|

市场调查报告书

商品编码

1750543

磁流变液市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Magnetorheological Fluid Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

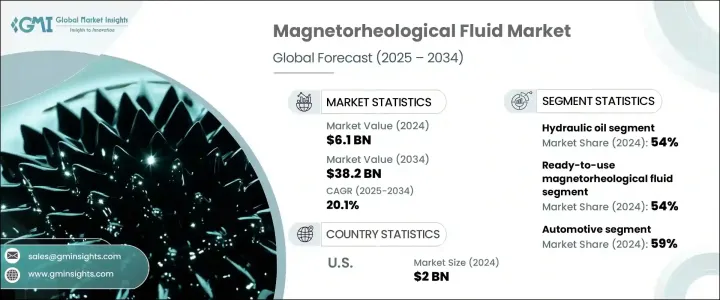

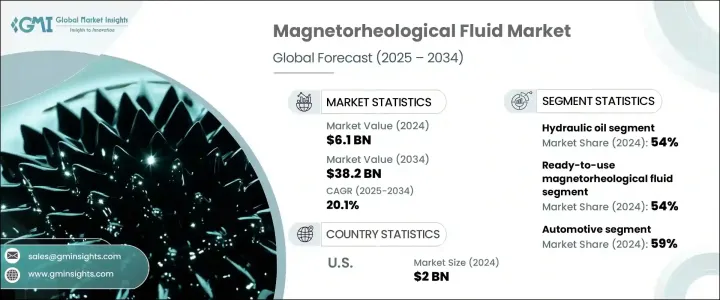

2024 年全球磁流变液市场价值为 61 亿美元,预计到 2034 年将以 20.1% 的复合年增长率增长,达到 382 亿美元,这得益于各行各业对先进阻尼和控制解决方案日益增长的需求。磁流变液具有在施加磁场的作用下快速且可逆地改变其流变特性的能力,因此在需要精确控制、高速响应和可变阻尼的应用中,其价值日益提升。汽车产业是磁流变液市场成长的重要贡献者,因为这些液体广泛用于悬吊系统、避震器和半主动阻尼装置,以提高车辆的操控性、舒适性和安全性。汽车产业的扩张(尤其是在发展中地区)以及对先进汽车技术的日益关注,推动了对基于磁流变液的解决方案的需求。

此外,工业自动化和控制领域也已成为磁流变流体市场的主要驱动力。流体广泛应用于工业阀门、离合器、煞车和机器人系统,其对机械系统提供精确且灵敏的控制能力备受推崇。人们日益重视提高製程效率、降低能耗和增强工业设备性能,这进一步促进了市场的扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 61亿美元 |

| 预测值 | 382亿美元 |

| 复合年增长率 | 20.1% |

就基础油成分而言,液压油细分市场在2024年创造了33亿美元的市场规模,占54%,这得益于其优异的热稳定性和氧化稳定性、与添加剂和磁性颗粒的广泛兼容性、以及广泛的可用性和成本效益。液压油在磁场下也表现出良好的流变性能,使其成为工业机械、国防系统和医疗器材等领域磁流变(MR)流体配方的首选。

即用型磁流变液市场在2024年创造了33亿美元的收入,这得益于其易于实施且无需内部配製或客製化。这些预混合解决方案旨在提供一致的性能、可靠性和安全性,从而最大限度地减少停机时间并提高营运效率。汽车(用于主动减震器和悬吊系统)、航太(用于振动控制和自适应起落架)以及机器人(用于触觉反馈和运动控制)等行业正越来越多地采用即用型磁流变液。

2024年,北美磁流变液市场规模达20亿美元,占38%的市场份额,这得益于汽车、航太和建筑等产业的强劲需求,以及市场对先进阻尼和振动控制技术的强烈需求。关键市场参与者的参与、大量的研发投入以及政府的支持性倡议,进一步巩固了北美在磁流变液市场的地位。

全球磁流变液市场的主要参与者包括 Ferrofluidics Corporation、巴斯夫 SE、LORD Corporation、日本涂料控股株式会社和曙光煞车工业株式会社。这些公司专注于策略合作伙伴关係、新产品发布和商业化努力,以扩大其市场份额。此外,在研发方面的大量投资也使其能够推出创新磁流变液产品,以满足各行各业不断变化的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 战略产业的回应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 主要出口国

- 主要进口国

註:以上贸易统计仅针对重点国家。

- 供应商格局

- 利润率分析

- 监管格局

- 衝击力

- 成长动力

- 汽车乘坐品质提升

- 建筑振动控制与抗震防护

- 敏捷而精确的机器人技术

- 产业陷阱与挑战

- 技术初始成本高

- 实施过程中熟练劳动力短缺

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按基础流体,2021 - 2034 年

- 主要趋势

- 油压

- 矿物油

- 硅油

- 其他的

第六章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 即用型磁流变液

- 半浓缩磁流变液

- 浓缩磁流变液

- 其他的

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 汽车

- 建筑与施工

- 航太

- 其他的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Ferrofluidics Corporation

- BASF SE

- LORD Corporation

- Nippon Paint Holdings Co., Ltd.

- Akebono Brake Industry Co., Ltd.

