|

市场调查报告书

商品编码

1750540

二氧化碳监测设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Capnography Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

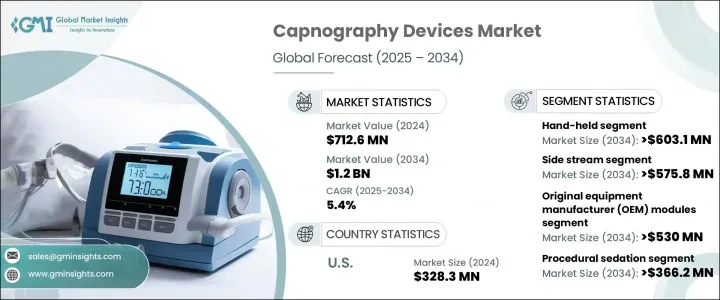

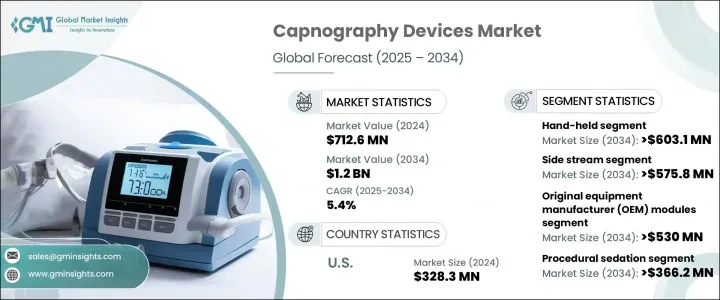

2024年,全球二氧化碳分析仪市场规模达7.126亿美元,预计2034年将以5.4%的复合年增长率成长,达到12亿美元。推动这一增长的因素包括呼吸系统疾病发病率的上升、重症监护和急救环境中二氧化碳分析仪的使用增加,以及人们对微创手术的日益青睐。此外,要求在患者镇静期间使用二氧化碳分析仪的法规,以及医疗保健领域采用先进技术的持续趋势,也推动了二氧化碳分析仪的普及。此外,便携式二氧化碳分析仪的需求不断增长,使其适用于门诊、急诊医疗服务和非医院环境,进一步推动了市场的成长。

二氧化碳监测设备的需求与其监测呼出气体中二氧化碳 (CO2) 水平的能力息息相关,这对于确保麻醉和重症监护过程中的病人安全至关重要。这些设备对于即时监测至关重要,使医疗保健提供者能够及早发现呼吸问题并有效应对。市场的成长也得益于人们对以患者为中心的护理日益增长的关注,以及技术进步,这些进步提高了这些设备的准确性和易用性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.126亿美元 |

| 预测值 | 12亿美元 |

| 复合年增长率 | 5.4% |

手持式设备市场预计将以5%的复合年增长率成长,贡献显着,预计到2034年市场价值将达到6.031亿美元。手持式二氧化碳监测设备因其便携性而备受青睐,是院前急救和门诊的理想选择。这些设备使医护人员能够在需要镇静或呼吸监测的诊疗过程中做出快速、明智的决策,从而确保病人安全。此外,与多参数系统相比,手持式二氧化碳监测设备的成本效益更高,因此在註重预算的医疗保健环境中广受欢迎。

从组件来看, OEM (原始设备製造商)模组预计将以 5.1% 的复合年增长率成长。这些模组整合到多参数系统中,为医疗机构提升诊断能力提供了一种经济高效的方式。其紧凑的设计以及与其他平台整合的能力使其能够高度适应各种医疗环境。对互通性和个人化护理的需求持续推动着对OEM模组的需求,这些模组在全球医院和诊断中心的吸引力日益增强。

2024年,美国二氧化碳监测设备市场规模达3.283亿美元,预计将持续维持成长动能。这得归功于强有力的监管支持,包括麻醉和手术镇静中二氧化碳监测的要求。此外,二氧化碳监测在门诊手术和院前急救的应用日益广泛,也促进了美国市场的成长。

全球二氧化碳监测设备市场的主要参与者包括 ZOLL Medical、美敦力、飞利浦医疗、Masimo Corporation 和 Becton, Dickinson and Company 等公司。这些公司透过策略合作、产品创新以及提供更先进、便携且经济高效的解决方案来巩固其市场地位。透过专注于客户对提高患者安全性和易用性的需求,这些公司正在提升其市场占有率。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 微创手术数量不断增加

