 Environmental impact on algae cultivation

- 3.4.3 Market opportunity

- 3.4.1 Growth drivers

- 3.5 Raw material landscape

- 3.5.1 Manufacturing trends

- 3.5.2 Technology evolution

- 3.6 Pricing analysis and cost structure

- 3.6.1 Pricing trends (USD/Ton)

- 3.6.1.1 North America

- 3.6.1.2 Europe

- 3.6.1.3 Asia Pacific

- 3.6.1.4 Latin America

- 3.6.1.5 Middle East Africa

- 3.6.2 Pricing factors (raw materials, energy, labor)

- 3.6.3 Regional price variations

- 3.6.4 Cost structure breakdown

- 3.6.5 Profitability analysis

- 3.6.1 Pricing trends (USD/Ton)

- 3.7 Regulatory framework and standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Company heat map analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Recent developments & impact analysis by key players

- 4.7.1 Company categorization

- 4.7.2 Participant’s overview

- 4.7.3 Financial performance

- 4.8 Product benchmarking

Chapter 5 Market Estimates & Forecast, By Source, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Microalgae

- 5.2.1 Spirulina (arthrospira)

- 5.2.2 Chlorella

- 5.2.3 Dunaliella

- 5.2.4 Haematococcus

- 5.2.5 Schizochytrium

- 5.2.6 Nannochloropsis

- 5.2.7 Other microalgae

- 5.3 Macroalgae (seaweed)

- 5.3.1 Red seaweed (rhodophyta)

- 5.3.2 Brown seaweed (phaeophyceae)

- 5.3.3 Green seaweed (chlorophyta)

- 5.3.4 Other macroalgae

- 5.4 Cyanobacteria (blue-green algae)

- 5.4.1 Aphanizomenon flos-aquae

- 5.4.2 Other cyanobacteria

Chapter 6 Market Estimates & Forecast, By Ingredient Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Proteins & amino acids

- 6.3 Whole algae protein

- 6.3.1 Protein concentrates

- 6.3.2 Protein isolates

- 6.3.3 Peptides & amino acids

- 6.4 Lipids & fatty acids

- 6.4.1 Omega-3 fatty acids (DHA/EPA)

- 6.4.2 Polar lipids

- 6.4.3 Other lipids

- 6.5 Carbohydrates & fibers

- 6.5.1 Alginates

- 6.5.2 Carrageenan

- 6.5.3 Agar

- 6.5.4 Fucoidan

- 6.5.5 Other carbohydrates & fibers

- 6.6 Pigments & antioxidants

- 6.6.1 Chlorophyll

- 6.6.2 Phycocyanin

- 6.6.3 Astaxanthin

- 6.6.4 Fucoxanthin

- 6.6.5 Other pigments & antioxidants

- 6.7 Vitamins & minerals

- 6.8 Whole algae ingredients

- 6.9 Other ingredient types

Chapter 7 Market Estimates & Forecast, By Form, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Powder

- 7.3 Liquid

- 7.4 Gel

- 7.5 Flakes

- 7.6 Tablets & capsules

- 7.7 Other forms

Chapter 8 Market Estimates & Forecast, By Production Method, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Open pond systems

- 8.3 Closed systems

- 8.4 Photobioreactors

- 8.5 Fermenters

- 8.6 Other closed systems

- 8.7 Hybrid systems

- 8.8 Wild harvesting (for macroalgae)

- 8.9 Other production methods

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Food & beverage

- 9.2.1 Bakery & confectionery

- 9.2.2 Dairy & dairy alternatives

- 9.2.3 Meat & seafood alternatives

- 9.2.4 Beverages

- 9.2.5 Snacks & convenience foods

- 9.2.6 Sauces, dressings & condiments

- 9.2.7 Other food applications

- 9.3 Dietary supplements

- 9.3.1 Protein supplements

- 9.3.2 Omega-3 supplements

- 9.3.3 Antioxidant supplements

- 9.3.4 General health supplements

- 9.3.5 Other supplement types

- 9.4 Animal feed

- 9.4.1 Aquaculture feed

- 9.4.2 Poultry feed

- 9.4.3 Swine feed

- 9.4.4 Pet food

- 9.4.5 Other animal feed

- 9.5 Cosmetics & personal care

- 9.5.1 Skincare

- 9.5.2 Haircare

- 9.5.3 Other cosmetic applications

- 9.6 Pharmaceuticals

- 9.7 Biofuels & bioenergy

- 9.8 Other applications

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 Food & Beverage Industry

- 10.3 Nutraceutical Industry

- 10.4 Animal Feed Industry

- 10.5 Cosmetics & Personal Care Industry

- 10.6 Pharmaceutical Industry

- 10.7 Energy Industry

- 10.8 Other End Use Industries

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East and Africa

Chapter 12 Company Profiles

- 12.1 AEP Colloids

- 12.2 AgarGel

- 12.3 Aliga Microalgae

- 12.4 Bioriginal Food & Science Corp

- 12.5 Cargill Inc.

- 12.6 Corbion

- 12.7 CP Kelco U.S. Inc

- 12.8 Gino Biotech

- 12.9 Hispanagar SA

- 12.10 KIMICA

- 12.11 Marine Hydrocolloids

- 12.12 Taiwan Chlorella Manufacturing Company

- 12.13 Triton