- New Energy and Industrial Technology Development Organization (NEDO)

- Boron Rubbers India

- Liquids Research Limited

- TA Instruments

- BASF Agricultural Solutions

- Anton Paar GmbH

- Beijing West Industries Co. Ltd. (BWI Group)

- CK Materials Lab Co., Ltd.

- Industrial Metal Powders (I) Pvt. Ltd.

The Global Magnetorheological Fluid Market was valued at USD 6.1 billion in 2024 and is estimated to grow at a 20.1% CAGR to reach USD 38.2 billion by 2034, driven by the increasing demand for advanced damping and control solutions across various industries. MR fluids have become increasingly valuable with their ability to rapidly and reversibly change their rheological properties in response to an applied magnetic field, in applications where precise control, high-speed response, and variable damping are required. The automotive industry has been a significant contributor to the growth of the MR fluid market, as these fluids are widely used in suspension systems, shock absorbers, and semi-active damping devices to enhance vehicle handling, comfort, and safety. The expansion of the automotive sector, particularly in developing regions, and the increasing focus on advanced vehicle technologies have fueled the demand for MR fluid-based solutions.

Moreover, the industrial automation and control sector has also emerged as a key driver for the MR fluid market. Fluids find applications in industrial valves, clutches, brakes, and robotic systems, where their ability to provide precise and responsive control over mechanical systems is highly valued. The growing emphasis on improving process efficiency, reducing energy consumption, and enhancing the performance of industrial equipment has further contributed to the market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.1 Billion |

| Forecast Value | $38.2 Billion |

| CAGR | 20.1% |

In terms of base fluid composition, the hydraulic oil segment generated USD 3.3 billion in 2024, accounting for a 54% share attributed to its excellent thermal and oxidative stability, broad compatibility with additives and magnetic particles, and its widespread availability and cost-effectiveness. Hydraulic oils also exhibit favorable rheological properties under magnetic fields, making them a preferred choice for magnetorheological (MR) fluid formulations across sectors such as industrial machinery, defense systems, and medical devices.

The ready-to-use MR fluid segment generated USD 3.3 billion in 2024, driven by its ease of implementation and reduced need for in-house formulation or customization. These pre-mixed solutions are engineered to offer consistent performance, reliability, and safety, thereby minimizing downtime and enhancing operational efficiency. Industries such as automotive (for active dampers and suspension systems), aerospace (for vibration control and adaptive landing gear), and robotics (for haptic feedback and motion control) are increasingly adopting ready-to-use MR fluids.

North America Magnetorheological Fluid Market was valued at USD 2 billion and held 38% share in 2024, driven by robust demand across sectors like automotive, aerospace, and construction, coupled with a strong inclination towards adopting advanced damping and vibration control technologies. The presence of key market players, substantial research and development investments, and supportive government initiatives further bolsters North America's position in the MR fluid market.

Key players in the Global Magnetorheological Fluid Market include Ferrofluidics Corporation, BASF SE, LORD Corporation, Nippon Paint Holdings Co., Ltd., and Akebono Brake Industry Co., Ltd. These companies are focusing on strategic partnerships, new product launches, and commercialization efforts to expand their market presence. Additionally, significant investments in research and development are enabling the introduction of innovative MR fluid products, catering to the evolving needs of various industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.3 Supply-side impact (raw materials)

- 3.2.3.1 Price volatility in key materials

- 3.2.3.2 Supply chain restructuring

- 3.2.3.3 Production cost implications

- 3.2.4 Demand-side impact (selling price)

- 3.2.4.1 Price transmission to end markets

- 3.2.4.2 Market share dynamics

- 3.2.4.3 Consumer response patterns

- 3.2.5 Key companies impacted

- 3.2.6 Strategic Industry responses

- 3.2.6.1 Supply chain reconfiguration

- 3.2.6.2 Pricing and product strategies

- 3.2.6.3 Policy engagement

- 3.2.7 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

Note: the above trade statistics will be provided for key countries only.

- 3.4 Supplier landscape

- 3.5 Profit margin analysis

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Automotive ride quality boost

- 3.7.1.2 Building vibration control & seismic protection

- 3.7.1.3 Agile & precise robotics

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial cost of technology

- 3.7.2.2 Skilled labor shortage for implementation

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Base Fluid, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Hydraulic oil

- 5.3 Mineral oil

- 5.4 Silicon oil

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Product, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Ready-to-use magnetorheological fluid

- 6.3 Semi-concentrated magnetorheological fluid

- 6.4 Concentrated magnetorheological fluid

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Building & construction

- 7.4 Aerospace

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Ferrofluidics Corporation

- 9.2 BASF SE

- 9.3 LORD Corporation

- 9.4 Nippon Paint Holdings Co., Ltd.

- 9.5 Akebono Brake Industry Co., Ltd.

- 9.6 New Energy and Industrial Technology Development Organization (NEDO)

- 9.7 Boron Rubbers India

- 9.8 Liquids Research Limited

- 9.9 TA Instruments

- 9.10 BASF Agricultural Solutions

- 9.11 Anton Paar GmbH

- 9.12 Beijing West Industries Co. Ltd. (BWI Group)

- 9.13 CK Materials Lab Co., Ltd.

- 9.14 Industrial Metal Powders (I) Pvt. Ltd.