- 呼吸系统疾病数量不断增加

- 二氧化碳监测仪的受欢迎程度超过血氧仪

- 最近的技术进步加上有利的政府倡议

- 整形手术数量不断增加

- 产业陷阱与挑战

- 缺乏熟练的专业人员

- 设备成本高

- 严格的监管准则

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 技术格局

- 差距分析

- 波特的分析

- PESTEL分析

- 未来市场趋势

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 手持式

- 独立

- 多参数

第六章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 侧流

- 主流

- 微流

第七章:市场估计与预测:按组成部分,2021 - 2034 年

- 主要趋势

- 原始设备製造商 (OEM) 模组

- 其他组件

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 程序镇静

- 急救医学

- 重症监护

- 疼痛管理

- 其他应用

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用途

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Becton, Dickinson and Company

- Criticare Systems

- Dragerwerk

- Edan Instruments

- Infinium Medical

- Masimo Corporation

- Medtronic

- Mindray Medical

- Nihon Kohden

- Nonin Medical

- Phillips Healthcare

- Shenzhen Comen Medical Instruments

- Smiths Medical

- ZOLL Medical

The Global Capnography Devices Market was valued at USD 712.6 million in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 1.2 billion by 2034, driven by several factors, including the rising incidence of respiratory diseases, increased use in critical care and emergency settings, and the growing preference for minimally invasive procedures. The adoption of capnography devices is also fueled by regulations that require their use during patient sedation, along with the ongoing trend of adopting advanced technologies in healthcare. Additionally, the increased demand for portable capnography units has made these devices suitable for outpatient clinics, emergency medical services, and non-hospital environments, further propelling market growth.

The demand for capnography devices is linked to their ability to monitor carbon dioxide (CO2) levels in exhaled breath, which is crucial for ensuring patient safety during anesthesia and critical care procedures. These devices are essential for real-time monitoring, allowing healthcare providers to detect respiratory issues early and respond effectively. The market's growth is also supported by the increasing focus on patient-centered care and technological advancements that improve the accuracy and ease of use of these devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $712.6 Million |

| Forecast Value | $1.2 Billion |

| CAGR | 5.4% |

The handheld segment is expected to grow at a 5% CAGR and contribute significantly with a projected value of USD 603.1 million by 2034. Handheld capnography devices are favored for their portability, making them ideal for use in pre-hospital care and ambulatory settings. These devices allow healthcare providers to make quick, informed decisions during procedures that require sedation or respiratory monitoring, ensuring patient safety. Moreover, their cost-effectiveness over multi-parameter systems drives their popularity in budget-conscious healthcare settings.

Based on components, OEM (Original Equipment Manufacturer) modules are expected to grow at a CAGR of 5.1%. These modules are integrated into multi-parameter systems, offering a cost-effective way for healthcare facilities to enhance their diagnostic capabilities. Their compact design and ability to integrate with other platforms make them highly adaptable for various healthcare environments. The need for interoperability and personalized care continues to push the demand for OEM modules, which are gaining traction in hospitals and diagnostic centers worldwide.

U.S. Capnography Devices Market was valued at USD 328.3 million in 2024 and is expected to continue its upward trajectory. This is due to strong regulatory support, including the requirement for capnography in anesthesia and procedural sedation. Additionally, the growing adoption of capnography in outpatient surgeries and pre-hospital care contributes to the market's expansion in the U.S.

Key players in the Global Capnography Devices Market include companies such as ZOLL Medical, Medtronic, Philips Healthcare, Masimo Corporation, and Becton, Dickinson and Company. These companies are strengthening their market positions through strategic collaborations, product innovations, and offering more advanced, portable, and cost-effective solutions. By focusing on customer needs for improved patient safety and ease of use, these companies are increasing their market presence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing number of minimally invasive surgeries

- 3.2.1.2 Rising number of respiratory diseases

- 3.2.1.3 Surging preference for capnometers over oximetry

- 3.2.1.4 Recent technological advancements coupled with favorable government initiatives

- 3.2.1.5 Increasing number of plastic surgeries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of skilled professionals

- 3.2.2.2 High cost of the device

- 3.2.2.3 Stringent regulatory guidelines

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technology landscape

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

- 3.11 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hand-held

- 5.3 Stand-alone

- 5.4 Multi-parameter

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Side stream

- 6.3 Main stream

- 6.4 Micro stream

Chapter 7 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Original equipment manufacturer (OEM) modules

- 7.3 Other components

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Procedural sedation

- 8.3 Emergency medicine

- 8.4 Critical care

- 8.5 Pain management

- 8.6 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Ambulatory surgical centers

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Becton, Dickinson and Company

- 11.2 Criticare Systems

- 11.3 Dragerwerk

- 11.4 Edan Instruments

- 11.5 Infinium Medical

- 11.6 Masimo Corporation

- 11.7 Medtronic

- 11.8 Mindray Medical

- 11.9 Nihon Kohden

- 11.10 Nonin Medical

- 11.11 Phillips Healthcare

- 11.12 Shenzhen Comen Medical Instruments

- 11.13 Smiths Medical

- 11.14 ZOLL Medical