|

市场调查报告书

商品编码

1750561

兽医 CT 影像市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Veterinary CT Imaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

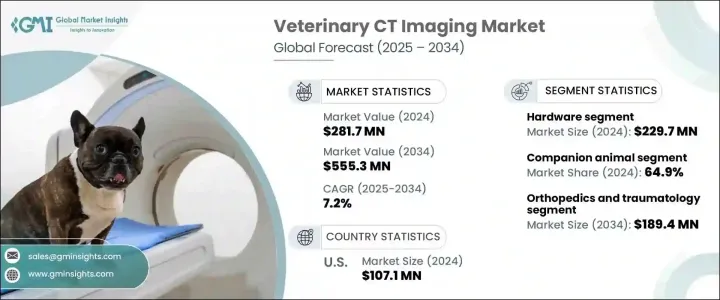

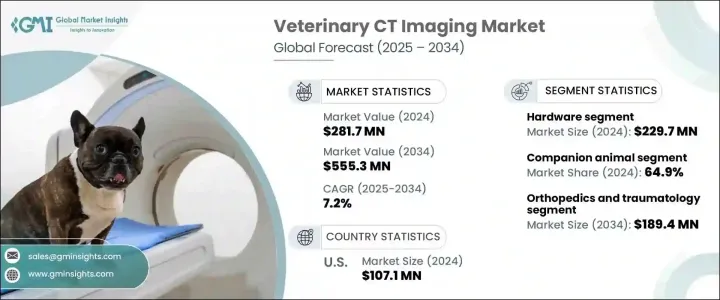

2024年,全球兽医CT影像市场规模达2.817亿美元,预计到2034年将以7.2%的复合年增长率成长,达到5.553亿美元。这主要得益于全球动物数量的成长、宠物日益普及、兽医服务可近性提高以及宠物照护日益受到重视等因素。随着越来越多的宠物和牲畜被诊断出患有慢性和复杂的疾病,对包括兽医CT成像在内的先进诊断技术的需求持续增长。这项技术透过提供清晰、细緻的三维动物解剖影像,彻底改变了兽医评估动物健康状况的方式,从而实现精准诊断和及时干预。

CT成像除了能够提供复杂解剖结构的高解析度影像外,还尤其适用于急诊。高解析度扫描仪和更快成像技术等创新进一步增强了其诊断能力,使其成为兽医领域不可或缺的工具。此外,兽医院和诊所的蓬勃发展以及宠物保险的普及,正在推动市场扩张。随着宠物和牲畜面临的健康问题(例如肿瘤、骨科损伤和器官异常)日益增多,对CT扫描仪等诊断影像工具的需求将持续成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.817亿美元 |

| 预测值 | 5.553亿美元 |

| 复合年增长率 | 7.2% |

伴侣动物领域在2024年占最大份额,达到64.9%,这得益于猫狗等宠物的普及,这些宠物越来越容易患上需要先进诊断工具的疾病。动物健康意识的增强以及专业治疗手段的普及,预计将继续推动兽医CT影像的需求,尤其是伴侣动物CT影像的需求。新兴经济体可支配收入的增加以及更先进诊断设备的上市将进一步推动这一市场的发展。

2024年,兽用CT成像市场中的硬体部分价值2.297亿美元。此部分包括CT扫描器、机架和侦测器等重要组件,这些组件对于获取详细的横断面影像以实现准确诊断至关重要。随着兽医诊所和医院越来越认识到先进诊断技术的重要性,预计对这些硬体解决方案的需求将稳步增长。这些组件对于产生高解析度影像至关重要,使兽医能够识别和治疗动物的各种疾病。兽医机构对先进诊断设备的持续投资将推动硬体部分的进一步成长,从而提升兽医的整体诊疗能力。

2024年,美国兽医CT影像市场规模达1.071亿美元,这得益于美国宠物拥有率高以及获得先进兽医护理服务的机会日益增多。随着人们对宠物健康的日益关注,宠物主人更倾向于为宠物寻找尖端的诊断工具,从而推动兽医CT成像系统的普及。此外,宠物保险覆盖率的提高也降低了这些先进诊断服务的可负担性,进一步促进了市场成长。美国也受益于完善的基础设施和成像技术的持续创新,确保市场保持强劲成长势头,并有望持续发展。

全球兽医CT影像产业的公司采取的策略包括影像技术创新、产品组合拓展以及透过合作扩大市场覆盖范围。佳能医疗系统公司和西门子医疗等公司专注于开发更高解析度、影像速度更快的先进CT扫描仪,以满足日益增长的精准诊断需求。通用电气医疗集团和Hallmarq兽医影像公司等其他公司则正在投资扩大产品线,并提升其在新兴市场的影响力。透过提高兽医影像解决方案的可近性和可负担性,这些公司旨在巩固其市场地位,并满足兽医领域对先进诊断工具日益增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 宠物拥有量和动物保健支出增加

- 动物疾病和伤害的发生率上升

- 成像模式的技术进步

- 已开发经济体兽医数量不断增加

- 产业陷阱与挑战

- CT扫描仪成本高昂

- 新兴市场动物健康意识较低

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 技术格局

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 硬体

- 固定式多层CT扫描仪

- 中端

- 高阶

- 低阶

- 便携式CT扫描仪

- 固定式多层CT扫描仪

- 耗材

- 软体

第六章:市场估计与预测:依动物类型,2021 - 2034 年

- 主要趋势

- 伴侣动物

- 牲畜

- 其他动物类型

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 骨科和创伤学

- 肿瘤学

- 牙科

- 神经病学

- 其他应用

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 兽医医院和诊所

- 诊断影像中心

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Carestream Health

- Canon Medical Systems Corporation

- Epica International

- GNI ApS

- GE Healthcare

- Hallmarq Veterinary Imaging

- Hitachi

- Isabelle Vets

- Neurologica corporation

- Koninklijke Philips NV

- Siemens Healthineers

- Sound

- Shenzhen Anke High-Tech

- Xoran Technologies

The Global Veterinary CT Imaging Market was valued at USD 281.7 million in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 555.3 million by 2034, driven by factors such as an increasing global animal population, the rising popularity of pets, greater access to veterinary services, and a higher focus on pet care. As more pets and livestock are diagnosed with chronic and complex health conditions, the demand for advanced diagnostic technologies, including veterinary CT imaging, continues to rise. This technology has revolutionized the way veterinarians assess animal health by offering clear, detailed, and three-dimensional images of animal anatomy, allowing for precise diagnostics and timely interventions.

In addition to its ability to provide high-resolution images of complex anatomical structures, CT imaging is particularly beneficial for emergency cases. Innovations like higher resolution scanners and faster imaging techniques have further enhanced its diagnostic capabilities, making it an invaluable tool in the veterinary field. Furthermore, the growth in veterinary hospitals, clinics, and the increasing availability of pet insurance are boosting market expansion. As pets and livestock face a growing number of health issues, such as tumors, orthopedic injuries, and organ abnormalities, the demand for diagnostic imaging tools like CT scanners will continue to increase.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $281.7 Million |

| Forecast Value | $555.3 Million |

| CAGR | 7.2% |

The companion animal segment held the largest share with 64.9% in 2024, driven by the growing adoption of pets such as dogs and cats, which are increasingly prone to diseases that require advanced diagnostic tools. The increasing awareness of animal health and the availability of specialized treatments are expected to continue driving the demand for veterinary CT imaging, particularly for companion animals. The rising disposable income in emerging economies and the launch of more sophisticated diagnostic devices will further propel this market.

The hardware segment within the veterinary CT imaging market accounted for USD 229.7 million in 2024. This segment includes essential components such as CT scanners, gantries, and detectors, all of which are crucial for obtaining the detailed cross-sectional images that enable accurate diagnoses. As veterinary clinics and hospitals increasingly recognize the importance of advanced diagnostic technologies, the demand for these hardware solutions is expected to grow steadily. These components are critical for producing high-resolution images, allowing veterinarians to identify and address a wide range of conditions in animals. The continued investment in sophisticated diagnostic equipment by veterinary facilities will drive further growth in the hardware segment, enhancing the overall capabilities of veterinary medicine.

United States Veterinary CT Imaging Market was valued at USD 107.1 million in 2024, driven by high rates of pet ownership in the country, along with increasing access to advanced veterinary care. With the growing focus on pet health, owners are more inclined to seek out cutting-edge diagnostic tools for their animals, leading to greater adoption of veterinary CT imaging systems. Additionally, the rise in pet insurance coverage has facilitated the affordability of these advanced diagnostic services, further contributing to market growth. The U.S. also benefits from a well-established infrastructure and ongoing innovations in imaging technology, ensuring that the market remains strong and poised for continued development.

Companies in the Global Veterinary CT Imaging Industry employ strategies such as innovation in imaging technology, expanding product portfolios, and increasing market reach through partnerships and collaborations. Companies like Canon Medical Systems Corporation and Siemens Healthineers focus on developing advanced CT scanners with higher resolution and faster imaging capabilities to meet the growing demand for precise diagnostics. Others, like GE Healthcare and Hallmarq Veterinary Imaging, are investing in expanding their product offerings and increasing their presence in emerging markets. By improving the accessibility and affordability of veterinary imaging solutions, these companies aim to strengthen their market position and cater to the increasing demand for advanced diagnostic tools in veterinary medicine.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased pet ownership and animal health expenditure

- 3.2.1.2 Rising prevalence of animal diseases and injuries

- 3.2.1.3 Technological advancements in imaging modalities

- 3.2.1.4 Rising number of veterinary practitioners in developed economies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of CT scanners

- 3.2.2.2 Low animal health awareness in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Stationary multi-slice CT scanner

- 5.2.1.1 Mid end

- 5.2.1.2 High end

- 5.2.1.3 Low end

- 5.2.2 Portable CT scanner

- 5.2.1 Stationary multi-slice CT scanner

- 5.3 Consumables

- 5.4 Software

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Companion animal

- 6.3 Livestock animal

- 6.4 Other animal types

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Orthopedics and traumatology

- 7.3 Oncology

- 7.4 Dental

- 7.5 Neurology

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospitals and clinics

- 8.3 Diagnostic imaging centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Carestream Health

- 10.2 Canon Medical Systems Corporation

- 10.3 Epica International

- 10.4 GNI ApS

- 10.5 GE Healthcare

- 10.6 Hallmarq Veterinary Imaging

- 10.7 Hitachi

- 10.8 Isabelle Vets

- 10.9 Neurologica corporation

- 10.10 Koninklijke Philips N.V.

- 10.11 Siemens Healthineers

- 10.12 Sound

- 10.13 Shenzhen Anke High-Tech

- 10.14 Xoran Technologies